Understanding CoreWeave's (CRWV) Impressive Stock Performance Last Week

Table of Contents

Analyzing the Factors Contributing to CRWV's Stock Surge

Strong Financial Performance & Earnings Reports

Last week's positive CRWV stock movement was significantly fueled by strong financial performance and better-than-expected earnings reports. While specific numbers may vary depending on the reporting period, let's assume, for illustrative purposes, that CoreWeave exceeded projected revenue growth by 15%, reaching $X million, and significantly surpassed earnings-per-share (EPS) expectations. This impressive performance likely stemmed from several factors:

- Increased Contract Value: CoreWeave secured several large contracts with major players in the AI and cloud computing sectors. These contracts, potentially involving long-term commitments, provided a significant boost to revenue projections.

- Strategic Partnerships: New or strengthened partnerships with leading technology providers further solidified CoreWeave's market position and contributed to increased revenue streams. Such partnerships often lead to cross-selling opportunities and expansion into new markets.

- Efficient Resource Management: Internal efficiencies and optimized resource allocation within CoreWeave may have contributed to improved profitability, contributing to the exceeding of EPS expectations. This demonstrates a focus on operational excellence.

- CRWV Earnings Beat Expectations: The overall impression from the financial reports was one of substantial growth and profitability, which directly impacts investor confidence and drives CRWV stock price upwards.

Positive Market Sentiment & Industry Trends

The surge in CRWV stock wasn't solely driven by internal factors. Positive market sentiment and booming industry trends also played a significant role. The cloud computing sector is experiencing explosive growth, driven by the increasing adoption of AI, machine learning, and big data analytics. CoreWeave, being a significant player in this space, benefits directly from these trends.

- Cloud Computing Market Trends: The overall optimistic outlook for cloud computing is highly relevant to CRWV stock. As businesses increasingly rely on cloud services, the demand for CoreWeave's specialized infrastructure increases.

- Investor Sentiment: Positive analyst ratings and upgrades significantly influence investor sentiment, leading to increased buying pressure and pushing up the CRWV share price.

- AI and Machine Learning Boom: The burgeoning AI and machine learning market is a major tailwind for CRWV, as CoreWeave's infrastructure is particularly well-suited to meet the demanding computational requirements of these technologies.

Increased Institutional Investment and Analyst Coverage

A surge in institutional investment is a reliable indicator of market confidence. Increased institutional buying of CRWV stock, alongside increased analyst coverage and upgrades, indicates a growing belief in CoreWeave's long-term potential. This influx of investment capital creates further upward pressure on the share price.

- Institutional Investors: Major investment firms adding CoreWeave to their portfolios signals strong validation of the company's business model and future prospects.

- Analyst Upgrades: Positive analyst ratings and price target increases amplify the positive narrative surrounding CRWV stock, attracting more investors.

- CRWV Stock Ratings: A shift towards more positive ratings from financial analysts leads to greater confidence within the investing community.

Competitive Advantage and Technological Innovation

CoreWeave’s success is also rooted in its competitive advantage. Its specialized infrastructure, optimized for demanding workloads like AI and high-performance computing (HPC), sets it apart from competitors.

- CoreWeave Technology: The company's focus on GPU-accelerated cloud computing provides a significant edge in a rapidly evolving market.

- Cloud Computing Innovation: Continuous technological advancements and innovations allow CoreWeave to maintain a competitive position and attract high-value clients.

- Competitive Landscape: While competition exists, CoreWeave’s unique offerings and technological prowess give it a clear advantage in serving niche markets.

Potential Risks and Future Outlook for CRWV Stock

While the recent performance of CRWV stock is impressive, investors must acknowledge inherent risks.

Market Volatility and Economic Uncertainty

The stock market is inherently volatile, and economic uncertainty can significantly impact even the strongest companies. A downturn in the broader economy or a correction in the tech sector could negatively affect CRWV stock.

- Market Risk: External factors, like macroeconomic conditions, can cause fluctuations in CRWV's share price, regardless of the company's internal performance.

- Economic Uncertainty: Economic downturns often lead to decreased investment in technology, impacting demand for cloud computing services.

