Uber Stock And Recession: Why Analysts Remain Bullish

Table of Contents

Uber's Resilience During Economic Downturns

Uber's ability to weather economic storms is a key factor driving analyst confidence. Several aspects contribute to its perceived recession-resistance.

Increased Demand for Affordable Transportation

During recessions, consumers often tighten their belts, cutting back on discretionary spending. This includes reducing personal vehicle usage due to increased fuel costs and maintenance expenses. Uber offers a compelling alternative.

- Lower fuel costs for consumers: Uber riders avoid the direct costs of fuel, maintenance, and insurance associated with car ownership.

- Convenience compared to public transport: Uber provides door-to-door service, often surpassing the convenience and accessibility of public transportation options.

- Flexibility for irregular work schedules: The gig economy, of which Uber is a major part, offers flexibility appealing to those whose work hours or availability may fluctuate during economic downturns. This creates a consistent demand for Uber's services.

Growth in Delivery Services (Uber Eats)

The food delivery market demonstrates remarkable resilience during economic downturns. People still need to eat, and the convenience of food delivery often outweighs other budgetary concerns. Uber Eats directly benefits from this trend.

- Increased home-based dining: Recessions can lead to people dining at home more frequently, increasing demand for food delivery services.

- Convenience factor: Uber Eats provides a wide selection of restaurants and easy online ordering, making it a popular choice regardless of economic conditions.

- Wider restaurant options: The platform offers access to diverse cuisines and restaurants that might not be easily accessible otherwise, increasing appeal and fostering customer loyalty.

Diversification of Revenue Streams

Uber's business model is not solely reliant on ride-sharing. Its diversification across food delivery (Uber Eats), freight (Uber Freight), and other emerging services creates a safety net during economic uncertainty.

- Reduced reliance on ride-sharing profits alone: A decline in ride-sharing revenue can be offset by growth in other sectors, making Uber less vulnerable to sector-specific downturns.

- Exposure to multiple growth markets: Uber's diverse offerings provide exposure to multiple sectors with varying growth trajectories, mitigating the impact of economic fluctuations.

- Strategic acquisitions for further expansion: Uber's history of strategic acquisitions shows its commitment to broadening its reach and diversifying its revenue base, further bolstering its recession-proof attributes.

Analyst Projections and Positive Outlook

Analyst projections for Uber stock remain positive, even in a potentially recessionary environment. Several factors underpin this confidence.

Strong Earnings Growth Potential

Despite economic headwinds, many analysts forecast continued earnings growth for Uber. This is largely attributed to the factors already discussed: the inherent resilience of its business model and the continued growth of its delivery services.

- Projected annual revenue growth percentages: Specific growth figures will vary depending on the analyst and their model, but the general trend points towards continued revenue expansion.

- Expected profitability timelines: While Uber's path to sustained profitability is ongoing, analysts believe the company's diversification and cost-cutting measures will ultimately lead to greater profitability.

- Market share growth predictions: Uber's strong brand recognition and expansive reach allow analysts to project continued market share gains, contributing to revenue growth.

Favorable Valuation

Some analysts consider Uber stock undervalued relative to its growth potential and resilience, creating a potentially attractive entry point for investors.

- Price-to-earnings ratio analysis: Analyzing Uber's P/E ratio compared to similar companies in the technology and transportation sectors provides valuable insight into its current valuation.

- Comparison to competitor valuations: Benchmarking Uber's valuation against competitors reveals potential undervaluation, especially considering its diversified revenue streams.

- Discussion of potential future upside: Considering the potential for future growth and expansion, analysts highlight the significant upside potential for Uber's stock price.

Technological Innovation and Future Growth

Uber's ongoing investment in technology is a major driver of future growth. This focus on innovation positions the company for expansion and increased efficiency.

- Autonomous vehicle technology development: Investment in autonomous driving technology positions Uber for long-term cost savings and operational efficiencies.

- Investment in AI and machine learning: AI-powered solutions optimize pricing, route planning, and customer service, improving efficiency and profitability.

- Expansion into new international markets: Uber continues to expand its services globally, tapping into new markets with significant growth potential.

Conclusion

Despite the looming threat of a recession, the reasons for analyst optimism regarding Uber stock are compelling. Uber's diversified revenue streams, strong growth potential in its delivery services, and continued technological innovation suggest a degree of resilience that may outperform other sectors during economic downturns. The company's relative affordability and convenience, particularly during periods of economic hardship, further contribute to the bullish outlook. While no investment is entirely without risk, Uber stock presents a potentially attractive opportunity for investors seeking a relatively recession-proof addition to their portfolios. Consider researching Uber stock further and consulting a financial advisor before making any investment decisions relating to Uber stock and its potential within the current economic climate.

