Treasury Market Insights: Key Takeaways From April 8th

Table of Contents

Yield Curve Movements and Their Implications

The yield curve, a graphical representation of Treasury yields across different maturities, showed notable changes on April 8th. Analyzing these shifts is critical for understanding broader economic expectations. The shape of the yield curve—whether it steepens, flattens, or inverts—provides valuable clues about the future direction of interest rates and the overall health of the economy.

- Specific yield changes: On April 8th, the 2-year Treasury note yield saw a [insert actual data, e.g., 5 basis point] increase, while the 10-year Treasury note yield experienced a [insert actual data, e.g., 3 basis point] rise. The 30-year Treasury bond yield also moved [insert actual data and direction]. These changes reflect shifting expectations regarding future interest rate policy and inflation.

- Yield curve inversion: While the overall curve might not have inverted entirely, specific segments, such as the spread between the 2-year and 10-year Treasury yields, might have narrowed significantly. A flattening or inversion of the yield curve is often interpreted as a potential precursor to an economic slowdown or recession. This is because it suggests investors expect lower long-term growth and are demanding lower yields on longer-term bonds.

- Economic expectations: The movements in the yield curve on April 8th can be linked to evolving expectations about inflation and future economic growth. A steeper curve often reflects expectations of stronger future economic growth and higher inflation, while a flatter or inverted curve implies the opposite. Analysts carefully scrutinize these shifts to gauge the market's sentiment about the economy's future trajectory. The relationship between Treasury yield movements and economic expectations is a vital component of market analysis.

Impact of Economic Data Releases

Economic data releases play a crucial role in shaping Treasury market dynamics. Any significant announcements on April 8th, particularly those related to inflation or employment, would have influenced Treasury yields. Let's examine the influence of specific data points:

- Specific economic data: [Insert specific economic data released on April 8th, e.g., The Consumer Price Index (CPI) for March was released, showing an inflation rate of X%, exceeding market expectations]. Alternatively, [The latest employment report showed a [insert data] increase in non-farm payrolls].

- Market reaction: The market's reaction to this data was [Insert details about market reaction, e.g., The release of the CPI data, exceeding expectations, initially sent Treasury prices lower, pushing yields higher, reflecting concerns about persistent inflation]. Similarly, [positive employment data might have pushed Treasury yields upwards].

- Market interpretation: The market's interpretation of the data is crucial. For example, while higher-than-expected inflation might initially pressure yields upward, if the market believes the Federal Reserve will aggressively combat inflation, long-term yields may stabilize or even decline. Understanding the nuances of the market's interpretation is key to understanding the impact of economic data on Treasury market movements.

Federal Reserve Policy and Market Sentiment

Federal Reserve actions and communications significantly influence the Treasury market. Any statements or actions (or the lack thereof) on April 8th regarding monetary policy would have shaped market sentiment and Treasury yields.

- Recent Fed announcements: [Insert details of any relevant Fed announcements on or around April 8th, e.g., The Federal Reserve maintained its benchmark interest rate at X%, signaling a pause in its rate-hiking cycle. However, the accompanying statement maintained a hawkish tone, suggesting further rate increases might be necessary later in the year].

- Market expectations: The market's expectations regarding future Fed policy decisions are paramount. If the market anticipates further interest rate hikes, Treasury yields are likely to rise as investors demand higher returns on their investments. Conversely, expectations of a rate pause or even rate cuts would typically lead to a decline in yields.

- Investor sentiment: Investor sentiment – whether risk-averse or risk-seeking – plays a significant role. During periods of heightened risk aversion, investors often flock to Treasury bonds, driving up demand and pushing Treasury yields lower. A flight-to-safety effect often pushes prices up and yields down.

