Trump's Next 100 Days: A Deep Dive Into Trade, Deregulation, And Executive Actions

Table of Contents

Trade Policy Under a Potential Trump Administration

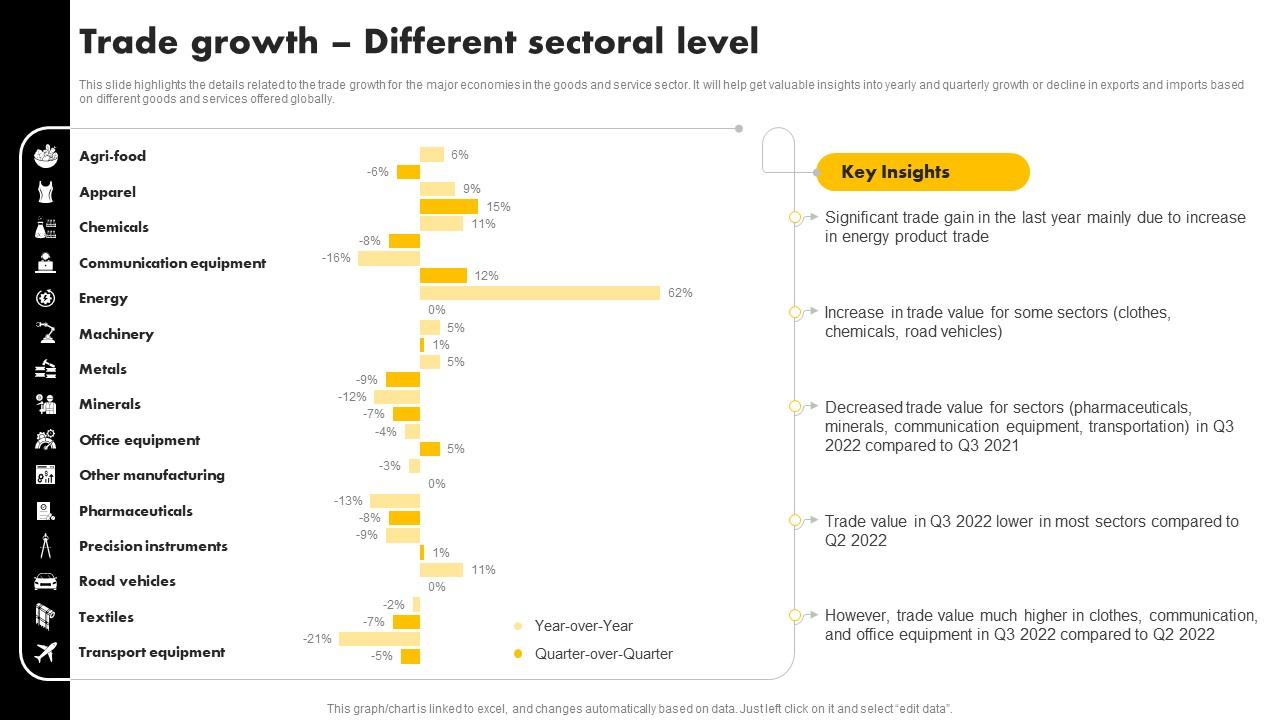

A potential Trump administration's approach to trade is likely to be characterized by protectionist measures and a renegotiation of existing trade agreements. This could significantly reshape the global economic landscape and have profound implications for American businesses and consumers.

Renegotiating Trade Deals

A central tenet of a potential Trump presidency would be the renegotiation, or even withdrawal from, key trade agreements. This includes the North American Free Trade Agreement (NAFTA), the Trans-Pacific Partnership (TPP), and potentially others.

- Potential Changes: Expect demands for significant alterations to NAFTA, focusing on increased protection for American industries and a rebalancing of trade flows. Withdrawal from the TPP is a strong possibility, prioritizing bilateral trade agreements over multilateral ones.

- Impact on Businesses and Consumers: Renegotiation could lead to uncertainty for businesses involved in cross-border trade, potentially impacting supply chains and investment decisions. Consumers might face higher prices for imported goods if tariffs are increased.

- Economic Consequences: The economic consequences are complex and depend heavily on the specifics of any renegotiated agreements or imposed tariffs. Potential outcomes range from minor adjustments to significant disruptions in global trade flows, potentially sparking "trade wars." Specific sectors like agriculture and manufacturing would be particularly vulnerable.

Imposing Tariffs and Trade Barriers

To achieve his protectionist goals, a potential Trump administration might utilize tariffs and other trade barriers to shield American industries from foreign competition.

- Targeted Industries: Industries likely to be targeted include steel, aluminum, textiles, and potentially automobiles. The imposition of "import tariffs" could significantly impact these sectors.

