Trump Tariffs And Market Volatility: Bank Of Canada's April Interest Rate Decision

Table of Contents

The Impact of Trump Tariffs on the Canadian Economy

The imposition of Trump tariffs significantly impacted the Canadian economy, given the deep trade relationship between Canada and the United States.

Trade Relations with the US

Canada and the US share a vast and integrated trading relationship. The Trump administration's tariffs disrupted this longstanding partnership, creating considerable economic uncertainty.

- Agriculture: The tariffs on Canadian agricultural products, such as dairy and lumber, led to reduced exports and revenue for Canadian farmers.

- Automotive: The automotive sector, a cornerstone of the Canadian economy, faced significant challenges due to tariffs on automotive parts and vehicles, impacting production and employment.

- Trade Data: Statistics Canada reported a decline in Canadian exports to the US following the implementation of tariffs, demonstrating a tangible negative impact on trade volumes and overall economic growth. These figures highlighted the vulnerability of the Canadian economy to fluctuations in US-Canada trade.

The "tariff impact" extended beyond specific sectors, creating a climate of uncertainty that dampened business investment and consumer confidence. The keywords "US-Canada trade" and "Canadian exports" reflect the significant disruption to bilateral trade.

Ripple Effects on Global Markets

The imposition of Trump tariffs didn't just affect bilateral trade; it generated widespread uncertainty and volatility in global financial markets. This "trade war" created ripple effects felt around the world, including in Canada.

- Market Fluctuations: Stock markets experienced significant fluctuations as investors reacted to the evolving trade landscape, leading to increased market volatility.

- Investor Sentiment: Investor confidence declined globally, with businesses delaying investment decisions due to uncertainty surrounding future trade policies.

- Spillover Effects: The global market volatility had a direct impact on the Canadian economy, affecting currency exchange rates, investment flows, and overall economic growth. This "global market volatility" impacted "investor confidence," making accurate economic forecasting extremely challenging.

Market Volatility Leading up to the April Decision

The period leading up to the Bank of Canada's April interest rate decision was characterized by significant market volatility stemming directly from Trump tariffs and their ripple effects.

Economic Indicators

Several key economic indicators provided a mixed picture of the Canadian economy in the period leading up to the April announcement. These indicators were heavily influenced by the ongoing trade uncertainty.

- Inflation Rate: Inflation remained relatively subdued, partly due to the dampening effect of trade uncertainty on consumer spending and business investment.

- Unemployment Figures: Unemployment figures showed a mixed trend, with some sectors experiencing job losses due to tariff-related disruptions, while others remained relatively stable.

- Canadian GDP: Canadian GDP growth slowed, reflecting the negative impact of trade disputes and global uncertainty on economic activity. Analyzing these "unemployment figures" and the "Canadian GDP" painted a complex picture for the Bank of Canada.

