Understanding Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

Key Valuation Metrics: Decoding the Numbers

Understanding the numbers behind a stock's price is fundamental to successful investing. Several key metrics help investors assess a company's value relative to its earnings, assets, and future cash flows. Let's delve into some of the most commonly used valuation metrics.

Price-to-Earnings Ratio (P/E):

- Definition and Calculation: The P/E ratio is calculated by dividing a company's market price per share by its earnings per share (EPS). It shows how much investors are willing to pay for each dollar of a company's earnings.

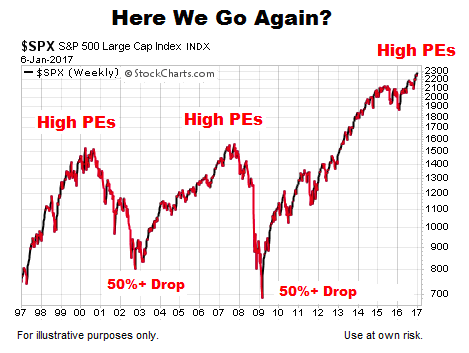

- Interpretation: A high P/E ratio might suggest that the market expects high future growth, while a low P/E ratio could indicate that the stock is undervalued or that the market anticipates slower growth. It's crucial to compare a company's P/E ratio to its industry peers and historical averages. Industry benchmarks provide context.

- BofA's Perspective: BofA analysts regularly incorporate P/E ratios into their stock analysis, considering factors like industry trends and economic forecasts. For example, BofA might analyze the P/E ratio of tech companies differently than those in the consumer staples sector, considering the differing growth prospects. Their research often highlights companies with compelling P/E ratios relative to their growth potential.

- Limitations: The P/E ratio can be distorted by accounting practices and one-time events. It's not a standalone metric and should be used in conjunction with other valuation methods.

Price-to-Book Ratio (P/B):

- Definition and Calculation: The P/B ratio compares a company's market capitalization to its book value (assets minus liabilities). It indicates how much investors are willing to pay for each dollar of net assets.

- Interpretation: A high P/B ratio may suggest that a company is overvalued, or that the market anticipates significant future growth. A low P/B ratio might indicate undervaluation or potential financial distress. Sectoral differences are important; financial companies, for example, usually have lower P/B ratios than technology companies.

- BofA's Insights: BofA uses P/B ratios in conjunction with other metrics, recognizing its limitations. Their analysis considers the industry context and the quality of a company's assets. For example, BofA might place greater emphasis on P/B ratios for companies with significant tangible assets, such as real estate companies.

- Limitations and Considerations: Book value can be less relevant for companies with significant intangible assets, such as technology firms. Inflation can also impact the book value accuracy.

Discounted Cash Flow (DCF) Analysis:

- Explanation: DCF analysis is a more complex valuation method that estimates a company's intrinsic value by discounting its projected future cash flows back to their present value. It requires forecasting future cash flows, the discount rate (reflecting risk), and terminal value.

- Advantages and Disadvantages: DCF provides a theoretically robust valuation, but it relies heavily on assumptions about future cash flows, making it sensitive to forecast errors.

- BofA's Utilization: BofA employs DCF analysis extensively in its investment research, developing sophisticated models incorporating various scenarios and risk factors. Their case studies often demonstrate the use of DCF to evaluate long-term investment opportunities.

- Challenges in Forecasting: Accurately predicting future cash flows is the main challenge of DCF analysis. Unforeseen economic events or changes in a company's competitive landscape can significantly alter its future cash flows.

Other Relevant Metrics:

- The PEG ratio (P/E ratio divided by the growth rate) helps to adjust the P/E ratio for growth.

- EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization) is useful for comparing companies with different capital structures.

These alternative metrics can provide a more comprehensive view of a company’s valuation, especially in specific situations. For a deeper understanding, consult financial resources such as BofA's research publications or reputable financial textbooks.

BofA's Market Outlook and Valuation Strategies

BofA's extensive research and analytical capabilities provide valuable insights into current market conditions and their impact on valuations.

