Two-Year Low: Indonesia's Reserve Dip Linked To Rupiah Challenges

Table of Contents

The Impact of a Weakening Rupiah on Indonesia's Foreign Exchange Reserves

A weakening Rupiah significantly impacts Indonesia's foreign exchange reserves. The depreciation of the Rupiah against major currencies like the US dollar directly affects the country's ability to manage its balance of payments and maintain sufficient foreign currency reserves.

-

Increased Import Costs: A weaker Rupiah increases the Rupiah cost of imports, widening the current account deficit. This means Indonesia spends more Rupiah to purchase the same amount of goods and services from abroad, putting significant pressure on the country's foreign exchange reserves. The higher cost of imports also contributes to inflation, further complicating the economic situation.

-

Depletion of Reserves: The increased demand for foreign currency to pay for these more expensive imports directly depletes the foreign exchange reserves held by Bank Indonesia, the Indonesian central bank. Businesses need more dollars, euros, and other foreign currencies to settle international transactions, leading to a drain on the reserves.

-

Bank Indonesia Intervention: To support the Rupiah and prevent excessive volatility, Bank Indonesia often intervenes in the foreign exchange market by selling foreign currency reserves to buy Rupiah. While this action temporarily stabilizes the exchange rate, it further reduces the country's foreign currency reserves.

-

Correlation Between Rupiah Volatility and Reserves: Recent data clearly shows a strong negative correlation between Rupiah volatility and the level of Indonesia's foreign exchange reserves. Periods of significant Rupiah depreciation are typically accompanied by a decline in reserves as the central bank intervenes and importers demand more foreign currency. (Include relevant chart/graph here if available)

Global Economic Headwinds and Their Effect on Indonesian Reserves

Global economic headwinds significantly contribute to the decline in Indonesia's foreign exchange reserves. The interconnectedness of the global economy means that challenges in one region can quickly impact others, including Indonesia.

-

Decreased Export Demand: Weakening global demand, particularly from key trading partners, reduces the inflow of foreign currency from Indonesian exports. This lower export revenue directly affects the country's ability to replenish its foreign exchange reserves.

-

Capital Outflow: Rising global inflation and interest rates often lead to capital outflow from emerging markets like Indonesia. Investors may move their funds to countries offering higher returns and perceived greater stability, reducing the inflow of foreign investment and putting downward pressure on the Rupiah.

-

Commodity Price Volatility: Indonesia is a major exporter of commodities like oil and palm oil. Fluctuations in global commodity prices, often caused by geopolitical events or supply chain disruptions, directly impact Indonesia's export revenue and, consequently, its foreign exchange reserves. A sharp drop in commodity prices can severely reduce the foreign currency earned from exports.

-

Impact of Specific Global Events: Recent events such as [mention specific recent global events and their impact on Indonesian reserves, e.g., the war in Ukraine, rising US interest rates]. These events highlight the vulnerability of Indonesia's reserves to external shocks.

Bank Indonesia's Response and Monetary Policy Strategies

Bank Indonesia has implemented various monetary policy strategies to address the decline in foreign exchange reserves and manage the Rupiah's exchange rate.

-

Monetary Policy Decisions: Bank Indonesia's recent decisions, such as [mention specific policy actions, e.g., interest rate hikes], aim to attract foreign investment, curb inflation, and support the Rupiah. These measures aim to make the Rupiah more attractive to investors, thereby increasing demand and potentially slowing its depreciation.

-

Exchange Rate Management: The central bank employs a managed floating exchange rate system. This involves intervening in the foreign exchange market to manage excessive volatility, but this intervention comes at the cost of depleting foreign exchange reserves.

-

Effectiveness of Strategies: The effectiveness of these strategies is subject to ongoing evaluation. While some measures might provide short-term relief, long-term sustainability requires a more comprehensive approach to economic management and diversification.

-

Potential Future Adjustments: Bank Indonesia may need to adjust its monetary policy further depending on evolving global and domestic economic conditions. This could involve further interest rate adjustments or other measures designed to boost the Rupiah and attract foreign investment.

The Role of Foreign Direct Investment (FDI) in Supporting Reserves

Foreign Direct Investment (FDI) plays a crucial role in supporting Indonesia's foreign exchange reserves and boosting economic growth.

-

Bolstering Reserves: FDI inflows bring in foreign currency, directly increasing the country's reserves. These investments represent a significant source of capital that can help offset the impact of a current account deficit.

-

Current FDI Trends: Analyzing recent FDI trends reveals [mention current trends and their effect on reserves]. Government policies play a vital role in shaping these trends.

-

Government Initiatives: The Indonesian government has been actively implementing initiatives to attract more FDI, including improving the investment climate, simplifying regulations, and promoting specific sectors. These initiatives aim to create a more attractive environment for foreign investors, which will have a positive impact on reserves.

Conclusion

This article highlights the interconnectedness between the recent two-year low in Indonesia's foreign exchange reserves, the fluctuating Rupiah exchange rate, and global economic headwinds. The weakening Rupiah, driven by increased import costs and global uncertainty, has significantly pressured the country's reserves. Bank Indonesia's monetary policy responses are crucial in stabilizing the situation. Sustained economic growth, attracting significant foreign direct investment, and effective management of the current account deficit are also vital for strengthening Indonesia's financial resilience and increasing its foreign currency reserves.

Call to Action: Stay informed about the latest developments concerning Indonesia's foreign exchange reserves and the Rupiah's performance. Understanding the dynamics of Indonesia's foreign currency reserves is crucial for investors and businesses operating within the Indonesian economy. Continue to monitor the situation for insights into the future trajectory of Indonesia's economic stability.

