Trump Extends Deadline On 50% EU Tariffs To July 9th

Table of Contents

The Original Tariff Threat and its Context

The initial threat of 50% tariffs on EU goods stemmed from a long-running dispute over subsidies granted to Airbus by European governments. The World Trade Organization (WTO) ruled in favor of the US, authorizing retaliatory tariffs. This decision set the stage for a potential trade war, threatening significant economic consequences. The potential impact was particularly severe for sectors heavily reliant on transatlantic trade.

- Aircraft Manufacturing: Boeing, a major US player, stood to gain from tariffs on Airbus, but the broader impact on the aerospace industry could have been considerable.

- Automobiles: The automobile industry, a significant part of both US and EU economies, faced the possibility of substantial tariff-related disruptions.

- Other Sectors: Numerous other sectors, from agricultural products to manufactured goods, were threatened by the imposition of these tariffs.

The potential economic consequences are multifaceted:

- Increased Prices for Consumers: Tariffs would likely lead to higher prices for consumers on a wide range of goods.

- Reduced Trade Volumes: The imposition of tariffs would almost certainly reduce trade volumes between the US and the EU, harming both economies.

- Retaliatory Measures: The EU could have responded with its own tariffs on US goods, escalating the trade war and causing further economic damage.

The Significance of the July 9th Deadline Extension

The extension of the tariff deadline to July 9th suggests a number of possibilities. It could signify ongoing negotiations between the US and the EU aimed at resolving the Airbus subsidy dispute. Alternatively, it might represent a strategic political maneuver by either side, buying time to reassess their positions.

The implications of this extension are far-reaching:

- De-escalation or Temporary Reprieve?: The delay could signal a willingness to find a negotiated settlement, or it could simply be a temporary pause before the tariffs are imposed.

- Uncertainty for Businesses: Businesses continue to face significant uncertainty, hindering their ability to plan for the future. Investment decisions are likely to be postponed until more clarity emerges.

Possible scenarios following July 9th include:

- Full Implementation of Tariffs: The tariffs could be fully implemented, leading to immediate economic consequences.

- Further Extension: The deadline could be extended again, prolonging the uncertainty.

- Negotiated Settlement: A compromise could be reached, either completely removing the tariffs or implementing them at a lower rate.

Impact on Businesses and Consumers

The uncertainty surrounding the Trump tariffs significantly affects businesses involved in EU-US trade. Importers and exporters alike face challenges in forecasting demand, managing inventory, and setting prices.

- Import/Export Businesses: Companies involved in importing and exporting goods between the US and EU are forced to navigate a volatile landscape, making accurate financial projections extremely difficult.

- Supply Chain Disruptions: The threat of tariffs could disrupt established supply chains, forcing businesses to seek alternative suppliers.

- Increased Costs for Businesses: Companies will incur additional costs related to navigating the regulatory complexities and potential for increased tariffs.

Consumers also face significant potential impacts:

- Higher Prices: The imposition of tariffs would almost certainly lead to higher prices for a range of imported goods.

- Reduced Choice: Some products might become unavailable due to tariffs making them uncompetitive.

Businesses can employ several strategies to mitigate the risks:

- Diversification of Supply Chains: Businesses might diversify their sourcing to reduce dependence on EU or US suppliers.

- Hedging Strategies: Companies might use financial instruments to hedge against potential price increases.

- Lobbying Efforts: Businesses might engage in lobbying efforts to influence policy decisions.

Future Outlook and Potential Resolutions

The likelihood of a resolution to the trade dispute remains uncertain. Several outcomes are possible:

- Complete Removal of Tariffs: A successful negotiation could result in the complete removal of the threatened tariffs.

- Partial Implementation: A compromise could see some tariffs implemented, but at a lower rate than initially proposed.

- Full Implementation & Escalation: The tariffs could be fully implemented, potentially leading to further retaliatory measures from the EU.

Potential compromises or solutions include:

- Negotiated Settlement of the Airbus Subsidy Dispute: The US and EU could reach an agreement that addresses the underlying concerns.

