Uber Technologies (UBER): Investment Potential And Risks

Table of Contents

Uber's Business Model and Market Position

Uber's core business model revolves around connecting riders with drivers through a convenient mobile app. This ride-hailing service forms the foundation of its operations, but Uber's reach extends far beyond. Uber Eats, its food delivery platform, competes fiercely with other delivery giants, while Uber Freight provides logistics solutions for businesses. This diversified approach offers a degree of resilience against market fluctuations.

Uber holds a significant market share in the ride-sharing industry in numerous regions globally. However, its market dominance faces constant challenges from competitors like Lyft, Didi Chuxing (in China), and others offering similar services. The competitive landscape is dynamic, requiring Uber to constantly innovate and adapt to maintain its competitive advantage. Its global expansion strategy focuses on penetrating new markets and exploring diverse transportation modes, including micromobility options like scooters and bikes.

- Market leader in ride-sharing in many regions.

- Significant growth in food delivery (Uber Eats) and freight services.

- Expanding into new markets and transportation modes (e.g., micromobility), showcasing strong global expansion potential.

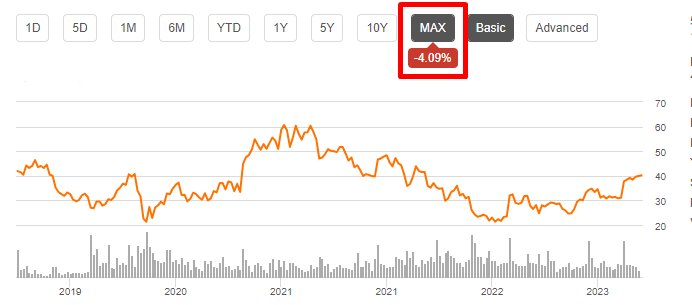

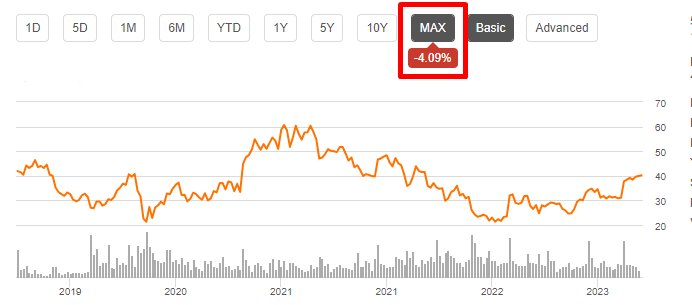

Growth Prospects and Financial Performance

Uber's revenue growth has been impressive, particularly in its early years. However, sustained profitability has been a challenge, partly due to intense competition and significant investments in technology and expansion. Analyzing Uber's financial performance requires a close look at key financial metrics like revenue growth, operating margins, and cash flow. Future growth hinges on several factors, including the continued expansion of its existing services, the successful launch of new initiatives, and technological advancements that improve efficiency and reduce costs. The long-term growth potential of the ride-sharing and delivery markets remains significant, driven by increasing urbanization and changing consumer preferences.

- Historical revenue and earnings data show periods of strong growth followed by challenges in achieving consistent profitability.

- Projected future growth is dependent on several factors, including successful expansion into new markets and maintaining a competitive edge.

- Key performance indicators (KPIs) such as customer acquisition cost, average revenue per user (ARPU), and driver satisfaction need close monitoring to evaluate Uber's progress.

Risks and Challenges Facing Uber

Investing in UBER stock involves navigating significant risks. Regulatory hurdles and legal challenges related to driver classification, worker rights, and data privacy pose ongoing uncertainties. The company faces intense competition, and disruptive technologies or new entrants could significantly impact its market share. Financial risks include high debt levels, fluctuating cash flow, and vulnerability to economic downturns, which can directly affect consumer spending on ride-sharing and delivery services.

- Ongoing legal battles regarding driver classification present significant financial and reputational risks.

- Intense competition in the ride-sharing and delivery sectors puts pressure on pricing and profitability.

- Vulnerability to economic downturns and changes in consumer spending patterns can significantly impact revenue and growth.

Valuation and Investment Strategies

Uber's current stock valuation needs careful assessment. Comparing its price-to-earnings ratio (P/E) and other valuation metrics to those of its competitors provides valuable context. Investment strategies for UBER stock can range from long-term buy-and-hold approaches to more short-term, opportunistic trading. Diversification within a broader investment portfolio is crucial to mitigate risk. Before making any investment decision, carefully consider your risk tolerance, investment goals, and the potential returns versus the inherent risks.

- Price-to-earnings ratio (P/E) and other valuation metrics should be compared to industry peers.

- Comparison to competitor valuations provides insights into Uber's relative market position.

- Potential return on investment (ROI) scenarios need to be considered, along with various market conditions.

Conclusion: Making Informed Decisions about Uber Technologies (UBER)

Investing in Uber Technologies (UBER) presents both exciting potential and substantial risks. This article has highlighted key factors influencing UBER stock's performance, including its business model, market position, growth prospects, and potential challenges. Remember, thorough due diligence is paramount. Before making any Uber investment, carefully weigh the information presented here against your own research and risk tolerance. Consider your investment goals and the overall market conditions. Before investing in Uber stock, carefully consider the information presented and conduct your own thorough research to make an informed investment decision. Remember, this is not financial advice, and investing in the stock market always carries inherent risk.

Featured Posts

-

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025 -

The Bitcoin Rebound Analyzing The Current Market Trends

May 08, 2025

The Bitcoin Rebound Analyzing The Current Market Trends

May 08, 2025 -

Trump Described As Transformational By Carney In Key Meeting

May 08, 2025

Trump Described As Transformational By Carney In Key Meeting

May 08, 2025 -

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025 -

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025

Collymore Calls For Artetas Accountability Latest Arsenal News

May 08, 2025