Uber's Stock Market Performance: Analyzing Recession Resistance

Table of Contents

Uber's Historical Stock Performance and Economic Cycles

Analyzing Uber's stock price fluctuations alongside significant economic events reveals valuable insights into its resilience. Since its IPO, Uber's stock has experienced periods of both robust growth and sharp declines, mirroring broader market trends. To understand Uber's stock market performance in relation to economic cycles, we need to examine its behavior during past recessions and market corrections.

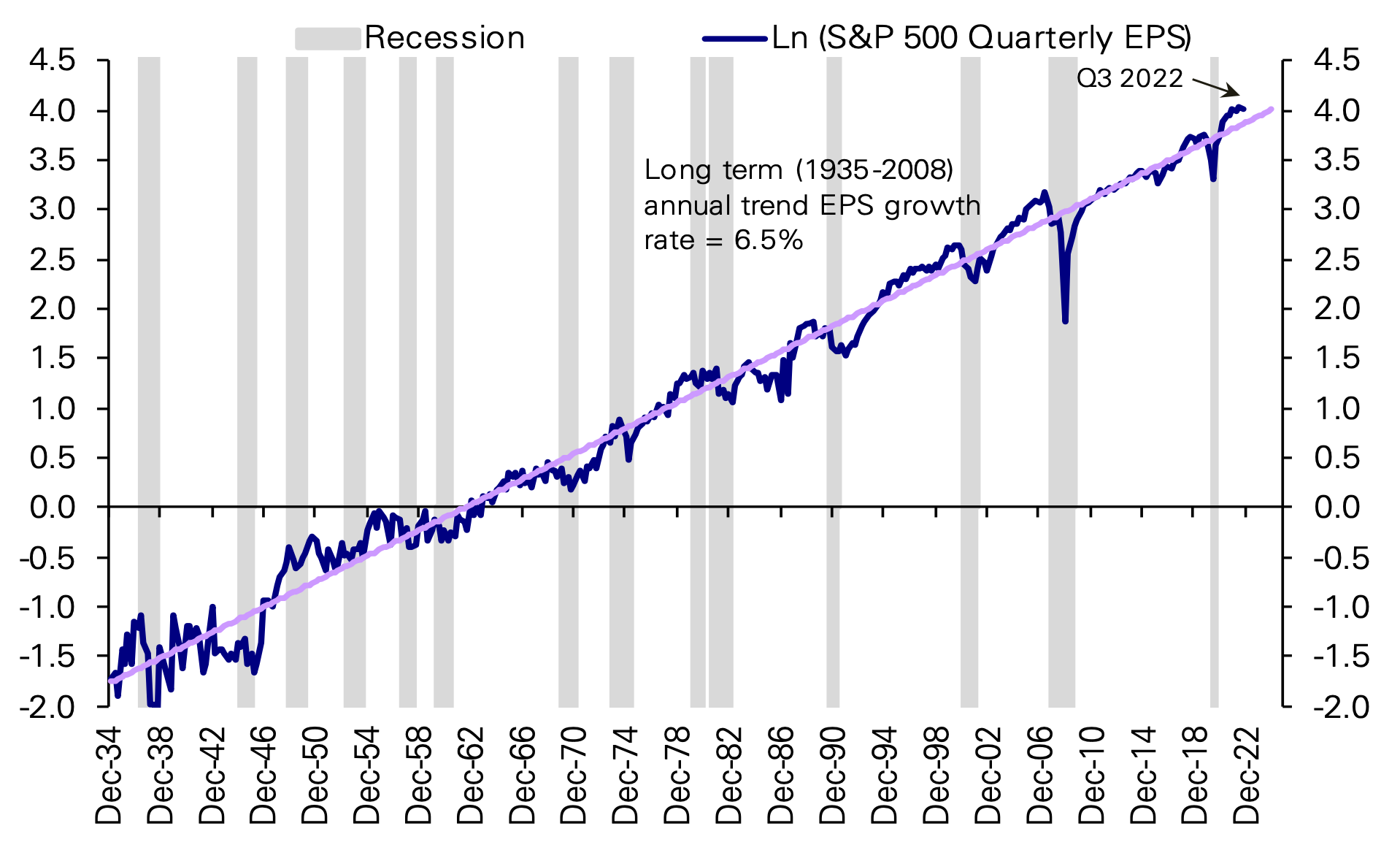

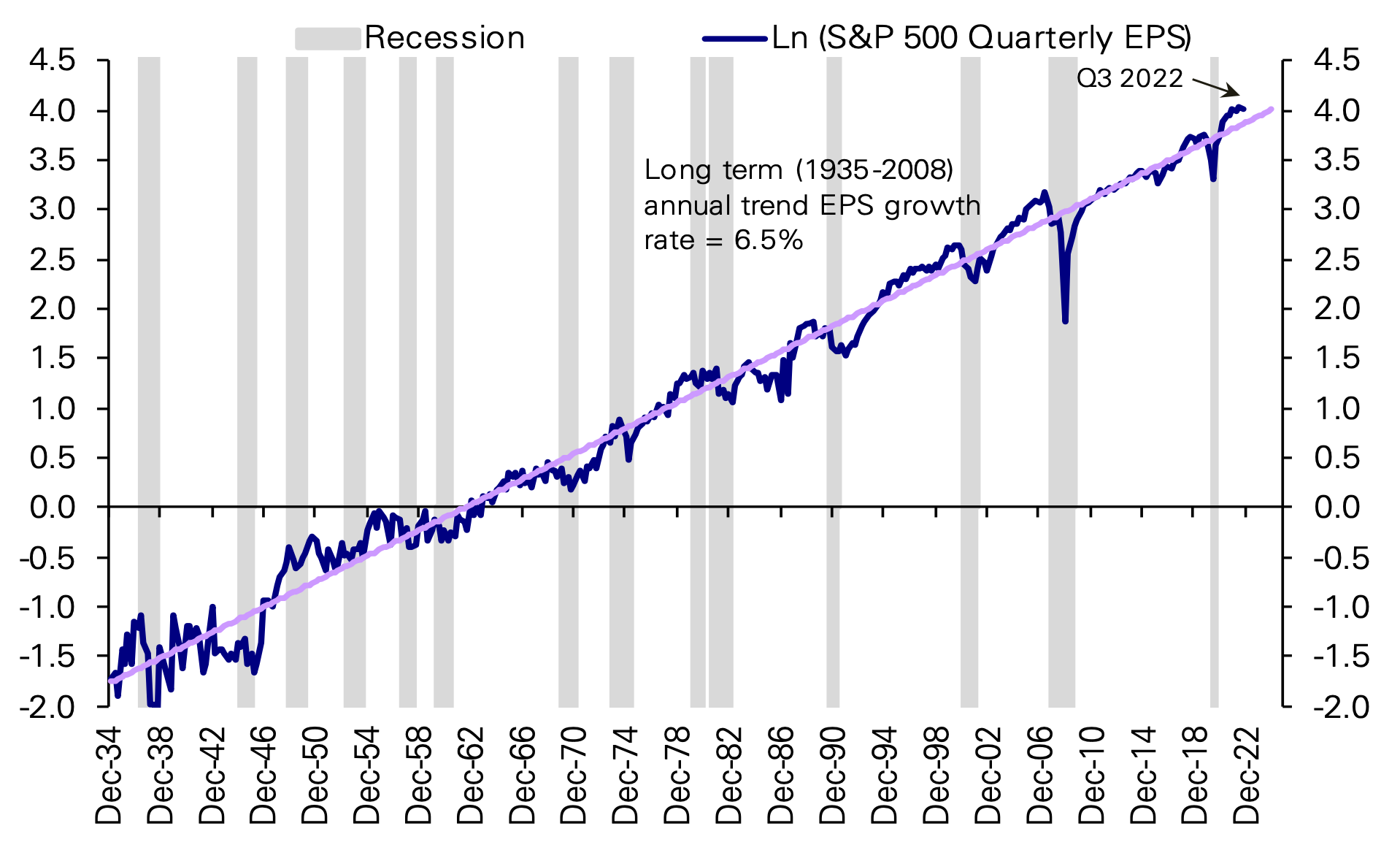

(Insert chart/graph showing Uber's stock price over time, correlated with economic indicators like recessions and market volatility)

- Specific examples: During the 2020 COVID-19 pandemic-induced recession, Uber's stock initially plummeted along with the broader market. However, its recovery was relatively swift, fueled by increased demand for its food delivery services (Uber Eats).

- Comparison to competitors: Compared to Lyft, a direct competitor, Uber demonstrated slightly greater resilience during the same period, potentially due to its broader diversification strategy.

- Influencing factors: The initial stock price drop was largely attributed to pandemic-related restrictions, while the subsequent recovery was driven by the increased adoption of its delivery services and strategic cost-cutting measures.

Factors Contributing to Uber's Recession Resistance (or Vulnerability)

Uber's ability to weather economic storms depends on several interconnected factors. Its recession resistance (or vulnerability) is a complex issue with multiple contributing elements.

Demand Elasticity and Essential Services

Uber's services, while not strictly essential, exhibit some degree of recession-resistance. While discretionary spending might decrease during economic downturns, the demand for transportation and delivery services, particularly for essential goods, remains relatively stable.

- Continued use: Even during recessions, many individuals and businesses rely on Uber for transportation and delivery, highlighting the service's sticky nature.

- Price sensitivity: Uber’s pricing models demonstrate some degree of price elasticity. During economic downturns, increased price sensitivity may require the company to adjust pricing strategies.