Featured Posts

-

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025 -

Nl Federal Election Who Are The Candidates

May 10, 2025

Nl Federal Election Who Are The Candidates

May 10, 2025 -

Executive Orders Under Trump The Transgender Perspective

May 10, 2025

Executive Orders Under Trump The Transgender Perspective

May 10, 2025 -

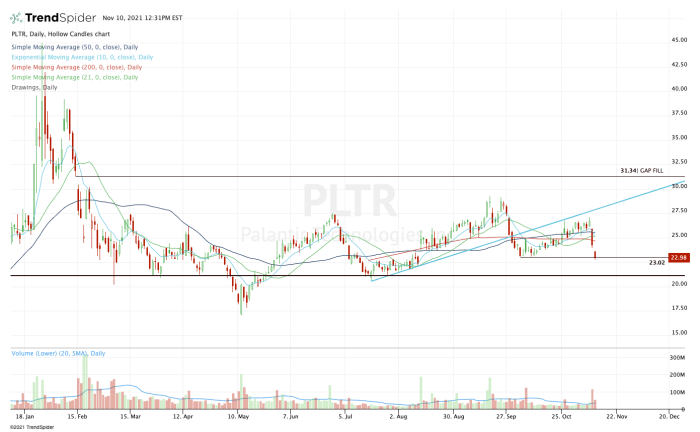

Is Palantir Stock A Good Investment Before Its May 5th Earnings Release

May 10, 2025

Is Palantir Stock A Good Investment Before Its May 5th Earnings Release

May 10, 2025 -

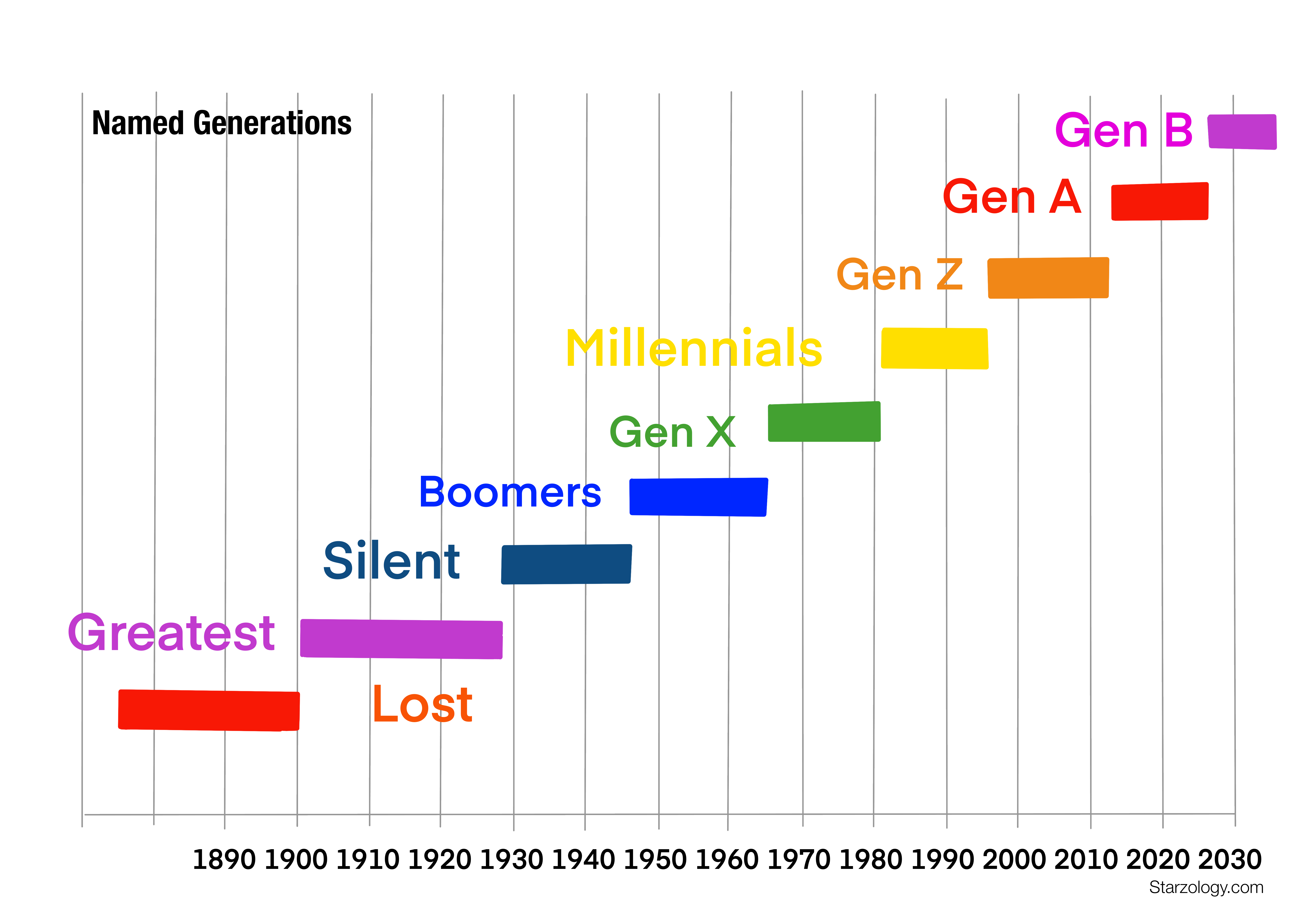

Attracting Gen Z Does Androids New Look Hold The Key

May 10, 2025

Attracting Gen Z Does Androids New Look Hold The Key

May 10, 2025