Trump Tariffs And The Fintech IPO Freeze: The Affirm Holdings Case Study

Table of Contents

The Impact of Trump Tariffs on the US Economy and Investor Sentiment

Trump's tariffs, intended to protect American industries, inadvertently created a climate of significant economic uncertainty. The resulting trade war increased market volatility and decreased investor confidence. This wasn't simply about increased prices for imported goods; it significantly disrupted global supply chains, impacting companies reliant on international trade, like many Fintech firms.

The ramifications were far-reaching:

- Increased costs for imported goods: Tariffs directly increased the cost of raw materials and components, squeezing profit margins for businesses across various sectors.

- Supply chain disruptions: The trade war led to unpredictable delays and shortages, disrupting production schedules and increasing operational costs.

- Negative impact on consumer spending: Higher prices and economic uncertainty dampened consumer confidence, leading to decreased spending, a crucial factor for many Fintech companies.

- Reduced investor confidence in the market: The overall economic instability fueled risk aversion among investors, making them hesitant to invest in potentially volatile sectors like Fintech.

This combination of factors created a perfect storm, impacting "investor sentiment" and drastically altering the "Fintech IPO market." The uncertainty surrounding "global supply chains" and the overall "trade war" made the market significantly riskier.

The Fintech IPO Freeze: A Direct Consequence of Economic Uncertainty

The period of Trump's tariffs witnessed a considerable decline in Fintech IPOs. The increased economic uncertainty fostered a climate of risk aversion among investors. Companies seeking to go public faced a more challenging environment, characterized by:

- Decreased valuations for Fintech startups: The uncertainty surrounding future earnings made investors less willing to pay high valuations for Fintech companies.

- Increased difficulty securing funding: Securing the necessary funding for an IPO became more challenging, as investors sought safer, more established investments.

- Postponement or cancellation of planned IPOs: Many Fintech companies postponed or even canceled their IPO plans due to unfavorable market conditions.

- Shift in investor focus towards more stable sectors: Investors shifted their focus to more traditional, less volatile sectors perceived as safer bets during times of economic uncertainty.

This "IPO slowdown" directly reflects the heightened "investor hesitancy" and the overall "market downturn" triggered by the trade war.

