Understanding Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

Key Valuation Metrics Explained

Understanding valuation metrics is fundamental to successful investing. These metrics provide a framework for assessing whether a stock is trading at a fair price, or potentially overvalued or undervalued. By comparing a company's valuation to its fundamentals (earnings, assets, sales), you can make more informed investment choices and potentially enhance your returns.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is one of the most widely used valuation metrics. It represents the market price per share divided by the company's earnings per share (EPS). A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or a perceived higher quality of earnings.

- Calculation: P/E Ratio = Market Price per Share / Earnings per Share

- Interpretation:

- High P/E Ratio: Could signify high growth potential, but also increased risk of overvaluation.

- Low P/E Ratio: Might suggest undervaluation, or potentially lower growth prospects or higher risk.

- Examples: Technology companies often have higher P/E ratios than utility companies due to different growth expectations. BofA's sector reports frequently highlight variations in P/E ratios across different industries, providing valuable comparative data.

- Limitations: P/E ratios can be distorted by one-time events, accounting practices, and cyclical industry factors. It's crucial not to rely solely on the P/E ratio.

Price-to-Book Ratio (P/B):

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company as recorded on its balance sheet.

- Calculation: P/B Ratio = Market Capitalization / Book Value of Equity

- Market Value vs. Book Value: Market value reflects what investors are willing to pay, while book value is a historical cost-based measure.

- Interpretation:

- High P/B Ratio: Suggests the market values the company significantly above its net asset value, potentially indicating strong growth prospects or intangible assets.

- Low P/B Ratio: Could indicate undervaluation or potential financial distress. However, industry context is vital; some industries naturally have lower P/B ratios.

- Usefulness: The P/B ratio is particularly useful for valuing companies with significant tangible assets, such as banks and real estate companies. BofA, with its extensive experience in the financial sector, frequently uses this metric in its analyses.

Price-to-Sales Ratio (P/S):

The Price-to-Sales ratio (P/S) measures the market value of a company relative to its revenue. It is often used for companies with negative earnings or those in early-stage growth.

- Calculation: P/S Ratio = Market Capitalization / Revenue

- Application: Useful for valuing companies with negative earnings or high growth potential where traditional metrics like P/E may not be applicable.

- Comparison: BofA's market analysis often includes comparisons of P/S ratios across competitors within the same sector, allowing investors to identify relatively overvalued or undervalued companies.

- Limitations: Doesn't account for profitability or expenses, so it's crucial to consider other factors.

Dividend Yield:

Dividend yield represents the annual dividend per share relative to the stock's market price. It provides insight into a company's income potential for investors.

- Calculation: Dividend Yield = (Annual Dividend per Share / Market Price per Share) * 100

- Importance: A key factor for income-oriented investors seeking regular cash flow.

- Analysis: BofA's research often analyzes dividend yield in conjunction with other valuation metrics to offer a more holistic perspective.

- Risks: High dividend yields can sometimes indicate higher risk, as companies might be forced to cut dividends if earnings decline.

BofA's Perspective on Current Market Valuations

BofA Securities regularly publishes reports analyzing market valuations across various sectors. Their recent research may highlight specific sectors they deem overvalued or undervalued based on their proprietary valuation models and analysis of market trends. (Note: Specific data from BofA reports would need to be inserted here, referencing the appropriate reports and with proper attribution.) For instance, BofA may point to technology stocks trading at high P/E multiples, suggesting potential overvaluation compared to historical averages or other sectors. Conversely, they might identify cyclical sectors with comparatively low P/E ratios, signaling possible undervaluation. Analyzing these reports provides valuable context for your own investment decisions. (Insert relevant charts and graphs from BofA reports here, with proper attribution).

Strategies for Utilizing Valuation Analysis

Effective investing relies on more than just individual metrics. A robust approach combines several strategies:

Comparative Analysis:

Compare valuation metrics across companies within the same industry. Identify companies with similar characteristics but significantly different valuations, potentially signaling attractive investment opportunities. For example, comparing the P/E ratios of two similar companies in the same sector will allow you to evaluate which one is comparatively more expensive or cheaper.

Intrinsic Value Calculation:

Estimating a company’s intrinsic value—what it's truly worth—is crucial. This can be done through techniques like discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value. BofA likely uses a combination of such methods, alongside their proprietary models, in their valuation assessments.

Risk Management:

Valuation metrics have limitations. Always consider qualitative factors—management quality, competitive landscape, regulatory risks—in your analysis. Diversification across different asset classes and sectors is critical to mitigate overall portfolio risk.

Conclusion

Understanding stock market valuations is crucial for successful investing. By utilizing key metrics like P/E, P/B, P/S ratios, and dividend yield, and incorporating insights from reputable sources such as BofA's market analyses, investors can make more informed decisions. Remember that no single metric provides a complete picture; a comprehensive approach, combining quantitative analysis with qualitative factors, is essential. Start improving your investment strategy today by mastering stock market valuations and leveraging resources like BofA's research.

