Ueda Warns Of Ripple Effects From Rising Long-Term Yields

Table of Contents

Impact on the Japanese Economy: Analyzing Ueda's Concerns

Governor Ueda's concerns are rooted in the multifaceted consequences of rising long-term yields on Japan's economic stability. The increase in yields presents a complex challenge that necessitates a thorough understanding of its potential ramifications.

Weakening Yen and Inflationary Pressures

Rising long-term yields can lead to a weaker yen through several mechanisms:

- Increased borrowing costs: Higher yields make it more expensive for foreign investors to borrow yen, potentially reducing demand for the currency.

- Capital outflow: Investors may shift funds to higher-yielding assets in other countries, leading to a decrease in demand for the yen.

- Import price increases: A weaker yen makes imports more expensive, contributing to inflationary pressures within Japan.

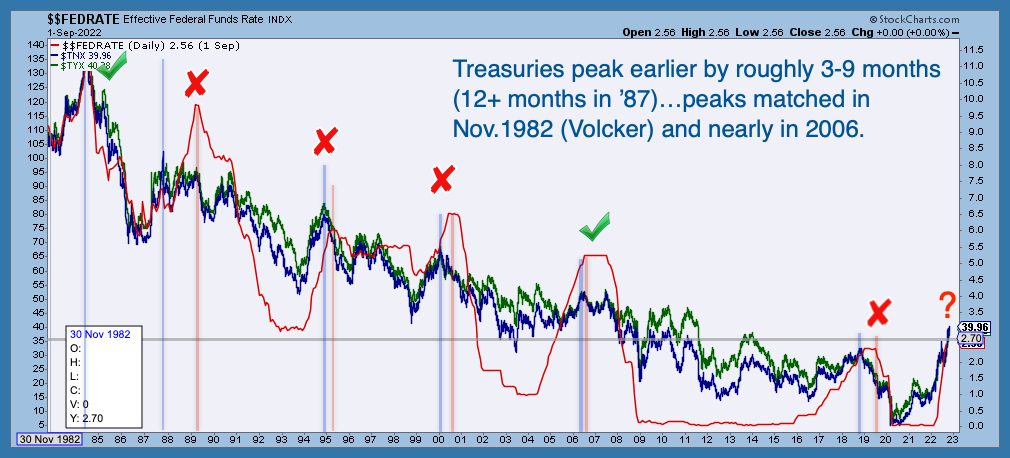

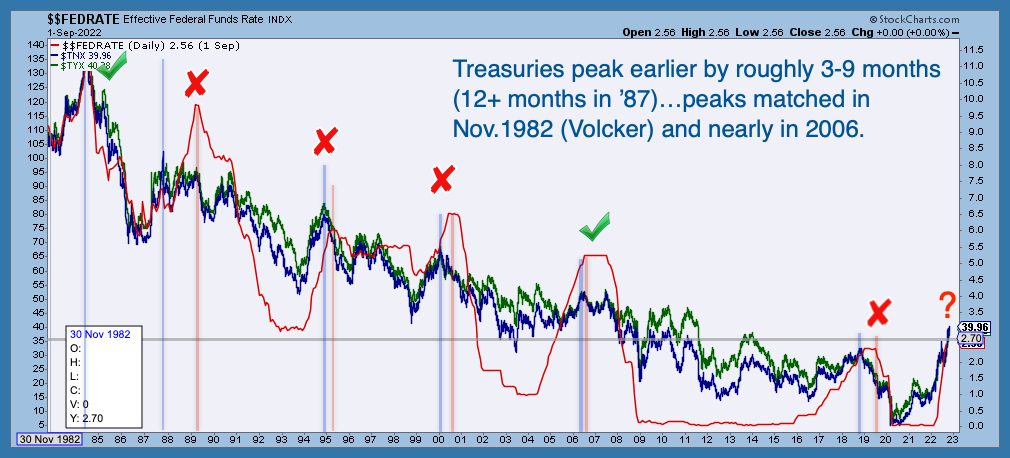

Currently, Japanese 10-year government bond yields are [insert current yield data], a significant increase from [insert previous yield data]. This rise, coupled with [insert current inflation rate data] inflation, fuels Governor Ueda's apprehension about the economy's trajectory.

