Understanding Elevated Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

Factors Contributing to Elevated Stock Market Valuations

Several interconnected factors contribute to the current environment of elevated stock market valuations. Understanding these drivers is crucial for investors seeking to make informed decisions.

Low Interest Rates and Quantitative Easing

Historically low interest rates and expansive quantitative easing (QE) policies have significantly influenced stock market valuations. Low interest rates reduce borrowing costs for companies, encouraging investment and expansion. This, in turn, boosts corporate earnings and increases the attractiveness of equities compared to lower-yielding bonds. Simultaneously, QE injects liquidity into the market, increasing the money supply and driving up demand for assets, including stocks.

- Reduced discount rates increase the present value of future earnings. Lower interest rates mean future earnings are discounted less heavily, leading to higher present valuations.

- Increased liquidity fuels demand for assets, including stocks. The abundance of capital makes investors more willing to take on risk and invest in equities.

- QE programs artificially inflate asset prices. By increasing the money supply, QE can inflate asset bubbles, leading to temporarily elevated valuations.

Examples include the period following the 2008 financial crisis, where near-zero interest rates and large-scale QE programs fueled a significant rally in stock markets. This period saw a notable increase in elevated stock market valuations, prompting debate on the sustainability of such growth.

Strong Corporate Earnings and Growth Expectations

Robust corporate earnings and optimistic future growth expectations are key drivers of high stock valuations. Strong current earnings justify higher price-to-earnings (P/E) ratios, reflecting investor confidence in a company's profitability. Furthermore, expectations of future growth, often fueled by technological advancements or expansion into new markets, can further inflate valuations. However, it’s crucial to differentiate between sustainable and unsustainable growth; overly optimistic projections can lead to market corrections when reality fails to meet expectations.

- Strong earnings justify higher price-to-earnings ratios. Profitable companies command higher valuations.

- Positive future growth forecasts support premium valuations. The prospect of future earnings growth boosts current prices.

- Risk of overestimating future growth potential. Unrealistic growth expectations can lead to inflated valuations and subsequent market corrections.

Increased Investor Demand and Speculation

The increased participation of retail investors and the rise of speculative trading have also contributed to elevated stock market valuations. The "fear of missing out" (FOMO) can drive irrational exuberance, pushing prices beyond fundamental justifications. Momentum investing, where investors buy assets whose prices are rising and sell those falling, can amplify price swings and create self-fulfilling prophecies. This speculative behavior can lead to the formation of market bubbles, characterized by unsustainable price increases driven by hype rather than fundamentals.

- FOMO (fear of missing out) can drive irrational exuberance. Emotional investing can lead to overvalued assets.

- Increased trading activity can amplify price swings. High trading volumes can exacerbate both upward and downward price movements.

- Speculative bubbles are inherently unsustainable. Eventually, reality catches up, and prices correct sharply.

Assessing the Risks of Elevated Stock Market Valuations

While strong fundamentals can support high valuations, it's crucial to acknowledge the inherent risks. Elevated stock market valuations increase the vulnerability to market corrections and heightened volatility.

Valuation Metrics and Their Limitations

Common valuation metrics like the P/E ratio and the cyclically adjusted price-to-earnings ratio (Shiller P/E) are used to assess whether the market is overvalued. However, these metrics have limitations. P/E ratios, for example, can be misleading without considering growth rates. Furthermore, comparing valuations across sectors and time periods requires careful consideration of underlying economic conditions and industry-specific factors. Qualitative factors, such as management quality and competitive landscape, are equally crucial and often overlooked.

- P/E ratios can be misleading without considering growth rates. High-growth companies often justify higher P/E ratios.

- Cyclical factors can influence valuation metrics. Economic cycles can distort the interpretation of valuation metrics.

- Qualitative factors (management, competitive landscape) are crucial. These factors cannot be fully captured by quantitative metrics.

Potential for Market Corrections and Volatility

Elevated stock market valuations make markets more susceptible to shocks. Unexpected negative news, such as rising interest rates or geopolitical instability, can trigger sharp corrections. History shows that periods of high valuations are often followed by significant market downturns. Therefore, diversification and robust risk management strategies are vital for investors navigating these potentially turbulent waters.

- High valuations make markets more susceptible to shocks. The higher the valuation, the further the market has to fall to reach a more sustainable level.

- Corrections can be sudden and significant. Market downturns can occur rapidly and unexpectedly.

- Diversification reduces exposure to market risk. A diversified portfolio helps mitigate losses during market corrections.

