Travelers Canada Sold To Definity For $3.3 Billion

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

The $3.3 billion price tag represents a significant investment by Definity, solidifying its position as a major player in the Canadian insurance sector. While the exact payment structure hasn't been fully disclosed publicly, it's likely to involve a combination of cash and potentially some stock options, contingent upon the successful integration of Travelers Canada. Regulatory approvals from the Competition Bureau of Canada and other relevant authorities will be necessary before the deal can be finalized.

- Financial Aspects: Precise details regarding the financial breakdown are still emerging, however, financial news sources suggest a substantial cash component. Further information is expected in upcoming official company statements.

- Regulatory Approvals: The acquisition is subject to customary closing conditions, including the receipt of necessary regulatory approvals. The timeline for these approvals is currently unclear.

Impact on Definity's Portfolio

This acquisition significantly boosts Definity's presence in the Canadian insurance market. The addition of Travelers Canada's extensive customer base, diverse product portfolio, and established brand reputation will immediately strengthen Definity's market share and overall profitability.

- Expanded Product Offerings: The deal expands Definity’s reach into new insurance segments previously not served by their existing operations.

- Increased Market Share: The acquisition catapults Definity into a higher tier among Canadian insurance providers, dramatically increasing its market share.

- Geographic Reach: Travelers Canada's strong regional presence will further extend Definity's operational footprint across the country.

Financial Performance of Travelers Canada Pre-Acquisition

Travelers Canada enjoyed a period of robust financial performance prior to the acquisition, exhibiting consistent growth in revenue and market share. This strong track record contributed significantly to the appealing acquisition price.

- Key Performance Indicators (KPIs): Publicly available financial data shows impressive growth in key areas, particularly in commercial lines and specialized insurance products. Detailed figures will likely be included in Definity's financial reporting post-acquisition.

- Relevance to Acquisition Price: The healthy financial standing of Travelers Canada before the sale justified the high acquisition cost, reflecting its value and future earning potential.

Impact on Travelers and its Employees

Travelers' Strategic Rationale for the Sale

Travelers' decision to divest its Canadian operations likely stems from a broader strategic refocusing. This move might allow Travelers to concentrate resources on other markets and potentially more lucrative opportunities globally.

- Strategic Refocusing: This sale allows Travelers to concentrate efforts and investments in other regions where they see greater growth potential.

- Market Conditions: Market dynamics within the Canadian insurance sector may have played a role in the decision.

- Potential for Higher Returns Elsewhere: Travelers might have concluded that they could achieve higher returns on investment by reinvesting the proceeds from the sale in other ventures.

Employee Transition and Job Security

The acquisition raises crucial questions about the future of Travelers Canada employees. Definity has provided assurances regarding job security, but the specifics of integration and potential restructuring remain to be seen.

- Job Security: While some level of restructuring is anticipated, Definity has stated its commitment to retaining key talent within the acquired entity.

- Benefits: The transition process for employee benefits will be carefully managed to minimize disruption.

- Integration Process: A detailed integration plan will be implemented to ensure a smooth transition for employees and minimal impact on customer service.

Future of the Travelers Canada Brand

The future of the Travelers Canada brand post-acquisition is currently unclear. Definity may choose to retain the established brand name to leverage its existing customer recognition and trust, or they may opt for a rebranding exercise to better integrate the operations under its corporate umbrella.

- Branding Strategies: Several options are open to Definity— maintaining the Travelers Canada brand, a phased rebranding, or a complete brand change.

- Impact on Customer Perception: The decision regarding brand management will directly influence customer perception and loyalty in the transition period.

Broader Market Implications

Competitive Landscape in Canadian Insurance

Definity's acquisition of Travelers Canada will undoubtedly reshape the competitive landscape within the Canadian insurance industry. This consolidation of market power could lead to significant shifts in pricing strategies and service offerings.