Current Market Conditions and their Impact on Valuations:

BofA continuously monitors macroeconomic factors like interest rates, inflation, and geopolitical events. These factors significantly influence investor sentiment and stock valuations. For example, rising interest rates typically lead to lower valuations as the discount rate in DCF models increases. BofA's reports detail their analyses of these factors and their anticipated effects on market valuations.

Sector-Specific Valuation Approaches:

Valuation approaches vary across sectors due to differences in growth rates, risk profiles, and industry dynamics. BofA utilizes specialized valuation techniques for each sector, adapting their methodologies to reflect the unique characteristics of different industries. For example, they might employ different valuation multiples for technology companies versus utilities companies, given their distinct growth trajectories and risk profiles.

Risk Management and Valuation:

Risk assessment is critical in valuation. BofA incorporates various risk factors – including macroeconomic risks, industry-specific risks, and company-specific risks – into their valuation models. They account for uncertainties and potential downside scenarios, providing a more comprehensive view of the potential return and risk associated with each investment.

Practical Applications for Investors: Using Valuation to Make Informed Decisions

Understanding valuation metrics is crucial for making sound investment decisions.

Building a Portfolio Based on Valuation:

- Identify undervalued stocks by comparing their valuation metrics (P/E, P/B, DCF) to their industry peers and historical averages.

- Diversify your portfolio across different sectors to reduce overall risk. BofA's research can guide you in identifying attractive investment opportunities across various sectors.

Monitoring Your Investments:

Regularly review the valuation metrics of your holdings to assess their performance relative to market conditions and your investment objectives. Track key metrics to ensure your portfolio remains aligned with your investment strategy. BofA suggests a regular review of your portfolio’s valuation, at least annually, and more frequently during times of significant market volatility.

Seeking Professional Advice:

While this article provides valuable insights, remember that self-analysis has limitations. Consulting with a financial advisor can provide personalized guidance tailored to your specific circumstances and investment goals. BofA's wealth management services offer expertise in portfolio construction and management based on rigorous valuation analysis.

Conclusion: Mastering Stock Market Valuations with BofA's Insights

Mastering stock market valuations involves understanding key metrics like P/E, P/B, and DCF analysis. BofA's perspective offers valuable insights into current market conditions, sector-specific valuation approaches, and effective risk management strategies. Use BofA's insights to understand stock market valuations and make informed investment decisions. Contact a BofA financial advisor today to discuss your investment strategy and develop a portfolio aligned with your financial goals.

Featured Posts

-

Myke Wright Lizzos Partner Exploring His Net Worth And Profession

May 05, 2025

Myke Wright Lizzos Partner Exploring His Net Worth And Profession

May 05, 2025 -

Investing In Middle Management A Strategy For Enhanced Company Performance And Employee Retention

May 05, 2025

Investing In Middle Management A Strategy For Enhanced Company Performance And Employee Retention

May 05, 2025 -

Washington Capitals 2025 Playoff Strategy A Partnership With Vanda Pharmaceuticals

May 05, 2025

Washington Capitals 2025 Playoff Strategy A Partnership With Vanda Pharmaceuticals

