Uber Stock And The Rise Of Autonomous Vehicles: An Investor's Perspective

Table of Contents

Uber's Current Business Model and its Dependence on Drivers

Uber's current business model heavily relies on a vast network of independent contractors – its drivers. This reliance, however, comes with substantial costs. Driver wages, benefits (where applicable), and the ever-present need to recruit and retain drivers significantly impact Uber's profitability and, consequently, its stock performance. High driver turnover rates add to operational inefficiencies and financial burdens.

- High driver turnover rates: The constant need to recruit and train new drivers is costly, impacting Uber's bottom line and potentially affecting investor confidence in Uber stock.

- Potential for labor disputes: The gig economy's inherent challenges, including classification of workers and benefits, can lead to legal battles and labor disputes, creating uncertainty around Uber stock prices.

- Comparison with competitors: Analyzing Uber's operating costs compared to competitors like Lyft reveals the significant expense of its current driver-dependent model, highlighting the potential for disruption from AV technology.

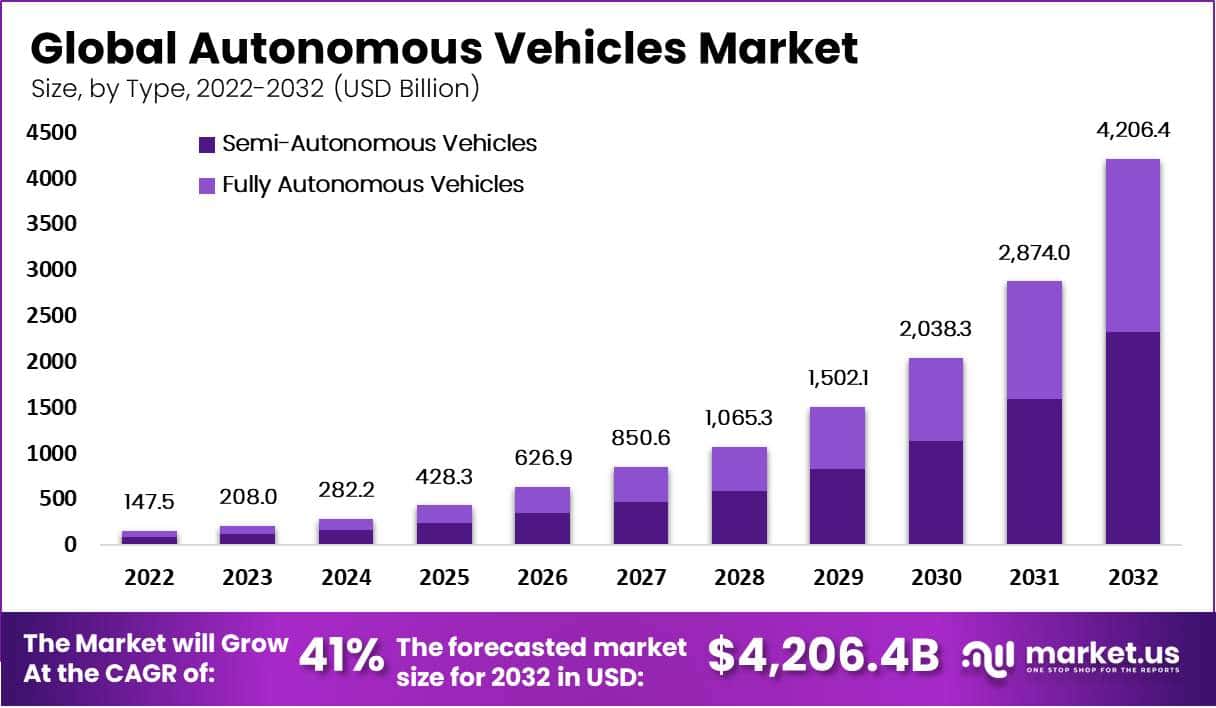

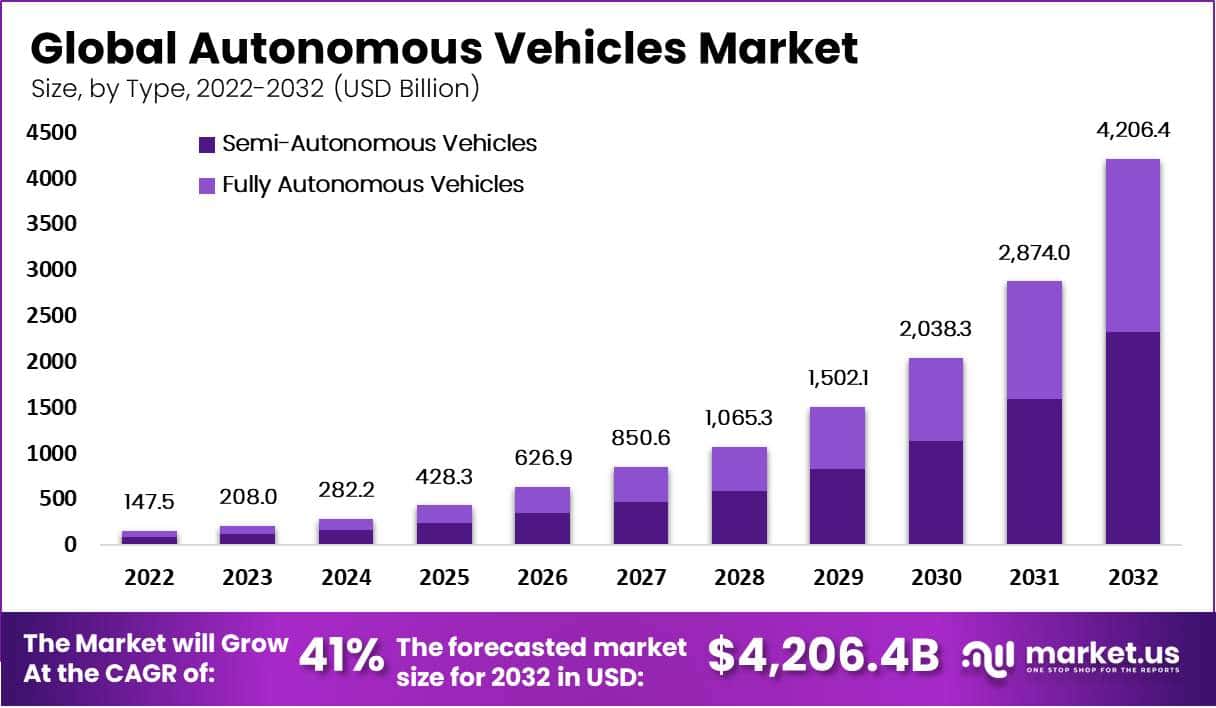

The Potential Impact of Autonomous Vehicles on Uber's Operations

The widespread adoption of autonomous vehicles holds the potential to fundamentally transform Uber's operations. By eliminating the need for human drivers, Uber could dramatically reduce its operational costs. This cost reduction would translate to higher profit margins and a significant boost to its stock price. Furthermore, AVs could unlock increased efficiency and scalability, allowing Uber to expand into new markets and offer a wider range of services.

- Reduced operational costs: Eliminating driver wages and benefits would drastically improve Uber's profit margins, potentially leading to a surge in Uber stock value.

- Potential for expansion: Autonomous vehicles could facilitate expansion into underserved areas and new service offerings, such as autonomous delivery services, broadening Uber's revenue streams.

- Increased market share: A more efficient and cost-effective model, driven by AV technology, could give Uber a substantial competitive advantage, potentially capturing a larger market share.

Investment Risks Associated with Autonomous Vehicle Technology

While the potential benefits are significant, investors in Uber stock must acknowledge the inherent risks associated with autonomous vehicle technology. The development of fully autonomous vehicles faces significant technological hurdles and uncertainties. Regulatory landscapes remain unclear, potentially delaying widespread adoption and creating unpredictable market conditions. Moreover, fierce competition from established automakers and tech giants adds another layer of risk.

- Risk of technological failures and safety concerns: Public perception and trust in AV technology are crucial. Any significant safety incidents could severely damage Uber's reputation and negatively impact its Uber stock price.