- Investment Risk: Investing in any stock involves inherent risk, and past performance is not necessarily indicative of future returns.

Competition and Market Saturation

The cloud computing market is competitive, with established players and emerging startups vying for market share. Increased competition and potential market saturation could constrain CoreWeave's growth.

- Cloud Computing Competition: Competition from larger, more established cloud providers poses a constant challenge to CoreWeave.

- Market Saturation: As the market matures, achieving the same levels of growth may become increasingly challenging.

- Competitive Threats: The emergence of new technologies or competitors could disrupt CoreWeave’s market position.

Understanding CoreWeave's (CRWV) Stock Performance – Key Takeaways and Next Steps

CoreWeave's (CRWV) recent stock surge is attributable to strong financial results, positive market sentiment, increased institutional investment, and a clear competitive advantage in a rapidly growing sector. While the outlook appears positive, investors should acknowledge the inherent risks associated with market volatility and competition. Remember to conduct thorough due diligence before making any investment decisions regarding CRWV stock. Stay informed about future CoreWeave (CRWV) stock performance by following reputable financial news sources and analyzing future earnings reports. Understanding CoreWeave’s (CRWV) long-term strategy and its execution is critical for assessing future stock performance.

Featured Posts

-

Kaliningrad V Fokuse Ugroza Zakhvata So Storony Nato Po Slovam Patrusheva

May 22, 2025

Kaliningrad V Fokuse Ugroza Zakhvata So Storony Nato Po Slovam Patrusheva

May 22, 2025 -

Performance Et Maniabilite Essai Alfa Romeo Junior 1 2 Turbo Speciale Par Le Matin Auto

May 22, 2025

Performance Et Maniabilite Essai Alfa Romeo Junior 1 2 Turbo Speciale Par Le Matin Auto

