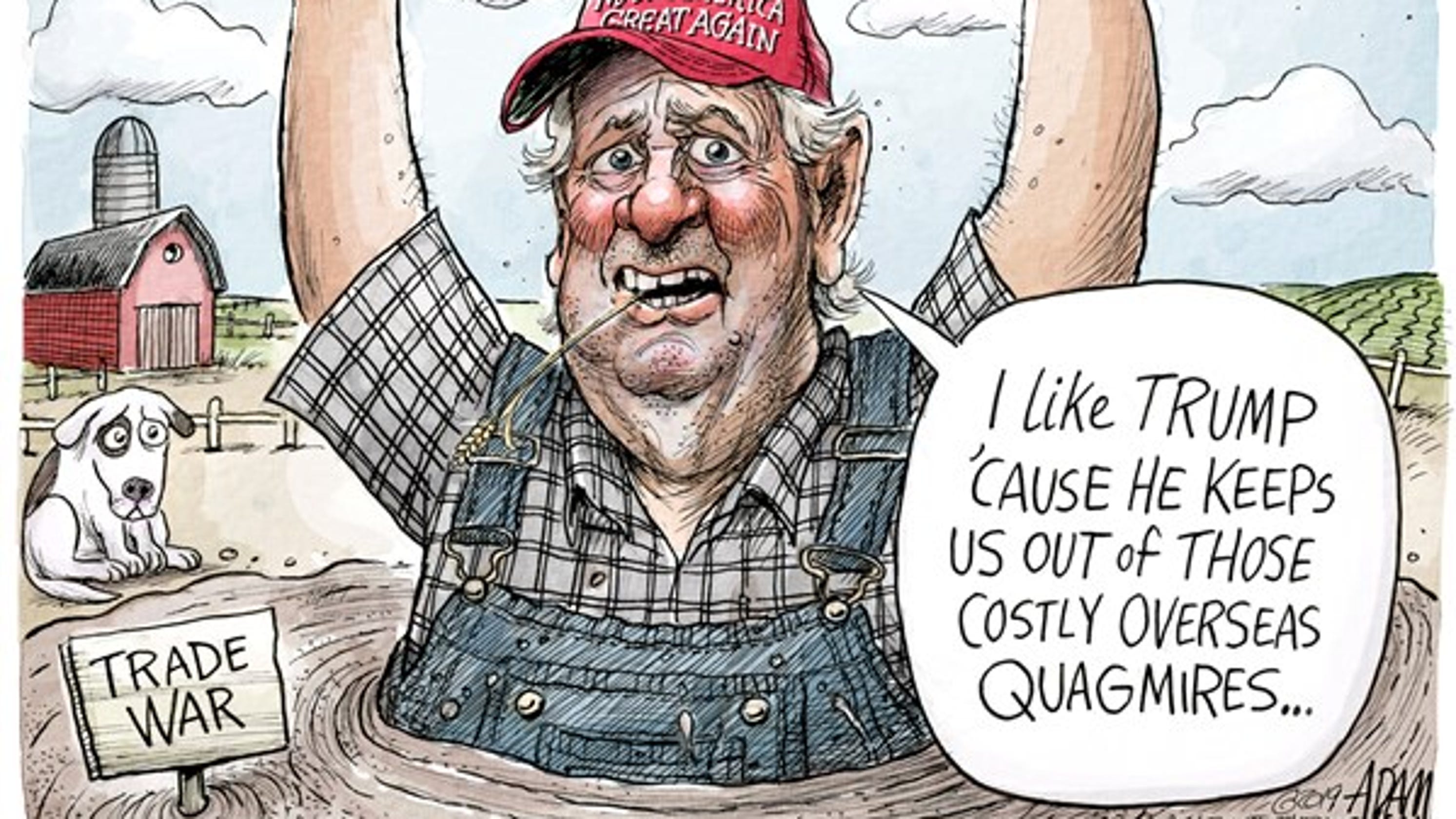

Trump's Tariffs: A Threat To The American Small Business Landscape

Table of Contents

Increased Input Costs and Reduced Profit Margins

The tariffs imposed significantly increased the cost of doing business for countless small American businesses. This impact manifested in two key areas: rising prices for raw materials and goods, and disruptions to established supply chains.

Rising Prices for Raw Materials and Goods

- Steel and aluminum tariffs: Tariffs on imported steel and aluminum, key components in many manufacturing and construction projects, drastically increased production costs. Small manufacturers, for example, saw their material costs jump by 15-20%, forcing difficult choices between absorbing the losses or raising prices, ultimately reducing profit margins.

- Impact on other sectors: The effects weren't limited to manufacturing. Construction firms faced higher costs for steel and aluminum, impacting project bids and profitability. Even seemingly unrelated sectors, like food processing (dependent on imported packaging materials), experienced cost increases.

