Trump Considers Tariffs: Impact On Commercial Aircraft And Engine Industry

Table of Contents

Direct Impact of Tariffs on Aircraft Manufacturing Costs

The imposition of Trump tariffs would directly translate into significantly higher manufacturing costs for commercial aircraft. This increase stems from the reliance on imported materials and components crucial to aircraft construction.

Increased Material and Component Costs

- Aluminum: A substantial portion of aluminum used in aircraft construction is imported. Tariffs could increase the cost of aluminum by 15-25%, significantly impacting manufacturing costs.

- Titanium: Similarly, titanium, a crucial component for high-strength, lightweight parts, is often sourced internationally. Tariffs on titanium could add another 10-20% to manufacturing expenses.

- Composites: Advanced composite materials, increasingly vital for fuel efficiency and structural integrity, are also frequently imported. Tariffs on these materials would further exacerbate cost increases.

- Impact on Profit Margins: These combined cost increases would severely squeeze profit margins for manufacturers like Boeing and Airbus, potentially leading to reduced production and job losses.

- Consumer Price Increases: Ultimately, these increased costs are likely to be passed on to consumers in the form of higher ticket prices for air travel.

Disruption of Supply Chains

Aircraft manufacturing relies on a complex global network of suppliers. Tariffs could severely disrupt this delicate balance, leading to significant delays and production stoppages.

