Understanding High Stock Market Valuations: BofA's Take And Investor Implications

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

BofA's recent reports reflect a cautious optimism regarding current stock market valuations. Their analysis utilizes various stock market valuation metrics, including Price-to-Earnings ratios (P/E), market capitalization levels, and other key indicators to assess the overall market health. While acknowledging the historically high valuations, BofA's assessment isn't necessarily a bearish prediction of an imminent crash. Instead, their analysis focuses on understanding the underlying drivers of these valuations and their potential sustainability.

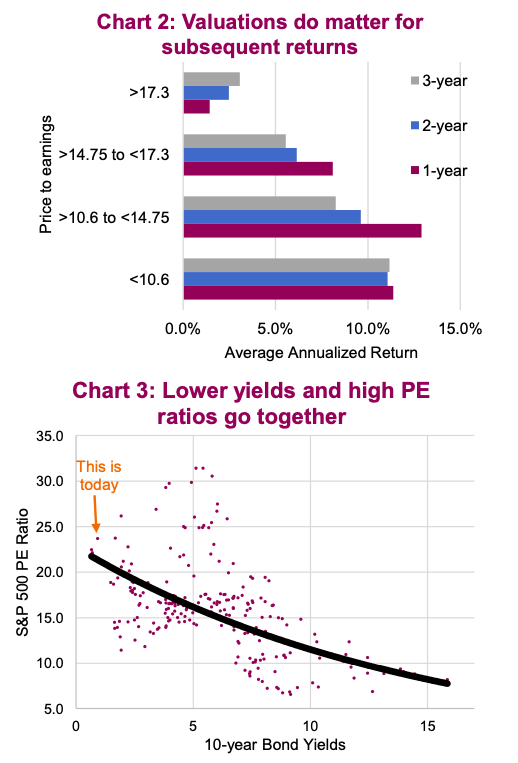

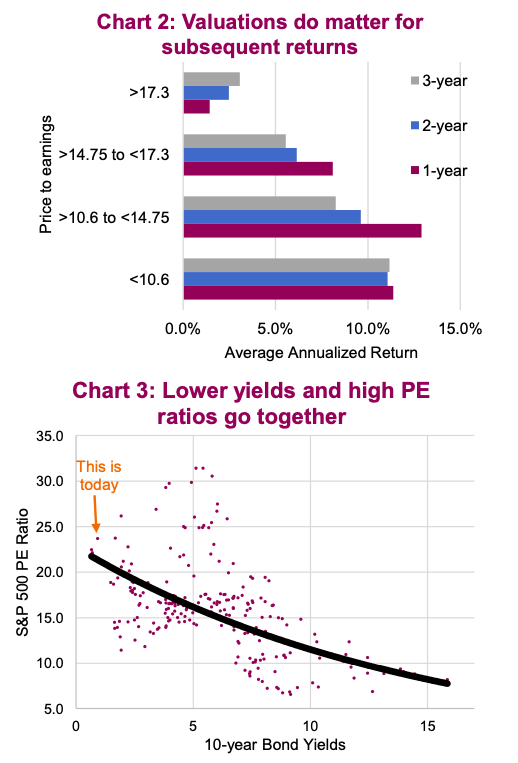

- BofA's assessment of current market valuation levels compared to historical averages: BofA often compares current P/E ratios to long-term historical averages, highlighting potential overvaluation in certain sectors. Specific data points will vary depending on the most recent report, but generally, they indicate valuations are above long-term averages. This suggests a degree of risk, especially for investors with shorter time horizons.

- Key factors cited by BofA contributing to high valuations: BofA typically points to a confluence of factors, including persistently low interest rates, strong corporate earnings (particularly in certain tech sectors), and continued investor confidence fueled by technological advancements and the expectation of future growth. These factors contribute to a higher demand for stocks, driving up prices.

- BofA's predicted trajectory for stock market valuations in the near and long term: BofA's predictions are usually nuanced and not outright forecasts. They tend to emphasize the importance of monitoring macroeconomic indicators, such as inflation and interest rate changes, to gauge the sustainability of current valuations. Their outlook typically incorporates a range of scenarios, acknowledging the inherent uncertainties in predicting market behavior.

Factors Driving High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. These factors influence investor behavior and ultimately drive up stock prices. Understanding these dynamics is essential for developing a sound investment strategy.

- The impact of low interest rates on stock valuations: Low interest rates make borrowing cheaper for companies and make bonds less attractive, encouraging investment in higher-yielding assets like stocks. This increased demand further drives up stock prices.

- The role of strong corporate earnings in supporting high stock prices: Strong corporate earnings, particularly in sectors benefiting from technological advancements and global economic growth, reinforce investor confidence and justify higher stock valuations. However, it's crucial to consider the sustainability of these earnings.

- The influence of inflation and economic growth on investor sentiment and valuations: Moderate inflation and healthy economic growth can positively influence investor sentiment, leading to higher stock valuations. However, high or unpredictable inflation can erode investor confidence and lead to market corrections.

- The impact of technological innovation on market capitalization and investor expectations: Rapid technological advancements consistently reshape industries and create new opportunities for investment, fueling investor expectations of future growth and leading to higher valuations, especially in the technology sector.

Investor Implications and Strategies

BofA's analysis, along with the factors driving high valuations, has significant implications for investors. It’s crucial to adopt strategies that mitigate risk and align with your investment goals.

