Understanding CoreWeave Stock: Recent News And Investor Sentiment

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave focuses on GPU-accelerated cloud computing, a rapidly expanding segment driven by the increasing demand for AI and machine learning applications. Its business model centers on providing scalable and flexible GPU cloud solutions to a diverse clientele, ranging from startups to large enterprises. This focus gives CoreWeave a significant competitive advantage.

CoreWeave differentiates itself through superior performance, cost-effectiveness, and specialized services. Its infrastructure is designed for optimal efficiency and sustainability, a crucial factor for environmentally conscious businesses. These strengths are bolstered by strategic partnerships with leading technology providers, ensuring access to cutting-edge hardware and software.

- Focus on AI and machine learning workloads: CoreWeave's platform is purpose-built for the demanding computational needs of AI and machine learning, offering unparalleled performance for training and inference.

- Sustainable and efficient infrastructure: CoreWeave emphasizes energy efficiency and sustainable practices in its data center operations, reducing its environmental footprint while maintaining high performance.

- Partnerships with leading technology providers: Collaborations with major players in the hardware and software industry ensure CoreWeave's platform remains at the forefront of technological innovation.

- Scalable and flexible solutions for diverse clients: CoreWeave's services adapt to the specific needs of different clients, offering tailored solutions for various workloads and budgets. This scalability is crucial for businesses experiencing rapid growth or fluctuating demand.

Recent News and Developments Affecting CoreWeave Stock

Recent news surrounding CoreWeave has significantly influenced investor sentiment and the stock price. Tracking these developments is vital for understanding the company's trajectory. (Note: This section requires updating with the most current news regarding funding rounds, partnerships, product launches, etc. Examples are provided below, replace with actual events.)

- Recent funding round details and valuation: For example, a recent Series E funding round could significantly boost the company's valuation and signal investor confidence. The size of the round and the valuation achieved would be key factors in assessing the impact on the stock price.

- New partnerships announced and their implications: Announcing partnerships with major cloud providers or software companies could broaden CoreWeave's reach and enhance its service offerings. The strategic implications of these partnerships should be carefully considered.

- Significant customer wins or contract announcements: Securing large contracts with major corporations demonstrates market acceptance and the potential for substantial revenue growth. The scale and scope of these wins significantly influence investor perception.

- Any regulatory changes affecting the company: Any new regulations impacting the cloud computing industry could either present opportunities or challenges for CoreWeave. Understanding these regulatory aspects is essential for a complete picture.

Analyzing Investor Sentiment Towards CoreWeave Stock

Analyzing investor sentiment requires examining multiple data points. Analyst ratings and price targets provide a professional perspective, while social media and news sentiment offer a glimpse into public opinion. However, it's important to consider both the positive and negative aspects.

- Summary of analyst ratings (buy, hold, sell): Tracking analyst ratings from reputable financial institutions provides a consensus view on the stock's potential. A predominance of "buy" ratings generally reflects positive sentiment.

- Average price target from analysts: The average price target set by analysts indicates their collective expectation for the future stock price. This figure provides a benchmark for assessing the stock's valuation.

- Key risks: competition, market volatility, regulatory hurdles: The competitive landscape in GPU cloud computing is intense. Market volatility and regulatory uncertainty also pose potential risks. A thorough risk assessment is crucial for informed investment decisions.

- Potential catalysts for future growth: Factors like successful product launches, strategic acquisitions, and expansion into new markets could act as catalysts for future growth. Identifying these potential catalysts is essential for long-term outlook.

CoreWeave Stock Valuation and Future Outlook

Evaluating CoreWeave's valuation requires comparing it to competitors in the GPU-accelerated cloud computing market. Analyzing its projected revenue growth and market share provides insight into its long-term potential.

- Comparison to competitors' market capitalization and growth rates: Comparing CoreWeave's valuation metrics to those of its main competitors helps determine whether it's overvalued or undervalued.

- Projected revenue growth and market share: Forecasting CoreWeave's future revenue growth and market share is crucial for assessing its long-term investment potential.

- Potential for expansion into new markets or services: CoreWeave's potential to expand into new geographic markets or offer additional services can significantly impact its future growth trajectory.

- Long-term sustainability and profitability: Analyzing CoreWeave's long-term sustainability and profitability ensures that the investment aligns with long-term financial goals.

Conclusion

CoreWeave is a significant player in the rapidly growing GPU-accelerated cloud computing market. Its focus on AI and machine learning workloads, combined with its efficient infrastructure and strategic partnerships, positions it for substantial growth. While risks exist, understanding recent news, investor sentiment, and the company's valuation is crucial for making informed investment decisions. Staying informed about CoreWeave stock and its performance requires regularly checking reputable financial news sources and conducting thorough due diligence. Understanding the intricacies of CoreWeave stock empowers you to make strategic investment choices in this dynamic sector. Learn more about CoreWeave's investment opportunities and stay updated on the latest CoreWeave news.