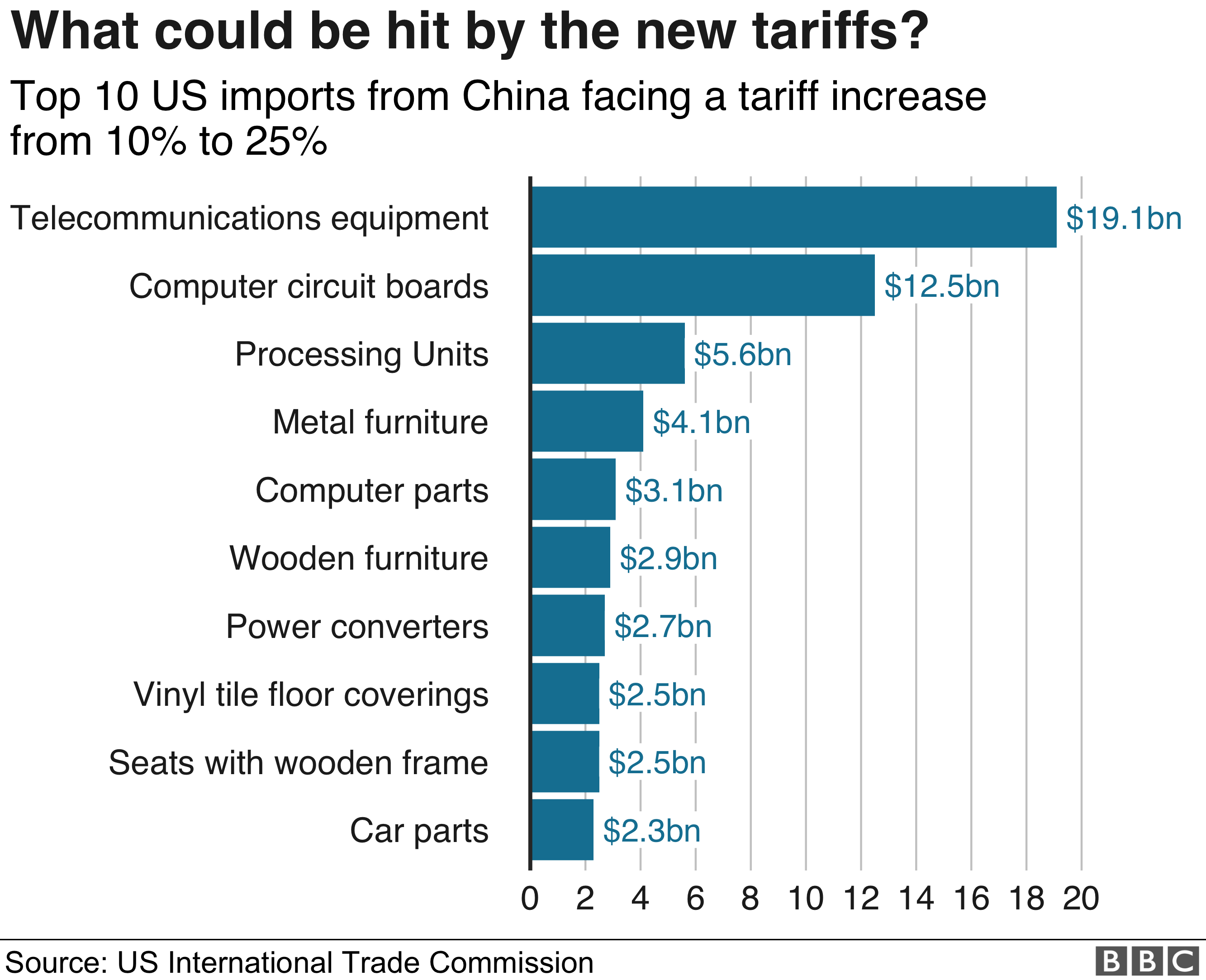

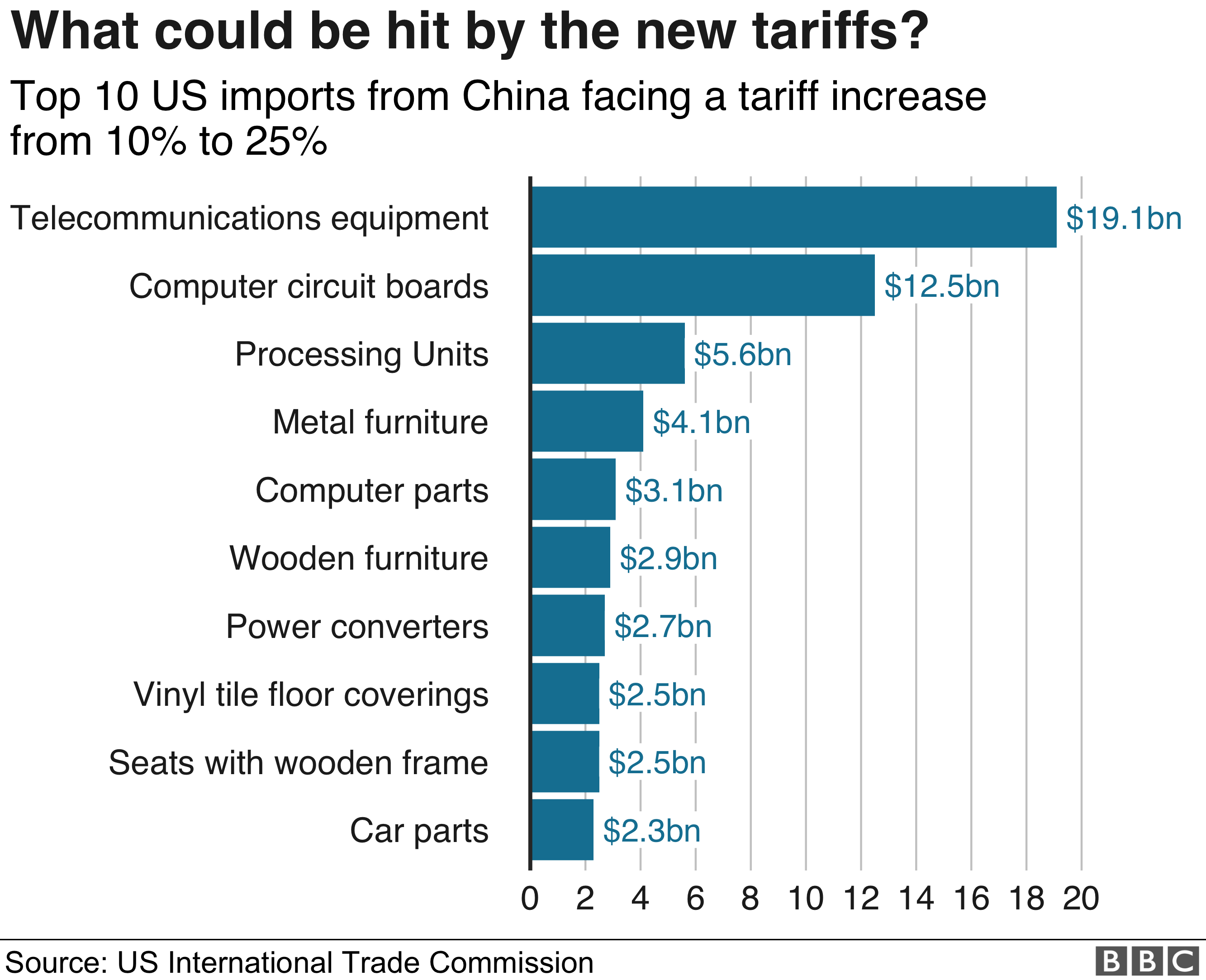

- Key Component Suppliers: Many crucial components are sourced from countries that might be targeted by tariffs. This includes parts from Canada, the EU, and various Asian nations.