Featured Posts

-

Market Rally Rockwell Automation Angi And Other Stocks Surge

May 17, 2025

Market Rally Rockwell Automation Angi And Other Stocks Surge

May 17, 2025 -

Nypbet Claim Your Bet365 Bonus And Bet On Knicks Vs Pistons

May 17, 2025

Nypbet Claim Your Bet365 Bonus And Bet On Knicks Vs Pistons

May 17, 2025 -

Post Game Fury Thibodeaus Criticism Of Game 2 Officiating

May 17, 2025

Post Game Fury Thibodeaus Criticism Of Game 2 Officiating

May 17, 2025 -

Fortnite Tmnt Skins How To Get Every Teenage Mutant Ninja Turtle Outfit

May 17, 2025

Fortnite Tmnt Skins How To Get Every Teenage Mutant Ninja Turtle Outfit

May 17, 2025 -

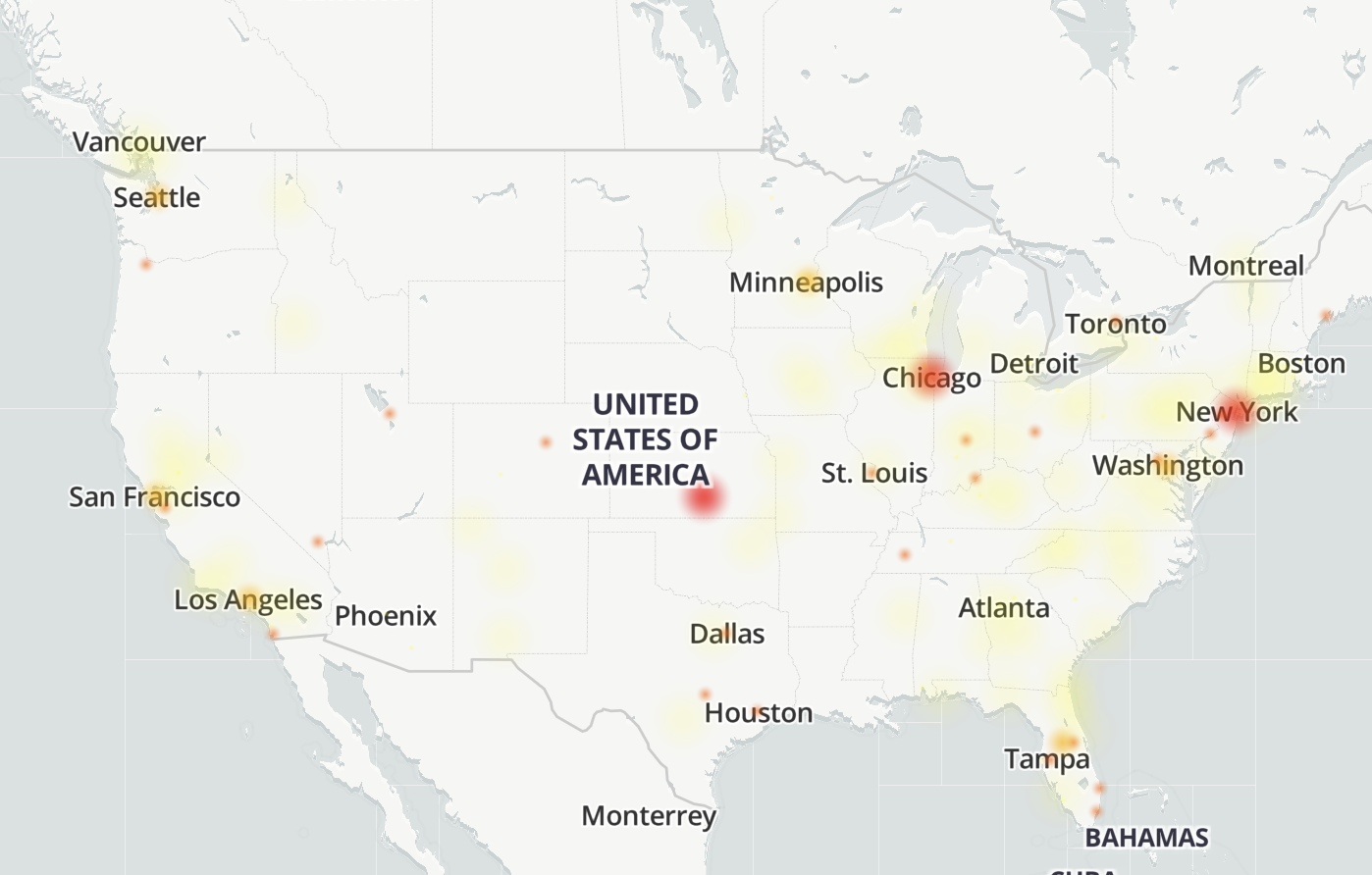

Is Reddit Down Thousands Report Problems Worldwide

May 17, 2025

Is Reddit Down Thousands Report Problems Worldwide

May 17, 2025