Featured Posts

-

Dissecting The Alleged Incidents Involving Blake Lively

May 22, 2025

Dissecting The Alleged Incidents Involving Blake Lively

May 22, 2025 -

Chi Zagrozhuye Vidmova Ukrayini Vid Nato Yevropeyskiy Bezpetsi Analiz Politichnikh Rizikiv

May 22, 2025

Chi Zagrozhuye Vidmova Ukrayini Vid Nato Yevropeyskiy Bezpetsi Analiz Politichnikh Rizikiv

May 22, 2025 -

Minkulturi Spisok Kritichno Vazhlivikh Telekanaliv 1 1 Inter Stb Ta Inshi

May 22, 2025

Minkulturi Spisok Kritichno Vazhlivikh Telekanaliv 1 1 Inter Stb Ta Inshi

May 22, 2025 -

Nato I Ukraina Pozitsiya Evrokomissii Po Voprosu Chlenstva

May 22, 2025

Nato I Ukraina Pozitsiya Evrokomissii Po Voprosu Chlenstva

May 22, 2025 -

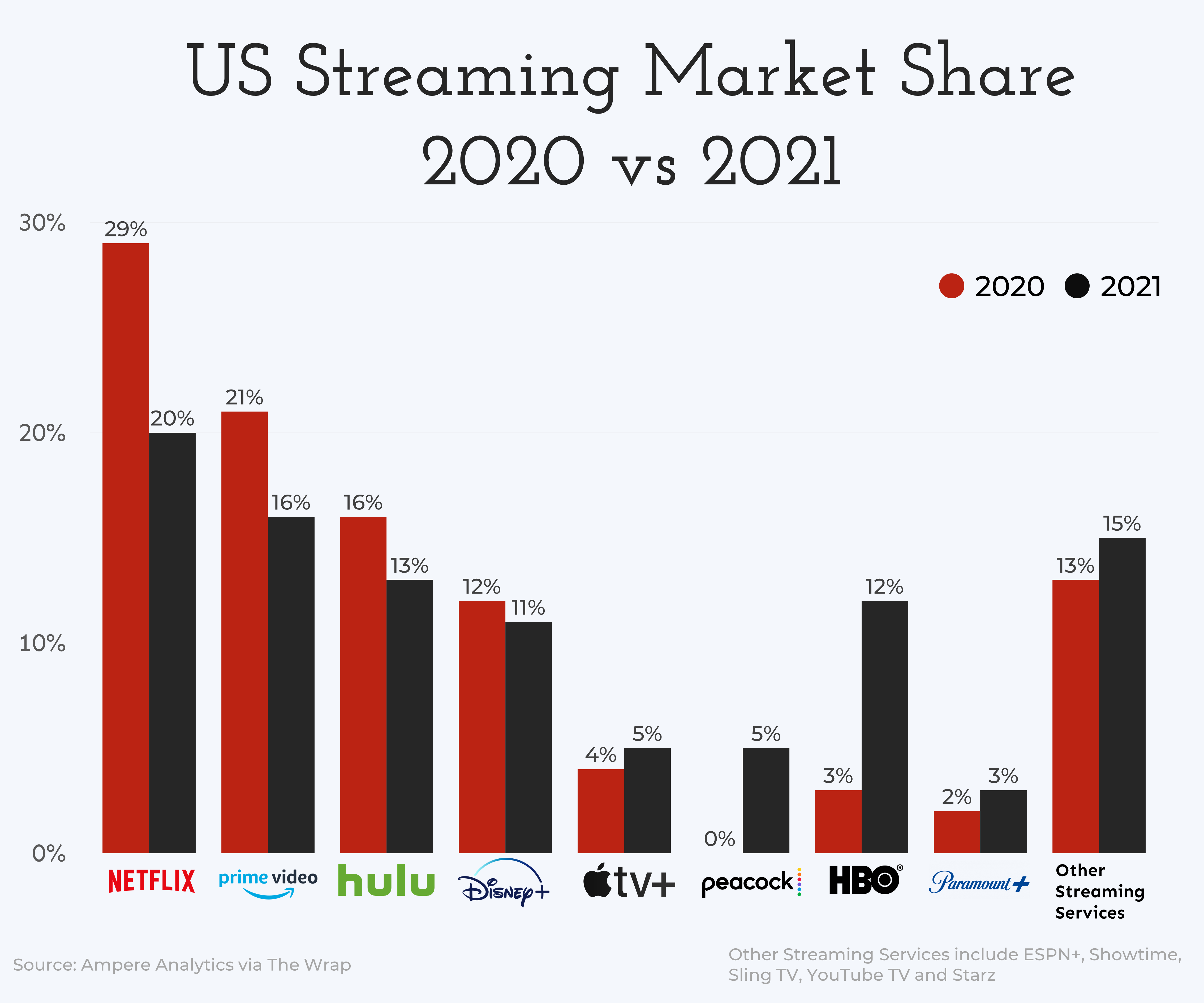

Streaming Services Profitability Vs User Experience

May 22, 2025

Streaming Services Profitability Vs User Experience

May 22, 2025

Latest Posts

-

Wordle 356 Solution Hints And Clues For March 6th Game

May 22, 2025

Wordle 356 Solution Hints And Clues For March 6th Game

May 22, 2025 -

Solve Wordle 356 Hints And The Answer For March 6th

May 22, 2025

Solve Wordle 356 Hints And The Answer For March 6th

May 22, 2025 -

Wordle 356 March 6th Clues And Solution

May 22, 2025

Wordle 356 March 6th Clues And Solution

May 22, 2025 -

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025 -

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025