Trump's Tariff Decision: Euronext Amsterdam Stocks Experience 8% Growth

Table of Contents

Understanding the Initial Market Reaction to Trump's Tariff Decision

The initial reaction to Trump's tariff announcement was overwhelmingly negative. Analysts predicted decreased global trade, increased prices for consumers, and a dampening effect on economic growth. The uncertainty surrounding the tariffs created a climate of fear and uncertainty, impacting investor confidence worldwide. Specific sectors, such as manufacturing and automotive, were expected to be particularly hard hit.

- Decreased investor confidence in manufacturing, automotive, and technology sectors.

- Potential for significant supply chain disruptions, impacting production and delivery timelines.

- Concerns about increased prices for consumers due to higher input costs for businesses.

- Widespread fears of retaliatory tariffs from affected countries.

The Unexpected Surge in Euronext Amsterdam Stocks

Despite the global negativity, Euronext Amsterdam witnessed a remarkable 8% increase in its stock market index (AEX) on March 8, 2018. This unexpected growth was substantial, representing a significant positive deviation from the expected market downturn. Trading volume also increased considerably during this period, indicating heightened activity driven by the unexpected market movement. While data on specific company-level gains might be difficult to find without access to detailed historical trading data, the overall market index performance clearly demonstrates this significant upswing.

- Significant gains across several sectors within the Euronext Amsterdam exchange. (Further research into specific company performance would provide more granular details).

- A notable increase in trading volume on Euronext Amsterdam on March 8, 2018, compared to previous days.

- The AEX index, a key indicator of the Dutch stock market's performance, experienced a dramatic and unexpected rise.

Analyzing the Reasons Behind the Unexpected Growth

The 8% surge in Euronext Amsterdam stocks following Trump's tariff decision is puzzling, defying the initial negative predictions. Several contributing factors could explain this counterintuitive market reaction:

Strategic Repositioning

Some companies listed on Euronext Amsterdam might have benefited from the shifting global trade patterns caused by the tariffs. Businesses able to fill the gaps left by affected companies might have seen increased demand and subsequently higher stock valuations. This strategic repositioning, seizing opportunities created by the altered trade landscape, could have been a significant contributor.

- Companies in sectors less directly impacted by the tariffs might have seen increased demand.

- Businesses capable of substituting for affected companies in global supply chains might have seen a surge in orders.

Increased Demand for Specific Goods

The tariffs may have inadvertently increased the demand for certain products manufactured by companies listed on Euronext Amsterdam. If these companies produced goods not subject to the tariffs or provided alternatives to tariffed goods, they could have experienced a surge in orders.

- Companies producing goods not subject to tariffs could have seen increased demand due to competitors being hampered.

- Businesses supplying substitutes for tariffed goods might have experienced substantial growth.

Investment Diversification

Investors might have perceived Euronext Amsterdam as a relatively safer haven compared to other markets more directly affected by the tariffs. This perception of relative safety could have led to increased investment, driving up stock prices.

- Investors seeking to diversify their portfolios away from more volatile markets might have chosen Euronext Amsterdam.

- The perceived stability of the Dutch economy and its less direct exposure to the initial tariff impacts could have been attractive.

Unexpected Economic Stimulus

While less likely, the tariffs might have inadvertently stimulated certain sectors of the Dutch economy in a way that benefitted Euronext Amsterdam companies. This is a less direct but potentially relevant explanation requiring further investigation.

- While less probable, indirect economic effects could have contributed positively to specific market sectors.

Long-Term Implications of Trump's Tariff Decision on Euronext Amsterdam

The long-term effects of Trump's tariff decision on Euronext Amsterdam remain uncertain. While the initial 8% surge was significant, its sustainability is questionable. The potential for a correction, a return to more expected market behavior, exists.

- Continued growth is possible if the factors contributing to the initial surge persist.

- A market correction is equally likely if those factors prove temporary.

- Future investment strategies should account for this level of uncertainty and volatility.

Conclusion

The 8% growth in Euronext Amsterdam stocks following Trump's tariff decision on March 8, 2018, was a surprising and counterintuitive market reaction. While several contributing factors, such as strategic repositioning, increased demand for certain goods, investment diversification, and even unexpected economic stimulus, might have played a role, the long-term implications remain uncertain. Understanding the complexities of global market reactions to significant political and economic events like Trump's tariff decisions is crucial. Stay informed about the impact of future Trump's tariff decisions and their potential effect on Euronext Amsterdam and other global stock markets. Understanding these complexities is crucial for successful investment strategies.

Featured Posts

-

Konchita Vurst Dnes Neyniyat Pt Sled Pobedata Na Evroviziya

May 24, 2025

Konchita Vurst Dnes Neyniyat Pt Sled Pobedata Na Evroviziya

May 24, 2025 -

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025 -

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

Mwshr Daks Alalmany Tjawz Qmt Mars W Ahmyt Hdha Alhdth Fy Alaswaq Alawrwbyt

May 24, 2025

Mwshr Daks Alalmany Tjawz Qmt Mars W Ahmyt Hdha Alhdth Fy Alaswaq Alawrwbyt

May 24, 2025

Latest Posts

-

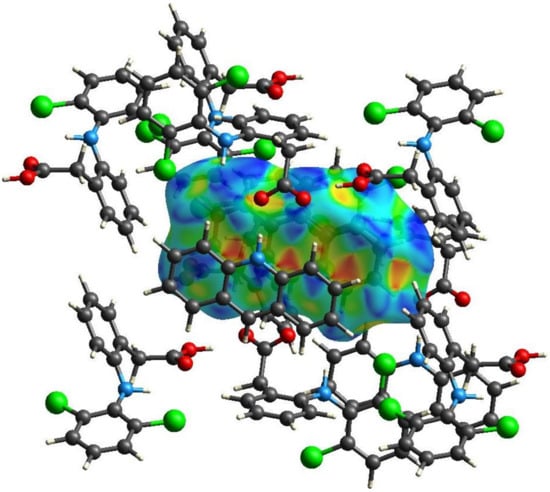

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025 -

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025 -

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025 -

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025