- Production Delays: Even minor delays in receiving crucial parts can bring entire assembly lines to a standstill, leading to missed delivery dates and significant financial losses.

- Just-in-Time Manufacturing: The "just-in-time" manufacturing model prevalent in the aerospace industry is particularly vulnerable to tariff-induced disruptions. Delays in receiving parts can severely hamper the efficiency of this system.

Impact on Engine Manufacturing and the Aerospace Supply Chain

The engine manufacturing sector, equally vital to the aerospace industry, faces similar challenges. Trump tariffs would increase the cost of engine components, reduce global competitiveness, and potentially trigger a sector-wide restructuring.

Increased Costs for Engine Components

Engine manufacturers like GE, Rolls-Royce, and Pratt & Whitney rely heavily on globally sourced components. Tariffs will inevitably inflate these costs, rippling through the entire supply chain.

- Precision Parts: Many intricate engine components are manufactured overseas, often in specialized facilities. Tariffs on these parts will directly increase engine manufacturing costs.

- Supply Chain Ripple Effect: Increased costs for engine components will subsequently drive up the overall cost of aircraft, impacting both manufacturers and airlines.

- Consolidation: The increased cost pressure might trigger consolidation within the engine manufacturing sector, reducing competition and potentially impacting innovation.

Reduced Global Competitiveness

Increased manufacturing costs due to Trump tariffs will make US-made aircraft and engines less competitive in the global marketplace.

- Production Cost Comparison: Manufacturers in countries unaffected by tariffs will enjoy a significant cost advantage, allowing them to offer more competitive prices.

- Market Share Loss: US manufacturers could experience a significant loss of market share to competitors in countries not subject to the same trade restrictions.

- Job Losses in the US: Reduced competitiveness could lead to job losses within the US aerospace industry as manufacturers struggle to compete in the global market.

Potential Responses from Aircraft and Engine Manufacturers

Facing the threat of Trump tariffs, aircraft and engine manufacturers are likely to explore various strategies to mitigate the negative impacts.

Reshoring and Nearshoring

Manufacturers might consider relocating production back to the US (reshoring) or to nearby countries (nearshoring) to avoid tariffs.

- Relocation Strategies: This could involve building new facilities in the US or establishing manufacturing hubs in countries with favorable trade agreements.

- Economic and Logistical Challenges: Reshoring and nearshoring present substantial economic and logistical challenges, including increased labor costs and potential supply chain disruptions.

Lobbying and Political Pressure

Industry lobbying groups will undoubtedly exert significant pressure on policymakers to mitigate the effects of tariffs.

- Industry Associations: Organizations representing the aerospace industry will actively engage in lobbying efforts to influence government policy and avoid detrimental trade restrictions.

- Lobbying Strategies: These strategies could include providing economic impact assessments, engaging in public relations campaigns, and working with lawmakers to find solutions.

Innovation and Cost Reduction Measures

Manufacturers will explore innovative solutions and cost-cutting measures to offset the increased expenses due to tariffs.

- Automation: Investing in automation technologies could reduce reliance on manual labor and potentially lower production costs.

- Process Optimization: Streamlining production processes and improving efficiency can help to offset some of the cost increases.

- Alternative Materials: Research and development into alternative materials could provide cost-effective substitutes for imported components.

Conclusion

The potential imposition of Trump tariffs presents significant challenges to the commercial aircraft and engine industry. Increased manufacturing costs, supply chain disruptions, and reduced global competitiveness could have severe consequences, impacting jobs, economic growth, and consumer prices. The industry's response will likely involve a combination of reshoring, lobbying efforts, and technological innovation to mitigate the negative impact. It's imperative that policymakers carefully consider the potential economic ramifications of trade policy on this vital industry. We urge you to contact your representatives and voice your concerns about the potential impacts of Trump tariffs on the commercial aircraft and engine industry. The future of this crucial sector depends on informed dialogue and responsible policy-making.