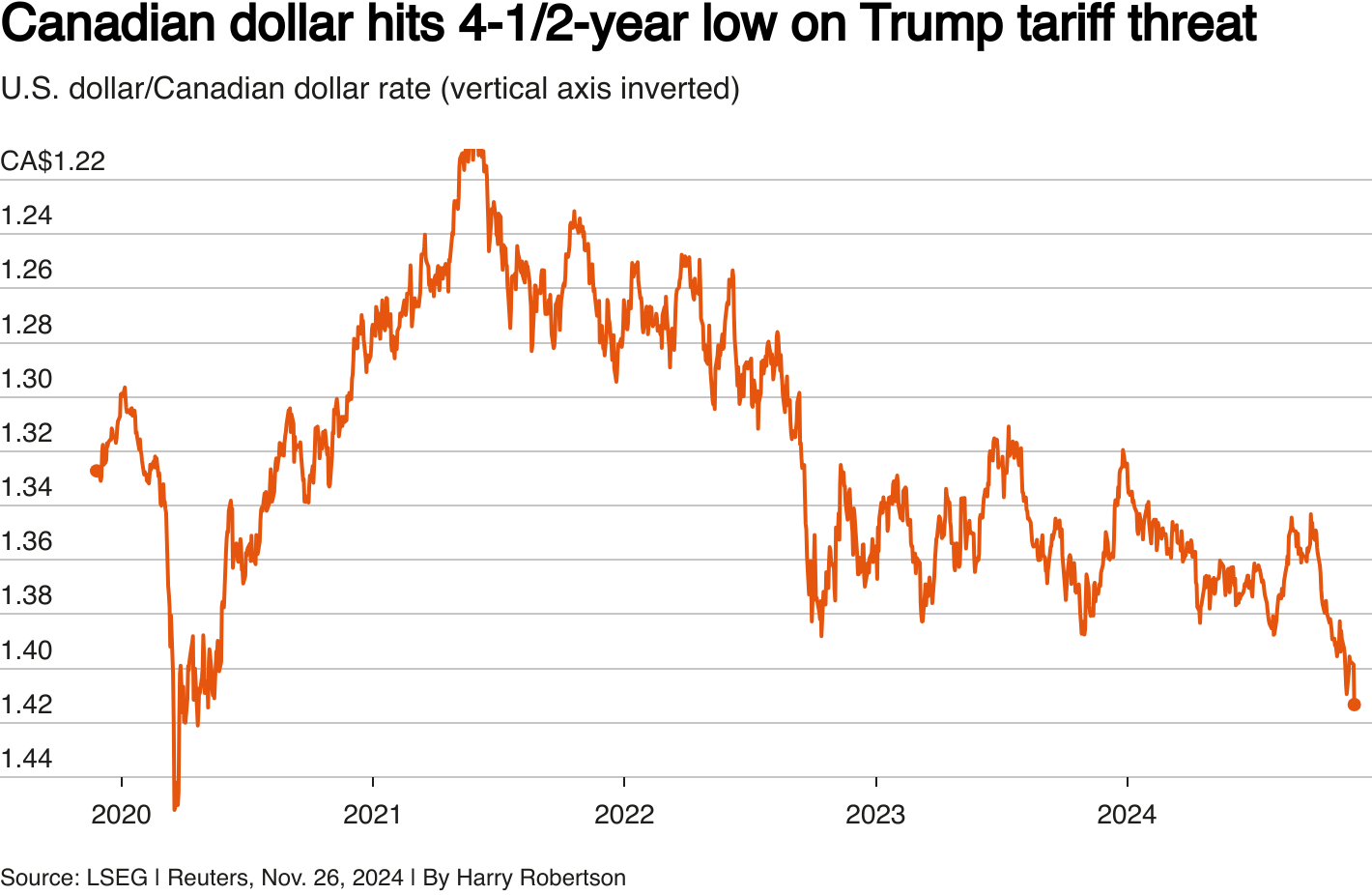

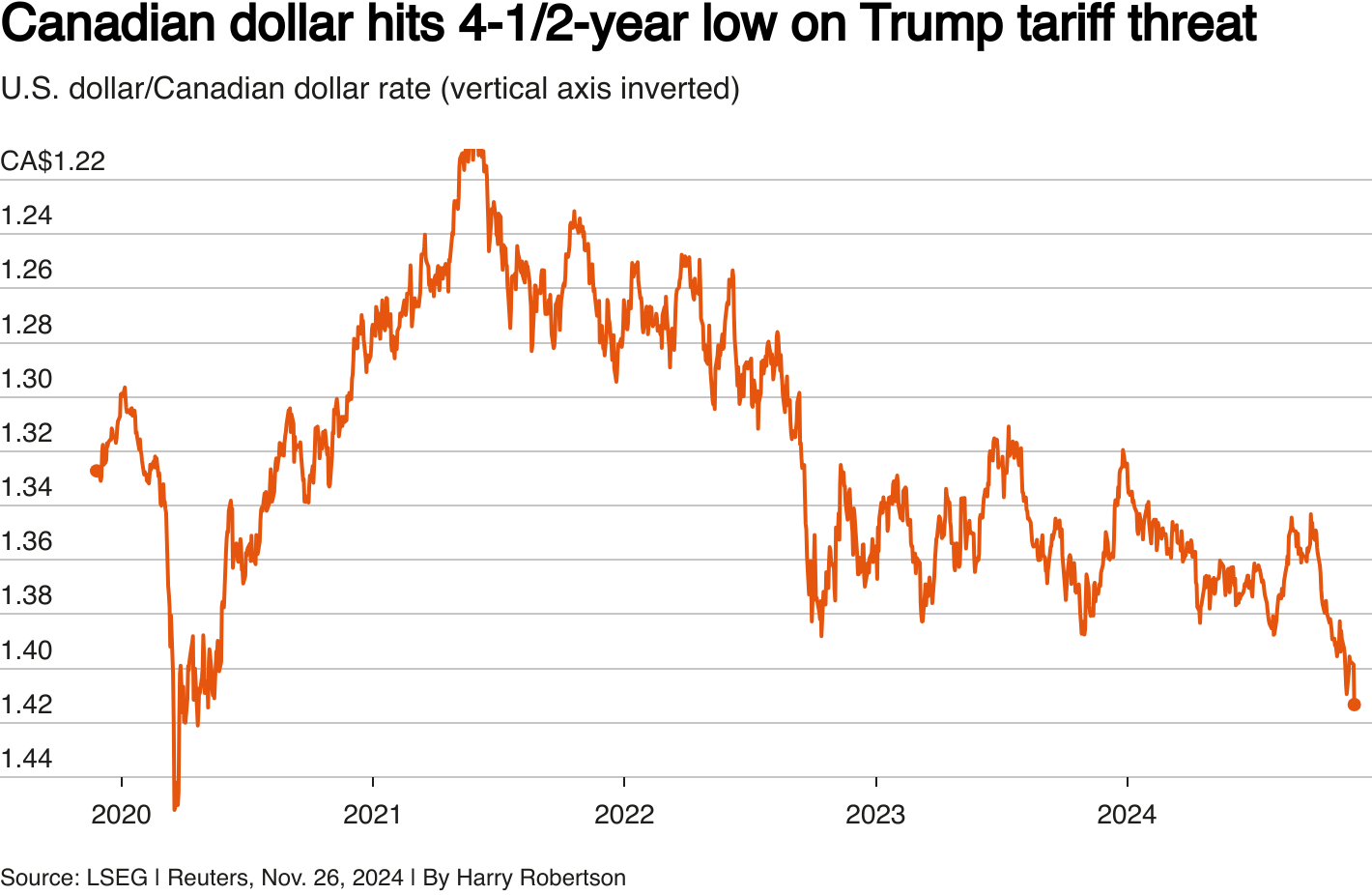

Currency Fluctuations

The uncertainty surrounding Trump tariffs and their impact on the Canadian economy led to significant fluctuations in the Canadian dollar.

- Exchange Rate Volatility: The Canadian dollar experienced volatility against major currencies, reflecting investor sentiment and uncertainty regarding future trade relations.

- Import/Export Impacts: Currency fluctuations impacted the cost of imports and exports, adding to the overall economic uncertainty and complicating the Bank of Canada's decision-making process. The "Canadian dollar" and "exchange rate" volatility became a key factor in assessing the economic health of the country.

The Bank of Canada's April Interest Rate Decision and its Rationale

The Bank of Canada's April interest rate decision was closely watched by economists and market participants alike, given the prevailing economic uncertainties.

The Announced Rate

In April [Insert Year], the Bank of Canada [Insert Action: held, increased, or decreased] its key interest rate to [Insert Rate].

- Reasoning: The Bank's decision was based on a careful assessment of various economic indicators, including inflation, employment, and economic growth. The [Insert Action: holding, increase, or decrease] reflected the Bank's assessment of the balance of risks to the Canadian economy at that time.

The Bank's Statement

The accompanying statement from the Bank of Canada provided further insights into the rationale behind the interest rate decision. Key points addressed the impact of Trump tariffs and market volatility on the Canadian economy.

