$TRUMP Coin Short Seller Scores White House Dinner

Table of Contents

The Identity and Strategy of the Short Seller

H3: Unmasking the Mystery: Who is behind the successful short position?

The individual or entity behind this successful Trump Coin short sell remains largely shrouded in mystery. While some speculate about a large hedge fund with a history of successful cryptocurrency shorting, the identity remains unconfirmed. However, analyzing the available data suggests a sophisticated understanding of the cryptocurrency market and the specific risks associated with Trump Coin.

- Investment Thesis: Their investment thesis likely centered on the inherent volatility of Trump Coin, combined with concerns about regulatory scrutiny and the potential for negative market sentiment stemming from political controversies surrounding the coin.

- Timing and Size: The short position was likely initiated several months before the significant price drop of Trump Coin. The size of the position is unknown, but it was undoubtedly substantial to yield the reported profits.

- Prior Activities: While no publicly available information directly links this short seller to previous significant cryptocurrency trades, their expertise suggests a background in high-stakes financial markets.

The Mechanics of the Short Sell and its Profitability

H3: Understanding Short Selling in Crypto:

Short selling involves borrowing an asset (in this case, Trump Coin), selling it on the market, and hoping the price falls. Later, the short seller buys the asset back at a lower price, returning it to the lender and pocketing the difference as profit. This strategy is inherently risky, especially in the volatile cryptocurrency market.

- Risks and Benefits of Short Selling Trump Coin: The high volatility of Trump Coin amplified both the risks and the rewards. A sudden positive news cycle could have wiped out any profits, or even resulted in significant losses. Regulatory uncertainty also posed a considerable risk. The potential rewards, however, were equally substantial given the coin's price swings.

- Estimated Profits: While precise figures remain confidential, sources suggest the short seller’s profits were substantial, likely in the millions of dollars, reflecting the significant price decline experienced by Trump Coin.

- Market Manipulation and News Events: Any significant negative news affecting Trump Coin, coupled with potential market manipulation, would have contributed to the price decline, boosting the short seller’s profits.

The White House Dinner Invitation – Speculation and Implications

H3: Unpacking the Invitation:

The White House dinner invitation to the Trump Coin short seller has sparked intense speculation and controversy. Was this a coincidence, a calculated political move, or something else entirely? The lack of transparency surrounding the invitation fuels various theories.

- Potential Motives: Possible motives range from a genuine appreciation for the short seller’s financial acumen to a strategic political move designed to foster positive relations with the financial community, or even to deflect criticism about the Trump Coin itself.

- Political Analysis: The invitation's political implications are substantial, particularly concerning the blurring lines between finance, politics, and cryptocurrency regulation. The event raises questions about potential conflicts of interest and transparency in government dealings.

- Public and Media Reaction: Public reaction has been mixed, ranging from outrage and accusations of favoritism to detached curiosity and amusement. The media coverage has been extensive, with many outlets questioning the ethics and implications of the invitation.

The Fallout and Future Predictions for Trump Coin

H3: Analyzing the Aftermath:

The news of the White House dinner and the short seller's success has sent shockwaves through the Trump Coin market.

- Current Price and Trading Volume: Following the news, Trump Coin's price experienced further volatility, although the long-term impact remains to be seen.

- Future Predictions: Predicting the future of Trump Coin is challenging, given its inherent volatility and the ongoing regulatory uncertainty. However, it’s likely that investor confidence has been shaken, impacting future trading volume.

- Investor Confidence and Legal Implications: The event raises questions about regulatory compliance and potential legal implications regarding market manipulation and insider trading. The future of Trump Coin, therefore, depends heavily on its response to these challenges.

Conclusion: Navigating the Trump Coin Market – Lessons Learned from a Short Seller's Success

This article highlighted the remarkable story of the Trump Coin short seller and their unexpected White House dinner invitation. Their success underscores both the potential rewards and significant risks associated with short selling in the volatile cryptocurrency market, especially in politically charged assets like Trump Coin. The key takeaway is the critical need for thorough research, careful risk assessment, and a deep understanding of market dynamics before engaging in such high-risk investment strategies. Learn more about the intricacies of short selling Trump Coin and navigate the crypto market safely.

