Understanding High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA's stance on current high stock market valuations tends to be cautiously optimistic, leaning towards a neutral perspective rather than outright bullish or bearish. Their analysis often incorporates a blend of positive economic indicators and concerns about elevated valuation metrics. While acknowledging the historically high valuations, they often highlight factors that could support continued growth, albeit at a potentially slower pace. Specific reports and analyses vary over time, so it's crucial to refer to their most recent publications for the most up-to-date assessment.

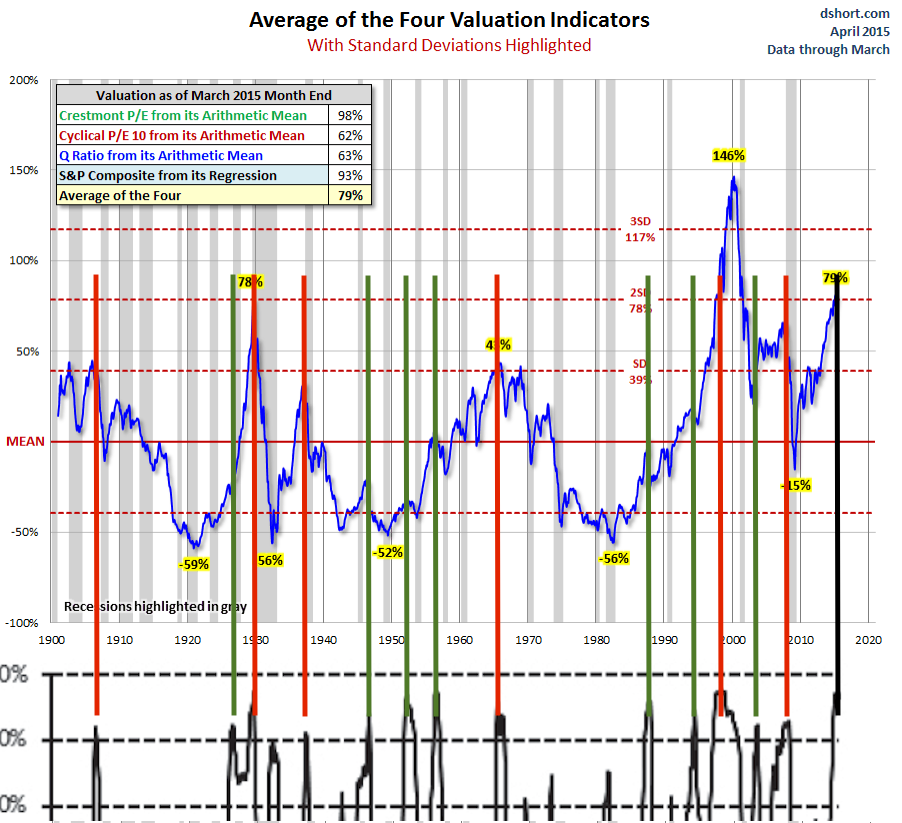

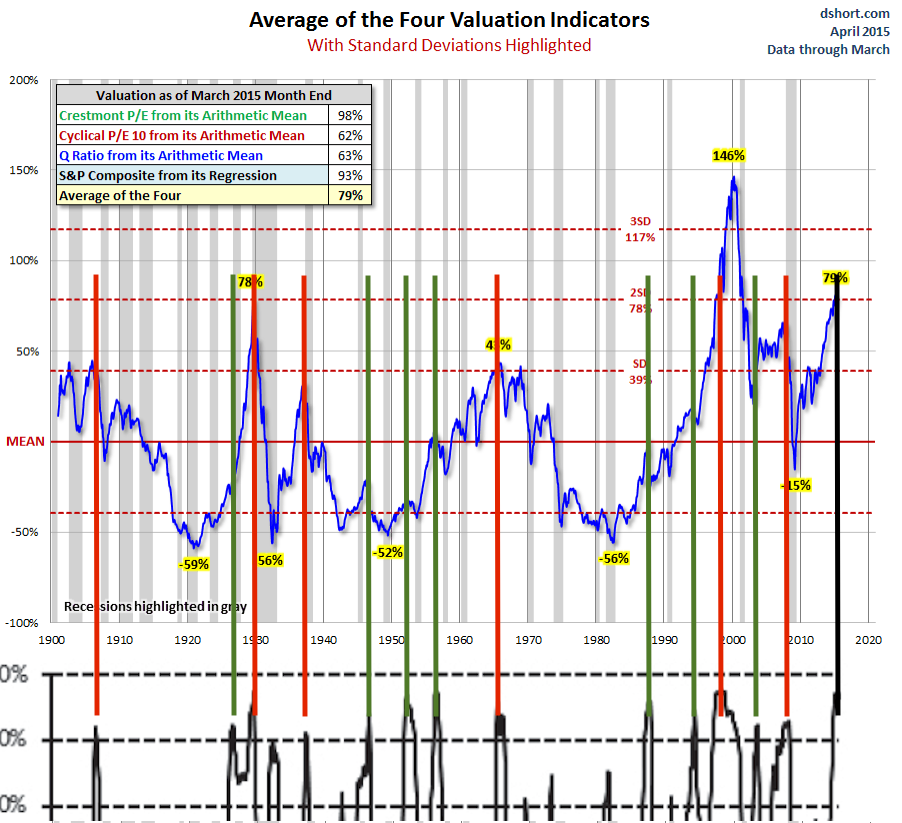

- Key metrics BofA uses to assess valuations: BofA utilizes a range of valuation metrics, including the Price-to-Earnings ratio (P/E), the Shiller PE ratio (CAPE), and the cyclically adjusted price-to-earnings ratio (CAPE) to gauge market valuation levels against historical averages and industry benchmarks. They also analyze various financial ratios and indicators to gain a holistic perspective.

- BofA's assessment of the impact of interest rates on valuations: Interest rate hikes are often a key factor influencing BofA's assessment of valuations. Higher interest rates generally make bonds more attractive relative to stocks, potentially leading to lower stock valuations. BofA's analysis will consider the magnitude and pace of interest rate adjustments to predict their likely impact on market sentiment and valuations.

- Specific sectors or companies BofA highlights: BofA's research often identifies specific sectors or companies that are deemed overvalued or undervalued based on their internal models and market analysis. These assessments can shift as market conditions change. For instance, certain technology stocks might be flagged as overvalued during periods of high growth expectations, while cyclical sectors might appear undervalued during economic downturns. Always refer to their latest research for current assessments.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is crucial for investors.

- Low interest rates: Historically low interest rates have made borrowing cheaper for companies and individuals, fueling investment and spending, thereby boosting corporate earnings and driving up stock prices. This low-cost capital environment incentivizes investment in riskier assets like equities.

- Quantitative easing (QE): Central banks' QE programs injected massive liquidity into the financial system, increasing the money supply and pushing down borrowing costs, further supporting asset prices including stocks.