- Comparison to discretionary spending: Unlike luxury goods or entertainment services, the demand for essential transportation and food delivery is less susceptible to drastic reductions during economic hardships.

Diversification of Revenue Streams (Uber Eats, Freight, etc.)

Uber's diversification beyond ride-sharing significantly contributes to its resilience. Uber Eats, Uber Freight, and other emerging businesses provide multiple revenue streams, mitigating risk associated with any single segment's performance.

- Individual stream performance: While ride-sharing might suffer during recessions, Uber Eats often sees increased demand, as consumers may opt for home delivery over dining out. Uber Freight's performance is linked to broader economic activity in the logistics sector.

- Interdependence: The various business units can support each other during downturns. For example, drivers who experience decreased ride-sharing demand can switch to food delivery, maintaining income and keeping them within the Uber ecosystem.

- Future diversification: Continued diversification into related yet distinct market segments will likely further enhance Uber's recession resistance.

Cost-Cutting Measures and Operational Efficiency

Uber has demonstrated an ability to adapt its operations and reduce costs during economic downturns. This cost optimization strategy plays a crucial role in maintaining profitability and protecting its stock price.

- Past cost-cutting initiatives: Examples include streamlining operations, reducing marketing spending, and optimizing driver allocation.

- Efficiency improvements: Technological advancements, such as improved route optimization algorithms, have contributed significantly to enhanced efficiency.

- Impact on profitability: Successful cost-cutting and efficiency improvements directly translate into improved profitability and contribute to a more resilient stock price.

External Factors Influencing Uber's Stock

Beyond internal factors, external forces significantly impact Uber's stock market performance.

- Past impact: Government regulations (regarding worker classification, for example), fluctuations in fuel prices, and overall market sentiment have all played a role in shaping Uber's stock price in the past.

- Future impact forecasting: Future recessions could exacerbate existing challenges, such as rising fuel costs and potential regulatory changes.

- Mitigation strategies: Uber can mitigate some risks through hedging strategies (for fuel costs), proactive lobbying efforts (regarding regulations), and diversification of its geographical footprint.

Future Outlook and Investment Implications

Forecasting Uber's stock performance during future recessions is challenging, but several factors suggest a degree of resilience. Its diversified revenue streams, cost-cutting capabilities, and adaptable business model provide a buffer against economic shocks.

- Risk assessment: Investing in Uber stock carries inherent risks, including competition, regulatory uncertainty, and macroeconomic factors.

- Long-term growth potential: The long-term growth potential for ride-sharing and delivery services remains significant, indicating potential for long-term stock appreciation.

- Investment recommendation: Based on the analysis, a balanced approach might be advisable, considering a diversified portfolio and a long-term investment horizon.

Conclusion: Evaluating Uber's Stock Market Performance and Recession Resistance

Uber's stock market performance demonstrates a complex interplay of internal and external factors. While vulnerabilities exist, its diversified business model, cost-cutting capabilities, and adaptability offer a degree of recession resistance. However, external factors and economic uncertainty will remain significant considerations. Understanding Uber's stock market performance and its recession resistance is crucial for any investor. Conduct thorough research and consider diversifying your portfolio accordingly.

Featured Posts

-

Planning Your Five Boro Bike Tour A Step By Step Guide

May 18, 2025

Planning Your Five Boro Bike Tour A Step By Step Guide

May 18, 2025 -

Dutch Unlikely To Support Eus Response To Trumps Import Tariffs

May 18, 2025

Dutch Unlikely To Support Eus Response To Trumps Import Tariffs

May 18, 2025 -

Brooklyns Newest Pickleball Destination City Pickles 60 000 Sq Ft Complex

May 18, 2025

Brooklyns Newest Pickleball Destination City Pickles 60 000 Sq Ft Complex

May 18, 2025 -

Finding The Best Australian Crypto Casino Sites For 2025

May 18, 2025

Finding The Best Australian Crypto Casino Sites For 2025

May 18, 2025 -

Understanding Fortune Coins For March Success

May 18, 2025

Understanding Fortune Coins For March Success

May 18, 2025

Latest Posts

-

Winning Daily Lotto Numbers Tuesday 29th April 2025

May 18, 2025

Winning Daily Lotto Numbers Tuesday 29th April 2025

May 18, 2025 -

See The Daily Lotto Results From Monday April 28 2025

May 18, 2025

See The Daily Lotto Results From Monday April 28 2025

May 18, 2025 -

Find The Daily Lotto Results For Tuesday 29th April 2025

May 18, 2025

Find The Daily Lotto Results For Tuesday 29th April 2025

May 18, 2025 -

28 April 2025 Daily Lotto Results Announced

May 18, 2025

28 April 2025 Daily Lotto Results Announced

May 18, 2025 -

April 29 2025 Daily Lotto Results Announced

May 18, 2025

April 29 2025 Daily Lotto Results Announced

May 18, 2025