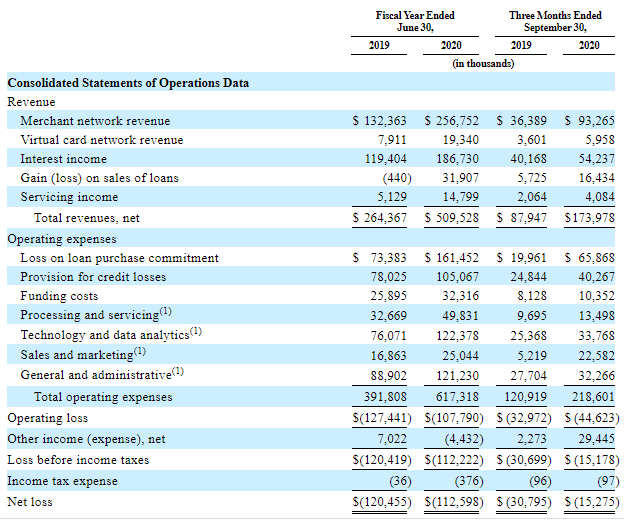

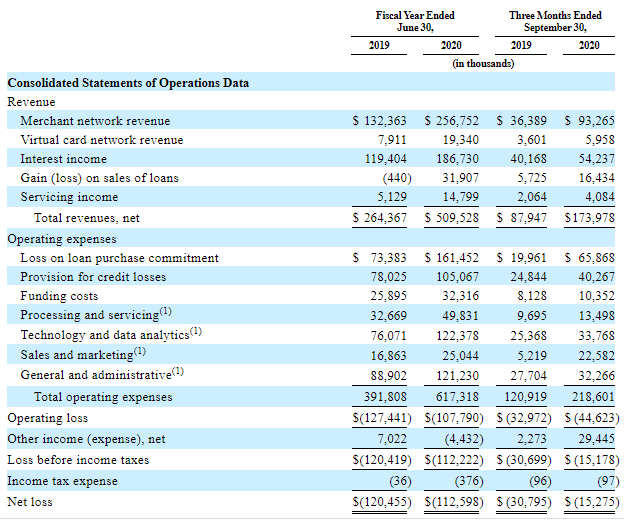

Affirm Holdings: A Case Study in Navigating the Challenging IPO Landscape

Affirm Holdings, a leading Buy Now Pay Later (BNPL) company, provides a compelling case study. Its business model, heavily reliant on consumer spending, made it particularly vulnerable to the economic uncertainty generated by the Trump tariffs. Affirm's reliance on consumer discretionary spending meant that a slowdown in consumer confidence directly impacted its bottom line.

While Affirm ultimately did complete its IPO, it faced several challenges:

- Affirm's reliance on consumer spending: The decline in consumer spending directly affected Affirm's transaction volume and revenue growth.

- Impact of tariffs on Affirm's operational costs: While not directly affected by tariffs on imported goods, the broader economic uncertainty increased operational costs and impacted investor confidence.

- Affirm's fundraising strategies during the period: Affirm likely had to adapt its fundraising strategies, potentially offering lower valuations or seeking alternative funding sources due to reduced investor appetite.

- Comparison to other Fintech companies' IPO performance: Affirm's IPO performance can be compared to other Fintech companies that either postponed or canceled their plans during the same period, highlighting the broader market impact.

This experience underscores the significant impact of macroeconomic factors on even successful "Fintech investment" opportunities.

Analyzing Affirm's Post-IPO Performance in Relation to the Tariffs

Affirm's post-IPO performance provides further insight into the long-term effects of the tariffs. While the immediate impact of the trade war subsided, the lingering effects on consumer confidence and market stability continued to influence its trajectory. Analyzing its stock performance in relation to overall market recovery offers valuable context. Factors such as the overall health of the consumer finance sector and the continued growth of the Buy Now Pay Later market also played a critical role in shaping Affirm's performance in the post-tariff environment. Analyzing this performance against the broader "market recovery" and assessing the "long-term effects of tariffs" provides valuable insights.

Conclusion: Trump Tariffs, Fintech IPOs, and the Lessons from Affirm Holdings

The Trump tariffs significantly impacted the Fintech sector, leading to a noticeable freeze in IPOs. The economic uncertainty fueled by the trade war reduced investor confidence and increased risk aversion, directly affecting companies like Affirm Holdings. Affirm's experience highlights the crucial role of macroeconomic factors in shaping the success of Fintech IPOs. Understanding the interplay between trade policies, investor sentiment, and market dynamics is essential for navigating uncertain economic times.

Understanding the impact of trade policies on Fintech IPOs is critical for future success in this dynamic sector. Navigating the challenges of Fintech IPOs in uncertain economic times requires a thorough understanding of market dynamics and a carefully planned strategy. Further research into the long-term effects of Trump tariffs on the Fintech sector is vital for mitigating future risks and maximizing opportunities.

Featured Posts

-

Droits Des Victimes D Oqtf L Udr Appelle A Une Indemnisation Sans Delai

May 14, 2025

Droits Des Victimes D Oqtf L Udr Appelle A Une Indemnisation Sans Delai

May 14, 2025 -

Basels Eurovision Bid A Focus On Diversity And Inclusion

May 14, 2025

Basels Eurovision Bid A Focus On Diversity And Inclusion

May 14, 2025 -

Estonias Unexpected Eurovision Bet An Italian Parody

May 14, 2025

Estonias Unexpected Eurovision Bet An Italian Parody

May 14, 2025 -

Ipo Activity Halts Amid Tariff Driven Market Chaos A Deep Dive

May 14, 2025

Ipo Activity Halts Amid Tariff Driven Market Chaos A Deep Dive

May 14, 2025 -

Eurojackpot Voitonumerot Tarkista Ilta Sanomista

May 14, 2025

Eurojackpot Voitonumerot Tarkista Ilta Sanomista

May 14, 2025