Trump's Economic Agenda: Who Pays The Price?

Table of Contents

Tax Cuts and Their Distributive Effects

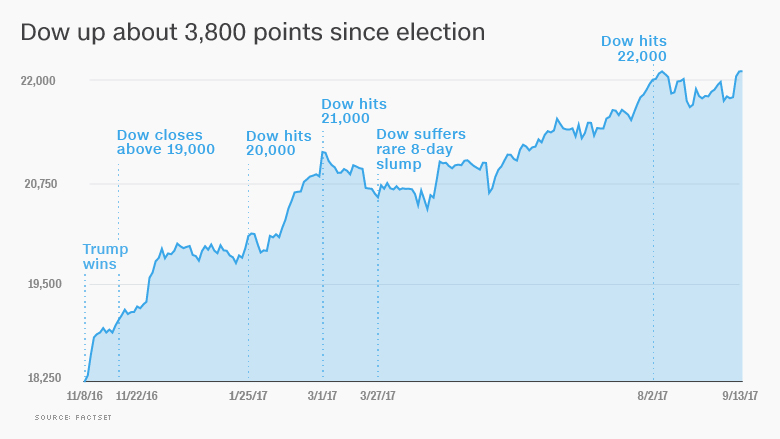

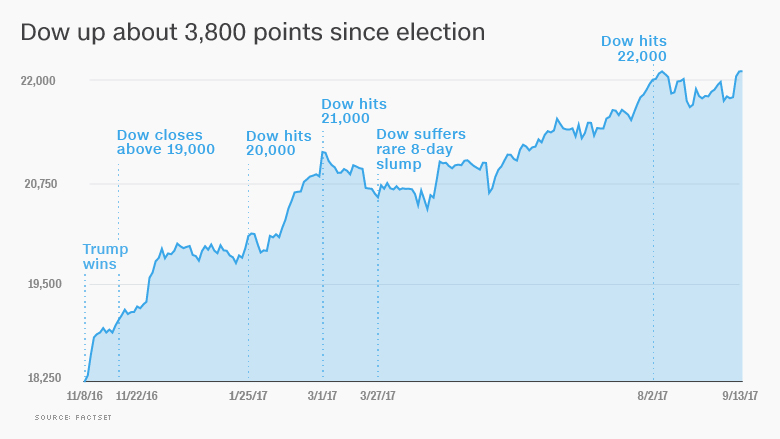

The cornerstone of Trump's economic agenda was the 2017 Tax Cuts and Jobs Act. This legislation significantly lowered both corporate and individual income tax rates. Keywords: Tax cuts 2017, corporate tax cuts, individual tax cuts, income inequality, wealth concentration.

-

Disproportionate Benefits: The tax cuts disproportionately benefited high-income earners and corporations. While all taxpayers received some reduction, the largest cuts went to those at the top of the income distribution. This exacerbated existing income inequality, leading to increased wealth concentration among the wealthiest Americans.

-

Trickle-Down Economics: The legislation was largely based on the theory of trickle-down economics – the idea that tax cuts for corporations and the wealthy would stimulate investment, job creation, and ultimately benefit everyone. However, empirical evidence supporting the effectiveness of trickle-down economics in generating widespread prosperity remains scarce. Many economists argued that the benefits did not "trickle down" as anticipated.

-

Income Growth Disparity: Statistical data following the tax cuts showed a significant widening of the gap in income growth between the highest and lowest income brackets. The wealthiest saw considerably larger increases in income compared to those in the middle and lower classes.

-

Increased National Debt: The substantial tax cuts resulted in a significant reduction in government revenue. This contributed to a substantial increase in the national debt, raising concerns about the long-term fiscal sustainability of the United States.

The Impact of Trade Wars and Protectionism

Trump's administration initiated numerous trade disputes, imposing tariffs on goods imported from China, Mexico, and other countries. This protectionist approach aimed to boost domestic industries and create American jobs. Keywords: Trade wars, tariffs, protectionism, global trade, import tariffs, export taxes, agricultural sector, manufacturing sector.

-

Higher Consumer Prices: Tariffs increased the cost of imported goods, directly impacting consumer prices. This burden disproportionately affected middle and lower-income families, who spend a larger portion of their income on essential goods and services.

