Uber Scraps Foodpanda Taiwan Acquisition Due To Regulatory Obstacles

Table of Contents

Taiwan's Stringent Antitrust Regulations

The primary reason for the failed Uber Foodpanda Taiwan acquisition boils down to Taiwan's stringent antitrust regulations and the concerns raised by the Fair Trade Commission (FTC).

Concerns Regarding Market Domination

The FTC expressed serious reservations about the potential for a combined Uber-Foodpanda entity to create a monopolistic market structure. Their primary concern centered around the significant impact on competition and the potential harm to consumers.

- Combined market share would have been significantly high: The merger would have resulted in a dominant market share, potentially exceeding the FTC's threshold for acceptable market concentration.

- FTC worried about reduced consumer choice and potential price increases: With less competition, the FTC feared a reduction in consumer choice and the potential for significantly higher prices for food delivery services.

- Lack of sufficient competitive alternatives in the market: The Taiwanese food delivery market, while competitive, lacks the sheer number of substantial players found in other regions. This lack of alternatives heightened the FTC's concerns about reduced consumer choice.

Lengthy and Complex Review Process

Taiwan's FTC is known for its rigorous and time-consuming review process for mergers and acquisitions. This process often involves extensive scrutiny and can lead to lengthy delays or even the outright rejection of proposed deals, as was the case here.

- Uber and Foodpanda faced extensive scrutiny and documentation requirements: The companies had to provide a substantial amount of documentation and data to satisfy the FTC's demands.

- Lengthy negotiations and potential compromises were required: To attempt to gain FTC approval, Uber and Foodpanda likely engaged in prolonged negotiations and considered potential compromises, such as divestitures. These proved ultimately unsuccessful.

- Uncertainty surrounding the timeline added to the challenges: The unpredictable nature of the FTC review process created substantial uncertainty, adding to the overall challenges faced by both companies.

The Impact on Uber's Global Strategy

The failed acquisition of Foodpanda in Taiwan represents a notable setback for Uber's broader global strategy in the competitive food delivery market and necessitates a reassessment of its approach in Asia.

Setback for Uber's Food Delivery Ambitions

The inability to secure Foodpanda represents a loss of a significant foothold in a key Asian market for Uber Eats. This highlights the challenges of inorganic growth via acquisition in highly regulated markets.

- Loss of a significant foothold in a key Asian market: Taiwan is a strategically important market within Asia, and losing the opportunity to acquire Foodpanda represents a missed opportunity for expansion.

- Potential need for alternative strategies to compete in Taiwan: Uber will now have to rely on organic growth through its existing Uber Eats platform to compete against entrenched players in Taiwan.

- Impact on investor confidence and future investment decisions: The failure of this high-profile acquisition could negatively impact investor confidence in Uber's ability to execute its growth strategy.

Re-evaluation of Asian Market Strategies

Moving forward, Uber will likely refocus on organic growth strategies in Taiwan and reconsider its approach to acquisitions in other Asian markets. This will necessitate a thorough review of its broader Asian market strategies.

- Increased focus on improving their existing Uber Eats service: Uber will need to invest heavily in enhancing the user experience, expanding its restaurant partnerships, and improving its delivery efficiency.

- Exploration of potential strategic alliances with other players: Rather than large-scale acquisitions, Uber may explore forming strategic alliances or partnerships with smaller, complementary businesses.

- Revised assessment of market entry strategies in other Asian countries: The experience in Taiwan will likely inform Uber's approach to future acquisitions and market entries across Asia.

Foodpanda's Future in Taiwan

Despite the failed acquisition, Foodpanda will continue its operations in Taiwan, now independently and with a renewed focus on market share and growth.

Independent Operation and Future Growth

Foodpanda remains a major player in the Taiwanese food delivery market. The company will now focus on strengthening its position against competitors through targeted growth strategies.

- Increased marketing and promotional efforts: Expect increased marketing campaigns and promotions to attract new customers and retain existing users.

- Investment in technology and service improvements: Further investment in technology infrastructure and service quality improvements will be crucial for Foodpanda’s ongoing competitiveness.

- Focus on retaining customers and attracting new users: Maintaining customer loyalty and attracting new users will be key priorities for Foodpanda’s future success.

Increased Competition in the Taiwanese Market

The Taiwanese food delivery market remains highly competitive, even without the Uber-Foodpanda merger. This intensified competition necessitates ongoing innovation and adaptation for all players.

- Increased pressure to innovate and offer competitive pricing: Foodpanda and its competitors will face intensified pressure to differentiate their services and offer competitive pricing.

- Need for strategic partnerships and collaborations: Strategic alliances and collaborations may prove crucial for survival in the increasingly crowded market.

- Focus on enhancing customer loyalty and satisfaction: Providing excellent customer service and building strong customer loyalty will be key differentiators in the market.

Conclusion

The failure of the Uber Foodpanda Taiwan acquisition highlights the significant regulatory challenges involved in mergers and acquisitions, particularly within the competitive food delivery sector. Taiwan's robust antitrust framework has played a decisive role in preventing the deal, showcasing the importance of navigating complex regulatory environments. This case underscores the need for thorough due diligence and a comprehensive understanding of antitrust regulations before pursuing such transactions. Understanding the intricacies of the regulatory landscape surrounding the Uber Foodpanda Taiwan acquisition is crucial for companies and investors alike. Further research into Taiwanese antitrust law and its impact on the food delivery sector would prove beneficial to anyone involved in similar ventures in the region.

Featured Posts

-

Prosvjednici U Berlinu Upali U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025

Prosvjednici U Berlinu Upali U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025 -

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 17, 2025

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 17, 2025 -

Hornets Vs Celtics Game Tonight Prediction Picks And Betting Odds

May 17, 2025

Hornets Vs Celtics Game Tonight Prediction Picks And Betting Odds

May 17, 2025 -

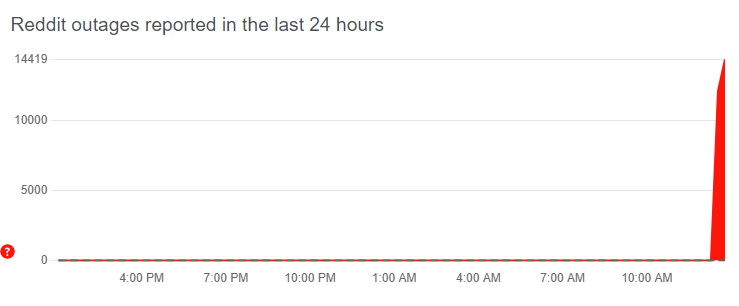

Global Reddit Outage Impacts Thousands Of Users

May 17, 2025

Global Reddit Outage Impacts Thousands Of Users

May 17, 2025 -

Comprehensive Moto News Coverage Gncc Mx Sx Flat Track Enduro

May 17, 2025

Comprehensive Moto News Coverage Gncc Mx Sx Flat Track Enduro

May 17, 2025