May 05, 2025 -

Albaneses Labor Leads In Australias Federal Election As Polls Open

May 05, 2025

Albaneses Labor Leads In Australias Federal Election As Polls Open

May 05, 2025 -

Concerns Mount Over Darjeeling Teas Future

May 05, 2025

Concerns Mount Over Darjeeling Teas Future

May 05, 2025

Latest Posts

-

Five South Bengal Districts Under Heatwave Warning

May 05, 2025

Five South Bengal Districts Under Heatwave Warning

May 05, 2025 -

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 05, 2025

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 05, 2025 -

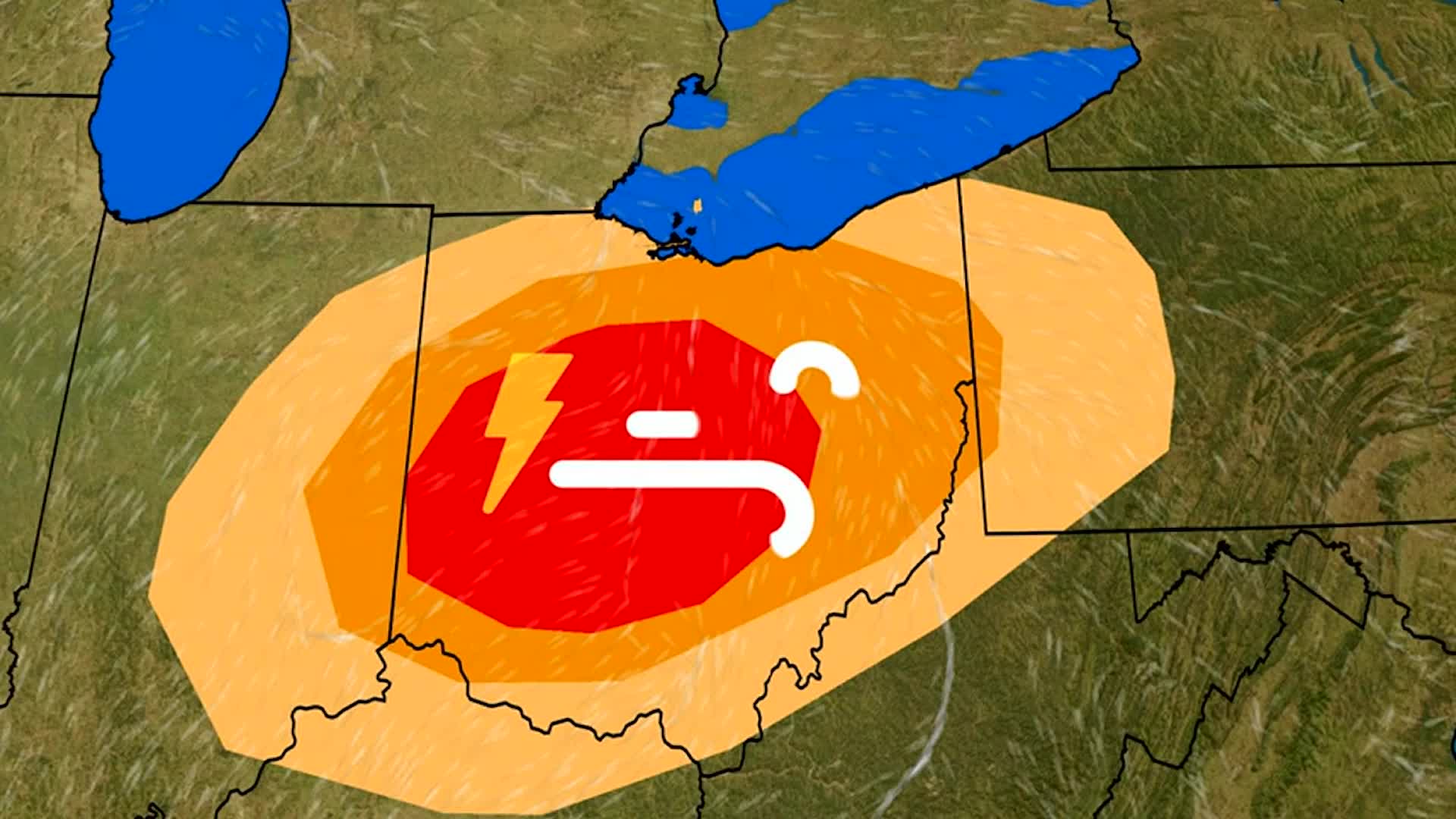

Mondays Severe Weather Threat A Nyc Forecast And Preparedness Guide

May 05, 2025

Mondays Severe Weather Threat A Nyc Forecast And Preparedness Guide

May 05, 2025 -

Heatwave Alert Five South Bengal Districts Brace For Extreme Heat

May 05, 2025

Heatwave Alert Five South Bengal Districts Brace For Extreme Heat

May 05, 2025 -

Challenges Facing Darjeeling Tea Production

May 05, 2025

Challenges Facing Darjeeling Tea Production

May 05, 2025