Trump Tax Reform: House Republican Bill Details Unveiled

Table of Contents

Individual Income Tax Changes

The Trump Tax Reform significantly altered individual income taxes. Understanding these changes is vital for effectively managing your personal finances.

Reduced Tax Brackets and Rates

The proposed bill reduced the number of individual income tax brackets from seven to four. This resulted in lower tax rates across the board, although the degree of reduction varied depending on income level.

- Proposed Brackets: The four proposed brackets were 12%, 25%, 35%, and 39.6%.

- Rate Comparison: The highest tax rate was reduced from 39.6% to 37%. Lower income brackets also saw reductions, although the percentage changes were less dramatic. For example, the 15% bracket was lowered to 12%.

- Impact on Income Groups: Lower and middle-income earners generally benefited from the simplified tax structure and lower rates. However, the extent of the benefits varied significantly depending on individual circumstances and deductions. Higher-income earners also experienced tax rate reductions, though the magnitude of savings was debated extensively.

Changes to Standard Deduction and Itemized Deductions

The Trump Tax Reform also made significant changes to deductions, impacting both standard and itemized deductions for taxpayers.

- Increased Standard Deduction: The standard deduction was significantly increased for both single and married filers, simplifying tax preparation for many individuals. This was intended to benefit those who previously itemized but would now find the standard deduction more advantageous.

- Elimination/Limitation of Itemized Deductions: Several itemized deductions were either eliminated or significantly limited. Most notably, the deduction for state and local taxes (SALT) was capped at $10,000, impacting taxpayers in high-tax states disproportionately. Other deductions were also affected, such as those for miscellaneous itemized deductions.

- Impact on Itemizers: Taxpayers who previously itemized saw their deductions reduced or eliminated, shifting many individuals to utilize the standard deduction instead. This simplification aimed to make the tax system more efficient, but it also led to criticisms of unequal impact across different demographics.

Child Tax Credit Modifications

Modifications to the Child Tax Credit (CTC) were another key component of the Trump Tax Reform.

- Increased Credit Amount: The amount of the child tax credit was increased.

- Expansion of Eligibility: The plan aimed to expand eligibility for the CTC, making it accessible to a larger number of families.

- Impact on Families: Families with children directly benefited from the increased amount and broader eligibility criteria, increasing disposable income for many. However, the full impact depended on individual family income and other tax circumstances.

Corporate Tax Rate Reduction

A cornerstone of the Trump Tax Reform was a significant reduction in the corporate tax rate.

Lower Corporate Tax Rate

The proposed bill drastically reduced the corporate tax rate, aiming to boost economic activity.

- Old Corporate Tax Rate: The previous corporate tax rate was 35%.

- New Proposed Corporate Tax Rate: The proposed corporate tax rate was reduced to 21%.

- Impact on Corporate Profits and Investment: This substantial reduction was intended to increase corporate profits, encourage investment, and create jobs. The actual impact remained a subject of ongoing debate and analysis.

International Tax Provisions

Changes to international taxation were also included in the Trump Tax Reform.

- Changes to Taxation of Foreign Income: The bill included provisions designed to address the taxation of foreign income earned by US corporations.

- Incentives for Repatriation: Incentives were put in place to encourage the repatriation of overseas profits back to the United States.

- Impact on US Competitiveness: The changes to international taxation were expected to influence the global competitiveness of US businesses, though the overall long-term effects were unclear.

Potential Economic Impacts of Trump Tax Reform

The Trump Tax Reform’s economic impacts were widely debated.

Economic Growth Projections

Economists offered differing projections regarding the economic effects of the Trump Tax Reform.

- Positive and Negative Forecasts: Forecasts ranged from significant economic growth to minimal impact, with some economists predicting negative long-term consequences.

- Expert Analyses: Numerous analyses were conducted by independent economists and organizations, offering a wide spectrum of predictions.

- Impact on Sectors: The bill's impact on different economic sectors varied, with some benefiting more than others.

National Debt Implications

The tax cuts were expected to significantly increase the national debt.

- Estimated Increase: The substantial tax cuts were predicted to lead to a substantial increase in the national debt.

- Long-Term Implications: The long-term economic consequences of this increased debt were a major point of concern for many economists and policymakers.

- Perspectives on Debt Sustainability: Different viewpoints emerged on the sustainability of the national debt and its potential implications for future economic stability.