- [Insert direct quote from the Bank of Canada's statement regarding Trump tariffs and their impact.]

- [Insert direct quote from the Bank of Canada's statement regarding market volatility and its effect on the Canadian economy.]

- [Insert direct quote from the Bank of Canada's statement summarizing their overall assessment and outlook.]

The keywords "monetary policy," "Bank of Canada statement," and "interest rate decision" are crucial for understanding the central bank's actions and their justification.

Future Outlook and Implications

The ongoing uncertainty surrounding trade relations and global market conditions makes it difficult to predict the future trajectory of the Canadian economy with certainty.

Potential Scenarios

Several potential economic scenarios could unfold depending on how the trade situation and global market conditions evolve.

- Escalating Trade Tensions: Further escalation of trade disputes could lead to a more significant slowdown in economic growth and increased market volatility.

- De-escalation: A resolution of trade disputes could boost investor confidence, leading to increased investment and economic growth.

- Status Quo: If the current situation persists, the Canadian economy might experience a period of moderate growth, but with continued uncertainty.

Impact on Canadian Businesses and Consumers

The Bank of Canada's interest rate decision and the ongoing uncertainty will have significant implications for Canadian businesses and consumers.

- Investment: Business investment decisions will continue to be influenced by the level of uncertainty surrounding future trade policies.

- Consumer Spending: Consumer confidence and spending patterns will likely be affected by the overall economic outlook and the potential for future economic shocks.

- Borrowing: Interest rate changes will impact borrowing costs for businesses and consumers, influencing investment and spending decisions.

Understanding the impact on "Canadian businesses" and "consumer spending," as well as the broader "economic outlook," is crucial for navigating the current economic climate.

Conclusion: Understanding the Interplay of Trump Tariffs, Market Volatility, and the Bank of Canada's Actions

This analysis has highlighted the complex relationship between Trump tariffs, market volatility, and the Bank of Canada's April interest rate decision. The imposition of Trump tariffs created significant uncertainty and volatility in global and domestic markets, influencing key economic indicators and ultimately impacting the Bank's monetary policy decisions. The Bank's response reflected its assessment of the risks and opportunities presented by this evolving economic landscape.

Key Takeaways:

- Trump tariffs significantly impacted the Canadian economy, particularly in sectors like agriculture and automotive.

- Market volatility resulting from trade tensions added to the economic uncertainty.

- The Bank of Canada's April interest rate decision reflected its assessment of these risks.

- The future outlook remains uncertain, dependent on the evolution of trade relations and global market conditions.

Call to Action: Stay updated on the impact of Trump tariffs and market volatility on the Bank of Canada's future decisions by following their announcements and economic news. Understanding the interplay between global trade tensions and domestic monetary policy is crucial for navigating the complexities of the Canadian economy in this uncertain environment. Stay informed about the evolving impact of Trump tariffs and market volatility on the Canadian economy.