- Effects on Global Trade Relations: Imposing significant tariffs risks retaliatory measures from other countries, escalating into broader "trade wars" and harming the global economy. "Export restrictions" could also be implemented.

- Economic Implications: Protectionist policies, while potentially benefiting certain domestic industries in the short term, could lead to higher prices for consumers, reduced competition, and slower economic growth in the long run. The impact on "global trade" could be severe.

Deregulation Efforts: Rolling Back Obama-Era Policies

A potential Trump administration is expected to aggressively pursue deregulation, particularly targeting environmental and financial regulations implemented during the Obama years.

Environmental Regulations

The rollback of environmental regulations is a high priority, potentially impacting climate change initiatives and broader environmental protection efforts.

- Targeted Regulations: The Clean Power Plan, regulations related to vehicle emissions, and other climate change policies are likely targets for repeal or significant amendment. This "environmental deregulation" could significantly alter the American energy landscape.

- Environmental Consequences: Weakening environmental protections could lead to increased pollution, accelerated climate change, and negative impacts on public health.

- Impact on Industry: The fossil fuel industry might benefit from reduced regulatory burdens, while the renewable energy sector could face challenges. The implications for the "Clean Air Act" are significant.

Financial Regulations

Financial deregulation is another key element of a potential Trump agenda, potentially loosening rules implemented after the 2008 financial crisis.

- Targeted Regulations: The Dodd-Frank Act, designed to reform the financial system, is a prime candidate for significant changes or partial repeal. This "financial deregulation" could lead to increased risk-taking in the financial sector.

- Risks and Benefits: Loosening regulations could boost economic growth in the short term by reducing compliance costs for financial institutions. However, it could also increase systemic risk, leading to potential instability.

- Impact on Financial Stability: The potential consequences for financial stability and economic growth are hotly debated, with supporters arguing for reduced burdens and opponents warning of increased vulnerability.

Executive Actions and Presidential Power

A potential Trump administration is likely to make extensive use of executive actions to bypass Congress and enact its agenda quickly.

The Use of Executive Orders and Memoranda

Executive orders and presidential memoranda allow the president to enact policies without congressional approval.

- Areas of Application: Expect executive actions on immigration, national security, and potentially other areas where rapid change is desired. This "presidential power" can be a powerful tool.

- Legal Challenges: The use of executive orders can face legal challenges, with the potential for judicial review. This can lead to lengthy court battles.

- Potential for Gridlock: While executive actions allow a president to bypass Congress, they can also lead to gridlock if the actions are challenged or are simply ineffective in the long run.

Appointments to Key Positions

The appointments to key positions within the administration and judiciary will significantly influence the implementation of a potential Trump agenda.

- Key Positions: Appointments to cabinet positions, agency heads, and judicial nominations will shape policy direction across various sectors. The "Senate confirmation" process will be crucial.

- Impact on Policy: These appointments will determine the interpretation and enforcement of regulations and laws, significantly impacting policy outcomes. The selection process and confirmation hearings will be closely scrutinized.

- Influence on Agenda: The individuals appointed will play a critical role in determining how effectively the administration can achieve its policy goals. These "cabinet appointments" and "judicial nominations" will have far-reaching consequences.

Conclusion

A potential Trump administration's first 100 days could bring significant changes to American trade policy, environmental regulations, and the financial sector through deregulation and the use of executive actions. Understanding the potential impact of these changes is crucial for businesses, investors, and citizens. The potential for "trade wars," increased systemic risk, and environmental damage are real concerns. The extent to which a potential Trump administration can successfully implement its agenda will depend on a combination of factors, including the willingness of Congress to cooperate, the effectiveness of executive actions, and the outcome of potential legal challenges. Stay informed on the unfolding developments and continue to analyze "Trump's Next 100 Days" and its long-term consequences. Further research and engagement with the topic are crucial to fully understand the implications of this pivotal period.

Featured Posts

-

Essential Willie Nelson Fast Facts For Fans

Apr 29, 2025

Essential Willie Nelson Fast Facts For Fans

Apr 29, 2025 -

Identifying And Analyzing The Countrys Top Business Growth Areas

Apr 29, 2025

Identifying And Analyzing The Countrys Top Business Growth Areas

Apr 29, 2025 -

How U S Companies Are Managing Costs In The Face Of Tariff Instability

Apr 29, 2025

How U S Companies Are Managing Costs In The Face Of Tariff Instability

Apr 29, 2025 -

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025 -

Ariana Grande And Jeff Goldblum Team Up For I Dont Know Why

Apr 29, 2025

Ariana Grande And Jeff Goldblum Team Up For I Dont Know Why

Apr 29, 2025