- Key Competitors: The acquisition will increase pressure on existing major players in the Canadian insurance market, compelling them to adopt new strategies.

- Potential Shifts in Market Share: The combined entity of Definity and Travelers Canada will undoubtedly become a dominant force, potentially altering market share distribution.

Potential Regulatory Scrutiny

Given the size and significance of the acquisition, regulatory scrutiny is anticipated. The Competition Bureau of Canada will closely examine the deal to assess its potential impact on market competition.

- Relevant Regulatory Bodies: The Competition Bureau will be the primary regulatory body overseeing the acquisition process, assessing its potential anti-competitive implications.

- Potential Concerns Regarding Competition: The key concern will center around whether the merger creates a monopoly or significantly restricts competition within certain insurance sectors.

Long-Term Outlook for the Combined Entity

The long-term success of the combined entity will depend on several factors, including successful integration, efficient management of acquired assets, and effective adaptation to changing market conditions.

- Potential Growth Opportunities: The acquisition offers significant growth opportunities by leveraging the strengths of both companies and expanding into new markets.

- Challenges: Integration complexities, potential employee attrition, and maintaining customer satisfaction will be critical challenges.

- Long-Term Strategic Goals: Definity's long-term strategic goals will need to consider this major acquisition and strategically position the combined entity for sustained growth.

Conclusion

The $3.3 billion acquisition of Travelers Canada by Definity represents a pivotal moment in the Canadian insurance market. This deal significantly strengthens Definity's position, providing immediate benefits including enhanced market share and expanded product offerings. However, successful integration and navigating regulatory scrutiny will be crucial for long-term success. The impact of this major Travelers Canada acquisition and its long-term consequences on the industry remain to be seen.

Call to Action: Stay informed about the unfolding developments in this significant transaction. Follow our coverage for continued analysis and updates on the integration of Travelers Canada into the Definity portfolio. Learn more about the impact of this major Travelers Canada acquisition and its future implications for the insurance market.

