Understanding Investor Psychology In Volatile Markets

Table of Contents

The Impact of Fear and Greed on Investment Decisions

The powerful emotions of fear and greed significantly influence investor behavior, often leading to panic selling and impulsive buying. These emotional responses can dramatically impact investment outcomes, especially during periods of market volatility.

- Fear can lead to selling assets at a loss, even if the underlying fundamentals remain strong. This is often driven by a desire to avoid further losses, even if it means locking in a loss prematurely.

- Greed, on the other hand, can encourage over-investment in speculative assets, ignoring potential risks. The allure of quick profits overrides rational assessment of risk.

- Herd mentality: Investors often follow the crowd, exacerbating market swings. This "bandwagon effect" can lead to significant price fluctuations as investors react emotionally to the actions of others, rather than conducting their own due diligence.

Loss aversion, a cognitive bias where the pain of a loss is felt more strongly than the pleasure of an equivalent gain, significantly impacts decision-making. Many investors will take more risks to avoid a loss than to achieve a comparable gain. Historical market crashes, like the 1987 Black Monday or the 2008 financial crisis, clearly demonstrate the devastating impact of fear and greed driving market volatility and irrational investment decisions. Cognitive biases, such as confirmation bias (seeking information that confirms pre-existing beliefs), further amplify these emotional responses.

Recognizing and Managing Your Own Biases

Several common cognitive biases affect investor behavior and contribute to poor investment decisions during times of market volatility. Understanding these biases is crucial to making rational choices.

- Overconfidence bias: Investors often overestimate their ability to predict market movements, leading to excessive risk-taking and poor portfolio diversification.

- Anchoring bias: Investors tend to rely too heavily on initial information, even if outdated. This can lead to sticking with an investment strategy despite changing market conditions.

- Availability heuristic: Recent events disproportionately influence decisions. Negative news, for instance, can dominate thinking, even if statistically less significant than other factors.

To mitigate these biases:

- Journaling: Regularly record your investment decisions and their rationales. This helps identify recurring biases.

- Seeking second opinions: Discuss your investment strategy with a trusted advisor or mentor. A fresh perspective can highlight flaws in your thinking.

- Diversification: Spread your investments across different asset classes to reduce your reliance on any single prediction.

By actively working to identify and manage your cognitive biases, you can significantly improve your investment decision-making, particularly in volatile markets.

The Role of Market Sentiment and News

Market sentiment, encompassing the collective optimism or pessimism of investors, significantly influences investor behavior and market volatility. Positive sentiment can drive prices higher, while negative sentiment can lead to sharp declines.

- News events: Major news events, both economic and geopolitical, can trigger emotional reactions, leading to dramatic market fluctuations.

- Social media and online forums: These platforms can amplify market sentiment, creating echo chambers and reinforcing emotional responses. This can lead to herd behavior and exacerbate price swings.

- Noise vs. significant news: Differentiating between market noise and truly significant news is crucial to avoid making rash investment decisions based on fleeting anxieties.

Filtering information and focusing on fundamental analysis is crucial during periods of heightened market volatility. Rather than reacting solely to headlines, prioritize a long-term investment strategy based on thorough research and a solid understanding of company fundamentals.

Developing a Robust Risk Tolerance Strategy

Understanding and managing your personal risk tolerance is paramount for successful investing, particularly during periods of market volatility. Your risk tolerance depends on various factors:

- Age: Younger investors generally have a longer time horizon and can tolerate higher risks.

- Financial goals: Short-term goals require a more conservative approach than long-term goals.

- Time horizon: The longer your investment time horizon, the more risk you can generally afford to take.

To mitigate risk:

- Assess your risk profile honestly: Use online questionnaires or consult a financial advisor to determine your appropriate risk level.

- Diversify your portfolio: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the impact of any single investment's poor performance.

- Avoid chasing high returns: High returns often come with higher risk. Focus on achieving steady, sustainable growth aligned with your risk tolerance.

Different investment strategies cater to various risk tolerances:

- Value investing: Focuses on undervalued assets.

- Growth investing: Targets companies with high growth potential.

- Index funds: Offer diversification and lower management fees.

Adjusting your investment strategy based on market volatility is essential. During periods of high uncertainty, consider shifting towards more conservative investments to protect your capital.

Seeking Professional Advice

Seeking advice from qualified financial advisors offers significant advantages, particularly during times of market volatility.

- Personalized guidance: Financial advisors provide tailored strategies based on your individual circumstances, financial goals, and risk tolerance.

- Comprehensive investment plan: They assist in creating a well-diversified and balanced investment portfolio.

- Support during uncertainty: They offer valuable support and guidance during market downturns, helping you avoid making emotional investment decisions.

Due diligence is crucial when selecting a financial advisor. Consider their experience, credentials, fees, and investment philosophy. Different types of advisors exist (e.g., financial planners, investment advisors, wealth managers), each with their specialization.

Conclusion

Understanding investor psychology is vital for navigating volatile markets. By recognizing the influence of fear, greed, cognitive biases, and market sentiment, investors can make more rational and informed decisions. Developing a robust risk tolerance strategy and seeking professional advice are crucial steps in protecting your investments and achieving your financial goals. Ignoring the impact of investor psychology in your investment strategy can lead to significant losses during periods of market volatility.

