U.S. Dollar's Performance: A Comparison To Nixon's First 100 Days

Table of Contents

The Nixon Shock and its Impact on the U.S. Dollar's Performance

The Nixon shock, a pivotal moment in global economic history, dramatically altered the U.S. dollar's performance and the international monetary system. Understanding this event is crucial for contextualizing current economic anxieties and the ongoing debate surrounding the U.S. dollar's future.

The Bretton Woods System and its Collapse

For nearly three decades, the Bretton Woods system maintained a fixed exchange rate, pegging major currencies to the U.S. dollar, which was, in turn, convertible to gold. This system, however, faced growing pressure due to persistent trade deficits and inflation in the United States. The inherent tension between maintaining a fixed exchange rate and managing domestic economic pressures ultimately led to its collapse.

- Closure of the Gold Window (August 15, 1971): Nixon's announcement that the U.S. would no longer convert dollars to gold at a fixed rate effectively ended the gold standard and sent shockwaves through global financial markets.

- Immediate Effects on Dollar Value: The dollar's value immediately came under pressure, depreciating against other major currencies as international confidence waned.

- Initial Market Reactions and Uncertainty: The move created significant uncertainty and volatility in global currency markets, as countries scrambled to adjust their exchange rate policies.

- Long-Term Consequences: The Nixon shock ushered in an era of floating exchange rates, fundamentally altering the landscape of international trade and finance. The world moved away from fixed exchange rates, leading to greater market-driven fluctuations in currency values.

Current U.S. Dollar Performance: A Macroeconomic Overview

Analyzing the current U.S. dollar's performance requires a careful examination of several key macroeconomic indicators. The dollar's strength or weakness isn't solely determined by a single factor; instead, it's a complex interplay of various economic forces.

Key Economic Indicators

Several key indicators provide insights into the current state of the U.S. economy and the dollar's performance:

- Current State of the Dollar: The U.S. dollar index (DXY), which tracks the dollar's value against a basket of other major currencies, provides a benchmark for its current strength. Recent movements in the DXY reflect the ongoing economic battles between inflation, interest rate adjustments and global economic uncertainty.

- Recent Fluctuations and Contributing Factors: Recent fluctuations in the dollar's value are largely attributable to factors such as interest rate changes by the Federal Reserve, global geopolitical instability (e.g., the war in Ukraine), and shifts in investor sentiment.

- Comparison to Pre-Nixon Shock Conditions: A comparison of current economic indicators—inflation, unemployment, GDP growth—to those preceding the Nixon shock reveals both similarities and striking differences in the economic landscape. While inflationary pressures existed then, the globalized nature of today's markets adds layers of complexity.

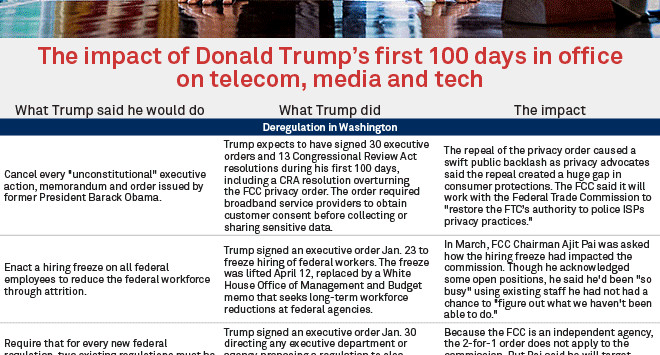

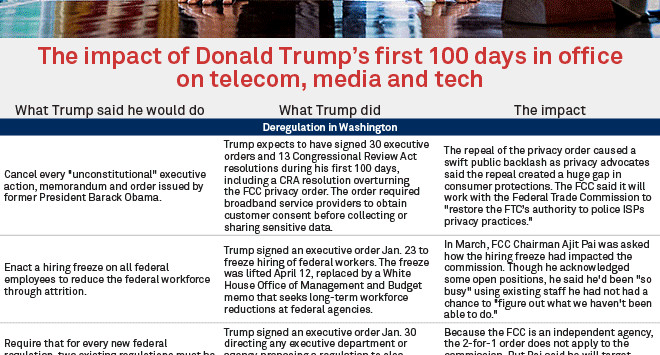

A Comparative Analysis: Nixon's First 100 Days vs. Present Day

Comparing the U.S. dollar's performance during Nixon's first 100 days with its current state reveals both striking similarities and critical differences in the economic context and policy responses.

