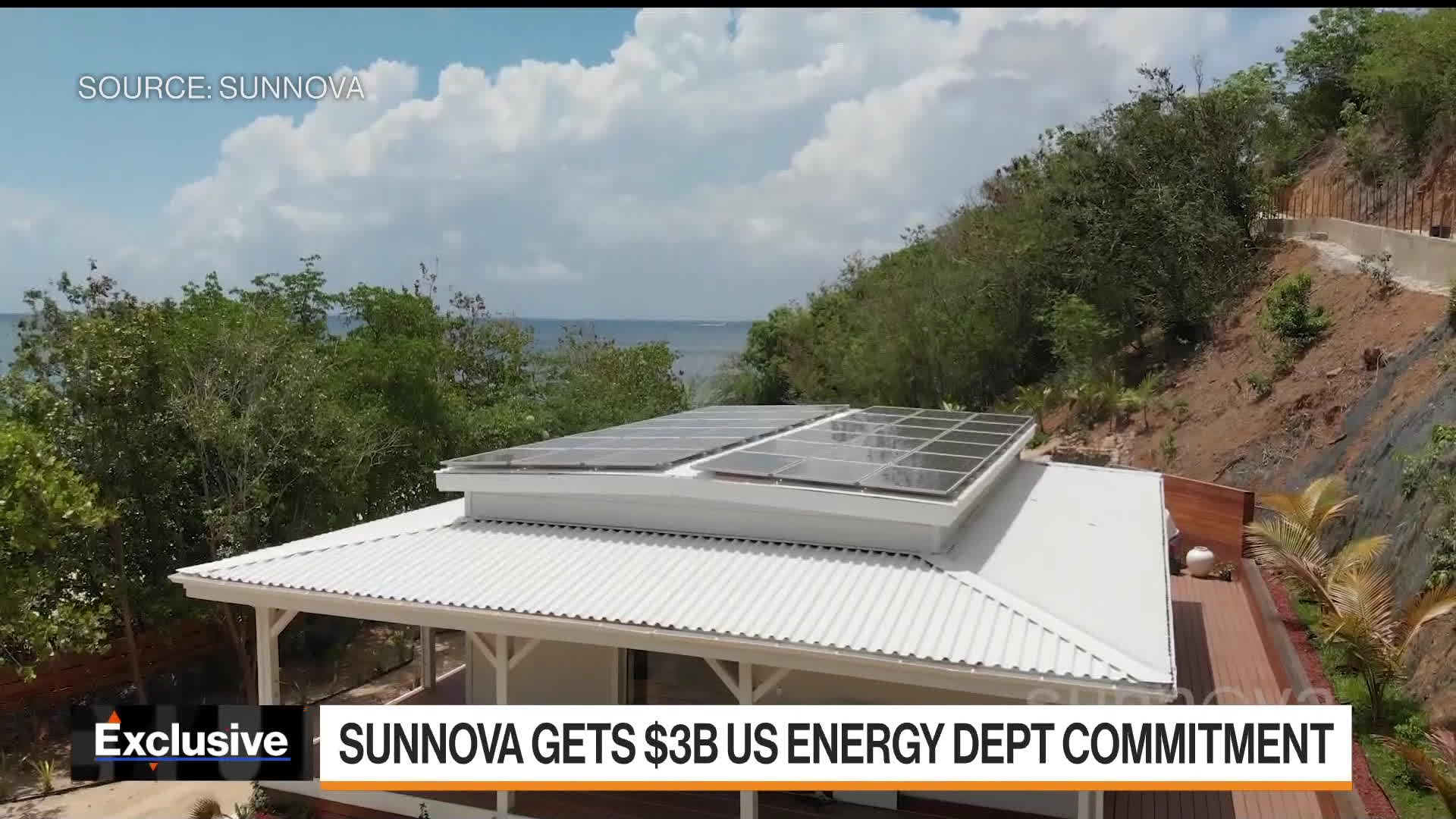

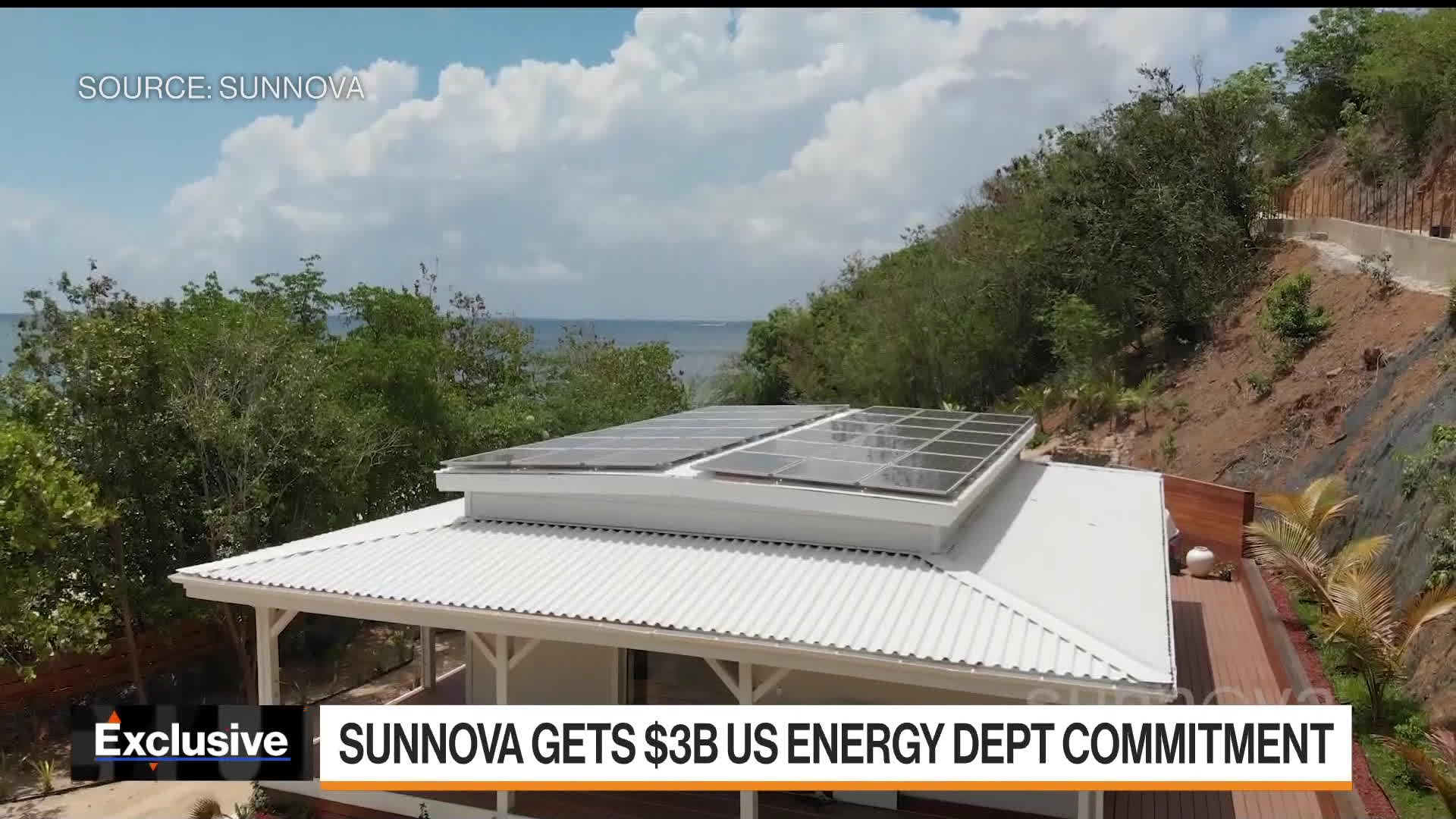

Trump Administration Cancels $3 Billion Sunnova Energy Loan: Details And Impact

Table of Contents

The Sunnova Energy Loan Guarantee: A Deep Dive

Understanding the Proposed Loan

The proposed $3 billion loan guarantee from the Department of Energy (DOE) was intended to significantly bolster Sunnova Energy's growth and expansion plans. This substantial financial backing would have allowed Sunnova, a leading residential solar energy provider, to accelerate several key initiatives.

- Expansion of Solar Panel Installations: The loan would have funded the installation of solar panels in thousands of homes across the United States, increasing access to clean energy and reducing reliance on fossil fuels.

- Research and Development: A portion of the funds was earmarked for research and development into new solar technologies, potentially leading to more efficient and cost-effective solar panels.

- Infrastructure Improvements: Investments in infrastructure would have included building new solar farms and upgrading existing energy grids to handle increased renewable energy production.

- Customer Acquisition and Marketing: The loan guarantee would have enabled Sunnova to significantly expand its marketing efforts, attracting more customers and accelerating market penetration.

- Job Creation: The project was projected to create thousands of high-paying jobs across various sectors, from manufacturing and installation to research and development.

The Trump Administration's Rationale for Cancellation

The Trump administration cited several reasons for rejecting the loan guarantee, most prominently concerns about financial risk and a shift in energy priorities.

- Concerns about Financial Viability: The administration argued that Sunnova's business model presented too high a risk for a government-backed loan guarantee.

- Shifting Energy Priorities: The administration prioritized fossil fuel energy sources, viewing renewable energy initiatives with less favor. This decision reflected the broader energy policy of the Trump administration.

- Political Motivations: Some critics suggested that the cancellation was politically motivated, potentially aimed at undermining the renewable energy sector and signaling support for the fossil fuel industry.

These justifications were met with considerable criticism from environmental advocates and renewable energy stakeholders who pointed to Sunnova's strong financial performance and the broader societal benefits of investing in clean energy.