BofA's Perspective and Investment Strategies

BofA Securities' analysis of the current market conditions acknowledges the elevated stock market valuations and the inherent risks. While their specific recommendations may vary based on market dynamics, a general strategy often includes a cautious approach, emphasizing diversification and risk management. They may advocate for a sector-specific allocation, favoring defensive sectors less vulnerable to economic downturns, or suggesting strategies to hedge against potential market volatility. Their outlook may highlight potential catalysts for market shifts, like interest rate changes or geopolitical events.

- BofA's assessment of current risks and opportunities. Their analysis will consider the factors discussed above.

- Specific investment recommendations based on BofA's analysis. These recommendations are likely to be dynamic and reflect prevailing market conditions.

- Scenarios for future market performance. BofA will likely offer several scenarios, ranging from optimistic to pessimistic.

Conclusion

Understanding elevated stock market valuations requires a nuanced perspective, considering factors like low interest rates, strong corporate earnings, and increased investor demand. While these elements can fuel strong market performance, they also introduce significant risks, including market corrections and increased volatility. BofA's analysis provides crucial insights for navigating this environment. Investors should carefully evaluate their risk tolerance, diversify their portfolios, and adopt a long-term investment strategy when dealing with high stock valuations. By understanding the drivers and potential dangers of elevated stock market valuations, investors can make more informed decisions and potentially mitigate losses. For further insights into managing your portfolio during periods of high stock valuations, consult with a financial advisor.

Featured Posts

-

Watch Mobland Episode 9 Featuring Tom Hardy And Pierce Brosnan For Free

May 27, 2025

Watch Mobland Episode 9 Featuring Tom Hardy And Pierce Brosnan For Free

May 27, 2025 -

Manchester Uniteds Pursuit Of Victor Osimhen A Transfer Analysis

May 27, 2025

Manchester Uniteds Pursuit Of Victor Osimhen A Transfer Analysis

May 27, 2025 -

25 Maggio 2024 Almanacco Santo Del Giorno Compleanni E Detti

May 27, 2025

25 Maggio 2024 Almanacco Santo Del Giorno Compleanni E Detti

May 27, 2025 -

Onlayn Vestnik Struma Lagard Preduprezhdava Za Globalni Trgovski Konflikti I Zaplakhata Za Evropa

May 27, 2025

Onlayn Vestnik Struma Lagard Preduprezhdava Za Globalni Trgovski Konflikti I Zaplakhata Za Evropa

May 27, 2025 -

The Sex Lives Of College Girls Why The Cancellation Has Fans Upset

May 27, 2025

The Sex Lives Of College Girls Why The Cancellation Has Fans Upset

May 27, 2025

Latest Posts

-

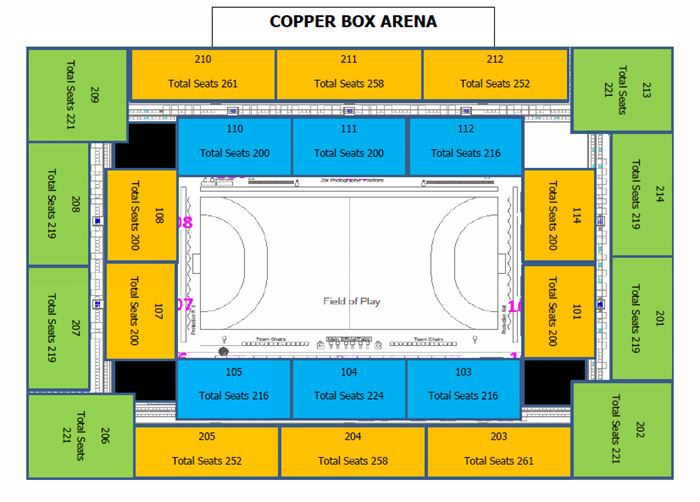

Gorillaz Copper Box Arena Dont Miss The Four Special London Shows

May 30, 2025

Gorillaz Copper Box Arena Dont Miss The Four Special London Shows

May 30, 2025 -

Gorillazs 25th Anniversary London Exhibitions And Live Performances

May 30, 2025

Gorillazs 25th Anniversary London Exhibitions And Live Performances

May 30, 2025 -

Londons Copper Box Arena Hosts House Of Kong Gorillaz Exhibition This Summer

May 30, 2025

Londons Copper Box Arena Hosts House Of Kong Gorillaz Exhibition This Summer

May 30, 2025 -

Gorillaz Tickets Four London Shows At Copper Box Arena Buy Now

May 30, 2025

Gorillaz Tickets Four London Shows At Copper Box Arena Buy Now

May 30, 2025 -

Copper Box Arena Gorillaz Tickets On Sale Limited Availability

May 30, 2025

Copper Box Arena Gorillaz Tickets On Sale Limited Availability

May 30, 2025