Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

The stock market has reached heights prompting considerable concern among investors. This article examines a BofA analysis of these historically high valuations, exploring contributing factors and their implications for your investment strategy. We’ll dissect the key drivers behind these high valuations and explore their meaning for both short-term and long-term investors.

Key Indicators of High Stock Market Valuations

Several key metrics help gauge whether current stock market valuations are justified or represent an overvalued market. BofA's analysis incorporates a multi-faceted approach, examining various indicators to provide a comprehensive assessment.

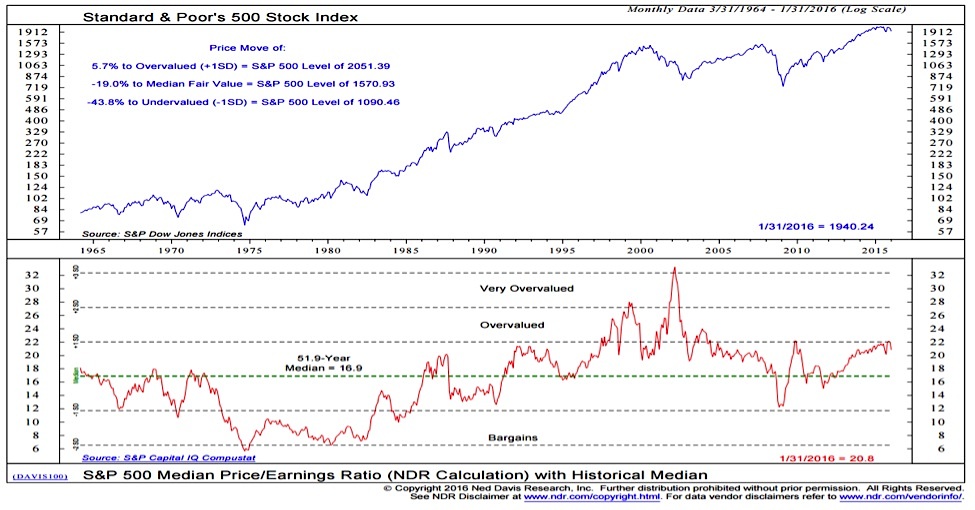

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating an overvalued stock. BofA's research likely compares current P/E ratios across different sectors and the overall market to historical averages. For instance, technology stocks often command higher P/E ratios than utility companies due to anticipated higher growth. However, relying solely on P/E ratios has limitations. A company's growth prospects and industry dynamics significantly influence its justifiable P/E.

- High P/E ratios suggest potentially overvalued stocks.

- Historical P/E data provides crucial context.

- Consider industry-specific P/E benchmarks for accurate comparison.

Cyclically Adjusted Price-to-Earnings Ratio (CAPE)

The CAPE ratio, also known as the Shiller P/E ratio, is a more robust valuation metric than the traditional P/E. It uses average inflation-adjusted earnings over the past ten years, smoothing out short-term earnings volatility. BofA's analysis likely considers the CAPE ratio's implications for long-term investment strategies. A high CAPE ratio, compared to historical peaks and troughs, might signal an overvalued market, while a low CAPE ratio could suggest undervaluation. Inflation and interest rates significantly influence the CAPE ratio; high inflation and rising interest rates generally exert downward pressure on valuations.

- The smoothing effect of CAPE reduces short-term volatility.

- It provides a longer-term perspective on market valuation.

- Consider the economic cycle when interpreting CAPE data.

Other Valuation Metrics

Beyond P/E and CAPE, BofA likely utilizes other valuation metrics for a holistic view. These include:

- Price-to-Sales (P/S): Compares a company's market capitalization to its revenue. Useful for valuing companies with negative earnings.

- Price-to-Book (P/B): Compares a company's market value to its net asset value. Useful for valuing asset-heavy businesses.

- Dividend Yield: The annual dividend per share relative to the stock price. Indicates the return from dividends.

BofA's comprehensive approach, incorporating multiple metrics, mitigates the limitations of any single indicator, offering a more nuanced and robust assessment of market valuation.

- Diversification of valuation metrics reduces bias.

- Each metric offers unique insights into company performance.

- Using multiple metrics provides a comprehensive assessment.

Factors Contributing to High Stock Market Valuations

Several factors contribute to periods of high stock market valuations. BofA's analysis likely identifies and weighs the relative importance of these contributing elements.

Low Interest Rates

Low interest rates have a profound impact on stock market valuations. Lower interest rates make borrowing cheaper for corporations, stimulating investment and boosting corporate earnings. Moreover, lower rates increase the present value of future earnings, making stocks appear more attractive relative to bonds. BofA's analysis likely considers the potential impact of future interest rate hikes, which could lead to decreased valuations as borrowing becomes more expensive and the present value of future earnings falls.

- Low interest rates make borrowing cheaper, boosting corporate investment.

- Lower rates increase the present value of future earnings.