-

Winners and Losers in Specific Industries: While some domestic industries benefited from protectionist measures, others suffered. The agricultural sector, for example, faced retaliatory tariffs from other countries, leading to significant losses for farmers. The manufacturing sector experienced a mixed impact, with some segments benefiting from increased domestic demand while others struggled with higher input costs.

-

Retaliatory Tariffs: Other countries responded to Trump's tariffs with their own retaliatory measures, creating a cycle of escalating trade tensions and harming global economic growth. This back-and-forth significantly impacted international trade relationships.

Deregulation and its Economic Consequences

The Trump administration pursued a policy of deregulation across various sectors, including environmental protection and finance. Keywords: Deregulation, environmental regulations, financial regulations, Dodd-Frank, corporate accountability, environmental impact, public health.

-

Rollback of Environmental Regulations: Numerous environmental regulations were rolled back, raising concerns about potential negative consequences for environmental protection and public health. These actions often prioritized short-term economic gains over long-term environmental sustainability.

-

Financial Deregulation: Efforts were made to loosen financial regulations, potentially increasing the risk of another financial crisis. The long-term effects of these changes on financial stability remain a subject of debate among economists.

-

Impact on Business Growth and Job Creation: While deregulation can potentially stimulate business growth and job creation by reducing compliance costs, it also carries risks. The net impact often depends on the specific regulations involved and the broader economic context.

The Impact on the Middle Class and Working Class

The impact of Trump's economic policies on the middle and working classes was a subject of intense scrutiny. Keywords: Middle class, working class, wage stagnation, job losses, income inequality, affordable healthcare.

-

Wage Growth: While job creation was positive in some sectors, wage growth for many middle- and working-class Americans remained stagnant or relatively modest. The benefits of economic growth did not always translate into substantial wage increases for these groups.

-

Job Losses and Gains: While some sectors experienced job growth, others experienced job losses due to factors such as automation, trade disputes, and factory closures. The net effect on employment for the middle and working classes was complex and varied across industries.

-

Healthcare Affordability: Changes in healthcare policy also impacted the middle and working classes. Access to affordable healthcare remained a significant concern.

Conclusion

Trump's economic agenda, while aiming for increased economic growth and job creation, had a complex and uneven impact. While some sectors and income brackets benefited significantly from tax cuts and deregulation, others, particularly the middle and working classes, faced increased costs due to trade wars and the erosion of certain protections. The long-term consequences of these policies remain a subject of ongoing debate and analysis. Understanding the full ramifications of Trump's economic policies is crucial for informed decision-making. Further research into the long-term effects of Trump's economic agenda is necessary to fully comprehend who ultimately paid the price and to inform future economic policy decisions. Continue your research on the lasting impact of Trump's economic policies to gain a comprehensive understanding.

Featured Posts

-

Death Of Pope Francis Remembering A Life Dedicated To Compassion

Apr 22, 2025

Death Of Pope Francis Remembering A Life Dedicated To Compassion

Apr 22, 2025 -

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025

How Tariffs Threaten Chinas Export Led Growth Model

Apr 22, 2025 -

Trump Protests A Nationwide Uprising

Apr 22, 2025

Trump Protests A Nationwide Uprising

Apr 22, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 22, 2025

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 22, 2025

Latest Posts

-

Shevchenko Vs Fiorot Will Retirement Define Ufc 315

May 12, 2025

Shevchenko Vs Fiorot Will Retirement Define Ufc 315

May 12, 2025 -

Fiorots Chance Can She Upset Shevchenko At Ufc 315

May 12, 2025

Fiorots Chance Can She Upset Shevchenko At Ufc 315

May 12, 2025 -

Ufc 315 Valentina Shevchenko Faces Fiorots Retirement Challenge

May 12, 2025

Ufc 315 Valentina Shevchenko Faces Fiorots Retirement Challenge

May 12, 2025 -

Shevchenkos Retirement Fight Fiorots Tough Test At Ufc 315

May 12, 2025

Shevchenkos Retirement Fight Fiorots Tough Test At Ufc 315

May 12, 2025 -

Shevchenko Vs Fiorot The Ufc Champs Indifference

May 12, 2025

Shevchenko Vs Fiorot The Ufc Champs Indifference

May 12, 2025