Understanding Principal Financial Group (PFG): An Analysis Of 13 Analyst Ratings

Table of Contents

Overview of Principal Financial Group (PFG)

Principal Financial Group (PFG) is a global financial services leader offering a diverse range of products and services. Its core business areas include retirement planning solutions, insurance products (life insurance, annuities), and investment management services. PFG caters to both individual and institutional clients, holding a substantial market share within the retirement and insurance sectors.

- Business Model: PFG operates through a diversified model, generating revenue from premiums, investment management fees, and other financial services.

- Key Services: Retirement plans (401(k), IRAs), life insurance, annuities, mutual funds, and investment advisory services.

- Market Position: A major player in the global financial services market, known for its strong brand reputation and wide product offerings.

- History & Performance: Established with a long history, PFG has demonstrated consistent financial performance, although subject to market fluctuations. (Note: Specific financial data would be inserted here in a published version).

- Key Competitors: MetLife, Prudential Financial, Northwestern Mutual, and other large financial institutions. Keywords: Principal Financial Group, PFG, financial services, insurance, retirement, investment management, competitors.

Methodology of Analyst Rating Analysis

This analysis considers 13 analyst ratings gathered from reputable sources including major financial news outlets (e.g., Bloomberg, Reuters, Yahoo Finance) and brokerage firms such as Goldman Sachs, Morgan Stanley, and JP Morgan. These sources provide a diversified perspective on PFG's investment prospects.

- Data Sources: The ratings used in this analysis were collected over a [Specify Time Period, e.g., three-month] period to ensure relevance.

- Rating Criteria: While no single weighting system was applied, the analysis considered the overall trend and consistency of ratings from different agencies. Greater emphasis was placed on ratings from firms with established records of financial analysis accuracy and expertise in the insurance sector.

- Limitations: Analyst ratings are inherently subjective and subject to revision. This analysis represents a snapshot in time and doesn't guarantee future performance. Keywords: Analyst ratings, methodology, financial analysis, data sources, weighting, limitations.

Summary of Analyst Ratings for PFG

The 13 analyst ratings were categorized as follows:

| Rating Category | Number of Ratings |

|---|---|

| Buy | 5 |

| Hold | 6 |

| Sell | 2 |

(Insert chart or graph visualizing the rating distribution here)

The average rating suggests a cautiously optimistic outlook on PFG's stock. This should be interpreted alongside the broader market conditions and the individual analyst reports. Keywords: PFG ratings, buy rating, sell rating, hold rating, analyst consensus, average rating, rating distribution.

Key Factors Influencing Analyst Ratings

Several key factors likely influenced the analyst ratings for PFG:

- Earnings Per Share (EPS): Consistent EPS growth indicates a healthy and profitable business, positively impacting analyst sentiment.

- Revenue Growth: Strong revenue growth demonstrates market demand for PFG's services and its competitive positioning.

- Return on Equity (ROE): A high ROE suggests efficient capital utilization and profitability, influencing investment attractiveness.

- Market Share: Maintaining or expanding market share in key sectors reflects competitiveness and potential for future growth.

- Regulatory Changes: The insurance and financial sectors are heavily regulated. Changes to regulations can significantly impact profitability and investor sentiment.

- Economic Outlook: Macroeconomic factors such as interest rates, inflation, and overall economic growth play a significant role in shaping analyst expectations. Keywords: EPS, revenue growth, ROE, market share, regulatory environment, economic factors, stock price, analyst sentiment, PFG stock.

Investment Implications and Recommendations Based on Analyst Ratings

The majority of analyst ratings suggest a "hold" or "buy" stance on PFG, indicating a generally positive sentiment. However, the presence of "sell" ratings highlights potential risks.

- Potential Investment Strategies: Investors with a long-term horizon and a moderate risk tolerance might consider PFG a viable investment. A "hold" strategy is also reasonable given the mixed analyst sentiment.