Featured Posts

-

The Border Mails James Wiltshire 10 Years In Pictures

May 23, 2025

The Border Mails James Wiltshire 10 Years In Pictures

May 23, 2025 -

County Season Preview Familiar Faces And The Race For Trophies

May 23, 2025

County Season Preview Familiar Faces And The Race For Trophies

May 23, 2025 -

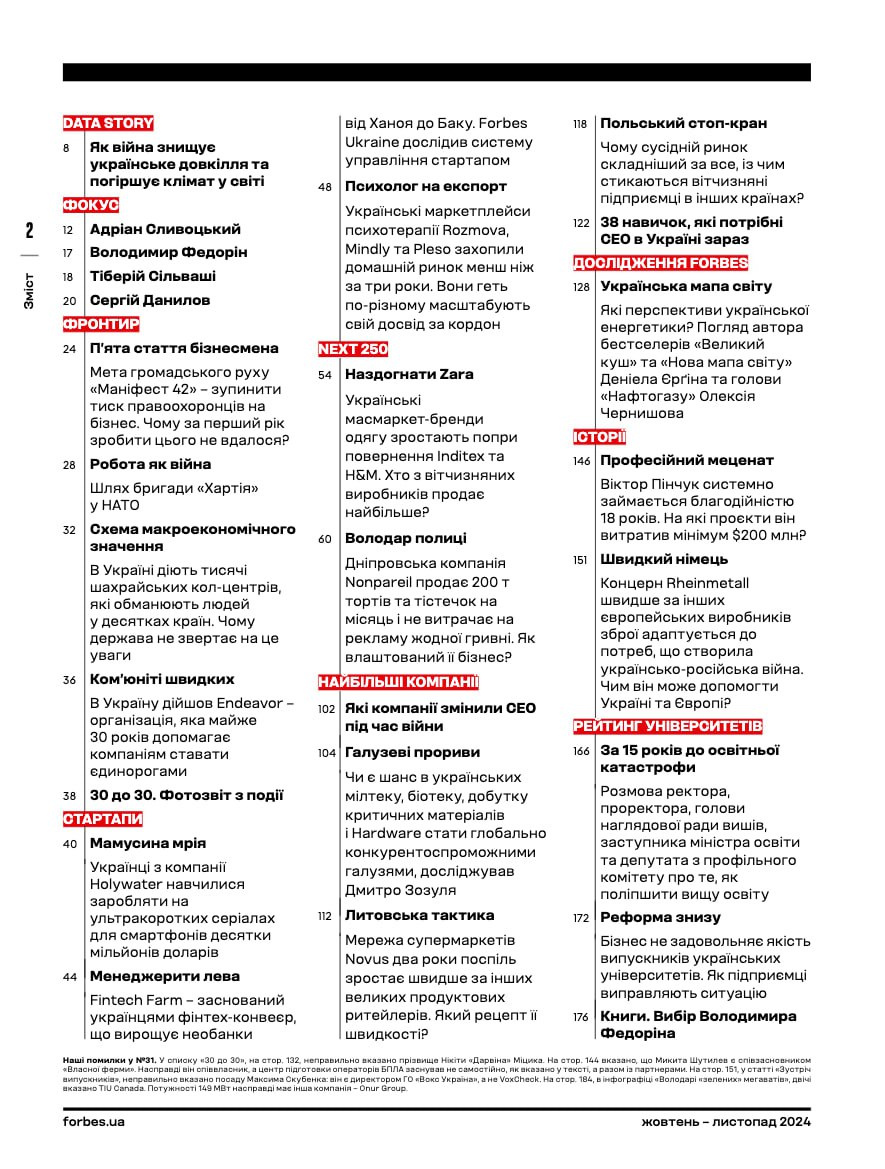

Naybilshi Finansovi Kompaniyi Ukrayini Za Dokhodami U 2024 Rotsi

May 23, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Dokhodami U 2024 Rotsi

May 23, 2025 -

Internet Reacts Kermit The Frog To Speak At Umd Graduation

May 23, 2025

Internet Reacts Kermit The Frog To Speak At Umd Graduation

May 23, 2025 -

James Wiltshires Photography 10 Years With The Border Mail

May 23, 2025

James Wiltshires Photography 10 Years With The Border Mail

May 23, 2025

Latest Posts

-

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Concert

May 23, 2025

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Concert

May 23, 2025 -

Fort Worth Stockyards Joe Jonas Unexpected Performance

May 23, 2025

Fort Worth Stockyards Joe Jonas Unexpected Performance

May 23, 2025 -

The Last Rodeo Highlighting Neal Mc Donoughs Character

May 23, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Character

May 23, 2025 -

Neal Mc Donough And The Last Rodeo A Western Showdown

May 23, 2025

Neal Mc Donough And The Last Rodeo A Western Showdown

May 23, 2025 -

Experience Free Films And Celebrity Encounters At The Dallas Usa Film Festival

May 23, 2025

Experience Free Films And Celebrity Encounters At The Dallas Usa Film Festival

May 23, 2025