Trump's Tax Plan: Republican Opposition And Potential Roadblocks

Table of Contents

Fiscal Responsibility Concerns Among Republicans

A significant source of Republican opposition stemmed from concerns about fiscal responsibility and the potential impact on the national debt and budget deficit. Many fiscally conservative Republicans argued that the tax cuts, without corresponding spending cuts, would dramatically increase the already substantial national debt. This concern resonated deeply within the party, creating a powerful counter-narrative to the plan's proponents.

- Projected Increased Deficit: Independent analyses projected a substantial increase in the national debt under Trump's tax plan, ranging from hundreds of billions to trillions of dollars over the next decade. These projections fueled concerns about the long-term fiscal health of the nation.

- Lack of Spending Cuts: Critics argued that the plan lacked sufficient mechanisms to offset the revenue losses from the proposed tax cuts. The absence of meaningful spending cuts made the plan fiscally unsustainable in the eyes of many Republicans.

- Statements from Key Figures: Prominent Republican figures, known for their fiscal conservatism, publicly voiced their reservations, highlighting the potential risks to the nation's financial stability. These dissenting voices played a crucial role in galvanizing opposition within the party.

Intra-Party Divisions on Tax Policy

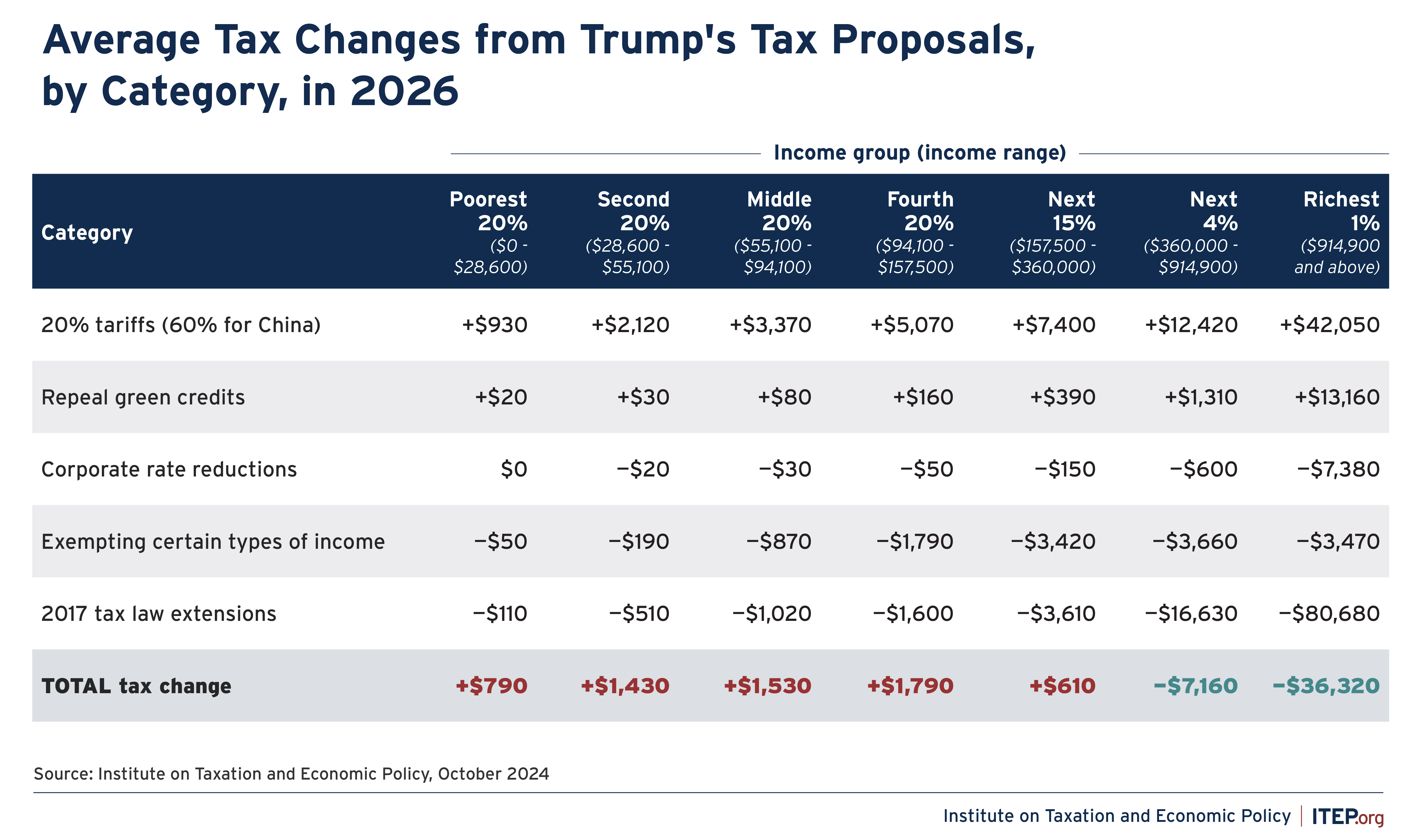

Beyond broad fiscal concerns, significant intra-party divisions emerged regarding the specific details of the tax plan. Disagreements arose between different factions within the Republican party, particularly between more conservative and moderate wings, regarding corporate tax rates, individual tax brackets, and the inclusion or exclusion of specific tax loopholes.

- Corporate Tax Rate Debates: While the plan proposed a reduction in the corporate tax rate, disagreements existed regarding the optimal level. Some Republicans advocated for a more drastic reduction, while others argued for a more moderate decrease to avoid excessive revenue loss.