- A Broader Trade Agreement: The dispute could be resolved within the context of a broader trade agreement between the US and the EU.

The future depends on the willingness of both sides to negotiate and find a mutually acceptable solution.

Conclusion: The Ongoing Saga of Trump's EU Tariffs – What to Watch For

The threat of Trump's EU tariffs, the subsequent deadline extension to July 9th, and the ensuing uncertainty have significant implications for businesses and consumers on both sides of the Atlantic. The potential for higher prices, supply chain disruptions, and an escalation of the trade war remain very real. The July 9th deadline is a crucial point, potentially leading to the implementation of tariffs, further negotiations, or a negotiated settlement. Understanding the impact of Trump’s EU tariffs on the global economy is paramount. Stay informed about further developments by following reputable news sources for updates on these ongoing trade negotiations. The situation remains fluid, and understanding the potential ramifications is vital for businesses and consumers alike.

Featured Posts

-

Exploring Guccis Silk Legacy An Assouline Book Featuring Nine Artists

May 27, 2025

Exploring Guccis Silk Legacy An Assouline Book Featuring Nine Artists

May 27, 2025 -

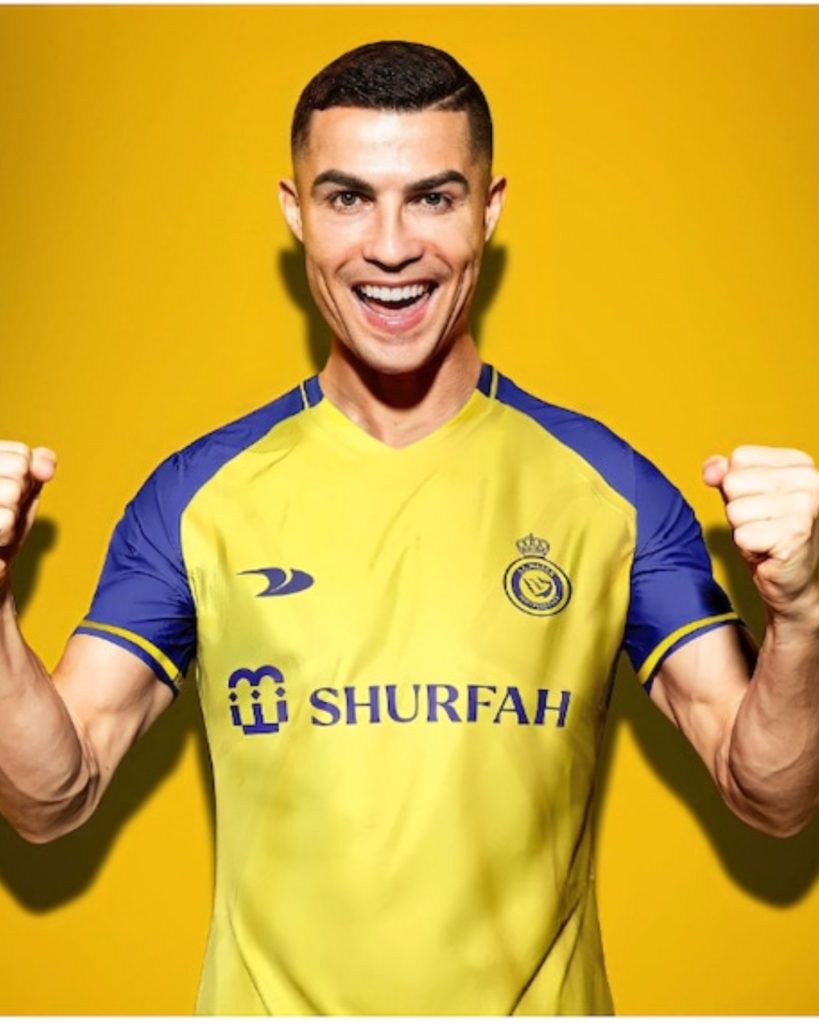

Emegha Three Premier League Clubs Join Transfer Race

May 27, 2025

Emegha Three Premier League Clubs Join Transfer Race

May 27, 2025 -

Yellowstones Biggest Losses 8 Actors Killed Off By Taylor Sheridan

May 27, 2025

Yellowstones Biggest Losses 8 Actors Killed Off By Taylor Sheridan

May 27, 2025 -

64 Million Transfer Manchester United In Talks With Top Striker

May 27, 2025

64 Million Transfer Manchester United In Talks With Top Striker

May 27, 2025 -

Atentatot Na Robert Kenedi Deshifriranje Na Novoob Avenite Dokumenti

May 27, 2025

Atentatot Na Robert Kenedi Deshifriranje Na Novoob Avenite Dokumenti

May 27, 2025

Latest Posts

-

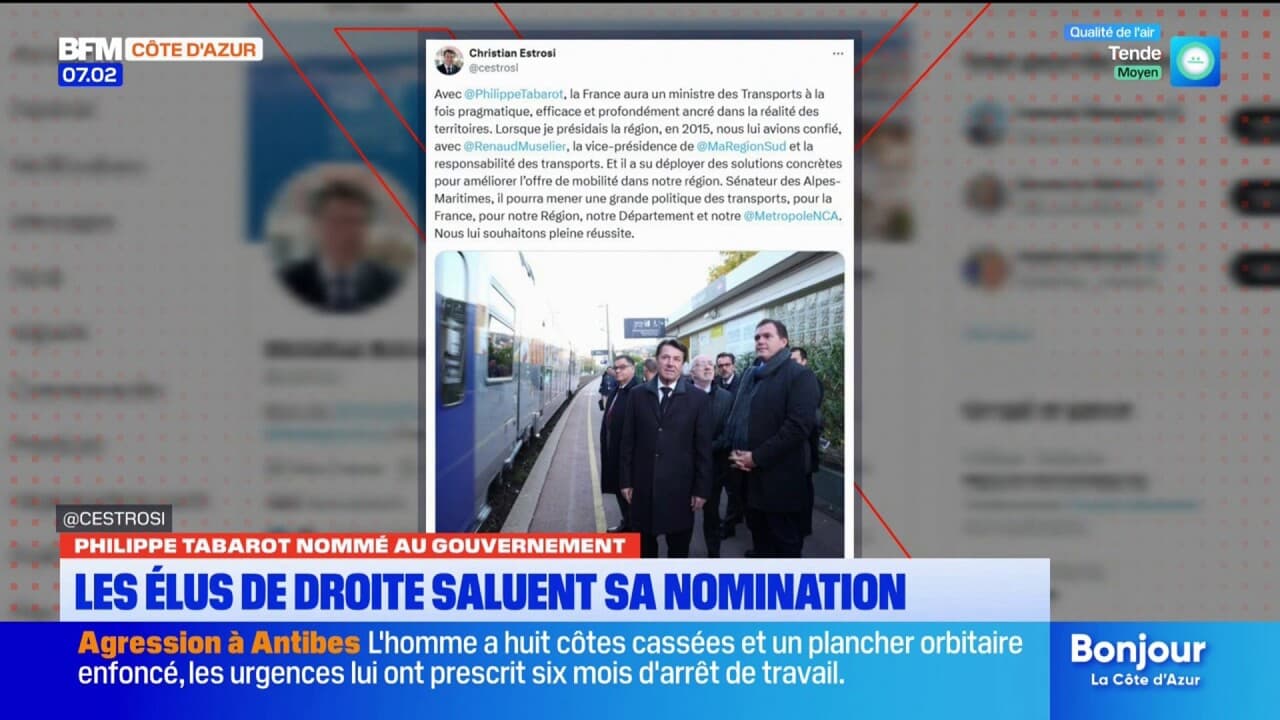

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025 -

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025 -

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025 -

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025

Comprendre Les Droits De Douane Un Guide Pratique

May 30, 2025 -

Annulation A69 Le Recours De L Etat Pour Le Sud Ouest

May 30, 2025

Annulation A69 Le Recours De L Etat Pour Le Sud Ouest

May 30, 2025