Similarities in Economic Context

Both periods share a common thread: significant economic uncertainty. In 1971, the Bretton Woods system's collapse created global instability. Today, we face challenges such as high inflation, supply chain disruptions, and geopolitical tensions. Both periods experienced considerable inflationary pressures, though the causes and mechanisms differ.

Differences in Policy Responses

While both eras involved significant shifts in economic policy, their nature and execution differed substantially. Nixon's response was a unilateral decision to abandon the gold standard. Current responses are far more multifaceted and involve coordinated international efforts in addition to domestic policy adjustments such as interest rate adjustments from the Federal Reserve.

- Impact on Dollar Value: The immediate impact on the dollar's value differed significantly. While Nixon's actions led to immediate devaluation, the current situation involves a more gradual, complex interplay of factors impacting the dollar's value.

- Global Economic Landscape: The global economic landscape is vastly different today than in 1971. Increased globalization, interconnected financial markets, and the rise of emerging economies significantly impact the dollar's performance in ways unimaginable during the Bretton Woods era.

- Long-Term Effects: The long-term effects of both periods’ decisions are still unfolding. The Nixon shock fundamentally altered the international monetary system, while the current economic policies are shaping the future direction of the global economy and the U.S. dollar's role within it.

Conclusion

Comparing the U.S. dollar's performance during Nixon's first 100 days with its current status highlights significant parallels and crucial distinctions. Both periods witnessed substantial economic uncertainty, but the policy responses and the global economic landscape have changed drastically. The Nixon shock led to a swift and dramatic shift away from the gold standard, while current economic challenges demand a more nuanced and collaborative approach. Understanding these historical parallels offers valuable insights into the complexities of managing a global reserve currency like the U.S. dollar.

Key Takeaways: The U.S. dollar's performance is intrinsically linked to domestic economic policies and global economic conditions. Both historical precedent and current trends underscore the importance of a stable macroeconomic environment for maintaining the dollar's value. The volatility of the dollar reflects the intricate interplay of various economic factors, ranging from interest rate changes to geopolitical instability.

Call to Action: Stay updated on the U.S. dollar's performance and its impact on your investments by regularly checking reliable financial news sources. Understanding the U.S. dollar's performance is crucial for informed financial decisions. Learn more about global economics and currency exchange rates today!

Featured Posts

-

Skolmassakern Helena Och Ivas Kamp Foer Oeverlevnad

Apr 29, 2025

Skolmassakern Helena Och Ivas Kamp Foer Oeverlevnad

Apr 29, 2025 -

Las Vegas Police Seek Information On Missing Paralympian Sam Ruddock

Apr 29, 2025

Las Vegas Police Seek Information On Missing Paralympian Sam Ruddock

Apr 29, 2025 -

Analyse Deutsche Teams Im Champions League Kopf An Kopf Rennen

Apr 29, 2025

Analyse Deutsche Teams Im Champions League Kopf An Kopf Rennen

Apr 29, 2025 -

You Tubes Senior Viewership A Look At Nprs Report On Audience Expansion

Apr 29, 2025

You Tubes Senior Viewership A Look At Nprs Report On Audience Expansion

Apr 29, 2025 -

Inside The Ccp United Fronts Influence In Minnesota

Apr 29, 2025

Inside The Ccp United Fronts Influence In Minnesota

Apr 29, 2025