Trump Tax Bill Passes House After Late-Night Revisions

Table of Contents

Key Revisions Made During Late-Night Negotiations

The late-night revisions to the Trump Tax Bill were the result of intense negotiations and a pressure-cooker environment within Congress. Lawmakers raced against the clock to finalize the bill before crucial deadlines, leading to several last-minute adjustments and compromises. These changes significantly altered the original proposal, impacting various aspects of the tax code.

-

Changes to Corporate Tax Rates: The corporate tax rate was significantly lowered from 35% to 21%. This dramatic reduction was a central tenet of the Trump administration's tax plan and is intended to boost business investment and economic growth.

-

Modifications to Individual Tax Brackets: While specific percentage changes varied, the Trump Tax Bill generally simplified the individual tax brackets, reducing the number of brackets and adjusting the tax rates within each. This resulted in both tax increases for some higher-income individuals and tax reductions for others.

-

Alterations to Deductions: Several deductions underwent significant changes. The state and local tax (SALT) deduction was capped, impacting taxpayers in high-tax states. While the standard deduction was increased, some itemized deductions were limited or eliminated, affecting taxpayers who previously benefited from itemizing. Changes also impacted the mortgage interest deduction, although the specific details regarding this varied.

-

Amendments Related to Pass-Through Businesses: The bill included adjustments to how pass-through businesses (like sole proprietorships, partnerships, and S corporations) are taxed. These changes aimed to provide tax relief for small business owners, but the exact impact varied greatly depending on individual circumstances.

-

Changes to Tax Credits: Several tax credits were either modified or expanded under the Trump Tax Bill. The child tax credit, for example, saw adjustments, although the specific details need to be checked against individual circumstances.

Impact on Different Taxpayers

The Trump Tax Bill's impact varies significantly depending on an individual's or business's financial situation.

High-Income Earners:

The tax implications for high-income earners, or high-net-worth individuals, were complex. While some experienced tax reductions due to changes in tax brackets, others faced increased taxes due to limitations or eliminations of certain deductions, such as the SALT deduction. Changes to capital gains taxes also had a significant impact on this group. The overall effect required careful consideration of individual circumstances and financial portfolios.

Middle-Class Families:

For middle-income families, the changes were multifaceted. The increased standard deduction offered tax relief for many, while adjustments to the child tax credit affected family tax relief in various ways. The overall impact on middle-class families varied substantially, depending on factors like family size, income level, and itemized deductions.

Businesses and Corporations:

The reduction in the corporate tax rate from 35% to 21% was a major driver of corporate tax reform. This was intended to stimulate investment, job creation, and overall economic growth. However, the effect on small business tax relief varied widely depending on the structure of the business and its specific circumstances. The bill also included provisions impacting international businesses, particularly concerning repatriation of foreign earnings.

Political and Economic Implications of the Trump Tax Bill

The Trump Tax Bill's passage generated considerable political debate, with partisan divides apparent throughout the legislative process. Congressional approval was hard-won, reflecting the complexities and controversies inherent within the bill.

Economically, the bill's impact is predicted to be far-reaching. Proponents argued it would stimulate economic growth, leading to increased job creation and higher wages. However, critics warned of potential negative consequences, such as increased inflation and a further expansion of the national debt. The potential impact on GDP growth and the national deficit remains a subject of ongoing analysis and debate. Long-term effects on the U.S. economy are yet to be fully understood and will require continuous monitoring.

Conclusion

The Trump Tax Bill, following late-night revisions, introduced significant changes to the US tax code, impacting high-income earners, middle-class families, and businesses in diverse ways. While some experienced tax reductions, others faced increases depending on specific circumstances. The political ramifications were significant, reflecting the partisan divide on major economic policy. The economic implications remain a subject of ongoing discussion, with potential positive and negative effects on GDP growth, inflation, and the national debt.

Stay informed about the evolving landscape of the Trump Tax Bill and its effects on your personal finances. Research your specific situation to understand how these changes might affect you and seek professional advice to optimize your tax strategy under this new legislation. Understanding the nuances of the Trump Tax Bill is crucial for financial planning.

