Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic outlook significantly influences their assessment of current stock market valuations. Their predictions regarding economic growth, inflation, and interest rates are key factors in determining whether current prices are sustainable. Understanding their perspective is crucial for investors trying to gauge the potential risks and rewards in the market.

-

BofA's forecast for GDP growth: BofA's recent reports (links to reports would be inserted here if publicly available) may project moderate GDP growth for the coming year, potentially influenced by factors like global economic conditions and domestic policy. This growth rate directly impacts corporate earnings, a key driver of stock prices. Slower-than-expected growth could pressure valuations, while stronger-than-expected growth might support them.

-

BofA's inflation outlook and its potential impact on corporate earnings: BofA's assessment of inflation is critical. High inflation erodes purchasing power and can impact corporate profit margins. If BofA anticipates persistent inflation, they might view current valuations as less sustainable, potentially recommending caution to investors. Conversely, a belief that inflation is transitory might lead to a more optimistic outlook on valuations.

-

BofA's view on future interest rate hikes and their effect on market sentiment: The Federal Reserve's monetary policy, including interest rate hikes, plays a major role in shaping market sentiment. BofA’s predictions on future interest rate adjustments influence their assessment of high stock market valuations. Higher interest rates generally increase borrowing costs for companies, potentially impacting investment and growth, which in turn affects stock valuations.

Analyzing Key Valuation Metrics from a BofA Perspective

BofA likely utilizes various key valuation metrics to assess whether current stock prices are justified or overvalued. These metrics provide a quantitative framework for evaluating market conditions in relation to high stock market valuations.

-

Price-to-Earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio might suggest that the market is placing a premium on future growth, which may or may not be warranted. BofA would analyze whether current P/E ratios are historically high relative to earnings growth prospects.

-

Price-to-Sales ratio (P/S): The P/S ratio compares a company's market capitalization to its revenue. It's often used for companies with negative earnings. BofA would use this metric to assess valuations, especially in rapidly growing sectors where earnings may lag revenue growth. A high P/S ratio might suggest an overvaluation if revenue growth doesn't justify the premium.

-

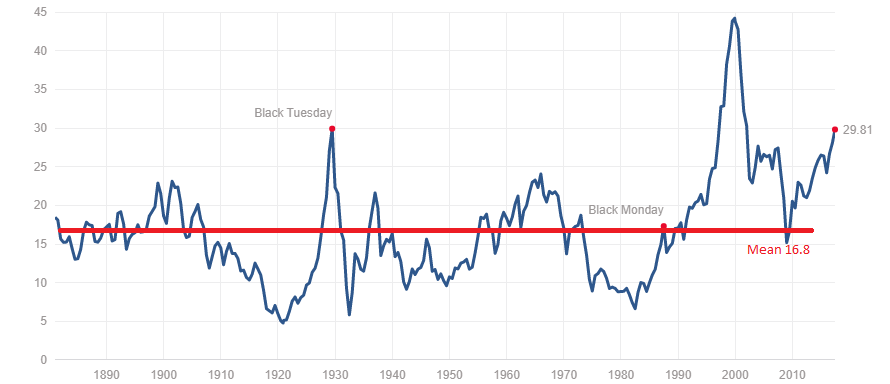

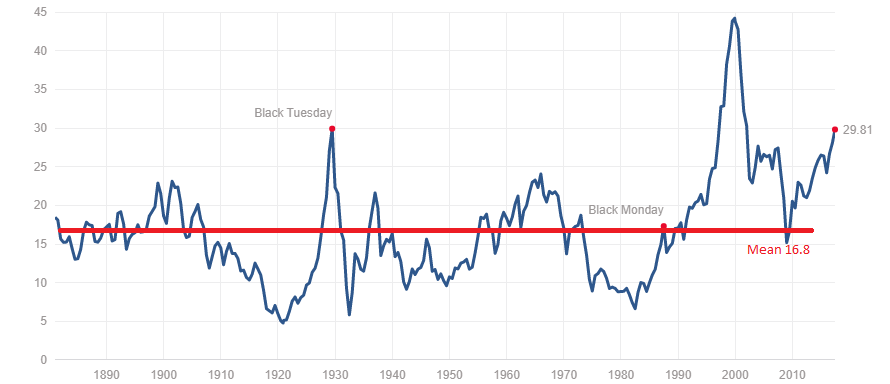

Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over time, providing a more stable measure of valuation. BofA's analysis would compare the current Shiller PE to its historical average to understand if current valuations are abnormally high. A historically high Shiller PE might indicate a higher risk of market correction.

BofA's interpretation of these metrics within the context of their macroeconomic outlook helps them to determine whether the current high stock market valuations are justified or represent a bubble.

BofA's Sector-Specific Views on High Valuations

BofA likely has sector-specific views on high valuations. Some sectors might be considered overvalued, while others might offer better value propositions. This nuanced perspective is crucial for investors seeking to optimize their portfolios.

-

Overvalued sectors: BofA might identify sectors like Technology (particularly specific sub-sectors like certain segments of software or growth stocks), or Consumer Discretionary as potentially overvalued due to high growth expectations already priced into the market. They might advise caution in these areas, suggesting a more selective approach.

-

Undervalued sectors: BofA might view sectors like Energy (driven by commodity prices and geopolitical factors) or Financials (depending on interest rate forecasts and economic outlook) as potentially undervalued, offering better risk-adjusted returns. These sectors might be seen as offering attractive entry points for investors.

-

Investment strategies: Based on their sector-specific views, BofA might suggest tailored investment strategies. This might involve reducing exposure to overvalued sectors and increasing allocations to undervalued sectors.

Risk Management Strategies for Investors in a High-Valuation Market

Given the inherent risks associated with high stock market valuations, BofA would emphasize prudent risk management strategies. Investors should carefully consider these recommendations to protect their portfolios.

-

Portfolio diversification: Diversifying investments across various sectors, asset classes (stocks, bonds, real estate, etc.), and geographies helps to reduce the impact of any single sector's underperformance.

-

Defensive investment strategies: In a high-valuation environment, BofA might recommend considering defensive strategies such as shifting towards lower-risk, higher-dividend yielding stocks or increasing bond allocations to balance the portfolio's overall risk profile.

-

Hedging strategies: Hedging involves using financial instruments to offset potential losses in the market. BofA might advise investors to explore hedging strategies, depending on their risk tolerance and investment objectives.

-

Adjusting investment timelines: Investors with longer time horizons might be more tolerant of market volatility associated with high valuations. However, investors with shorter time horizons might need to adjust their investment strategies to mitigate potential losses.

Conclusion: Navigating High Stock Market Valuations with BofA's Guidance

BofA's perspective on high stock market valuations offers valuable insights for investors. Their macroeconomic outlook, valuation metric analysis, sector-specific views, and risk management recommendations provide a comprehensive framework for navigating the current market environment. By carefully considering BofA's perspective on high stock market valuations and by implementing sound risk management strategies, investors can navigate these challenging market conditions more effectively. Learn more about BofA's market analysis and investment strategies today! Remember that this information is for general knowledge and should not be construed as financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Trump Lawsuit Prompts 60 Minutes Executive Producers Exit

Apr 24, 2025

Trump Lawsuit Prompts 60 Minutes Executive Producers Exit

Apr 24, 2025 -

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025 -

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025 -

Trump Denies Plans To Remove Federal Reserve Chair Powell

Apr 24, 2025

Trump Denies Plans To Remove Federal Reserve Chair Powell

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025