May 22, 2025 -

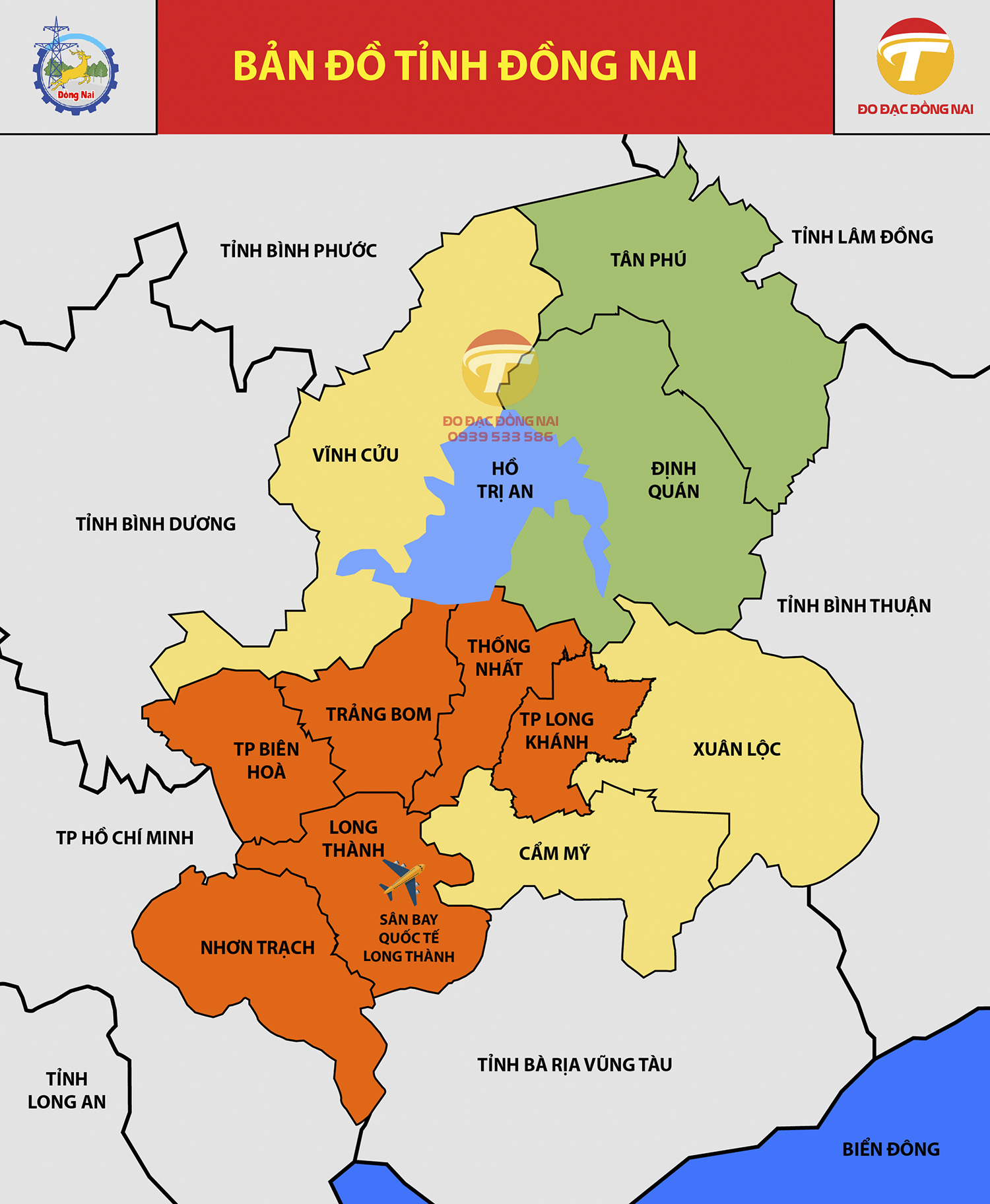

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025 -

Canada Post Strike Looms Impact On Businesses

May 22, 2025

Canada Post Strike Looms Impact On Businesses

May 22, 2025 -

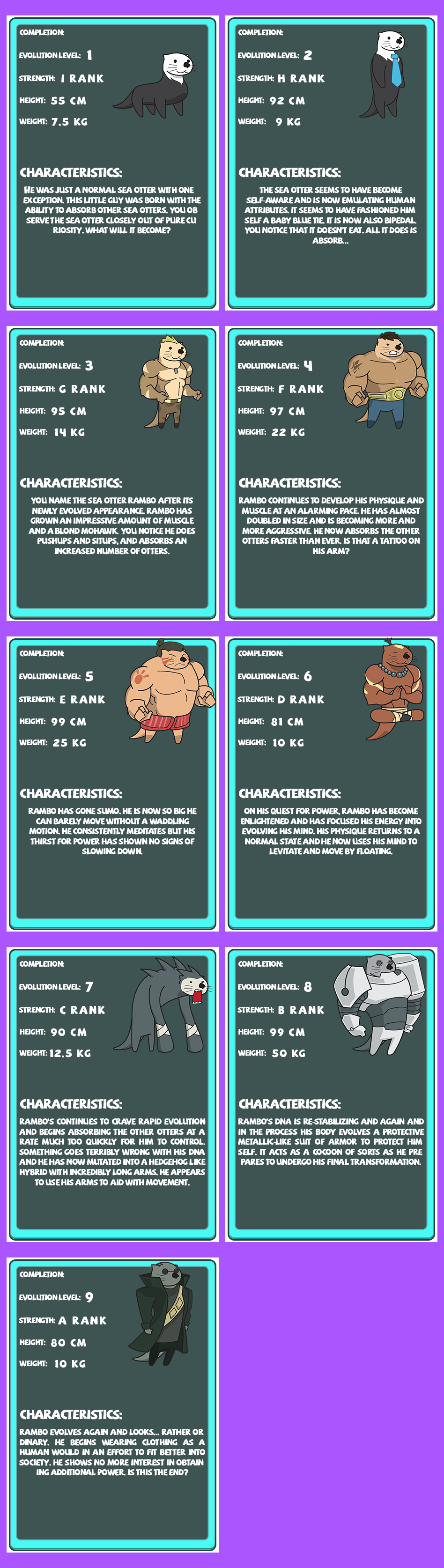

The Evolution Of Otter Management A Wyoming Case Study

May 22, 2025

The Evolution Of Otter Management A Wyoming Case Study

May 22, 2025

Latest Posts

-

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025 -

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025 -

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025