- Strategies for mitigating risk in a highly valued market: Diversification across various asset classes (stocks, bonds, real estate) is crucial. A defensive investing approach, focusing on established companies with lower volatility, can be considered.

- Opportunities for investors seeking growth in a high-valuation environment: While overall valuations are high, opportunities for growth may still exist within specific sectors or individual companies that demonstrate strong fundamentals and future growth potential. Careful stock selection is vital.

- The importance of considering your risk tolerance and investment timeline: Your risk tolerance and investment timeline significantly influence your investment strategy. Longer-term investors may be more tolerant of market fluctuations, while shorter-term investors may need a more conservative approach.

- Potential benefits of value investing during periods of high valuations: Value investing, focusing on undervalued companies, can be a viable strategy even in a high-valuation market. This requires thorough fundamental analysis to identify companies trading below their intrinsic value.

Alternative Asset Classes to Consider

Given the high valuations in the stock market, diversifying into alternative asset classes can be a prudent strategy to reduce overall portfolio risk.

- Overview of real estate investment and its potential correlation with the stock market: Real estate investment can provide diversification benefits, as it often exhibits a lower correlation with the stock market. However, it's essential to consider factors such as property location, market conditions, and potential liquidity constraints.

- Analysis of bond markets and their role in portfolio diversification: Bonds, particularly government bonds, can provide a counterbalance to the riskier investments in your portfolio during periods of high equity valuations, offering relative stability.

- Brief discussion of other alternative investments: Other alternatives, like hedge funds and private equity, may offer higher potential returns but often come with higher risks and lower liquidity. These are generally suitable only for sophisticated investors with higher risk tolerances.

Conclusion

BofA's analysis highlights the current high stock market valuations, driven by factors such as low interest rates and strong corporate earnings. While this presents opportunities, it also necessitates a cautious approach. Investors should diversify their portfolios, consider their risk tolerance and investment timeline, and explore alternative asset classes to mitigate risk. Understanding high stock market valuations and BofA's insights are crucial for developing a robust investment strategy. Conduct thorough research and consider consulting with a financial advisor to create a personalized plan that aligns with your individual financial goals. Understanding high stock market valuations is key to long-term investment success.

Featured Posts

-

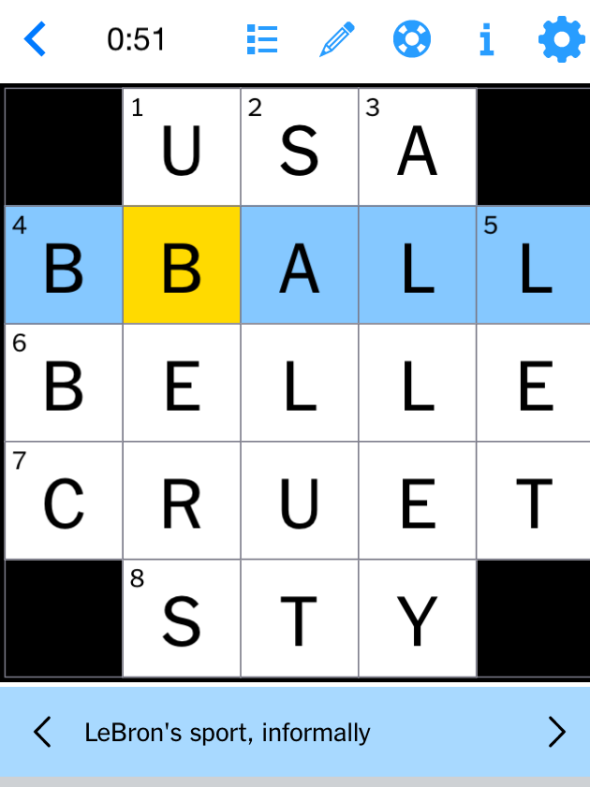

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025 -

Liverpools Luck Arne Slot And Luis Enrique On Alisson And The Reds

May 21, 2025

Liverpools Luck Arne Slot And Luis Enrique On Alisson And The Reds

May 21, 2025 -

Dexter Funko Pops A Collectors Guide

May 21, 2025

Dexter Funko Pops A Collectors Guide

May 21, 2025 -

Buy Canadian Beauty Products A Look At Tariff Effects

May 21, 2025

Buy Canadian Beauty Products A Look At Tariff Effects

May 21, 2025 -

Family Tragedy Train Collision Leaves Two Adults Dead Children Injured And Missing

May 21, 2025

Family Tragedy Train Collision Leaves Two Adults Dead Children Injured And Missing

May 21, 2025

Latest Posts

-

Four Star Admirals Corruption Conviction A Detailed Analysis

May 21, 2025

Four Star Admirals Corruption Conviction A Detailed Analysis

May 21, 2025 -

Retired Admiral Found Guilty Details On Four Bribery Convictions

May 21, 2025

Retired Admiral Found Guilty Details On Four Bribery Convictions

May 21, 2025 -

Admirals Bribery Case A Window Into The Navys Culture Of Corruption

May 21, 2025

Admirals Bribery Case A Window Into The Navys Culture Of Corruption

May 21, 2025 -

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 21, 2025

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 21, 2025 -

Bribery Charges Against Top Navy Admiral Reveal Systemic Failures

May 21, 2025

Bribery Charges Against Top Navy Admiral Reveal Systemic Failures

May 21, 2025