- Individual Tax Bracket Disagreements: Similar divisions emerged concerning individual tax rates. Disputes arose over the extent of tax cuts for various income brackets, with some arguing for more targeted relief for specific groups.

- Compromise Challenges: The diverse viewpoints within the Republican party made reaching a unified stance on the tax plan extremely challenging. Negotiating compromises and bridging the gaps between different factions proved to be a significant hurdle.

Procedural Hurdles and Senate Challenges

The legislative process itself presented significant obstacles to the passage of Trump's tax plan. Procedural hurdles within the Senate, particularly the potential for a filibuster, threatened to derail the plan. The need for bipartisan support or the use of the reconciliation process added complexity and uncertainty.

- Senate Filibuster Threat: The Senate's filibuster rule allowed a minority of senators to block legislation unless a supermajority (60 votes) could be achieved. This posed a significant threat to the plan's passage, especially given the narrow Republican majority.

- Reconciliation Process Limitations: The reconciliation process, which allows certain legislation to pass with a simple majority, could have been used, but it had limitations on the types of provisions it could include. This restricted the scope of potential changes.

- Bipartisan Cooperation Challenges: The lack of bipartisan support further complicated the process. Securing enough Democratic votes to overcome a potential filibuster proved to be an unlikely scenario, making the reconciliation process the more likely, yet constrained, pathway.

Public Opinion and Political Fallout

The success or failure of Trump's tax plan held significant political consequences, impacting public opinion and the upcoming midterm elections. Polling data provided insights into public perception, revealing varying levels of support and opposition across different demographics.

- Polling Data Variations: Public opinion polls showed a mixed response to the tax plan, with varying levels of support depending on factors such as income level and political affiliation.

- Political Risks for Both Parties: The plan's passage or failure carried political risks for both Republicans and Democrats. Republicans faced the risk of alienating voters with unpopular provisions, while Democrats could leverage opposition to the plan to gain political advantage.

Conclusion

Trump's tax plan faced considerable opposition within the Republican party itself, creating significant roadblocks to its passage. Concerns about fiscal responsibility, intra-party divisions on tax policy, and procedural hurdles in the Senate all contributed to a challenging legislative environment. The potential economic and political consequences of the plan's success or failure underscored the high stakes involved. Follow the unfolding debate on Trump's tax plan and stay updated on the roadblocks facing Trump's tax reform to understand its potential impact on the economy and the political landscape. Learn more about the potential consequences of Trump's tax plan through reputable news sources and policy analyses.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Allegations

Apr 29, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6 Allegations

Apr 29, 2025 -

Khaznas Saudi Expansion Post Silver Lake Deal Data Center Strategy

Apr 29, 2025

Khaznas Saudi Expansion Post Silver Lake Deal Data Center Strategy

Apr 29, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof A Says No

Apr 29, 2025

Should Investors Worry About Current Stock Market Valuations Bof A Says No

Apr 29, 2025 -

Trial Of The Century Cardinals Allegations Of Prosecutorial Misconduct And Newly Discovered Evidence

Apr 29, 2025

Trial Of The Century Cardinals Allegations Of Prosecutorial Misconduct And Newly Discovered Evidence

Apr 29, 2025 -

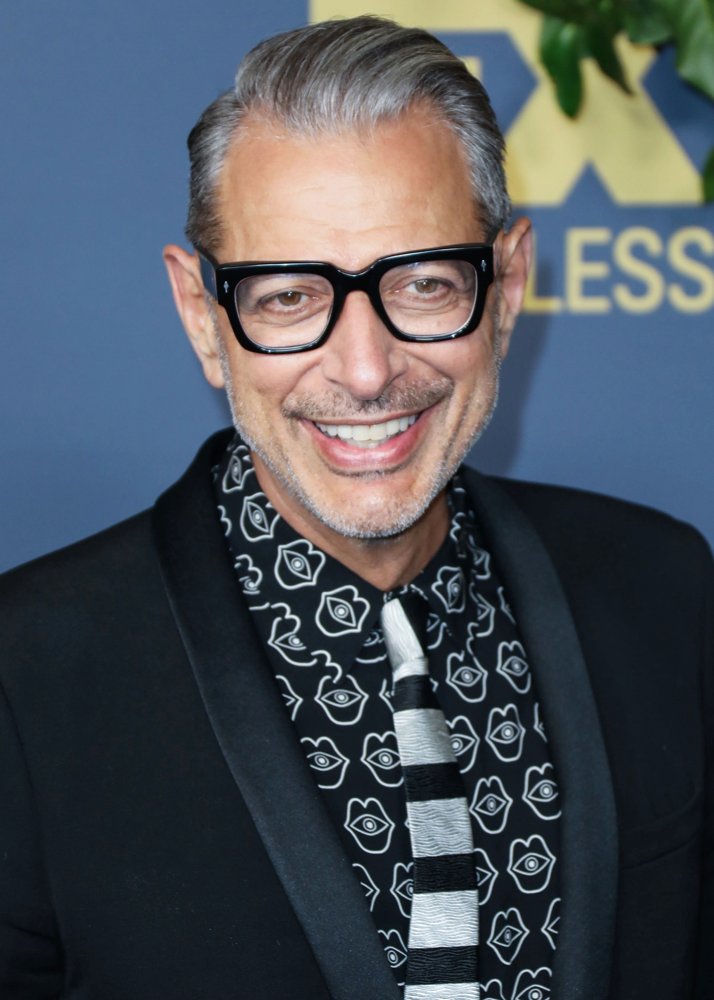

Jeff Goldblum Releases Unexpected New Album

Apr 29, 2025

Jeff Goldblum Releases Unexpected New Album

Apr 29, 2025