Uber Investment: Potential, Risks, And Future Outlook

Table of Contents

Potential Returns of Uber Investment

H3: Market Dominance and Growth Potential: Uber's dominance in the ride-sharing market is undeniable. Its expansion into food delivery (Uber Eats), freight (Uber Freight), and other micromobility services diversifies its revenue streams and offers substantial growth potential.

- High growth projections in emerging markets: Untapped markets in developing countries present significant opportunities for expansion and increased market share. Uber's global reach offers a compelling advantage.

- Potential for increased market share in existing markets: Continuous innovation and strategic partnerships can help Uber solidify its position and potentially acquire smaller competitors. This could lead to significant gains in market capitalization.

- Potential for strategic acquisitions and partnerships: Acquiring complementary businesses or partnering with tech giants could significantly enhance Uber's services and overall value proposition, impacting its return on investment (ROI).

H3: Technological Innovation and Future Technologies: Uber's substantial investments in autonomous vehicles (AVs) and electric vehicle (EV) integration position it as a leader in technological disruption.

- Potential for cost reduction through automation: The successful deployment of autonomous vehicles could significantly reduce operational costs, boosting profitability and increasing shareholder value.

- First-mover advantage in autonomous ride-sharing: Establishing a strong presence in the autonomous ride-sharing market early could provide a significant competitive edge. This presents a potentially lucrative long-term investment.

- Appeal to environmentally conscious consumers: The integration of EVs appeals to an increasingly environmentally aware customer base, enhancing the brand's image and attracting a wider range of consumers.

H3: Diversification and Revenue Streams: Uber's strategic diversification reduces its reliance on ride-sharing alone.

- Strong performance of Uber Eats: The impressive growth of Uber Eats demonstrates the success of its diversification strategy, providing a significant and stable revenue stream.

- Growth potential in Uber Freight: The logistics sector offers substantial growth opportunities, and Uber Freight's expansion into this market presents a significant avenue for future profits.

- Potential for new services and partnerships: Uber's platform allows for continuous expansion into new services and strategic partnerships, creating further revenue streams and enhancing overall financial stability.

Risks Associated with Uber Investment

H3: Regulatory and Legal Challenges: Uber faces ongoing regulatory and legal challenges globally.

- Driver classification disputes: The ongoing debate about driver classification (employee vs. independent contractor) continues to pose significant legal and financial risks.

- Antitrust concerns: Concerns about monopolistic practices and anti-competitive behavior could lead to significant fines and regulatory restrictions.

- Licensing and permit issues: Navigating complex licensing and permitting requirements across different jurisdictions adds to operational complexities and costs.

- Varying regulations across countries: The diverse regulatory landscape across different countries necessitates significant compliance efforts and can impact profitability.

H3: Competition and Market Saturation: The ride-sharing market is increasingly competitive.

- Competition from Lyft and other ride-sharing services: Intense competition from established players like Lyft and new entrants can lead to price wars and reduced profit margins.

- Potential for market saturation: In some mature markets, the potential for further growth may be limited, increasing the pressure to expand into new markets or diversify services.

- Challenges in maintaining market leadership: Maintaining market leadership requires continuous innovation, effective marketing, and operational efficiency.

H3: Economic Factors and External Risks: Macroeconomic factors significantly influence Uber's performance.

- Sensitivity to fuel prices: Fluctuations in fuel prices directly impact Uber's operational costs and profitability.

- Impact of economic downturns: During economic recessions, consumer spending on ride-sharing and delivery services tends to decrease, affecting revenue.

- Geopolitical risks: Global geopolitical events can negatively impact Uber's operations in certain regions.

- Impact of pandemics: The COVID-19 pandemic highlighted the vulnerability of Uber's business model to unforeseen global events.

Future Outlook for Uber Investment

H3: Long-Term Growth Projections: Despite the risks, Uber's long-term growth potential remains substantial.

- Potential for sustained growth in emerging markets: Continued expansion into underserved markets presents significant opportunities for growth.

- Expected impact of technological innovations: The successful implementation of autonomous vehicles and other technological advancements could dramatically improve efficiency and profitability.

- Potential for increased profitability: Cost optimization measures and successful diversification strategies should lead to increased profitability in the long term.