Featured Posts

-

University Of Marylands 2025 Graduation Kermit The Frog To Speak

May 24, 2025

University Of Marylands 2025 Graduation Kermit The Frog To Speak

May 24, 2025 -

300 Million Cyberattack Hits Marks And Spencer Full Impact Revealed

May 24, 2025

300 Million Cyberattack Hits Marks And Spencer Full Impact Revealed

May 24, 2025 -

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025 -

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 K Mechte Stat Devushkoy Bonda

May 24, 2025 -

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025

Latest Posts

-

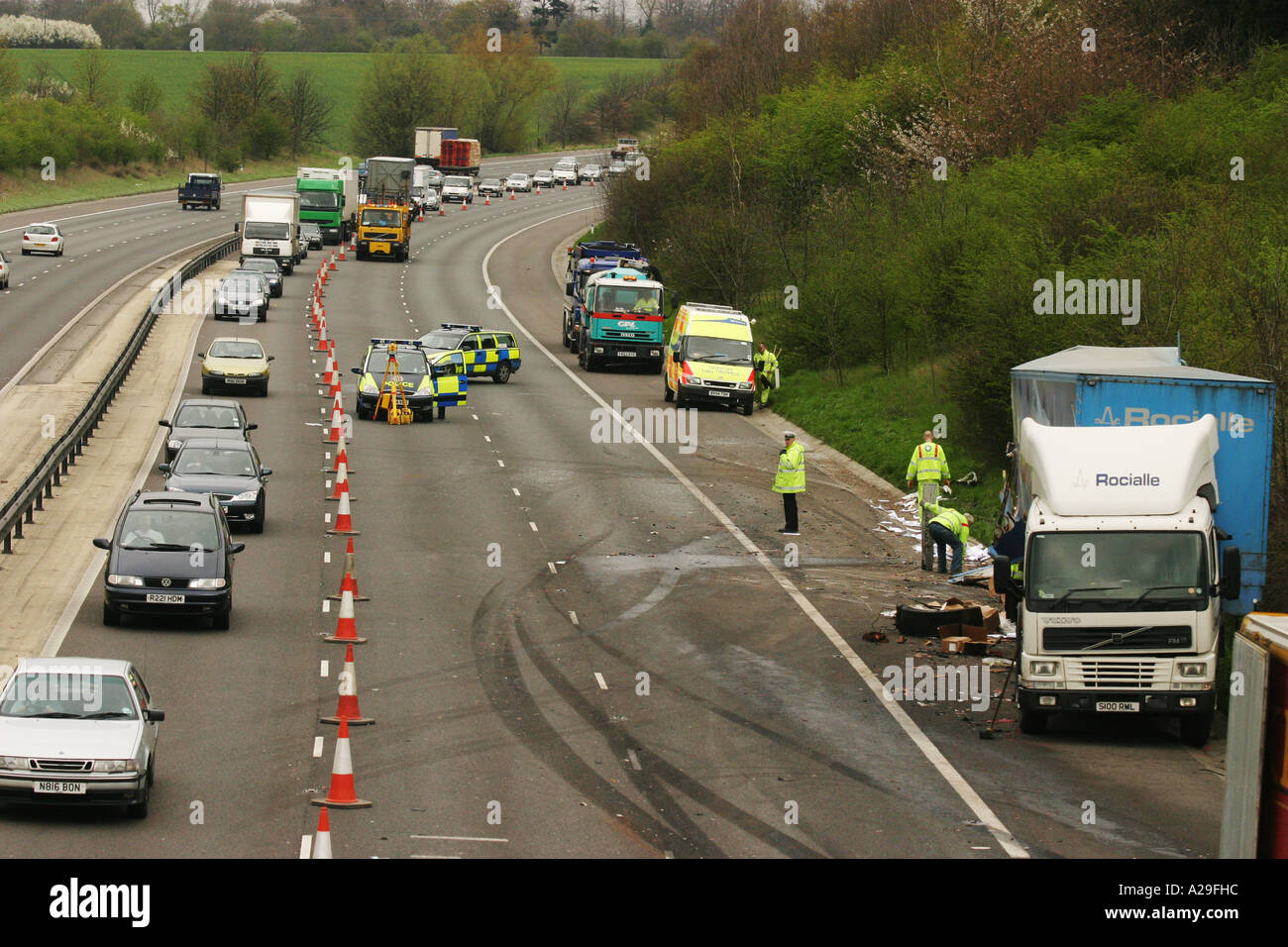

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025 -

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025 -

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025 -

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025 -

Live M56 Traffic Motorway Closure After Serious Collision

May 25, 2025

Live M56 Traffic Motorway Closure After Serious Collision

May 25, 2025