Uber's Resilience: Analyzing The Stock's Recession Resistance

Table of Contents

Uber's Diversified Revenue Streams as a Buffer Against Recession

Uber's success isn't solely reliant on its ridesharing services. Its diversification into multiple revenue streams acts as a significant buffer against economic downturns. This strategy mitigates the risk associated with any single sector experiencing a decline.

Beyond Ridesharing: A Multi-Pronged Approach

Uber's expansion beyond its core ridesharing business has been crucial to its recession resistance. Uber Eats, its food delivery service, has become a substantial revenue generator, particularly during periods when discretionary spending on transportation might decrease. Similarly, Uber Freight, focusing on logistics and trucking, provides a less volatile revenue stream compared to the passenger transportation market.

- Quantifiable Contributions: While precise figures fluctuate, Uber Eats consistently contributes a significant percentage to Uber's overall revenue, demonstrating its importance in overall financial performance. Uber Freight's contribution is steadily increasing, further diversifying its income sources.

- Mitigating Risk: The diversification strategy allows Uber to weather economic storms more effectively. If the ridesharing market slows due to a recession, the growth in other segments helps to offset the decline.

- Past Performance: During previous economic slowdowns, Uber Eats showed relatively stronger performance than its ridesharing counterpart, illustrating the resilience of its diversified model. Uber Freight also demonstrated a certain level of stability even in times of reduced consumer spending.

- Segmental Resilience: Each segment, while connected, has unique market dynamics. This intrinsic diversity within the company lessens the overall impact of economic fluctuations.

[Insert chart illustrating the revenue contribution of each segment over time, clearly showing diversification.]

Cost-Cutting Measures and Operational Efficiency

Uber's commitment to operational efficiency and strategic cost management has significantly enhanced its resilience during periods of economic uncertainty. The company has consistently implemented cost-cutting measures to maintain profitability.

Strategic Cost Management: A Multifaceted Approach

Uber's cost-cutting strategies aren't merely about reducing expenses; they're about optimizing operations for greater efficiency and profitability.

- Driver Compensation Optimization: Uber has implemented various strategies to optimize driver compensation, ensuring fair compensation while maintaining cost-effectiveness.

- Operational Efficiency Improvements: Through technological advancements and streamlined processes, Uber has improved its operational efficiency, reducing operational costs.

- Technology Streamlining: Investing in technology to improve route optimization, driver dispatch, and customer service has led to significant cost savings.

- Restructuring and Layoffs (if applicable): In certain instances, Uber has undertaken restructuring and layoffs to reduce its workforce and align its expenses with revenue projections during periods of economic downturn.

[Insert chart showing improvement in profitability margins and operational efficiency over time.]

The Evolving Business Model and Adaptability

Uber's ability to adapt its business model to changing market conditions is a crucial factor in its recession resistance. This adaptability is driven by its innovative use of technology and its willingness to embrace new market opportunities.

Adapting to Changing Market Conditions: Innovation as a Shield

Uber's success hinges on its ability to anticipate and react to shifts in consumer behavior and economic trends.

- Subscription Services and Premium Options: The introduction of subscription services and premium options provides a stable revenue stream, less susceptible to fluctuations in overall economic activity.

- Strategic Partnerships: Collaborations with other businesses expand Uber's reach and access to new customer segments.

- Technological Innovation: Continuous investment in technology allows Uber to improve its services, enhance customer experience, and adapt to changing demands efficiently.

[Insert case studies showcasing Uber's successful adaptations to economic changes, for example, the successful launch of Uber Eats during the pandemic.]

Investor Sentiment and Market Perception of Uber's Recession Resistance

Analyzing Uber's stock performance during previous economic downturns reveals a relative resilience compared to some other companies in similar sectors. Understanding investor sentiment towards Uber's recession resistance is key.

Analyzing Stock Performance During Economic Downturns: A Comparative Look

Uber's stock performance relative to other companies during past periods of economic uncertainty is a valuable indicator of its perceived recession resistance.

- Benchmark Comparisons: Comparing Uber's stock performance to relevant industry benchmarks (e.g., other transportation companies) reveals its relative stability.

- Investor Confidence: Market data, including stock price and trading volume, reflects investor confidence in Uber's ability to navigate economic challenges.

- Analyst Ratings and Reports: Analyst reports and ratings provide valuable insights into the market's perception of Uber's recession resistance and future prospects.

[Insert chart comparing Uber's stock performance against market indices during economic downturns.]

Conclusion

Uber's resilience during economic downturns is a result of its diversified revenue streams, strategic cost-cutting measures, and its remarkable adaptability. Its ability to evolve its business model and capitalize on new opportunities demonstrates its potential for continued growth even in uncertain economic climates. Understanding Uber's recession resistance is crucial for investors looking to navigate economic uncertainty. Further investigate Uber's financial reports and consider its role in a diversified portfolio, assessing its potential as a recession-resistant investment. Consider diversifying your portfolio with investments exhibiting similar levels of Uber's stock resilience and economic stability.

Featured Posts

-

Josh Harts Wife Comments On Jaylen Browns Game 5 Highlights

May 17, 2025

Josh Harts Wife Comments On Jaylen Browns Game 5 Highlights

May 17, 2025 -

El Colapso De Koriun Inversiones Analisis Del Esquema Ponzi

May 17, 2025

El Colapso De Koriun Inversiones Analisis Del Esquema Ponzi

May 17, 2025 -

Angel Reeses Dpoy Win Shadowed By Serious Injury

May 17, 2025

Angel Reeses Dpoy Win Shadowed By Serious Injury

May 17, 2025 -

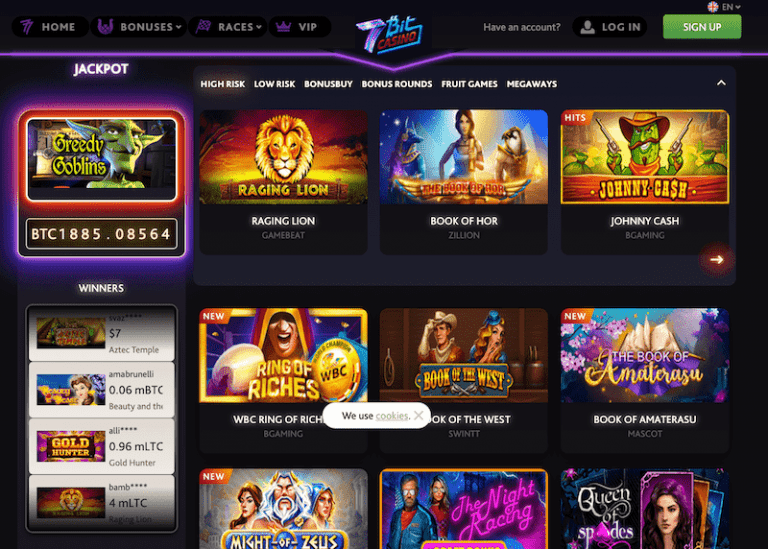

The Ultimate Guide To Bitcoin And Crypto Casinos In 2025

May 17, 2025

The Ultimate Guide To Bitcoin And Crypto Casinos In 2025

May 17, 2025 -

Get More For Less Practical And Affordable Options

May 17, 2025

Get More For Less Practical And Affordable Options

May 17, 2025