Learn more about managing your emotions and making sound investment decisions in volatile markets. Take control of your financial future by understanding investor psychology today!

Featured Posts

-

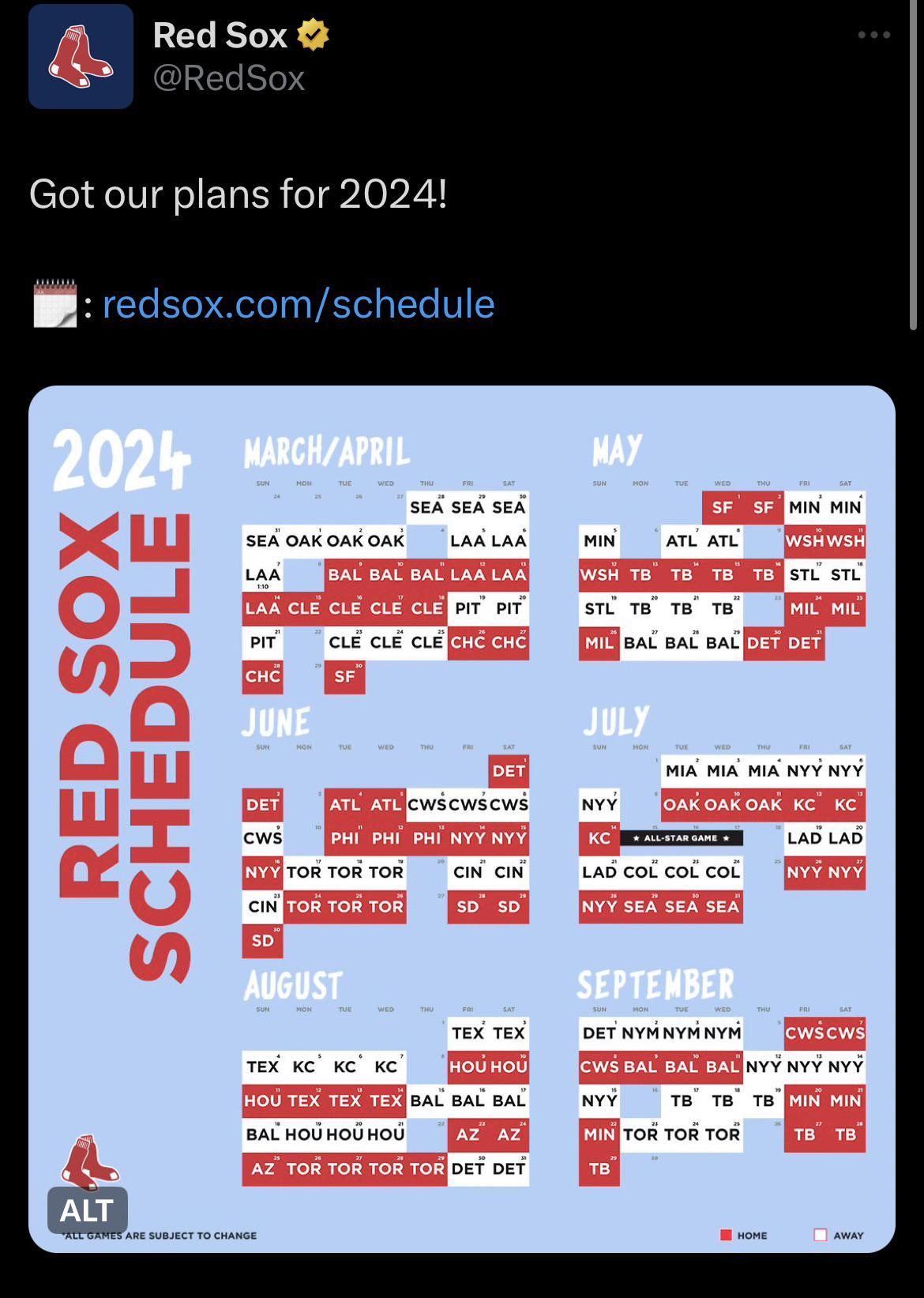

Red Sox And Blue Jays Face Off Full Lineups And Buehlers Impact

Apr 28, 2025

Red Sox And Blue Jays Face Off Full Lineups And Buehlers Impact

Apr 28, 2025 -

Yankees Avoid Sweep Rodon Shines In Crucial Win

Apr 28, 2025

Yankees Avoid Sweep Rodon Shines In Crucial Win

Apr 28, 2025 -

Quietly Dominant Could This Red Sox Player Be A Breakout Star

Apr 28, 2025

Quietly Dominant Could This Red Sox Player Be A Breakout Star

Apr 28, 2025 -

Federal Workers Facing Layoffs Transitioning To State And Local Government Jobs

Apr 28, 2025

Federal Workers Facing Layoffs Transitioning To State And Local Government Jobs

Apr 28, 2025 -

Colorado Qb Shedeur Sanders Joins The Cleveland Browns

Apr 28, 2025

Colorado Qb Shedeur Sanders Joins The Cleveland Browns

Apr 28, 2025