Challenges for the Bank of Japan's Monetary Policy

The Bank of Japan's (BOJ) yield curve control (YCC) policy is designed to maintain low long-term interest rates to stimulate economic growth. Rising long-term yields directly challenge this policy, creating significant difficulties:

- Maintaining YCC becomes increasingly expensive as the BOJ needs to intervene more frequently in the bond market to suppress yields.

- The effectiveness of monetary easing is diminished as higher yields counteract the intended stimulative effect.

- The BOJ may need to consider adjusting its policy stance, potentially through abandoning or modifying YCC, which could have unpredictable consequences for the economy.

Effects on Corporate Investment and Consumer Spending

Higher borrowing costs associated with rising long-term yields directly impact both corporate investment and consumer spending:

- Businesses may postpone or cancel expansion plans due to increased financing costs, leading to slower economic growth.

- Consumers may reduce spending on big-ticket items like houses and cars due to higher mortgage and loan interest rates.

- Industries heavily reliant on borrowing, such as real estate and construction, are particularly vulnerable to this slowdown. The potential for a significant economic contraction is a key concern.

Global Implications: International Spillover Effects of Rising Japanese Yields

The Japanese economy is intricately interwoven with the global financial system, and changes in Japanese long-term yields have significant international repercussions.

Impact on Global Financial Markets

Shifts in Japanese long-term yields can trigger a domino effect across global bond markets:

- Increased Japanese yields can influence investor sentiment globally, potentially leading to higher interest rates in other countries.

- The interconnectedness of global financial markets means that changes in one market can rapidly spread to others, creating volatility and uncertainty.

- Currency exchange rates are also affected; a stronger yen (potentially due to capital inflows seeking higher Japanese yields) can impact trade balances and competitiveness for other nations.

Influence on Foreign Investment in Japan

Rising yields can attract foreign investment into Japan, but also create potential downsides:

- Higher yields make Japanese government bonds more attractive to international investors, potentially leading to increased capital inflows.

- However, if the yield rise is perceived as a sign of economic weakness or instability, it could lead to capital flight.

- The net effect on Japan's current account balance is uncertain and depends on the interplay between these competing forces.

Conclusion: Navigating the Challenges of Rising Long-Term Yields

Governor Ueda's warning underscores the serious potential consequences of rising long-term yields. Their impact on the Japanese economy, including the weakening yen, inflationary pressures, and challenges to monetary policy, is significant. Moreover, these rising yields have global implications, affecting international financial markets and foreign investment in Japan. The interconnected nature of global finance means these effects are not confined to Japan alone. The future trajectory of long-term yields remains uncertain, but navigating these challenges will require careful policy adjustments and a watchful eye on market dynamics. Stay updated on the latest developments regarding rising long-term yields by following reputable financial news sources and consulting with financial professionals. Understanding these trends is crucial for making informed investment decisions and managing your economic outlook.