- Strong corporate earnings growth: Although growth rates vary across sectors, strong corporate earnings, particularly in certain sectors, have helped to justify higher valuations for many companies. However, this factor is not uniform across the market and is subject to fluctuations.

- Investor sentiment and market psychology: Positive investor sentiment, driven by factors like technological innovation and economic optimism, can lead to higher stock prices even in the face of potential risks. Market psychology often plays a significant role in determining valuations.

- Technological advancements: Rapid technological advancements and the emergence of disruptive technologies have fueled significant growth in specific sectors, leading to high valuations for companies positioned to benefit from these trends.

Risks Associated with High Stock Market Valuations

Investing in a market with high stock market valuations carries inherent risks.

- Increased risk of market corrections or crashes: High valuations often precede market corrections or crashes, as prices become unsustainable relative to underlying fundamentals. Market corrections are a natural part of the cycle, but can lead to significant short-term losses.

- Potential for lower future returns: Stocks purchased at high valuations generally offer lower potential returns compared to those bought at lower valuations. Future returns depend on earnings growth and other factors, but historically high valuations suggest potentially lower returns.

- Vulnerability to economic downturns or interest rate hikes: High valuations make the market more susceptible to economic shocks and interest rate increases. These events can trigger widespread selling pressure, resulting in sharp price declines.

- The impact of inflation on stock valuations: Inflation erodes the purchasing power of earnings, potentially impacting stock valuations. Higher inflation rates can lead to higher interest rates and decreased consumer spending.

Investment Strategies for High Stock Market Valuations: BofA's Recommendations (if available)

BofA's recommendations for navigating high stock market valuations often emphasize a cautious, diversified approach. Specific recommendations vary based on their current market outlook. (Note: Specific investment recommendations require access to BofA's research reports).

- Diversification strategies: BofA usually emphasizes diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. Diversification reduces the impact of poor performance in any single asset class.

- Focus on value investing versus growth investing: Depending on their assessment, BofA might recommend a shift towards value investing (identifying undervalued companies) versus growth investing (focusing on companies with high growth potential but potentially high valuations).

