Understanding Finance Loans: Interest, EMIs, Tenure, And The Application Process

Table of Contents

Decoding Interest Rates in Finance Loans

Interest rates are the cost of borrowing money. Understanding them is fundamental to securing a beneficial finance loan. Different types of interest rates significantly impact your monthly payments and the overall cost of the loan.

Types of Interest Rates:

Finance loans typically offer two main types of interest rates: fixed and variable.

- Fixed Interest Rates: These remain constant throughout the loan tenure, providing predictability in your monthly payments.

- Advantages: Predictable budgeting, easier financial planning.

- Disadvantages: May not benefit from future interest rate drops.

- Variable Interest Rates: These fluctuate based on market conditions, potentially impacting your EMIs.

- Advantages: May offer lower initial interest rates, potentially leading to lower total interest paid if rates decrease.

- Disadvantages: Unpredictable monthly payments, making budgeting more challenging.

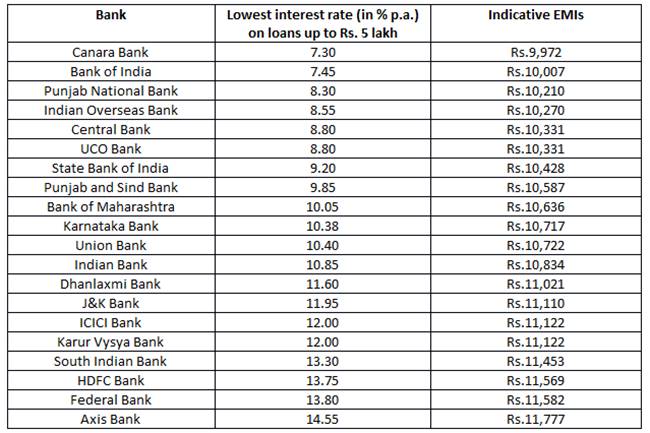

Factors influencing interest rate determination include your credit score, loan amount, loan tenure, and prevailing market interest rates. Comparing rates from different lenders is essential to secure the most competitive offer.

Calculating Interest Accrual:

Understanding how interest accrues is crucial for managing your finances effectively. Two common methods are simple interest and compound interest.

- Simple Interest: Calculated only on the principal amount. Formula: Simple Interest = (Principal × Rate × Time)/100

- Compound Interest: Calculated on the principal amount plus accumulated interest. This leads to significantly higher total repayment over time.

Understanding the Annual Percentage Rate (APR) is also critical. The APR represents the total cost of borrowing, including interest and any other fees.

Impact of Interest on Total Repayment:

Interest significantly impacts the total amount you repay. A higher interest rate translates to a much larger total repayment amount over the loan tenure.

- Example Scenario 1: A ₹10,00,000 loan at 10% interest for 10 years will result in a higher total repayment than the same loan at 8% interest.

- Example Scenario 2: A shorter loan tenure (e.g., 5 years instead of 10 years) will significantly reduce the total interest paid, despite higher monthly EMIs.

- Strategies to Minimize Interest Payments: Consider a higher down payment and/or opting for a shorter loan tenure to reduce the overall interest burden.

Understanding EMIs (Equated Monthly Installments)

Your EMI is the fixed amount you pay each month to repay your finance loan. Understanding how it's calculated and managed is vital for responsible borrowing.

EMI Calculation:

The EMI calculation considers three main factors: principal loan amount, interest rate, and loan tenure. Many online EMI calculators simplify this process. The formula is complex, but online tools make it readily accessible.

- Factors Affecting EMI: Increasing the loan amount or interest rate will increase your EMI. Conversely, a longer loan tenure will reduce your monthly EMI but increase the total interest paid.

Managing EMIs:

Effective EMI management requires careful budgeting and financial planning.

- Creating a Budget: Track your income and expenses to ensure you can comfortably afford your EMIs.

- Setting Financial Goals: Align your borrowing with your financial objectives to avoid over-stretching your finances.

- Managing Unexpected Expenses: Have an emergency fund to handle unexpected costs and avoid defaulting on your EMIs.

- Prepayment Options: Explore the possibility of prepaying your loan to save on interest.

Factors Affecting EMI Amounts:

The interplay between loan amount, interest rate, and tenure significantly impacts your EMI.

- Reducing Loan Tenure: Shortening the loan tenure increases your monthly EMI but reduces the total interest paid over the loan's life.

- Higher Interest Rates: Higher interest rates lead to significantly higher EMIs and total repayment amounts.

- Amortization Schedule: Understanding your amortization schedule (a table showing principal and interest components of each EMI payment) allows for better financial planning.

Choosing the Right Loan Tenure

The loan tenure—the repayment period—is a crucial decision. It directly affects your monthly payments and the total interest paid.