Conclusion

The Trump Tax Reform, as outlined in the House Republican bill, represents a significant overhaul of the US tax code. The proposed changes, including reduced individual and corporate tax rates, modified deductions, and alterations to the child tax credit, have the potential to significantly impact the US economy. Understanding the details of these proposed changes—from the intricacies of individual income tax bracket adjustments to the broader implications of corporate tax rate reductions and their effects on national debt—is essential for navigating the new landscape. Further analysis and debate are crucial to fully assessing the long-term effects of this far-reaching Trump Tax Reform. Stay informed about developments concerning this landmark legislation and its potential consequences for your financial well-being. Learn more about the intricacies of Trump Tax Reform and how it might affect you.

Featured Posts

-

Official Report Sam Elliott To Appear In Landman Season 2

May 13, 2025

Official Report Sam Elliott To Appear In Landman Season 2

May 13, 2025 -

The Unending Nightmare Gaza Hostage Crisis And Its Impact On Families

May 13, 2025

The Unending Nightmare Gaza Hostage Crisis And Its Impact On Families

May 13, 2025 -

Jelena Ostapenkos Triumph At The Stuttgart Open Defeating Sabalenka

May 13, 2025

Jelena Ostapenkos Triumph At The Stuttgart Open Defeating Sabalenka

May 13, 2025 -

Sam Elliott Joins Landman Season 2 Cast Official Report

May 13, 2025

Sam Elliott Joins Landman Season 2 Cast Official Report

May 13, 2025 -

Bosses Talk Tough The Shifting Power Dynamic In The Workplace

May 13, 2025

Bosses Talk Tough The Shifting Power Dynamic In The Workplace

May 13, 2025

Latest Posts

-

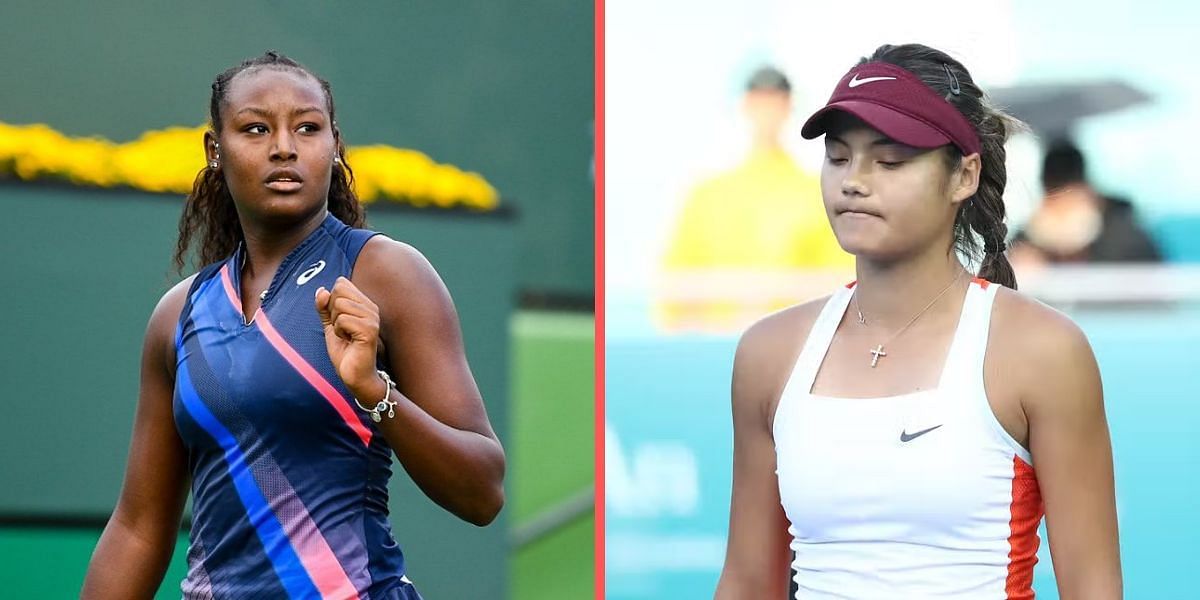

Wta News Stearns Early Departure In Austin

May 14, 2025

Wta News Stearns Early Departure In Austin

May 14, 2025 -

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025 -

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025 -

Danielle Collins Upsets Swiatek Causing World Ranking Shift

May 14, 2025

Danielle Collins Upsets Swiatek Causing World Ranking Shift

May 14, 2025 -

Emma Raducanus Coaching Change A Two Week Trial Ends

May 14, 2025

Emma Raducanus Coaching Change A Two Week Trial Ends

May 14, 2025