U.S. Dollar's Performance: A Comparison Of Presidential First 100 Days

Table of Contents

Methodology: Assessing U.S. Dollar Performance

Accurately assessing the U.S. dollar's performance requires a robust methodology. We primarily utilize the U.S. Dollar Index (DXY), a weighted average of the dollar against six major currencies (Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc). This index provides a comprehensive overview of the dollar's strength relative to its global counterparts. We will also consider exchange rates against these major currencies individually to gain a more nuanced understanding.

However, it's crucial to acknowledge limitations. Attributing the U.S. dollar's performance solely to the first 100 days of a presidency is an oversimplification. The economic impact of any administration unfolds over years, influenced by various factors beyond presidential control.

- Limitations of the 100-Day Metric: Short-term fluctuations can be volatile and don't always reflect long-term trends. External shocks, such as global pandemics or unexpected geopolitical events, can significantly outweigh the impact of initial presidential policies.

- External Factors: Interest rate changes set by the Federal Reserve, global economic growth, international trade dynamics, and investor sentiment all play a significant role in determining the U.S. dollar's value. These factors need to be considered alongside presidential actions when analyzing currency movements.

Case Studies: Analyzing Specific Presidencies

To illustrate the complexities involved, let's analyze the U.S. dollar's performance during the first 100 days of three recent presidencies:

President Obama's First 100 Days (2009):

President Obama inherited the Great Recession. His initial economic policies focused on stimulus packages and bank bailouts.

- Economic Policies: American Recovery and Reinvestment Act of 2009, auto industry bailouts.

- U.S. Dollar Performance: The DXY showed a mixed performance during this period, initially weakening due to the economic crisis but showing some stabilization towards the end of the 100 days. The dollar's value against the Euro fluctuated significantly.

- Analysis: The dollar's movement reflected the ongoing global economic crisis rather than a direct response to Obama's early policies. The uncertainty surrounding the economic recovery likely contributed to volatility.

President Trump's First 100 Days (2017):

President Trump campaigned on promises of deregulation and tax cuts.

- Economic Policies: Promises of tax cuts and deregulation, discussions of trade protectionism.

- U.S. Dollar Performance: The DXY initially strengthened, potentially reflecting optimism surrounding potential pro-growth policies. However, this was relatively short-lived compared to longer-term trends.

- Analysis: While initial market reactions were positive, the impact of Trump's policies on the U.S. dollar's long-term performance remains a subject of ongoing debate, with factors like trade wars playing a significant role.

President Biden's First 100 Days (2021):

President Biden focused on addressing the COVID-19 pandemic and enacting a large stimulus package.

- Economic Policies: American Rescue Plan, infrastructure investments.

- U.S. Dollar Performance: The DXY showed moderate fluctuations, reflecting uncertainty surrounding the pandemic's economic impact and the effectiveness of the stimulus package.

- Analysis: The dollar's performance during this period was likely influenced by a confluence of factors, including the ongoing pandemic, global economic recovery, and market responses to Biden's economic agenda.

Factors Influencing the U.S. Dollar's Movement During the First 100 Days

Several interconnected factors influence the U.S. dollar's movement beyond presidential actions:

Domestic Policy:

Proposed legislation, budget announcements, and regulatory changes significantly impact investor confidence and, consequently, the dollar. For example, significant tax cuts or increased government spending can influence the dollar's value through their effect on inflation and economic growth.

International Relations:

International trade agreements, diplomatic relations, and geopolitical events can profoundly affect the U.S. dollar. Trade disputes, for instance, can create uncertainty and lead to dollar volatility. Sanctions or shifts in global alliances can also impact the dollar's perceived strength.

Market Sentiment:

Investor confidence and speculation are powerful drivers of currency values. Positive news about the U.S. economy can boost the dollar, while negative news or uncertainty can lead to a decline. Market speculation, driven by various factors, can also cause significant short-term fluctuations.

Conclusion

Analyzing the U.S. dollar's performance during the first 100 days of various presidencies reveals a complex interplay of factors. While presidential policies can influence the currency's movement, it's impossible to attribute fluctuations solely to presidential actions within such a short timeframe. Global economic conditions, interest rates, and market sentiment play crucial roles. Therefore, a comprehensive understanding of U.S. dollar performance requires a broader perspective, considering a multitude of internal and external factors. To gain a deeper understanding of the intricate relationship between presidential policies and the U.S. dollar's performance, continue researching economic indicators and following market trends. Further analysis of the U.S. dollar's performance under different administrations is crucial for informed financial decision-making.

Featured Posts

-

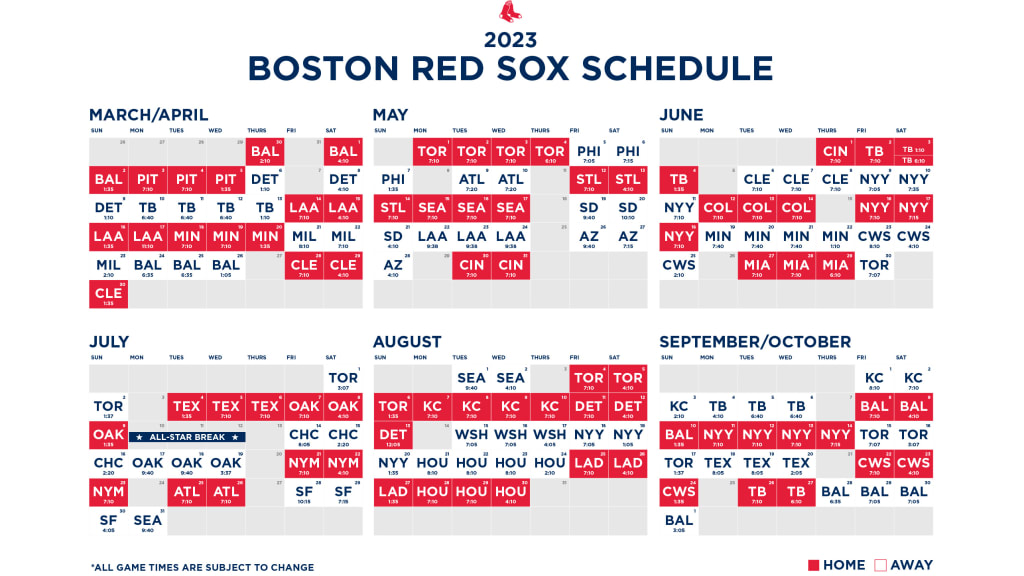

2025 Red Sox Options For Replacing Tyler O Neills Production

Apr 28, 2025

2025 Red Sox Options For Replacing Tyler O Neills Production

Apr 28, 2025 -

Legal Dispute Creditors Demand For Denise Richards Husbands Finances

Apr 28, 2025

Legal Dispute Creditors Demand For Denise Richards Husbands Finances

Apr 28, 2025 -

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025 -

Pilihan Warna Baru Jetour Dashing Kejutan Di Iims 2025

Apr 28, 2025

Pilihan Warna Baru Jetour Dashing Kejutan Di Iims 2025

Apr 28, 2025 -

Xs Financial Restructuring Analyzing The Impact Of Musks Debt Sale

Apr 28, 2025

Xs Financial Restructuring Analyzing The Impact Of Musks Debt Sale

Apr 28, 2025