Understanding PwC's Decision To Exit Nine Sub-Saharan African Markets

Table of Contents

Financial Performance and Profitability in Sub-Saharan Africa

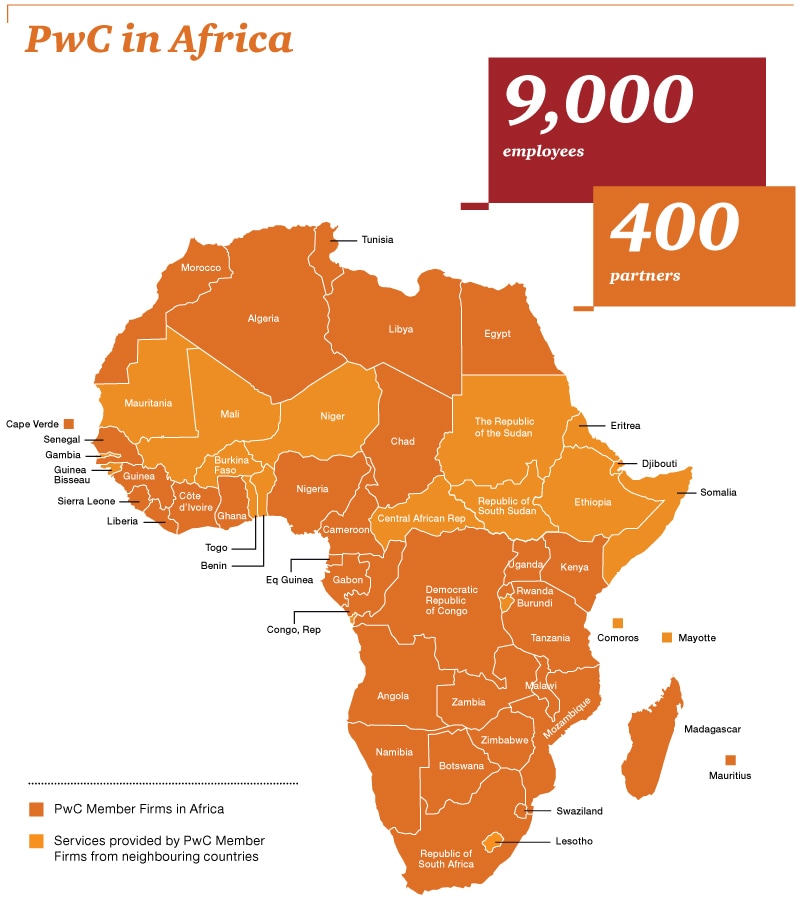

PwC's decision to exit these nine markets wasn't arbitrary. A key factor contributing to the "PwC market exit strategy" was likely underwhelming financial performance in these specific locations. Analyzing PwC's financial performance in Africa reveals a complex picture. While PwC operates in many successful African markets, the affected regions may have presented consistent challenges to profitability. "PwC financial performance Africa" data, while not publicly available in detail, likely pointed towards a strategic need for divestment.

Operating within the Sub-Saharan African context presents numerous obstacles. "Sub-Saharan Africa economic challenges" are significant, including:

- Economic Volatility: Fluctuations in currency exchange rates and unpredictable economic growth can severely impact profitability.

- Infrastructure Limitations: Poor infrastructure, including unreliable electricity and internet access, increases operational costs.

- Regulatory Hurdles: Navigating complex and sometimes inconsistent regulatory frameworks adds to the administrative burden and expense.

- Increased Competition: Intense competition from both established international firms and increasingly capable local players further squeezes profit margins.

These challenges contributed to:

- Low profitability margins compared to other regions.

- High operating costs due to infrastructure deficiencies.

- Increased competition from local and international firms.

Strategic Restructuring and Global Priorities

PwC's "PwC global strategy" is likely undergoing significant changes, with this exit aligning with a broader restructuring initiative. This "PwC Sub-Saharan Africa exit" suggests a shift in resource allocation towards markets offering higher growth potential and better profit margins. The decision reflects a "resource allocation strategy" prioritizing key markets and streamlining operations globally.

This strategic move involves:

- A focus on higher-growth, higher-margin markets.

- Centralization of operations and streamlining of processes for increased efficiency.

- Significant investment in technology and digital transformation in core markets, enhancing competitiveness and profitability. This "corporate restructuring" prioritizes long-term sustainability and growth.

Political and Regulatory Risks in Sub-Saharan Africa

The "PwC Africa withdrawal" is also influenced by the political and regulatory landscape within the affected Sub-Saharan African countries. "Political risk Africa" and "regulatory uncertainty Africa" are considerable factors influencing business decisions.

Several issues likely played a role:

- Political Instability: Political instability in specific countries can disrupt business operations and create uncertainty for investment.

- Changes in Tax Laws or Regulations: Unpredictable changes in tax laws and regulations can significantly impact profitability and operational efficiency.

- Increased Bureaucratic Hurdles and Corruption: Navigating bureaucratic hurdles and dealing with corruption can be both time-consuming and expensive. "Sub-Saharan Africa political instability" and associated corruption are well-documented challenges.

These factors contribute to the significant "business risks in Africa," impacting investment decisions for multinational corporations like PwC.

Impact on Clients and Employees

The "PwC Sub-Saharan Africa exit" has significant implications for both clients and employees. PwC needs to manage the transition smoothly and minimize disruption. The company likely has developed comprehensive transition plans:

- Client Transition Plans and Support Services: Ensuring a seamless transition of services to alternative providers is crucial for maintaining client relationships.

- Employee Relocation or Redeployment Options: Providing support and opportunities for affected employees is essential for minimizing negative impacts on the workforce.

- Potential Disruption to Ongoing Projects: Mitigation strategies are needed to minimize disruptions to ongoing projects and ensure their completion. Effective "employee support" is a vital part of the exit strategy. The focus should be on a transparent and fair process for all.

Conclusion

PwC's decision to exit nine Sub-Saharan African markets is a complex one, driven by a confluence of factors. Poor financial performance in those specific markets, coupled with a global strategic restructuring prioritizing higher-growth and higher-margin opportunities, played a key role. Furthermore, the inherent political and regulatory risks within the Sub-Saharan African business environment likely influenced this "PwC market exit strategy." The impact on clients and employees highlights the importance of a carefully managed transition. Understanding the reasons behind the "PwC Sub-Saharan Africa exit" is crucial for navigating the evolving landscape of the Sub-Saharan African business environment. To stay informed on further developments regarding the "PwC Sub-Saharan Africa exit" and its broader implications, it's recommended to follow PwC's official statements and reputable industry news sources.

Featured Posts

-

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025 -

Immigrant Detention Following Underground Nightclub Raid Cnn Report

Apr 29, 2025

Immigrant Detention Following Underground Nightclub Raid Cnn Report

Apr 29, 2025 -

Dont Miss Out Hudsons Bay Liquidation Sale Now On

Apr 29, 2025

Dont Miss Out Hudsons Bay Liquidation Sale Now On

Apr 29, 2025 -

Fort Belvoir Holds Vigil Remembering Soldiers Lost In Helicopter Crash

Apr 29, 2025

Fort Belvoir Holds Vigil Remembering Soldiers Lost In Helicopter Crash

Apr 29, 2025 -

Julianne Moore And Milly Alcock A Cult Connection Revealed In Netflixs Sirens Trailer

Apr 29, 2025

Julianne Moore And Milly Alcock A Cult Connection Revealed In Netflixs Sirens Trailer

Apr 29, 2025