Featured Posts

-

Polisi Elikopteron Ipa Iae Prasino Fos Gia Symfonia 1 4 Disekatommyrion Dolarion

May 29, 2025

Polisi Elikopteron Ipa Iae Prasino Fos Gia Symfonia 1 4 Disekatommyrion Dolarion

May 29, 2025 -

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy

May 29, 2025

Mstqbl Jwnathan Tah Me Brshlwnt Alqrar Alrsmy

May 29, 2025 -

Air Jordan Releases May 2025 Preview

May 29, 2025

Air Jordan Releases May 2025 Preview

May 29, 2025 -

Confirmed Actors To Play Harry Hermione And Ron In Upcoming Harry Potter Tv Show

May 29, 2025

Confirmed Actors To Play Harry Hermione And Ron In Upcoming Harry Potter Tv Show

May 29, 2025 -

Ueda Cautious On Long Yield Surge Eyes Potential Ripple Effects

May 29, 2025

Ueda Cautious On Long Yield Surge Eyes Potential Ripple Effects

May 29, 2025

Latest Posts

-

2025 Pro Motocross Championship A Season Preview

May 31, 2025

2025 Pro Motocross Championship A Season Preview

May 31, 2025 -

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025 -

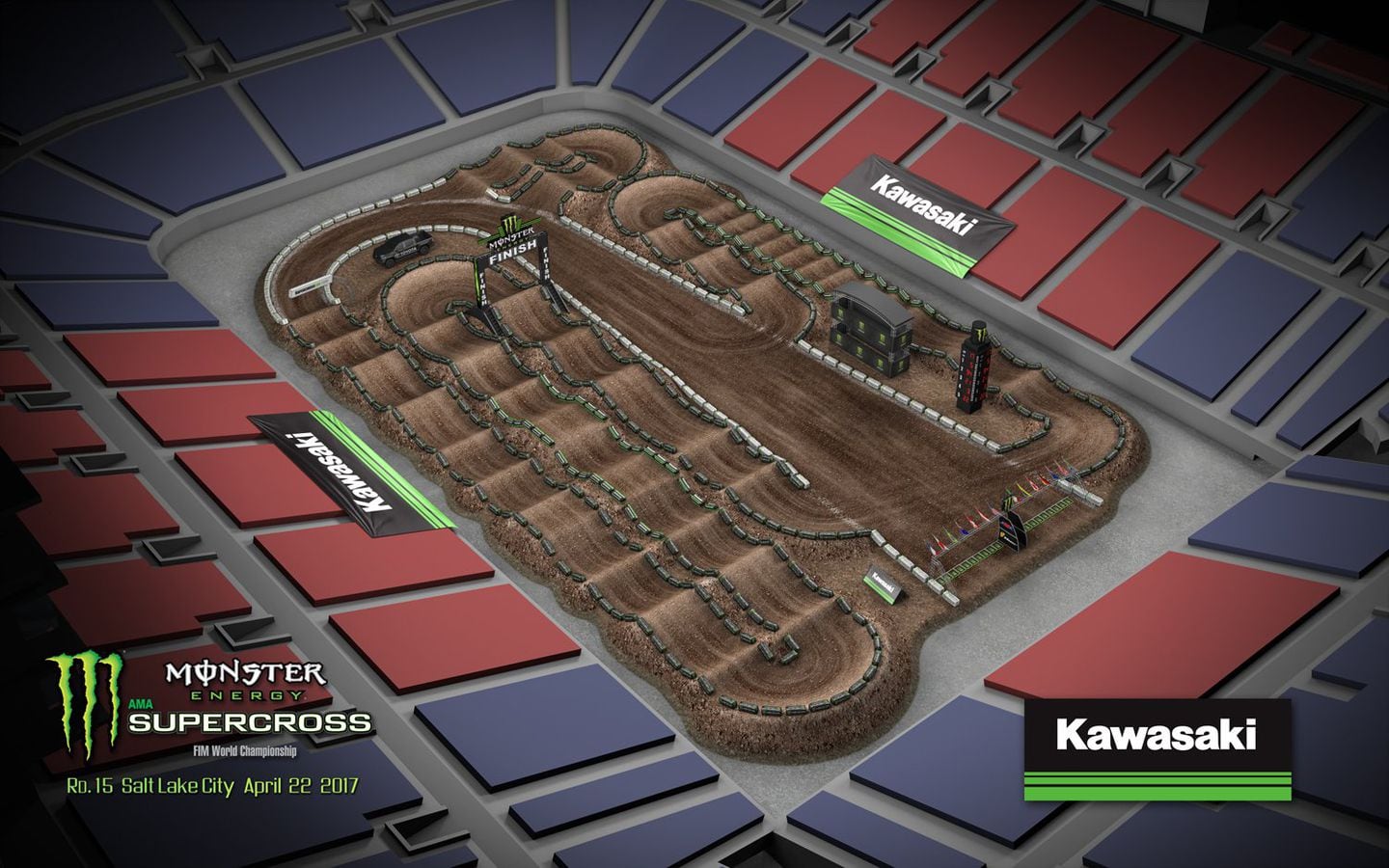

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025 -

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025