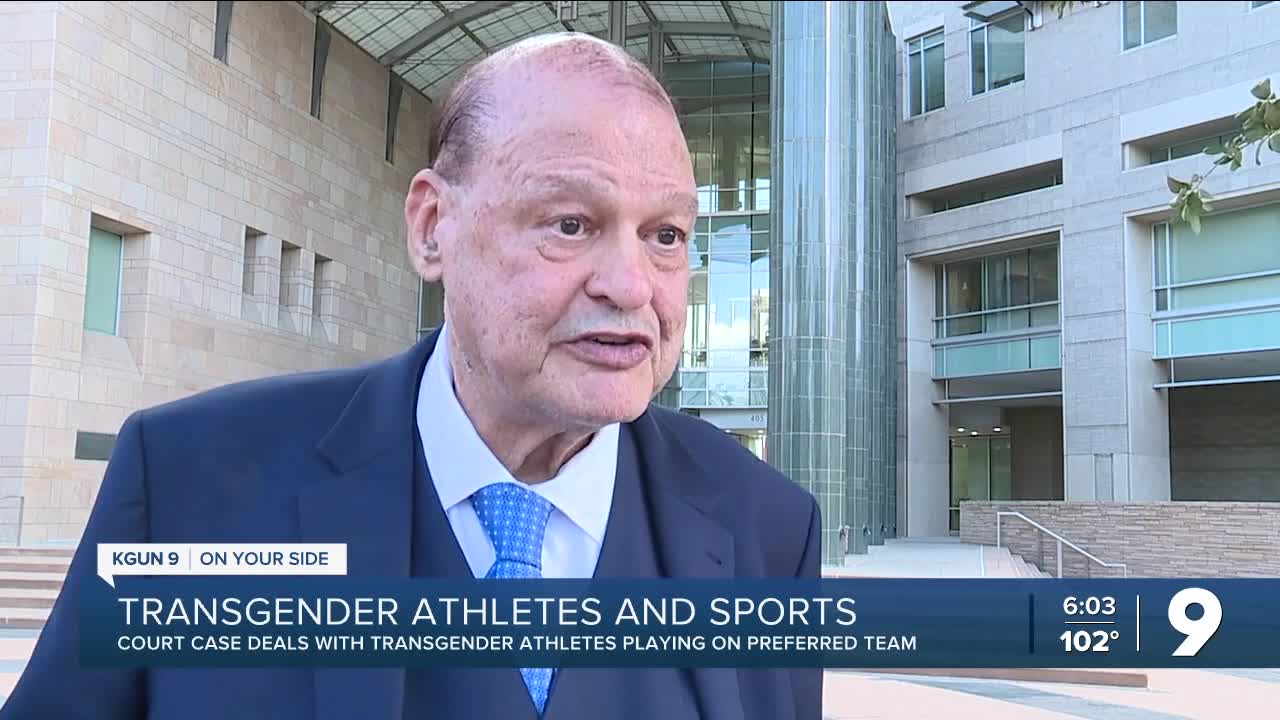

Geopolitical Factors and Their Influence

Geopolitical events can significantly impact the Treasury market, particularly impacting investor sentiment and the demand for safe-haven assets.

- Specific geopolitical events: [Mention any relevant geopolitical events from April 8th, e.g., Escalating tensions in [geopolitical location] added to global uncertainty, influencing investor behavior].

- Impact on investor risk appetite: Geopolitical uncertainty often increases investor risk aversion. This can lead to increased demand for Treasury bonds, considered a safe-haven asset, thereby pushing yields lower.

- Flight-to-safety effect: The flight-to-safety effect is a common response to geopolitical instability. Investors move funds into perceived safe assets, such as Treasury bonds, seeking stability and reducing risk. This increased demand for Treasury securities lowers yields.

Conclusion

April 8th saw notable shifts in the Treasury market, primarily driven by economic data releases that exceeded expectations, ongoing uncertainty about Federal Reserve policy, and lingering geopolitical risks. Understanding these Treasury market insights is critical for navigating the complexities of the bond market. The interplay between yield curve movements, economic indicators, and investor sentiment continues to shape the Treasury landscape. The volatility observed underscores the importance of continuous monitoring and analysis for successful investment strategies.

Call to Action: Stay informed on the latest developments in the Treasury market by regularly checking our website for updated Treasury market insights and analysis. Subscribe to our newsletter to receive timely alerts and expert opinions on Treasury yields and market trends.