- Ripple effect: This cost increase didn't stay within the businesses that directly imported materials. Small businesses were forced to pass these increased costs onto consumers, potentially leading to decreased demand and further hurting sales. The difficulty in absorbing increased costs without impacting prices directly hit profit margins, squeezing already thin profit lines for many small businesses.

The Impact on Supply Chains

- Disrupted global supply chains: Tariffs disrupted established global supply chains, leading to increased lead times and significantly higher shipping costs. Small businesses, often reliant on just-in-time inventory management, were particularly vulnerable to these disruptions.

- Reduced negotiating power: Unlike larger corporations, small businesses often have less negotiating power with suppliers, making it harder to mitigate the impacts of tariffs or secure alternative suppliers quickly.

- Supplier dependency: Many small businesses rely on specific international suppliers for unique or specialized goods. When tariffs impacted these suppliers, small businesses faced significant challenges finding alternative, equally cost-effective options. The search for new suppliers often involved increased costs and time delays, further damaging their bottom line.

Reduced Competitiveness in the Global Marketplace

The tariffs not only increased input costs but also significantly reduced the competitiveness of American small businesses in the global marketplace. This happened through higher prices for American goods and retaliatory tariffs from other countries.

Higher Prices for American Goods

- Reduced export opportunities: The increased cost of production, due to tariffs, made American-made goods more expensive for international buyers. This directly translated to reduced export opportunities for small businesses reliant on international sales.

- Increased competition from foreign producers: As American goods became more expensive, foreign producers gained a competitive advantage, especially in export markets. This led to a significant loss of market share for many American small businesses.

- Examples: American furniture manufacturers, for instance, found themselves unable to compete with cheaper imports from countries not subject to the same tariffs. This competitive disadvantage led to decreased orders, reduced revenue, and in some cases, business closures.

Retaliatory Tariffs from Other Countries

- Double whammy: Other countries retaliated by imposing their own tariffs on American goods. This created a “double whammy” for small businesses, facing both increased input costs and reduced export opportunities.

- Examples: The EU and China, among others, responded with tariffs on various American products, including agricultural goods and manufactured products. This hurt American small businesses specializing in exports to those markets.

- Lost export markets: These retaliatory tariffs effectively closed off export markets for numerous small businesses, leading to significant revenue losses and financial instability.

Access to Capital and Financing Challenges

The economic uncertainty created by the tariffs significantly impacted small businesses' access to capital and financing. This was a serious hurdle in adapting to the new economic realities.

Increased Financial Risk and Uncertainty

- Reduced lending: Banks and investors became more hesitant to lend money to small businesses operating in sectors heavily affected by tariffs. The increased financial risk and uncertainty made them less willing to take on new clients or extend credit lines.

- Impact on expansion and innovation: This reduced access to capital severely hampered small businesses' ability to expand their operations, invest in new technologies, or innovate to overcome tariff-related challenges.

- Limited investment: The uncertainty also discouraged investors from providing venture capital or other forms of equity financing to small businesses in affected sectors.

Limited Government Support

- Inadequate assistance programs: Existing government support programs for small businesses often proved inadequate to address the specific challenges posed by tariffs.

- Bureaucratic hurdles: Accessing these programs frequently involved complex bureaucratic processes, making it difficult for many small businesses to receive timely and effective assistance.

- Lack of targeted support: Many felt the existing programs were not specifically tailored to the unique financial struggles brought about by the tariffs.

Conclusion

Trump's tariffs presented a significant threat to the American small business landscape, leading to increased costs, reduced competitiveness, and financial instability for many businesses. The ripple effects of these policies, including supply chain disruptions and retaliatory tariffs, significantly hampered small business growth and prosperity. Understanding the lasting impact of these policies is crucial for policymakers and small business owners alike. To better navigate future economic uncertainties, small businesses must adopt robust risk management strategies, diversify their supply chains, and advocate for policies that support their continued growth and competitiveness. Avoiding similar economic pitfalls in the future requires careful consideration of the potential impact of trade policies on the American small business sector. The long-term effects of these tariffs serve as a cautionary tale, emphasizing the need for a more nuanced approach to trade policy that protects the interests of American small businesses.

Featured Posts

-

Is Selena Gomez Dating Benny Blanco Addressing The Cheating Speculation

May 12, 2025

Is Selena Gomez Dating Benny Blanco Addressing The Cheating Speculation

May 12, 2025 -

Lily Collins And Charlie Mc Dowells Daughter Tove Family Photos

May 12, 2025

Lily Collins And Charlie Mc Dowells Daughter Tove Family Photos

May 12, 2025 -

Zurich Classic Mc Ilroy Lowry Face Steep Climb In Title Defense

May 12, 2025

Zurich Classic Mc Ilroy Lowry Face Steep Climb In Title Defense

May 12, 2025 -

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Coms Predictions

May 12, 2025

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Coms Predictions

May 12, 2025 -

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025