Featured Posts

-

Mm Amania Com Ufc 315 Betting Odds Analysis And Weekend Picks

May 11, 2025

Mm Amania Com Ufc 315 Betting Odds Analysis And Weekend Picks

May 11, 2025 -

De Betwiste Relaties Van Prins Andrew Een Onderzoek Naar Zijn Contacten

May 11, 2025

De Betwiste Relaties Van Prins Andrew Een Onderzoek Naar Zijn Contacten

May 11, 2025 -

Who Will Lead Stellantis Us Executive Among Top Choices

May 11, 2025

Who Will Lead Stellantis Us Executive Among Top Choices

May 11, 2025 -

5 Essential Dos And Don Ts To Secure A Private Credit Role

May 11, 2025

5 Essential Dos And Don Ts To Secure A Private Credit Role

May 11, 2025 -

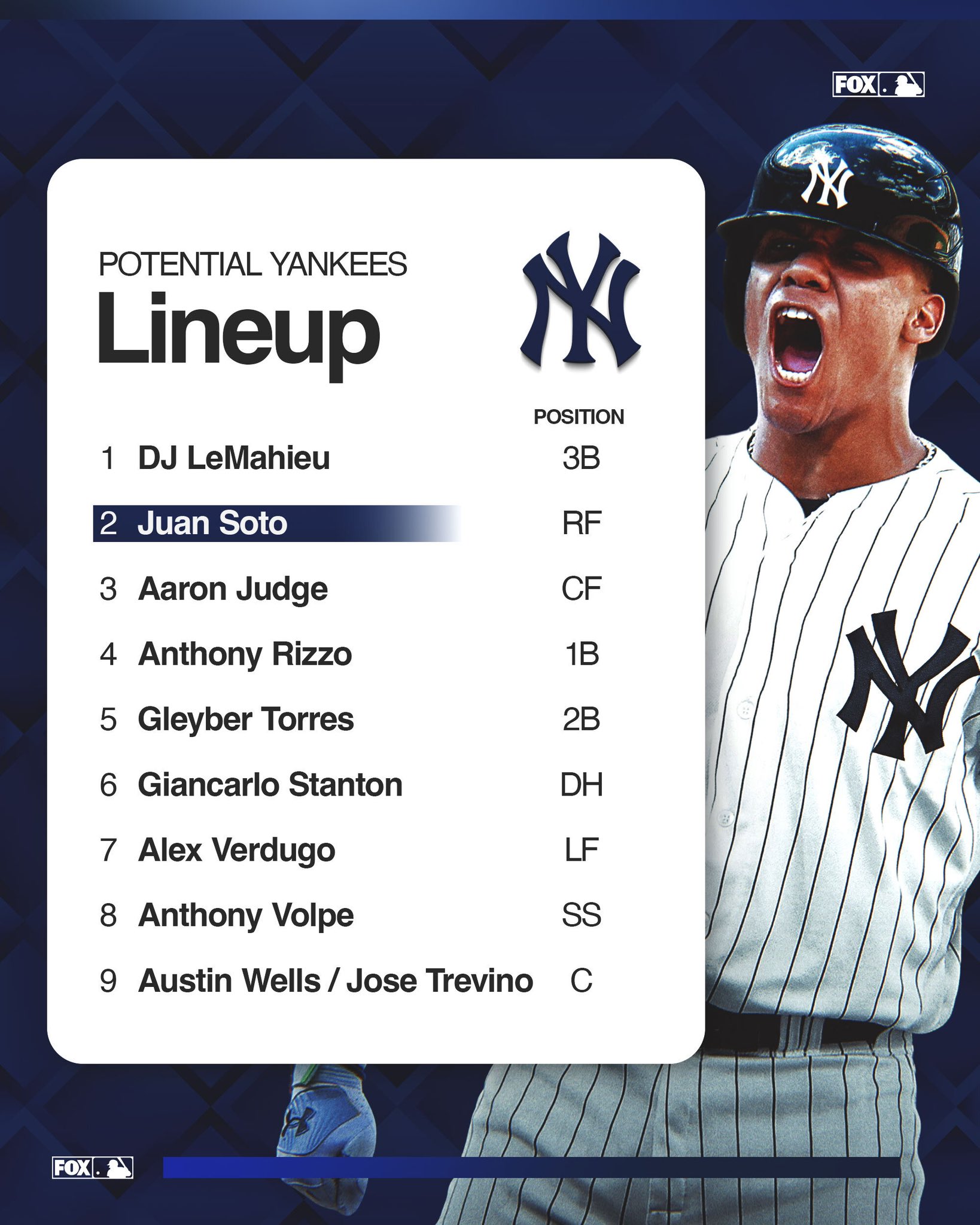

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 11, 2025