Featured Posts

-

Us Attorney General Escalates Fight Over Transgender Athletes In Minnesota

Apr 29, 2025

Us Attorney General Escalates Fight Over Transgender Athletes In Minnesota

Apr 29, 2025 -

Vincenzo Grifo Ciro Immobile Luca Toni Andrea Barzagli And Ruggiero Rizzitelli Italian Stars Who Conquered The Bundesliga

Apr 29, 2025

Vincenzo Grifo Ciro Immobile Luca Toni Andrea Barzagli And Ruggiero Rizzitelli Italian Stars Who Conquered The Bundesliga

Apr 29, 2025 -

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025 -

Jeff Goldblum Explains His Input On The Flys Conclusion

Apr 29, 2025

Jeff Goldblum Explains His Input On The Flys Conclusion

Apr 29, 2025 -

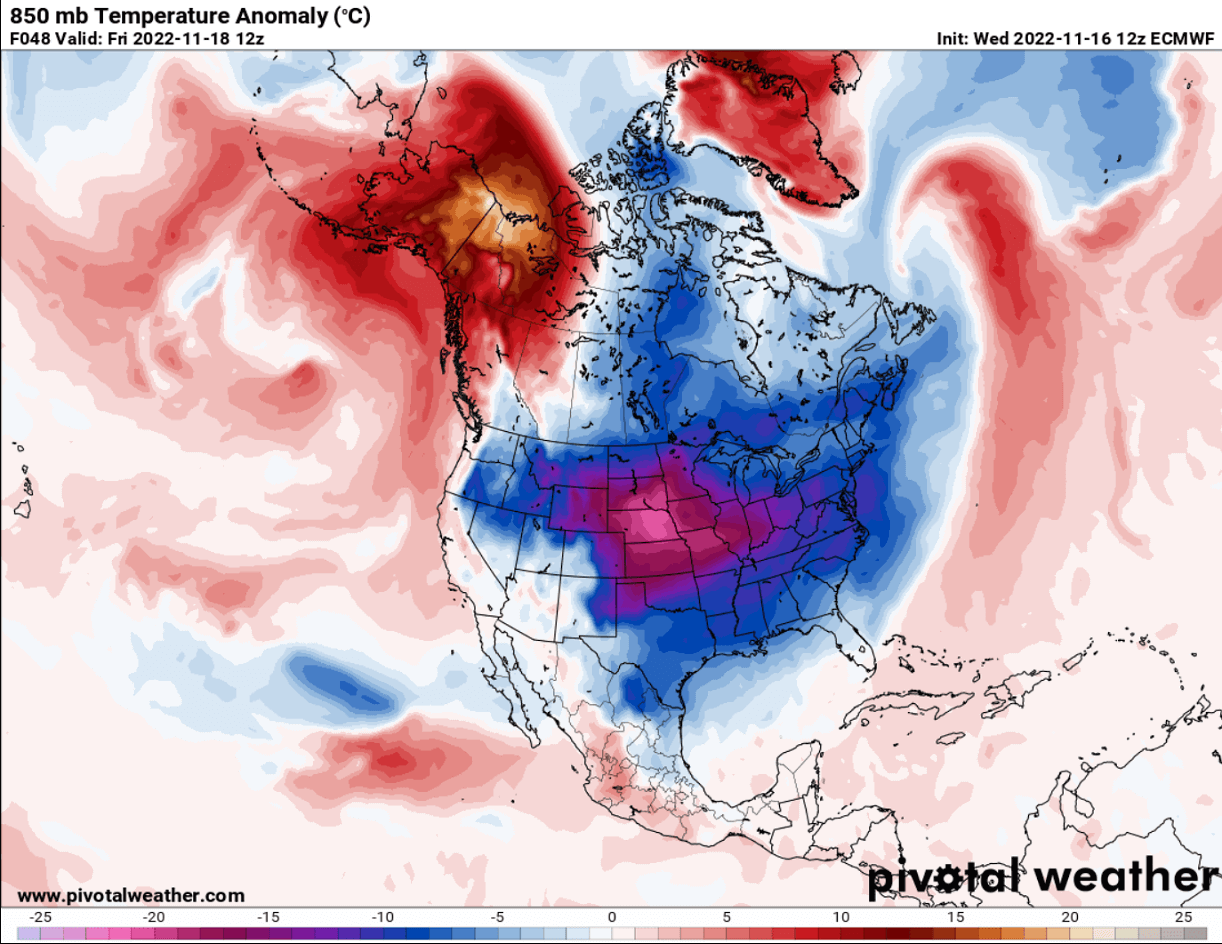

2025 Louisville Hit Hard By Severe Weather Snow Tornadoes And Historic Flooding

Apr 29, 2025

2025 Louisville Hit Hard By Severe Weather Snow Tornadoes And Historic Flooding

Apr 29, 2025