The Role of the Department of Energy

The Department of Energy played a central role in evaluating the loan guarantee application and ultimately making the decision to cancel it. The DOE's Loan Programs Office (LPO) is responsible for managing the government's loan guarantee program for renewable energy and other clean energy technologies.

- DOE's Evaluation Process: The DOE conducted a rigorous review of Sunnova's application, assessing the financial risks, technological feasibility, and environmental impact of the project.

- Internal Disagreements: While not publicly confirmed, reports indicated internal disagreements within the DOE regarding the appropriateness of the cancellation, highlighting the complexities of the decision-making process within the agency.

- Authority and Responsibility: The DOE has broad authority to approve or reject loan guarantee applications based on its assessment of the risks and benefits involved.

Impact and Consequences of the Cancellation

Effect on Sunnova Energy

The cancellation of the $3 billion loan guarantee had significant negative repercussions for Sunnova Energy.

- Stock Price Decline: The announcement led to an immediate and substantial drop in Sunnova's stock price, eroding investor confidence and potentially hindering future fundraising efforts.

- Project Delays: Several planned expansion projects were put on hold or canceled, delaying the deployment of clean energy infrastructure.

- Reduced Investment: The cancellation signaled a lack of government support for renewable energy projects, making it more challenging to secure private investment.

- Potential Layoffs: The company may have been forced to cut jobs due to reduced funding and delayed projects, impacting employees and the broader economy.

Wider Implications for the Solar Energy Industry

The Sunnova loan cancellation had ripple effects across the entire solar energy sector.

- Investor Sentiment: The decision dampened investor confidence in the renewable energy sector, making it more difficult for other companies to secure financing for similar projects.

- Future Loan Applications: Other companies seeking government-backed loans for renewable energy projects became more hesitant, potentially slowing the growth of the industry.

- Availability of Capital: The cancellation created uncertainty in the market, reducing the overall availability of capital for solar energy initiatives.

Political and Environmental Ramifications

The cancellation had far-reaching political and environmental implications.

- Environmental Goals: The decision undermined the administration's stated commitment to combating climate change and transitioning to a cleaner energy future.

- Clean Energy Policy: The cancellation signaled a shift away from supporting renewable energy development, potentially hindering progress towards environmental sustainability.

- Political Backlash: The decision drew significant criticism from environmental groups, renewable energy advocates, and members of the opposition party.

Alternative Financing Options and the Future of Sunnova

Exploring Alternative Funding Sources

Despite the setback, Sunnova Energy has several avenues to pursue alternative funding.

- Private Equity Investment: The company can seek investments from private equity firms specializing in renewable energy projects.

- Corporate Bonds: Sunnova may issue corporate bonds to raise capital from institutional investors.

- Project Financing: The company can pursue project-specific financing from banks and other financial institutions.

- Strategic Partnerships: Collaborations with larger energy companies could provide access to capital and expertise.

Sunnova's Response and Future Outlook

Sunnova's response to the loan cancellation included a reassessment of its business strategy and exploration of alternative financing options. While the cancellation presented significant challenges, Sunnova's strong market position and the ongoing demand for solar energy suggest a promising future. The company has indicated a commitment to pursuing its growth plans through various alternative strategies, highlighting its resilience and adaptability.

Conclusion

The Trump administration's cancellation of the $3 billion loan guarantee for Sunnova Energy represents a significant blow to the renewable energy sector. This decision had profound implications for Sunnova's financial stability, the broader solar energy industry's growth trajectory, and the overall push towards clean energy initiatives. The uncertainty created by this cancellation underscores the vital role of government policy in shaping the future of renewable energy.

Call to Action: Learn more about the impact of the Sunnova Energy loan cancellation and stay updated on the latest news regarding government funding for renewable energy projects. Understanding the intricacies of renewable energy financing is crucial for anyone invested in the future of clean energy. [Link to relevant resource/article]

Featured Posts

-

Negotiations Stall Amorim Blocks Man Uniteds Star Player Acquisition

May 30, 2025

Negotiations Stall Amorim Blocks Man Uniteds Star Player Acquisition

May 30, 2025 -

Ticketmasters Urgent Warning Avoid Fake Ticket Sellers And Protect Your Money

May 30, 2025

Ticketmasters Urgent Warning Avoid Fake Ticket Sellers And Protect Your Money

May 30, 2025 -

Recours De L Etat Le Projet A69 Dans Le Sud Ouest Relance

May 30, 2025

Recours De L Etat Le Projet A69 Dans Le Sud Ouest Relance

May 30, 2025 -

Tom Aspinall Responds To Jon Jones Public Shaming

May 30, 2025

Tom Aspinall Responds To Jon Jones Public Shaming

May 30, 2025 -

Southeast Asian Solar Imports Hit With Us Tariffs What You Need To Know

May 30, 2025

Southeast Asian Solar Imports Hit With Us Tariffs What You Need To Know

May 30, 2025