- Rising rates can lead to decreased valuations and potentially market corrections.

Strong Corporate Earnings

Robust corporate earnings growth significantly supports high stock valuations. BofA's research likely examines the sustainability of this growth. While strong earnings justify higher valuations to a certain extent, investors need to analyze the quality and sustainability of earnings growth. Potential headwinds, such as economic slowdowns, rising input costs, or increased competition, can impact future earnings and affect valuations.

- Strong earnings justify higher valuations, to an extent.

- Analyze the quality and sustainability of earnings growth.

- Consider potential economic slowdowns and their impact on future earnings.

Investor Sentiment and Market Speculation

Investor psychology and market sentiment play a crucial role in driving valuations. Overly optimistic sentiment can push valuations beyond what's justified by fundamentals, potentially creating market bubbles. BofA’s analysis likely considers the current level of investor optimism and the risks associated with excessive speculation. Market corrections can occur when sentiment shifts, leading to a rapid decline in prices.

- Market sentiment can drive valuations beyond fundamentals.

- Bubbles can form due to speculative investing.

- Be aware of potential market corrections driven by shifts in investor sentiment.

Investment Implications of High Stock Market Valuations

High stock market valuations necessitate a strategic approach to investing. BofA's recommendations likely emphasize risk management and diversification.

Strategic Asset Allocation

In a potentially overvalued market, BofA likely recommends diversifying portfolios beyond equities. This might involve increasing allocations to less volatile assets such as bonds, real estate, or commodities. Re-evaluating risk tolerance and investment time horizons is crucial. A long-term investment strategy focused on value creation remains paramount.

- Consider increasing allocation to less volatile assets.

- Re-evaluate risk tolerance and investment time horizon.

- Focus on long-term value creation.

Stock Selection Strategies

Even in a high-valuation market, opportunities exist to identify undervalued stocks. BofA’s approach likely focuses on fundamental analysis, identifying companies with strong fundamentals and sustainable growth, even if the overall market appears overvalued. Thorough due diligence is essential to uncover companies trading below their intrinsic value.

- Focus on companies with strong fundamentals and sustainable growth.

- Look for companies trading below their intrinsic value.

- Perform thorough due diligence before investing.

Conclusion

BofA's analysis presents a complex picture of current high stock market valuations. Strong corporate earnings and low interest rates contribute to elevated prices; however, investors should remain cautious and carefully consider valuation metrics like P/E and CAPE ratios. Understanding these indicators, the broader economic context, and investor sentiment is crucial for a sound investment strategy. By carefully managing risk and focusing on long-term value, investors can navigate high stock market valuations and capitalize on opportunities. Remember to conduct thorough research and consider professional advice before making any investment decisions related to high stock market valuations.

Featured Posts

-

Solve Nyt Strands Game 374 March 12 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 374 March 12 Hints And Answers

May 10, 2025 -

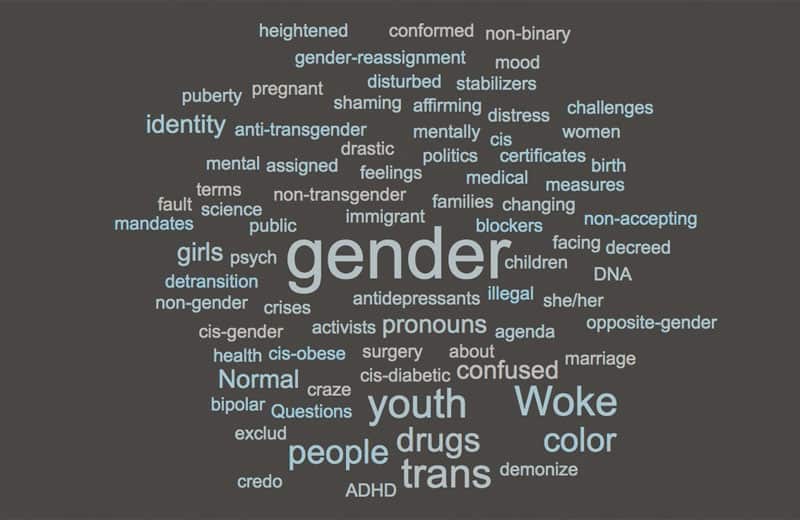

How Trumps Executive Orders Affected The Transgender Community A Personal Account

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community A Personal Account

May 10, 2025 -

The Bangkok Post And The Push For Transgender Rights An Analysis

May 10, 2025

The Bangkok Post And The Push For Transgender Rights An Analysis

May 10, 2025 -

Nottingham Attacks Survivors Stories Of Resilience And Recovery

May 10, 2025

Nottingham Attacks Survivors Stories Of Resilience And Recovery

May 10, 2025 -

Apples Ai Strategy Strengths Weaknesses And Opportunities

May 10, 2025

Apples Ai Strategy Strengths Weaknesses And Opportunities

May 10, 2025