Tenure and its Implications:

Choosing the right tenure involves balancing affordability with long-term financial implications.

- Shorter Tenure: Higher EMIs but lower overall interest cost. Requires stronger financial capacity.

- Longer Tenure: Lower EMIs but higher overall interest cost. More manageable monthly payments but higher total repayment.

Consider your personal financial capacity and future financial commitments.

Factors to Consider When Choosing Tenure:

Several factors influence the optimal loan tenure.

- Affordability: Ensure your chosen EMI fits comfortably within your monthly budget.

- Financial Goals: Align your loan tenure with your short-term and long-term financial plans.

- Future Financial Commitments: Consider potential changes in your income or expenses.

Prepayment Options and Penalties:

Many lenders allow prepayment of loans, which can save you money on interest.

- Benefits of Prepayment: Reduce total interest paid, shorten the loan tenure.

- Conditions for Prepayment: Check your loan agreement for any prepayment penalties or conditions.

- Potential Penalties: Some lenders charge prepayment penalties, so it's important to understand the terms.

- Calculating Savings from Prepayment: Calculate the potential savings to determine if prepayment is financially advantageous.

The Finance Loan Application Process

Securing a finance loan involves several steps, from gathering documents to submitting your application.

Gathering Required Documents:

Before applying, gather necessary documentation to streamline the process.

- Income Proof: Payslips, bank statements, tax returns.

- Identity Proof: Aadhaar card, passport, driving license.

- Address Proof: Utility bills, rental agreement.

- Specific Documents: Different lenders may require additional documents.

Choosing the Right Lender:

Carefully compare lenders based on several factors.

- Interest Rates: Compare interest rates from multiple lenders to secure the best deal.

- Fees: Consider any processing fees, administrative charges, or other associated costs.

- Customer Service: Research the lender’s reputation and customer service quality.

- Loan Types: Understand different loan types and terms offered. Use online comparison tools to aid your research.

Submitting the Application and Follow-Up:

Once you've selected a lender, submit your application and follow up regularly.

- Online vs. In-Person Application: Choose the method most convenient for you.

- Tracking Application Status: Regularly check on the status of your application.

- Communication with Lender: Maintain open communication with your lender throughout the process.

- Understanding Loan Approval Process: Be aware of the steps involved in the loan approval process.

Conclusion:

Understanding the intricacies of finance loans, including interest rates, EMIs, tenure, and the application process, is paramount for making sound financial decisions. By carefully considering these factors and following the steps outlined above, you can increase your chances of securing the most suitable finance loan for your needs. Don't hesitate to compare different lenders and thoroughly research your options before committing to a finance loan. Take control of your finances by confidently navigating the world of finance loans!

Featured Posts

-

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025 -

The Stars Of The Dubbo Championship Wrestling Musical A Full Cast Reveal

May 28, 2025

The Stars Of The Dubbo Championship Wrestling Musical A Full Cast Reveal

May 28, 2025 -

Como Escuchar Pepper Premiere 96 6 Fm

May 28, 2025

Como Escuchar Pepper Premiere 96 6 Fm

May 28, 2025 -

Teylr Suift Khyu Dzhakman I Skandalt Novi Podrobnosti Za Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Teylr Suift Khyu Dzhakman I Skandalt Novi Podrobnosti Za Bleyk Layvli I Dzhstin Baldoni

May 28, 2025 -

Trump Extends Eu Tariff Deadline To July 9th

May 28, 2025

Trump Extends Eu Tariff Deadline To July 9th

May 28, 2025

Latest Posts

-

Debat A L Assemblee Nationale Le Rn Lfi Et La Question Des Frontieres

May 30, 2025

Debat A L Assemblee Nationale Le Rn Lfi Et La Question Des Frontieres

May 30, 2025 -

Urgence Infestation De Rats A Florange Et Inquietudes Des Parents De L Ecole Bouton D Or

May 30, 2025

Urgence Infestation De Rats A Florange Et Inquietudes Des Parents De L Ecole Bouton D Or

May 30, 2025 -

Strategies Politiques A L Assemblee Nationale Frontieres Et La Nouvelle Donne

May 30, 2025

Strategies Politiques A L Assemblee Nationale Frontieres Et La Nouvelle Donne

May 30, 2025 -

Probleme De Rats A Florange Les Parents De Bouton D Or Demandent Des Solutions

May 30, 2025

Probleme De Rats A Florange Les Parents De Bouton D Or Demandent Des Solutions

May 30, 2025 -

Assemblee Nationale 2024 Le Rassemblement National Face A La France Insoumise

May 30, 2025

Assemblee Nationale 2024 Le Rassemblement National Face A La France Insoumise

May 30, 2025