Understanding The BIG 100: Data From Big Rig ROCK Report 3.12

Table of Contents

Top Performing Fleets in the BIG 100: Identifying Industry Leaders

The Big Rig ROCK Report 3.12 ranks the top 100 trucking fleets (the BIG 100) based on a comprehensive set of key performance indicators (KPIs). Understanding what separates these industry leaders is key to improving your own fleet's performance.

Metrics Used for Ranking:

The ranking considers a multitude of factors crucial for successful fleet management. These KPIs provide a holistic view of fleet performance, highlighting areas of strength and weakness.

- Fuel Efficiency: Minimizing fuel consumption is vital for cost reduction. The BIG 100 consistently demonstrates best practices in fuel management.

- Safety Scores: A strong safety record reflects a commitment to driver training and vehicle maintenance, resulting in fewer accidents and improved operational efficiency.

- On-Time Delivery Rates: Meeting deadlines consistently is paramount for customer satisfaction and maintaining a positive reputation.

- Operational Efficiency: This encompasses various aspects, including minimizing downtime, optimizing routes, and efficient cargo handling.

Analyzing the data reveals that high-ranking fleets aren't necessarily defined by size. While large fleets possess economies of scale, many smaller, specialized fleets consistently excel due to their focused operations and niche expertise. Successful strategies often involve robust driver retention programs, advanced technology adoption, and proactive maintenance schedules.

Emerging Trends Revealed in the BIG 100 Data

The BIG 100 data reveals fascinating trends shaping the future of the trucking industry.

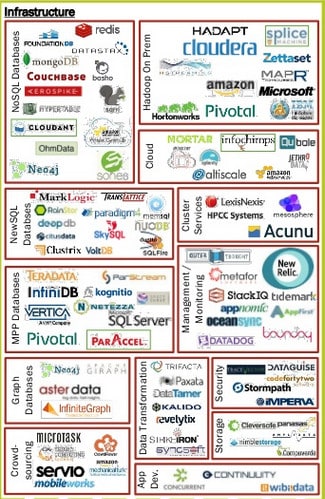

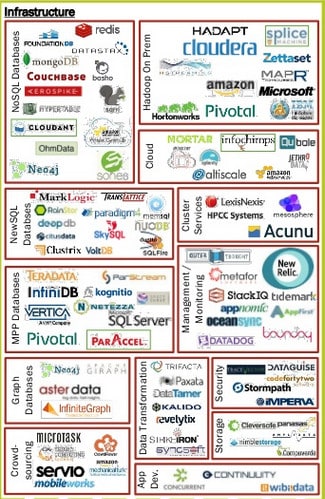

Technological Advancements:

Technology plays a pivotal role in the success of top-performing fleets.

- Telematics: Real-time tracking and data analysis optimize routes, improve fuel efficiency, and enhance driver safety.

- Route Optimization Software: Sophisticated algorithms analyze traffic patterns, road conditions, and delivery schedules to create the most efficient routes, minimizing fuel consumption and transit time.

- Driver Assistance Systems: Advanced driver-assistance systems (ADAS) such as lane departure warnings, automatic emergency braking, and adaptive cruise control enhance safety and prevent accidents.

Sustainability Initiatives:

The trucking industry is increasingly focused on sustainability. The BIG 100 data reflects this trend.

- Alternative Fuels: Adoption of alternative fuels like biodiesel, compressed natural gas (CNG), and even electric vehicles is gaining traction among top fleets committed to reducing their carbon footprint.

- Eco-Friendly Driving Practices: Training programs focused on fuel-efficient driving techniques, such as smooth acceleration and braking, contribute significantly to reduced fuel consumption and emissions.

Regional Performance Variations within the BIG 100

Geographic location significantly impacts fleet performance.

Geographic Analysis:

- Terrain: Mountainous regions pose unique challenges compared to flatlands, influencing fuel consumption and transit times.

- Fuel Prices: Fluctuations in fuel prices across different regions directly affect operating costs.

- Regulatory Environments: Variations in regulations regarding weight limits, hours of service, and emissions standards impact operational strategies.

Comparing East Coast and West Coast fleets reveals interesting disparities. West Coast fleets, often operating longer distances, may prioritize fuel efficiency more aggressively than those on the shorter routes of the East Coast.

Market Demand and its Influence:

Regional variations in market demand influence fleet performance. High demand areas may see increased operational pressures and higher freight rates, while less active regions may face challenges in maintaining consistent revenue streams. Understanding these regional supply chain dynamics is critical.

Key Takeaways and Actionable Insights from the BIG 100

The BIG 100 data underscores the importance of proactive fleet management, technological adoption, and a commitment to sustainability. Key takeaways include:

- Prioritizing fuel efficiency through technology and driver training offers significant cost savings.

- Investing in driver safety and training programs minimizes risks and enhances operational efficiency.

- Embracing sustainable practices not only reduces environmental impact but also enhances the company's image and attracts environmentally conscious clients.

Conclusion: Leveraging the BIG 100 for Improved Fleet Performance

The Big Rig ROCK Report 3.12 and its analysis of the BIG 100 provide invaluable insights into the current state of the trucking industry. By analyzing the data, trucking companies can identify best practices, improve their operational efficiency, enhance safety, and strengthen their competitive advantage. Analyze the BIG 100 data to identify areas for improvement within your own fleet. Unlock the potential of the BIG 100 by downloading the full Big Rig ROCK Report 3.12 today and gaining a competitive edge in the dynamic world of freight transportation.

Featured Posts

-

Zimbabwe Dominates Bangladesh On Day One Complete Control Secured

May 23, 2025

Zimbabwe Dominates Bangladesh On Day One Complete Control Secured

May 23, 2025 -

Freddie Flintoffs Journey From Crash To Recovery Healing Ptsd And A Renewed Purpose

May 23, 2025

Freddie Flintoffs Journey From Crash To Recovery Healing Ptsd And A Renewed Purpose

May 23, 2025 -

Sam Cook Earns England Call Up For Zimbabwe Test

May 23, 2025

Sam Cook Earns England Call Up For Zimbabwe Test

May 23, 2025 -

Roger Daltreys Health The Who Singer Battles Hearing And Sight Loss At 81

May 23, 2025

Roger Daltreys Health The Who Singer Battles Hearing And Sight Loss At 81

May 23, 2025 -

Big Rig Rock Report 3 12 Big 100 Comprehensive Trucking Data

May 23, 2025

Big Rig Rock Report 3 12 Big 100 Comprehensive Trucking Data

May 23, 2025

Latest Posts

-

Cat Deeleys Massimo Dutti Suit Perfect For Summer Workwear

May 23, 2025

Cat Deeleys Massimo Dutti Suit Perfect For Summer Workwear

May 23, 2025 -

Shop Cat Deeleys Midi Dress From Marks And Spencer

May 23, 2025

Shop Cat Deeleys Midi Dress From Marks And Spencer

May 23, 2025 -

Cat Deeleys Stunning Butter Yellow Suit Summer Office Style Inspiration

May 23, 2025

Cat Deeleys Stunning Butter Yellow Suit Summer Office Style Inspiration

May 23, 2025 -

Is Cat Deeleys M And S Midi Dress Still Available

May 23, 2025

Is Cat Deeleys M And S Midi Dress Still Available

May 23, 2025 -

Find Cat Deeleys M And S Midi Dress Limited Stock

May 23, 2025

Find Cat Deeleys M And S Midi Dress Limited Stock

May 23, 2025