- Disclaimers: Analyst ratings should not be the sole basis for investment decisions. Thorough due diligence including fundamental analysis and personal risk assessment is crucial before committing capital. Keywords: Investment strategy, buy recommendation, sell recommendation, hold recommendation, risk assessment, investment decision, PFG investment.

Conclusion: Understanding Principal Financial Group (PFG) Investment Outlook

Our analysis of 13 analyst ratings reveals a generally positive, albeit cautious, outlook on Principal Financial Group (PFG). While the majority of ratings lean towards "hold" and "buy," the presence of "sell" ratings underscores the importance of comprehensive due diligence. The key factors influencing these ratings highlight the complexity of evaluating PFG's investment prospects. By understanding the various analyst ratings and performing your own due diligence, you can make a more informed decision about investing in Principal Financial Group (PFG). Keywords: Principal Financial Group, PFG, analyst ratings, investment decision, investment strategy, stock analysis, due diligence.

Featured Posts

-

The Knicks Offensive Woes How Brunsons Return Might Affect The Team

May 17, 2025

The Knicks Offensive Woes How Brunsons Return Might Affect The Team

May 17, 2025 -

Prosvjednici U Berlinu Upali U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025

Prosvjednici U Berlinu Upali U Teslin Izlozbeni Prostor Prijetnja Planetu

May 17, 2025 -

Last Chance Apple Tv At 3 For 3 Months

May 17, 2025

Last Chance Apple Tv At 3 For 3 Months

May 17, 2025 -

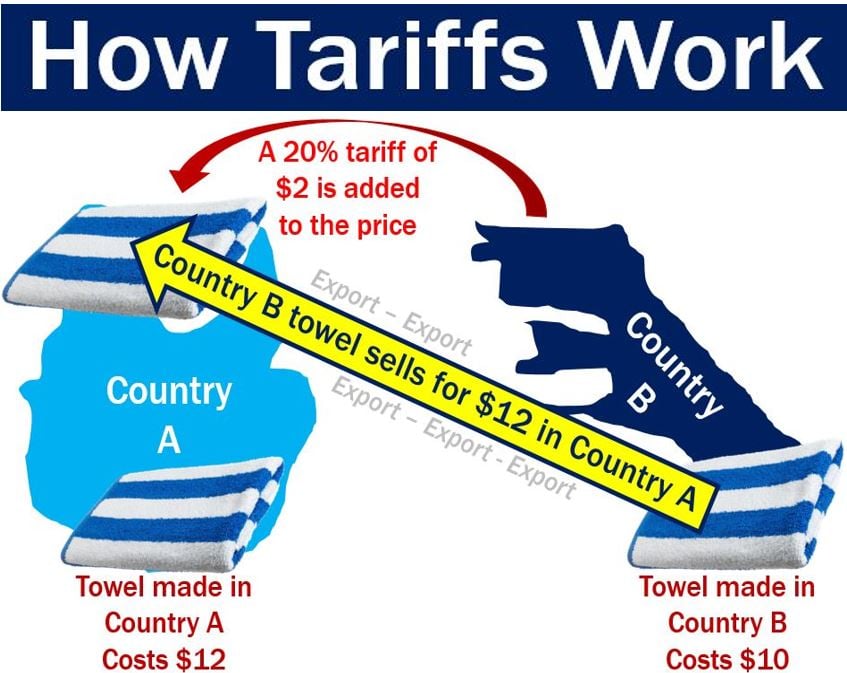

Impact Of Trump Tariffs On Japans Economy Q1 2018 As A Baseline

May 17, 2025

Impact Of Trump Tariffs On Japans Economy Q1 2018 As A Baseline

May 17, 2025 -

Mlb Game Day Mariners Vs Reds Predictions Analysis And Best Odds

May 17, 2025

Mlb Game Day Mariners Vs Reds Predictions Analysis And Best Odds

May 17, 2025