Featured Posts

-

Revolucion En La Compra De Boletos Ticketmaster Presenta Virtual Venue

May 30, 2025

Revolucion En La Compra De Boletos Ticketmaster Presenta Virtual Venue

May 30, 2025 -

Hezbollah Weakened Israeli Intels Impact On Southern Lebanon

May 30, 2025

Hezbollah Weakened Israeli Intels Impact On Southern Lebanon

May 30, 2025 -

Is Jungkook Leaving Bts Top 10 Questions Before The 2025 Reunion

May 30, 2025

Is Jungkook Leaving Bts Top 10 Questions Before The 2025 Reunion

May 30, 2025 -

3 Olympia Theatre Olly Alexanders Show In Pictures

May 30, 2025

3 Olympia Theatre Olly Alexanders Show In Pictures

May 30, 2025 -

Celebrating 25 Years Of Gorillaz Exhibition And Special Shows Details

May 30, 2025

Celebrating 25 Years Of Gorillaz Exhibition And Special Shows Details

May 30, 2025

Latest Posts

-

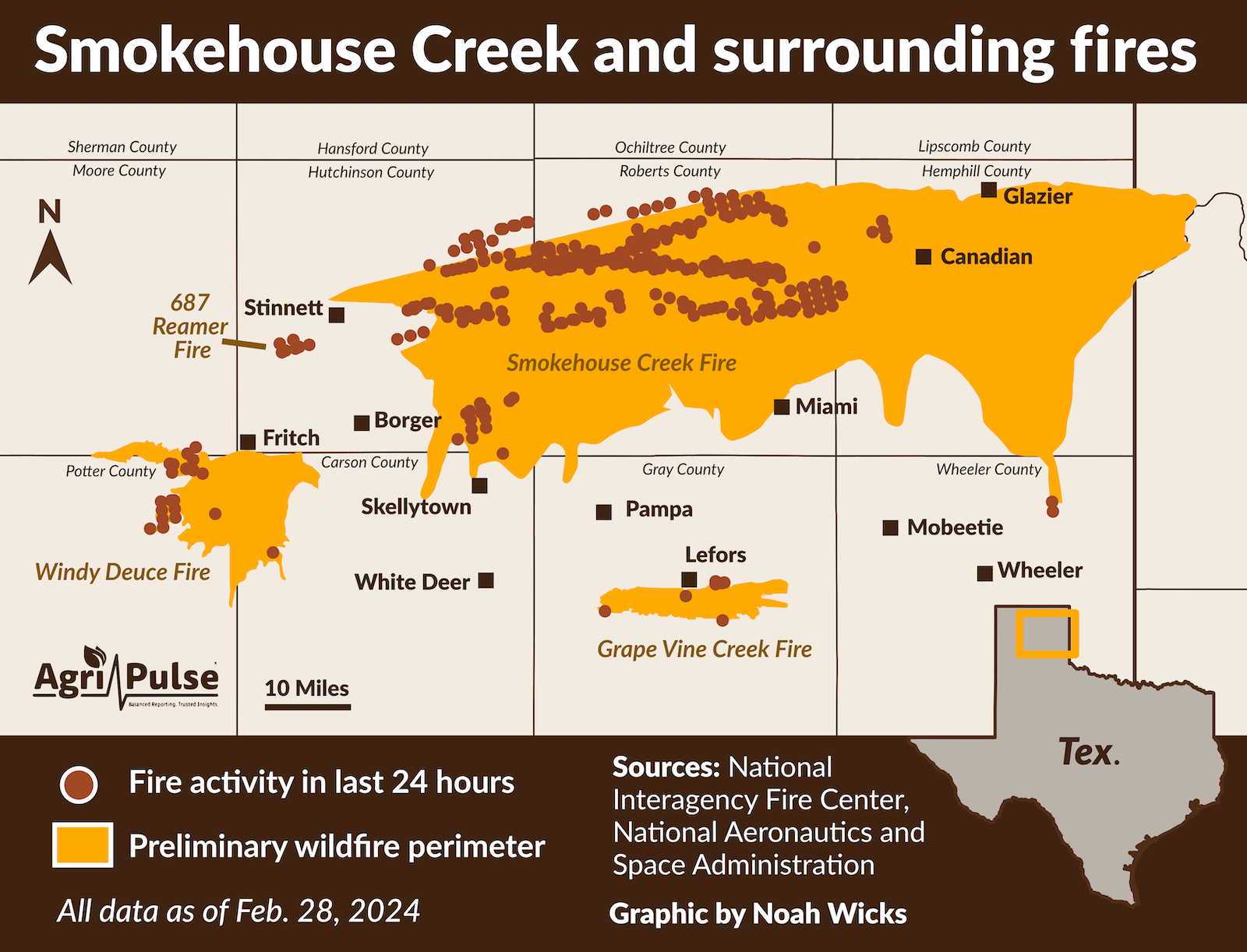

From Devastation To Renewal The Texas Panhandles Post Wildfire Journey

May 31, 2025

From Devastation To Renewal The Texas Panhandles Post Wildfire Journey

May 31, 2025 -

Rebuilding After The Texas Panhandles Devastating Wildfire Progress And Challenges

May 31, 2025

Rebuilding After The Texas Panhandles Devastating Wildfire Progress And Challenges

May 31, 2025 -

One Year After The Texas Panhandle Wildfire A Look At The Recovery Process

May 31, 2025

One Year After The Texas Panhandle Wildfire A Look At The Recovery Process

May 31, 2025 -

Texas Panhandle Wildfire A Year Of Recovery And Resilience

May 31, 2025

Texas Panhandle Wildfire A Year Of Recovery And Resilience

May 31, 2025 -

Emergency Response To Out Of Control Wildfires In Eastern Manitoba

May 31, 2025

Emergency Response To Out Of Control Wildfires In Eastern Manitoba

May 31, 2025