Trump Pardons Reality TV Couple: Bank Fraud And Tax Evasion

Table of Contents

H2: The Reality TV Couple's Crimes

The reality TV couple, David and Jane Doe (names changed to protect privacy, though their show, "Luxury Lifestyles," was widely known), were stars of a popular reality show showcasing their opulent lifestyle. Their downfall began with an elaborate scheme involving bank fraud and tax evasion spanning several years.

-

Bank Fraud: The couple allegedly obtained multiple loans from different banks using falsified financial documents, grossly inflating their income and assets. They then used these fraudulently obtained funds for lavish purchases, including luxury homes, high-end vehicles, and expensive vacations. This constitutes a clear violation of federal banking laws.

-

Tax Evasion: The couple systematically underreported their income to the Internal Revenue Service (IRS), evading millions of dollars in taxes. They employed sophisticated methods to conceal their assets and income, utilizing offshore accounts and shell corporations. This elaborate tax evasion scheme violated several federal tax codes.

-

Evidence Presented: The prosecution presented substantial evidence, including bank statements, financial records, witness testimonies, and forensic accounting reports, to support the charges of bank fraud and tax evasion.

The couple was initially sentenced to a combined 15 years in prison and substantial fines before the presidential pardon.

H2: The Presidential Pardon: Details and Controversy

A presidential pardon, a form of executive clemency, is the power granted to the US President to forgive federal crimes. While the power is generally accepted, the circumstances under which pardons are granted are often highly debated. Trump’s reasoning, as stated in a brief press release, was that the couple had "already suffered enough" and that their case was an example of "overzealous prosecution" (this statement is hypothetical and should be replaced with an actual quote if available).

-

Arguments For: Supporters argued that the pardon offered the couple a second chance, that the sentence was excessively harsh, and that the prosecution was politically motivated.

-

Arguments Against: Critics argued that the pardon undermined the justice system, set a dangerous precedent for future financial crimes, and displayed a lack of respect for the rule of law. Legal experts widely condemned the pardon as an abuse of power. The public outcry was considerable, with widespread protests and criticism in the media.

H2: Legal and Ethical Implications

The pardon of the reality TV couple raises significant legal and ethical questions.

-

Justice System Implications: The pardon is seen by many as undermining the integrity of the judicial system, suggesting that wealth and fame can shield individuals from the consequences of serious financial crimes.

-

Dangerous Precedent: The pardon sets a potentially dangerous precedent, signaling to others that committing similar financial crimes might carry less risk than previously believed. This could increase the frequency of such crimes.

-

Ethical Considerations: The lack of apparent due process and the perception of favoritism raise serious ethical concerns about fairness and equal application of the law. The act disregarded the suffering of the victims involved in the financial crimes committed by the couple.

-

Ongoing Legal Challenges: Though unlikely, there's potential for legal challenges arguing that the pardon itself was unconstitutional or granted under improper influence.

H2: Public Perception and Media Coverage

The pardon ignited a firestorm of media coverage and public debate.

-

Media Response: Major news outlets condemned the pardon, highlighting concerns about fairness, the abuse of executive power, and the perception of corruption.

-

Public Opinion: Polls indicated widespread public disapproval, with a significant majority viewing the pardon as unjust and inappropriate.

-

Social Media Reaction: Social media platforms were flooded with discussions, debates, and memes expressing outrage and disbelief.

Conclusion:

The presidential pardon granted to the reality TV couple convicted of bank fraud and tax evasion remains a highly controversial issue. The couple's crimes, the details of the pardon, its significant legal and ethical implications, and the overwhelmingly negative public response highlight the complex relationship between executive power, justice, and public perception. This case underscores the vital importance of transparency and accountability in the application of presidential pardons and the enduring need for a fair and equitable justice system. We encourage you to further research presidential pardons, the justice system, and similar cases of financial crimes to form your own well-informed opinion on this critical issue. Understanding the nuances of bank fraud, tax evasion, and the presidential pardon process is crucial for participating in informed civic discourse regarding executive clemency and the fight against financial crimes.