H3: Investment Strategies: Potential investors should carefully consider their risk tolerance and investment goals.

- Consideration of risk tolerance: Investing in Uber involves a degree of risk, so investors should only invest what they can afford to lose.

- Diversification within a portfolio: It's crucial to diversify investments to mitigate risk. Don't put all your eggs in one basket.

- Monitoring key performance indicators: Regular monitoring of key performance indicators (KPIs) like revenue, profitability, and market share is essential.

Conclusion

Uber Investment presents a compelling opportunity with considerable potential returns, driven by market dominance, technological innovation, and diversification. However, significant risks associated with regulatory hurdles, competition, and economic factors must be carefully considered. A thorough understanding of these factors is essential before making any investment decisions. Before investing in Uber or any other stock, conduct thorough research by consulting reputable financial news sources and seeking advice from qualified financial advisors to make informed decisions about investing in Uber. Consider your risk tolerance and carefully evaluate the Uber investment opportunities available to you.

Featured Posts

-

Rumour Harder Are Schlotterbeck And Stiller Liverpools Next Defensive Targets

May 17, 2025

Rumour Harder Are Schlotterbeck And Stiller Liverpools Next Defensive Targets

May 17, 2025 -

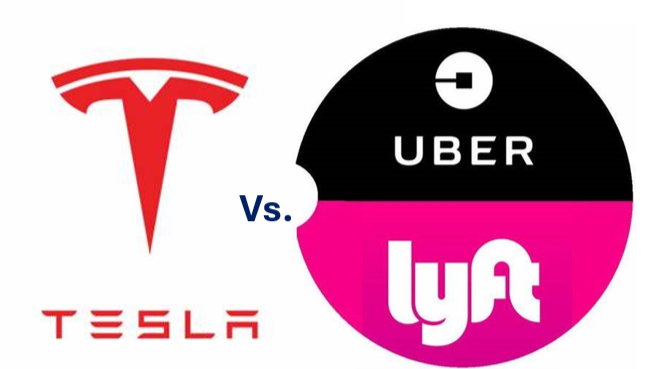

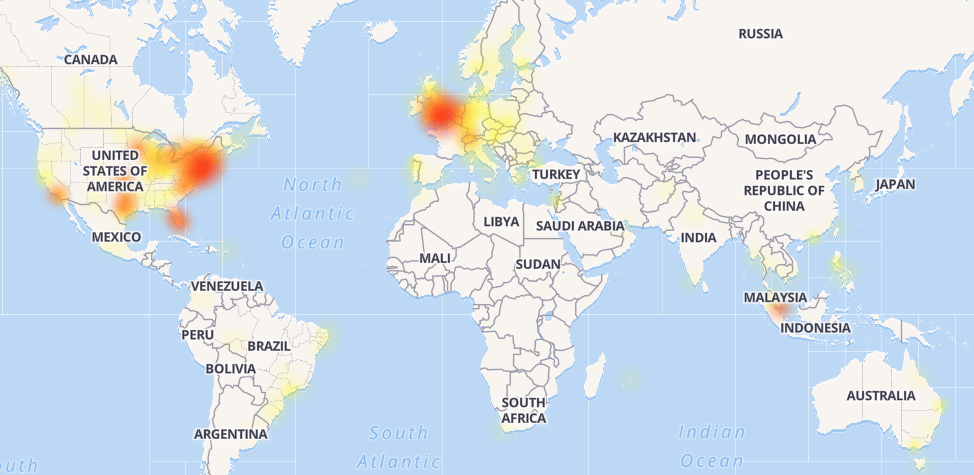

Global Reddit Outage Leaves Users Offline

May 17, 2025

Global Reddit Outage Leaves Users Offline

May 17, 2025 -

Alex Fines Birthday Surprise Cassie Reveals Baby Gender

May 17, 2025

Alex Fines Birthday Surprise Cassie Reveals Baby Gender

May 17, 2025 -

Major Reddit Outage Impacts Users Globally

May 17, 2025

Major Reddit Outage Impacts Users Globally

May 17, 2025 -

Jackbit The 1 Bitcoin Casino In The Usa

May 17, 2025

Jackbit The 1 Bitcoin Casino In The Usa

May 17, 2025