Featured Posts

-

Pokemon Tcg Pocket Shining Revelry A Completionists Nightmare

May 29, 2025

Pokemon Tcg Pocket Shining Revelry A Completionists Nightmare

May 29, 2025 -

Frances Plan To Combat Drug Crime Mobile Phone Seizures

May 29, 2025

Frances Plan To Combat Drug Crime Mobile Phone Seizures

May 29, 2025 -

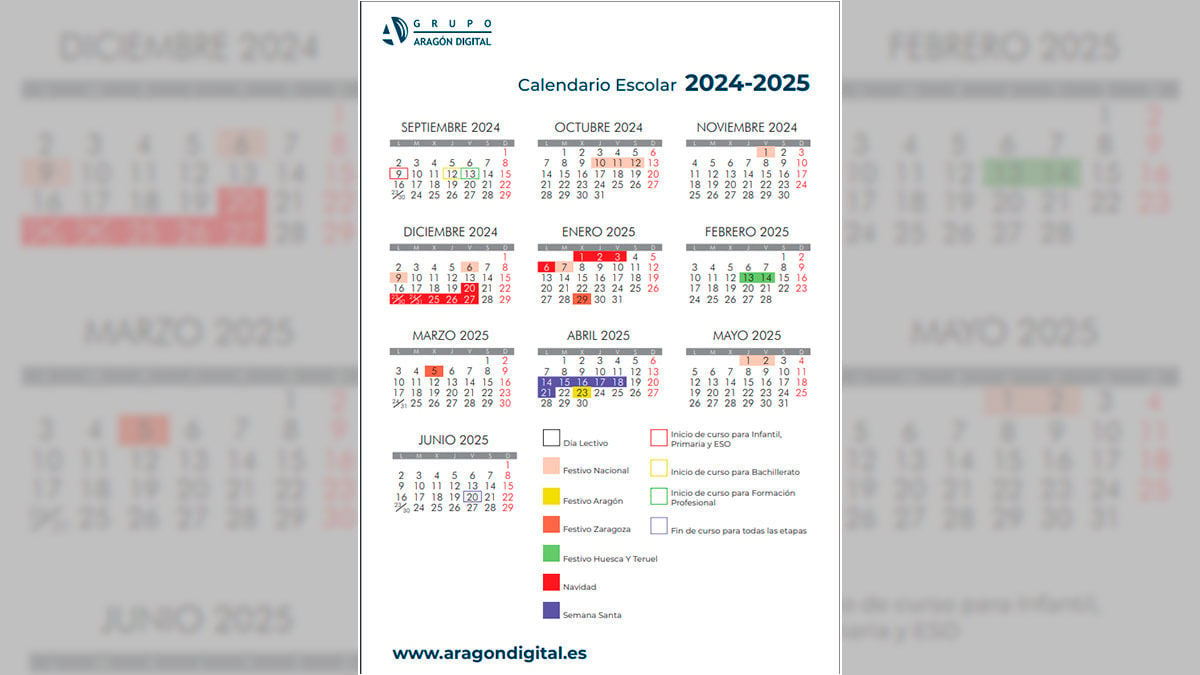

Sobredemanda Escolar En Aragon 58 Centros Con Problemas De Admision

May 29, 2025

Sobredemanda Escolar En Aragon 58 Centros Con Problemas De Admision

May 29, 2025 -

Top Riders And Hondas Winning Motorcycles A Winning Combination

May 29, 2025

Top Riders And Hondas Winning Motorcycles A Winning Combination

May 29, 2025 -

Celebrity Big Brother Controversy Aj Odudu Breaks Silence On Mickey Rourke

May 29, 2025

Celebrity Big Brother Controversy Aj Odudu Breaks Silence On Mickey Rourke

May 29, 2025

Latest Posts

-

Le Cas Sanofi Pourquoi Le Laboratoire Reste T Il Sous Evalue En Europe

May 31, 2025

Le Cas Sanofi Pourquoi Le Laboratoire Reste T Il Sous Evalue En Europe

May 31, 2025 -

Rejets Toxiques A Mourenx Sanofi Et Le Medicament Depakine Mis En Examen

May 31, 2025

Rejets Toxiques A Mourenx Sanofi Et Le Medicament Depakine Mis En Examen

May 31, 2025 -

Sanofi Aktie Kursanstieg Rilzabrutinib Erhaelt Orphan Drug Designation

May 31, 2025

Sanofi Aktie Kursanstieg Rilzabrutinib Erhaelt Orphan Drug Designation

May 31, 2025 -

Sanofi Et Ses Comparables Europeens Evaluation Et Perspectives De Croissance

May 31, 2025

Sanofi Et Ses Comparables Europeens Evaluation Et Perspectives De Croissance

May 31, 2025 -

Sous Valorisation De Sanofi Comparaison Avec Les Concurrents Pharmaceutiques Europeens

May 31, 2025

Sous Valorisation De Sanofi Comparaison Avec Les Concurrents Pharmaceutiques Europeens

May 31, 2025