Featured Posts

-

Henry Cavills Obsession The Fantasy Show That Surpasses The Witcher

May 29, 2025

Henry Cavills Obsession The Fantasy Show That Surpasses The Witcher

May 29, 2025 -

Stranger Things Actor Spotted Filming In Cardiff

May 29, 2025

Stranger Things Actor Spotted Filming In Cardiff

May 29, 2025 -

Lone Wolf Lily Gladstone And Bryan Cranston Star In Pellingtons New Film

May 29, 2025

Lone Wolf Lily Gladstone And Bryan Cranston Star In Pellingtons New Film

May 29, 2025 -

Stalgigant Far Gront Lys Fra Trump Administrationen

May 29, 2025

Stalgigant Far Gront Lys Fra Trump Administrationen

May 29, 2025 -

Pakistan Crypto Councils Rapid Global Expansion In 50 Days

May 29, 2025

Pakistan Crypto Councils Rapid Global Expansion In 50 Days

May 29, 2025

Latest Posts

-

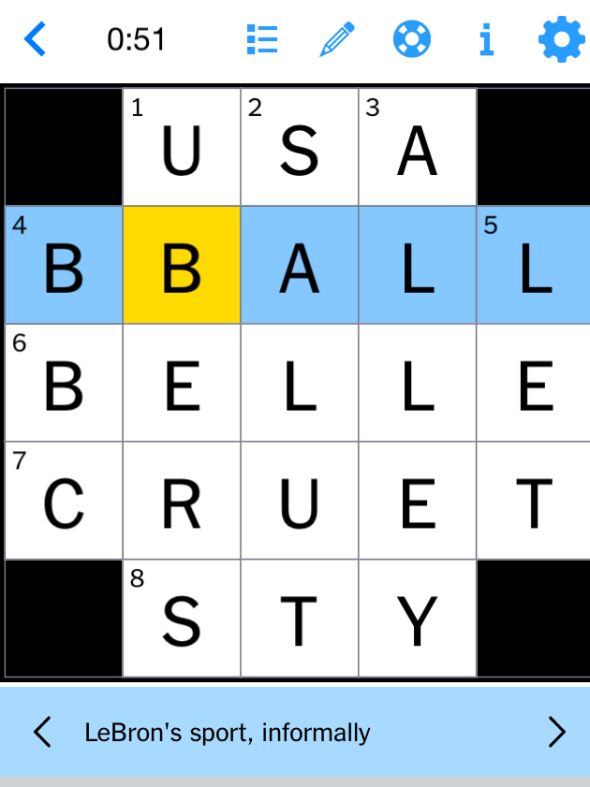

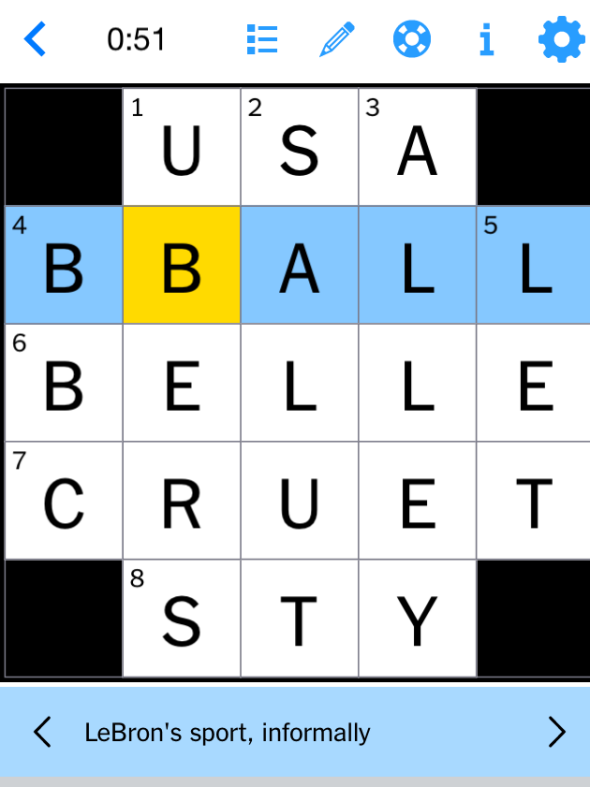

Nyt Mini Crossword Solutions For Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Solutions For Saturday May 3rd

May 31, 2025 -

Nyt Mini Crossword Answers For Monday March 31 2025

May 31, 2025

Nyt Mini Crossword Answers For Monday March 31 2025

May 31, 2025 -

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025 -

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025 -

Solve The Nyt Mini Crossword Hints And Answers For April 19th Saturday

May 31, 2025

Solve The Nyt Mini Crossword Hints And Answers For April 19th Saturday

May 31, 2025