UK Households: Don't Ignore New HMRC Letters

Table of Contents

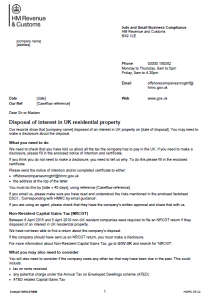

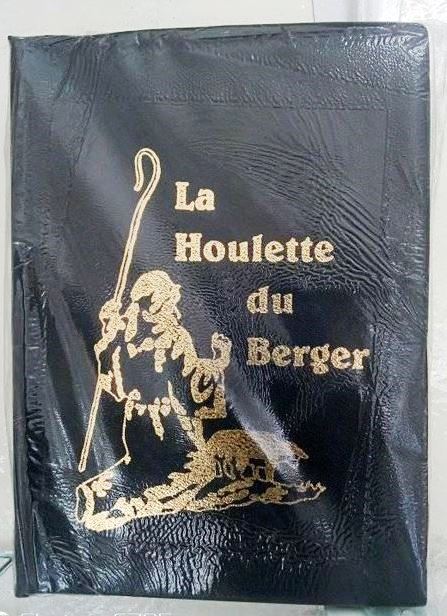

Types of HMRC Letters UK Households Should Expect

HMRC sends various letters, each with different implications. Understanding the type of letter you've received is the first step to responding appropriately. Ignoring any HMRC letter, regardless of its content, is risky.

-

Tax Demands: A tax demand letter signifies you owe HMRC money. It will specify the amount due, the deadline for payment, and the consequences of late payment. Late payment can lead to significant penalties, potentially increasing the original debt substantially. Payment options usually include online payment, bank transfer, and cheque. Check the letter carefully for your unique payment reference. If you disagree with the demand, you must contact HMRC immediately to discuss your concerns.

-

Tax Refunds: Receiving a tax refund letter is positive news! This letter confirms you are due a repayment. The letter will detail the amount and the expected timeframe for receiving the money. Make sure to keep a copy of this letter for your records.

-

Enquiry Letters: An HMRC enquiry letter indicates they need further information about your tax return or tax affairs. Respond promptly and completely, providing all requested documentation. Failure to cooperate can lead to penalties and further investigation. Gather all relevant supporting documents like payslips, bank statements, and invoices before responding.

-

Self-Assessment Reminders: These letters remind you to submit your self-assessment tax return by the deadline (typically 31 January). Ignoring this reminder can result in significant penalties for late submission. Access the HMRC self-assessment online portal to file your return promptly: [link to HMRC self-assessment portal].

-

Payment Plan Letters: If you've had difficulty paying your tax bill, HMRC might offer a payment plan. This letter will outline the terms of the agreement, including the amount of each payment and the payment schedule. Carefully review the terms and contact HMRC if you require any adjustments.

-

Penalty Letters: This letter informs you of a penalty for late payment, late submission, or inaccurate information provided. The letter will explain the reason for the penalty and may offer options for appealing the decision. Review the penalty carefully, understand the reasoning, and consider seeking professional advice if needed.

How to Identify Genuine HMRC Communication

Unfortunately, scams pretending to be from HMRC are common. Knowing how to identify genuine HMRC communication is essential to protect yourself from fraud.

-

Official Letterhead & Branding: Genuine HMRC letters will feature the official HMRC logo and letterhead. They will be professionally printed and not appear hastily produced.

-

Contact Details: The letter will include legitimate HMRC contact information, which you can verify by checking the official HMRC website. Never use contact details provided in a suspicious email.

-

Personal Details: Genuine letters will always include your unique taxpayer reference number (UTR) and other personal details specific to your tax file.

-

Email vs. Post: While HMRC may use email for some communications, important updates, particularly those relating to tax demands or penalties, are usually sent by post. Be wary of emails requesting immediate payment or personal information.

-

Suspicious Links: Never click on links within emails claiming to be from HMRC unless you have independently verified the email's authenticity through official channels. Hover your mouse over the link to see the actual URL before clicking.

What to Do if You Receive an Unclear or Concerning HMRC Letter

If you receive an HMRC letter you don't understand or that raises concerns, take these steps:

-

Contact HMRC Directly: Contact HMRC using their official channels: phone, online portal, or post. Find their contact details on the official government website. Avoid using contact details found on suspicious emails or websites.

-

Seek Professional Advice: If the letter is complex or you need help understanding your tax obligations, consider consulting a qualified tax advisor.

-

Keep Records: Keep copies of all HMRC correspondence and any documentation you send to them. This will be crucial if you need to appeal a decision or clarify any issues later.

-

Understand Your Rights: You have rights as a taxpayer. HMRC must follow due process, and you can appeal decisions you disagree with.

-

Don't Ignore It: Ignoring an HMRC letter will not make the problem go away. It will only worsen the situation, potentially leading to escalating penalties and legal action.

Conclusion

Promptly responding to HMRC letters is crucial for managing your UK household taxes effectively. Understanding the different types of HMRC letters, identifying genuine communications, and knowing how to respond appropriately are vital for avoiding penalties and resolving any tax-related issues swiftly. Ignoring HMRC communication can lead to severe financial consequences.

Don't delay! If you've received an HMRC letter, review this information and take action immediately. If you have any doubts, contact HMRC or seek professional advice regarding your HMRC letters promptly. Understanding your HMRC communications is key to responsible tax management.

Featured Posts

-

Hmrc Child Benefit Notifications What To Look Out For

May 20, 2025

Hmrc Child Benefit Notifications What To Look Out For

May 20, 2025 -

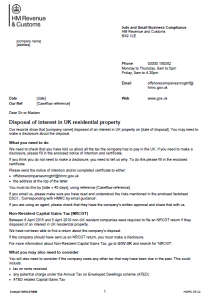

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025 -

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025 -

Philippines Missile Deployment In South China Sea Chinas Strong Reaction

May 20, 2025

Philippines Missile Deployment In South China Sea Chinas Strong Reaction

May 20, 2025 -

Fin Du Litige Jaminet Stade Toulousain Le Joueur Rembourse Le Club

May 20, 2025

Fin Du Litige Jaminet Stade Toulousain Le Joueur Rembourse Le Club

May 20, 2025

Latest Posts

-

Tadic Incident Fenerbahce Kondigt Harde Aanpak Aan

May 20, 2025

Tadic Incident Fenerbahce Kondigt Harde Aanpak Aan

May 20, 2025 -

Dusan Tadic Sari Lacivertli Tarihe Damga Vurdu Mu

May 20, 2025

Dusan Tadic Sari Lacivertli Tarihe Damga Vurdu Mu

May 20, 2025 -

Talisca Dan Sonra Tadic Mi Fenerbahce Nin Transfer Planlari

May 20, 2025

Talisca Dan Sonra Tadic Mi Fenerbahce Nin Transfer Planlari

May 20, 2025 -

Woede Bij Fenerbahce Keihard Optreden Tegen Tadic Na Ajax Incident

May 20, 2025

Woede Bij Fenerbahce Keihard Optreden Tegen Tadic Na Ajax Incident

May 20, 2025 -

Fenerbahce De Tadic Doenemi Basarilar Ve Gelecek

May 20, 2025

Fenerbahce De Tadic Doenemi Basarilar Ve Gelecek

May 20, 2025