Featured Posts

-

Winning Numbers Daily Lotto Tuesday 15th April 2025

May 03, 2025

Winning Numbers Daily Lotto Tuesday 15th April 2025

May 03, 2025 -

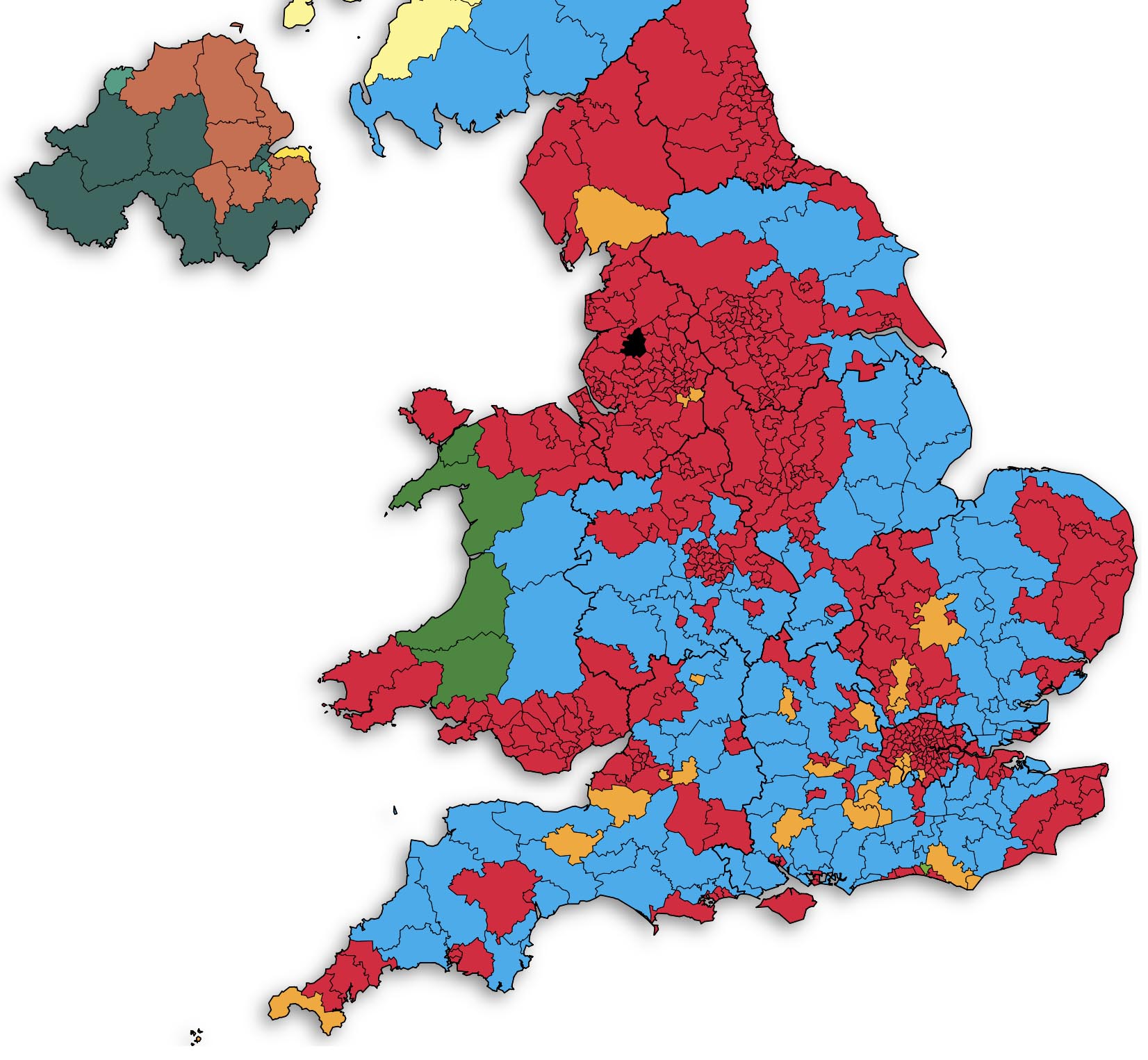

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025 -

The New Direction Of Energy Policy Insights From Guido Fawkes Analysis

May 03, 2025

The New Direction Of Energy Policy Insights From Guido Fawkes Analysis

May 03, 2025 -

Barrow Afc Fans Cycle For Sky Bet Every Minute Matters Relay

May 03, 2025

Barrow Afc Fans Cycle For Sky Bet Every Minute Matters Relay

May 03, 2025 -

Analyzing Donald Trumps Claims Calibri Font Vs Ms 13 Tattoos

May 03, 2025

Analyzing Donald Trumps Claims Calibri Font Vs Ms 13 Tattoos

May 03, 2025

Latest Posts

-

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025 -

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025 -

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025 -

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025 -

Exploring The Prose Of Alan Roden Style Themes And Impact At The Spectator

May 03, 2025

Exploring The Prose Of Alan Roden Style Themes And Impact At The Spectator

May 03, 2025