- Uncertainty surrounding government regulations: The regulatory environment for self-driving cars is still evolving, creating uncertainty and potential delays in implementation. This regulatory uncertainty directly impacts the timeline for realizing the financial benefits of AVs for Uber.

- Competitive landscape: The autonomous vehicle market is fiercely competitive. Established automakers and tech giants are heavily investing in this technology, posing a considerable threat to Uber's market position and the future of its Uber stock.

Evaluating Uber Stock Based on Autonomous Vehicle Potential

Evaluating Uber stock requires a comprehensive assessment of Uber's autonomous vehicle strategy. Investors should analyze several key factors:

- Analyzing Uber's R&D investments: Examining Uber's investments in R&D for autonomous driving technology provides insight into its commitment to this transformative technology.

- Assessing partnerships and collaborations: Analyzing Uber's collaborations with other companies in the AV sector can highlight its strategic approach and potential for success.

- Considering long-term growth potential vs. short-term risks: Investors need to balance the long-term potential of autonomous vehicles with the short-term risks and uncertainties associated with this developing technology.

Different investment strategies exist based on individual risk tolerance. Conservative investors might prefer a "wait-and-see" approach, while more aggressive investors might see the potential for significant returns in Uber stock despite the risks.

Conclusion

The future of Uber stock is intricately linked to the success of autonomous vehicle technology. While the potential for cost savings, increased efficiency, and market expansion is substantial, investors must carefully consider the significant technological, regulatory, and competitive risks. Thorough research is crucial before making any investment decisions. Consider the long-term vision for Uber's autonomous vehicle program alongside its current financial performance. Remember to consult with a financial advisor before investing in Uber stock or any other security. Further research into the autonomous vehicle market and the competitive landscape will aid in a more informed investment strategy. Don't hesitate to explore additional resources to better understand the potential of Uber stock within the evolving landscape of ride-sharing and autonomous driving.

Featured Posts

-

Glen Powells Running Man Transformation Fitness Character And A Three Word Mantra

May 08, 2025

Glen Powells Running Man Transformation Fitness Character And A Three Word Mantra

May 08, 2025 -

Filipe Luis Logra Otro Exito Nuevo Titulo Conquistado

May 08, 2025

Filipe Luis Logra Otro Exito Nuevo Titulo Conquistado

May 08, 2025 -

Pulgar Y Su Gesto Un Detalle Que Enamoro A Los Hinchas Del Flamengo

May 08, 2025

Pulgar Y Su Gesto Un Detalle Que Enamoro A Los Hinchas Del Flamengo

May 08, 2025 -

Lahwr Chkn Mtn Awr Byf Ky Brhty Hwyy Qymtyn Awr Ewam Ky Mshklat

May 08, 2025

Lahwr Chkn Mtn Awr Byf Ky Brhty Hwyy Qymtyn Awr Ewam Ky Mshklat

May 08, 2025 -

Made In Gujranwala Exhibition Sufians Acknowledgment Of Gcci Presidents Achievement

May 08, 2025

Made In Gujranwala Exhibition Sufians Acknowledgment Of Gcci Presidents Achievement

May 08, 2025