U.S.-China Truce Fuels Global Stock Market Rally

Table of Contents

Easing Trade Tensions: The Catalyst for the Rally

The recent de-escalation in U.S.-China trade tensions has acted as a powerful catalyst for the global stock market rally. While the relationship remains complex, a series of recent events suggest a move towards reduced confrontation. For example, the pause on the implementation of some planned tariffs has significantly reduced uncertainty in the market. Furthermore, renewed discussions and negotiations between the two economic giants signal a potential path towards a more stable trade relationship.

- Reduced uncertainty boosts investor confidence. The prolonged trade war created significant volatility and uncertainty, making investors hesitant to commit capital. The easing of tensions removes this major obstacle, encouraging a more positive outlook.

- Lower trade barriers lead to increased global trade and economic growth. Reduced tariffs and trade restrictions facilitate smoother global commerce, benefiting businesses and economies worldwide. This positive impact translates into increased profitability and higher stock valuations.

- Specific sectors (e.g., technology, manufacturing) benefiting most from the truce. Companies in sectors heavily impacted by the trade war, such as technology and manufacturing, are experiencing disproportionately large gains as supply chains stabilize and market access improves. For example, shares in several major technology companies saw double-digit percentage increases following the announcement of the truce.

- Examples of companies whose stock prices have increased significantly. [Insert examples of specific companies and their percentage stock price increases. Use reputable financial news sources to support these claims.]

Impact on Key Global Indices

The U.S.-China truce has had a demonstrably positive impact on major global stock market indices. Following the announcements of de-escalation, we’ve seen significant gains across the board.

- Percentage increases in key indices. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw significant percentage increases [Insert specific percentage increases with dates]. Similarly, international indices like the FTSE 100 and the Shanghai Composite experienced notable growth, reflecting the global nature of the impact.

- Analysis of trading volumes and volatility. Trading volumes increased substantially in the period following the truce announcement, indicating heightened investor activity. Market volatility, however, has generally decreased, suggesting increased confidence.

- Comparison to previous market trends. The current rally contrasts sharply with the periods of uncertainty and decline seen during the height of the trade war. This shift highlights the significant role trade tensions play in global market sentiment.

- Mention any specific market anomalies or unexpected movements. [Include any interesting market anomalies or unexpected movements that occurred in specific sectors or indices in response to the news.]

Investor Sentiment and Market Outlook

The shift in investor sentiment is palpable. The prevailing pessimism that characterized the market during the trade war has been largely replaced by a sense of optimism and increased risk appetite.

- Increased risk appetite among investors. Investors are now more willing to invest in riskier assets, such as emerging market equities and high-growth technology stocks. This is a clear indication of growing confidence in the future economic outlook.

- Changes in investment strategies. Investment strategies are being adjusted to reflect the new market environment. Many investors are shifting their portfolios towards sectors that stand to benefit most from the easing of trade tensions.

- Expert opinions and predictions about future market performance. [Include quotes from reputable financial analysts and economists offering their perspectives on the market's future performance in light of the truce.]

- Potential risks and challenges that could still impact the market. While the truce is positive, it's crucial to acknowledge that the underlying geopolitical issues are not entirely resolved. Renewed tensions or unforeseen challenges could still impact market performance.

Long-Term Implications for US-China Relations

The long-term impact of this truce on US-China relations and the global economy is yet to be fully understood. It presents both opportunities and significant risks.

- Potential for further cooperation between the two nations. The truce could potentially pave the way for greater cooperation on other global issues, potentially boosting international stability and economic growth.

- Risks of renewed tensions and future trade disputes. The underlying causes of the trade disputes remain unresolved, creating the potential for renewed conflicts in the future. This uncertainty must be factored into any long-term investment strategies.

- Impact on global supply chains and international trade. The easing of tensions should help stabilize global supply chains, making it easier for businesses to operate across borders and reducing costs.

Conclusion

The U.S.-China truce has indeed fueled a significant global stock market rally, driven by reduced trade tensions and increased investor confidence. However, the long-term implications remain uncertain, and vigilance is advised. The reduced uncertainty and improved investor sentiment are key takeaways, but potential risks still exist. (Keywords: U.S.-China truce, global stock market rally, investor confidence, trade tensions)

Call to Action: Stay informed about the evolving U.S.-China relationship and its impact on global markets. Monitor the U.S.-China truce closely to make informed investment decisions and capitalize on future opportunities in this dynamic market environment. Learn more about navigating the complexities of the U.S.-China trade relationship and its effects on your investment portfolio. (Keywords: U.S.-China truce, global stock market rally, investment decisions, investment portfolio)

Featured Posts

-

Discover Lindts New Chocolate Destination In Central London

May 14, 2025

Discover Lindts New Chocolate Destination In Central London

May 14, 2025 -

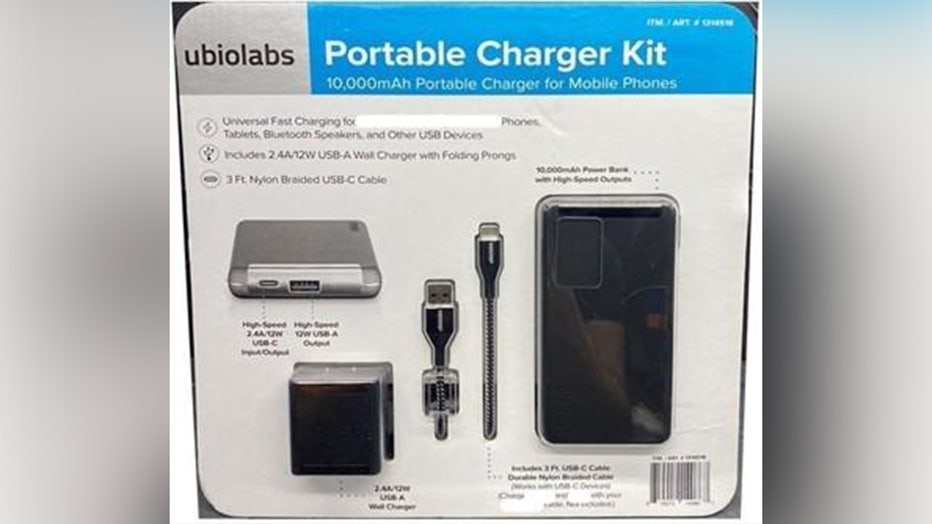

Walmart Issues Recall On Electric Ride On Toys And Portable Chargers

May 14, 2025

Walmart Issues Recall On Electric Ride On Toys And Portable Chargers

May 14, 2025 -

Mission Impossible Dead Reckoning Tom Cruises High Altitude Stunt Revealed

May 14, 2025

Mission Impossible Dead Reckoning Tom Cruises High Altitude Stunt Revealed

May 14, 2025 -

Is There A Ghost In Suits La Investigating The Rumors

May 14, 2025

Is There A Ghost In Suits La Investigating The Rumors

May 14, 2025 -

Borussia Dortmund Leading The Race For Jobe Bellingham

May 14, 2025

Borussia Dortmund Leading The Race For Jobe Bellingham

May 14, 2025