- Sector-specific recommendations: BofA might suggest specific sectors they believe offer more attractive risk-reward profiles in the current market environment.

- Importance of risk management: Proper risk management, including setting stop-loss orders and establishing a clear investment strategy, is vital in high-valuation environments.

- Consideration of alternative investments: In periods of high stock market valuations, alternative investments (like commodities or certain fixed-income strategies) may be considered to diversify exposure.

Long-Term Perspective and Market Volatility

BofA typically emphasizes a long-term perspective even in periods of market volatility associated with high stock market valuations. While acknowledging the potential for short-term corrections, they often highlight the long-term growth potential of the market, particularly when factoring in economic fundamentals and technological advancements. Their predictions for market trends are typically presented in their research and should be consulted for the latest updates.

Conclusion

BofA's insights on high stock market valuations highlight the need for a balanced and diversified approach. While acknowledging the risks associated with currently elevated valuations, their analysis often incorporates potential positive factors such as strong corporate earnings in certain sectors and underlying economic growth. The factors driving these high valuations, including low interest rates and increased market liquidity, are important to consider. A well-diversified investment strategy that incorporates risk management and a long-term perspective is key to success in this dynamic market environment.

Understanding and navigating high stock market valuations requires careful consideration of various factors. By incorporating BofA's analysis and adopting a well-diversified approach, investors can better position themselves for success in this dynamic market. Conduct thorough research and consult with a financial advisor before making any investment decisions related to high stock market valuations. Stay informed about changes in market conditions and adjust your strategy as needed to manage your investment portfolio effectively in the face of high valuations.

Featured Posts

-

Government Plans Early Prison Releases Amidst Wilders Protest

May 18, 2025

Government Plans Early Prison Releases Amidst Wilders Protest

May 18, 2025 -

Explore Taylor Swifts Eras Tour Costumes High Resolution Photos

May 18, 2025

Explore Taylor Swifts Eras Tour Costumes High Resolution Photos

May 18, 2025 -

New Orleans Jail Escape Video Evidence Released By Cnn

May 18, 2025

New Orleans Jail Escape Video Evidence Released By Cnn

May 18, 2025 -

Revolutionizing Coding With Chat Gpts New Ai Coding Agent

May 18, 2025

Revolutionizing Coding With Chat Gpts New Ai Coding Agent

May 18, 2025 -

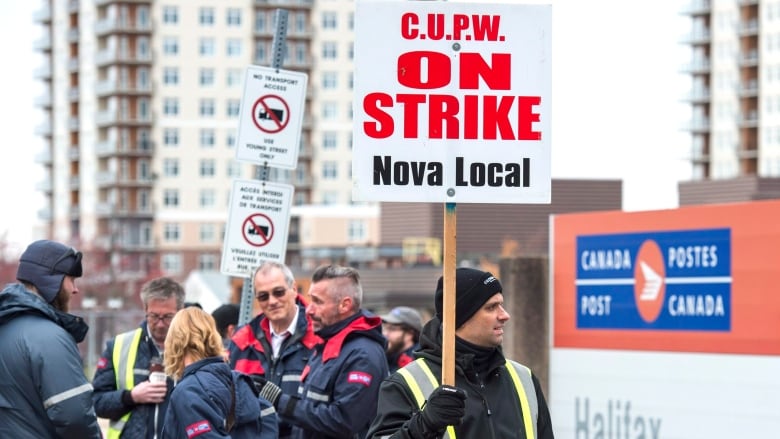

Is Canada Post Effectively Bankrupt A New Report Advocates For Delivery Changes

May 18, 2025

Is Canada Post Effectively Bankrupt A New Report Advocates For Delivery Changes

May 18, 2025

Latest Posts

-

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025 -

Following Breakup Claims Kanye West And Bianca Censori Enjoy Dinner In Spain

May 18, 2025

Following Breakup Claims Kanye West And Bianca Censori Enjoy Dinner In Spain

May 18, 2025 -

Pokhorony Po Uestovski Vdokhnovenie Ot Pashi Tekhnikom I Zaveschanie Kane

May 18, 2025

Pokhorony Po Uestovski Vdokhnovenie Ot Pashi Tekhnikom I Zaveschanie Kane

May 18, 2025 -

Kanye West Bianca Censori Dinner Date Defies Breakup Reports In Spain

May 18, 2025

Kanye West Bianca Censori Dinner Date Defies Breakup Reports In Spain

May 18, 2025 -

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025