Understanding The Challenges: Japan's Steep Government Bond Yield Curve

Table of Contents

The Mechanics of Japan's Government Bond Market

Japan's government bond market, dominated by Japanese Government Bonds (JGBs), is one of the largest and most liquid in the world. JGBs are issued by the Japanese Ministry of Finance to finance government spending. They are categorized by maturity, with short-term JGBs typically maturing within a year, medium-term bonds maturing in 1-10 years, and long-term bonds maturing in over 10 years. The Bank of Japan (BOJ) plays a crucial role, acting as both a buyer and seller of JGBs, influencing market liquidity and interest rates.

- Key Players: The market includes domestic and foreign banks, insurance companies, pension funds, and individual investors.

- Trading Volume: Daily trading volume is exceptionally high, reflecting the market's depth and liquidity.

- Market Depth: The market’s depth ensures efficient price discovery and minimizes price volatility, although recent events are challenging this.

Factors Contributing to the Steep Yield Curve

The recent steepening of Japan's government bond yield curve is a result of several interacting factors:

BOJ's Monetary Policy

The BOJ's Yield Curve Control (YCC) policy, aimed at keeping long-term interest rates low, has been a key factor. While initially successful in stimulating the economy, the policy has faced increasing pressure due to persistent inflation. The unintended consequence of YCC has been a widening gap between short-term and long-term yields, contributing to the steep curve.

Inflationary Pressures

Recent increases in inflation, both domestically and globally, are putting upward pressure on bond yields. Rising inflation erodes the purchasing power of fixed-income investments, leading investors to demand higher yields to compensate for the risk. Global inflation, particularly in the US, further exacerbates this pressure.

Global Economic Uncertainty

Global economic uncertainty, fueled by factors such as the war in Ukraine and supply chain disruptions, influences investor sentiment. Risk-averse investors may shift away from higher-risk assets, increasing demand for the perceived safety of Japanese government bonds, potentially impacting the yield curve. The actions of the US Federal Reserve and other central banks also play a significant role.

Increased Government Borrowing

Japan's substantial and growing government debt necessitates increased issuance of JGBs. This increased supply can, under certain conditions, put downward pressure on bond prices and upward pressure on yields, contributing to the steepening of the curve.

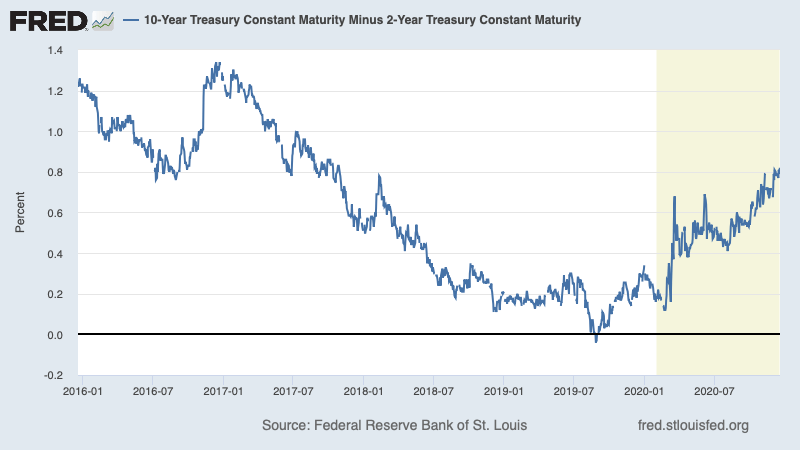

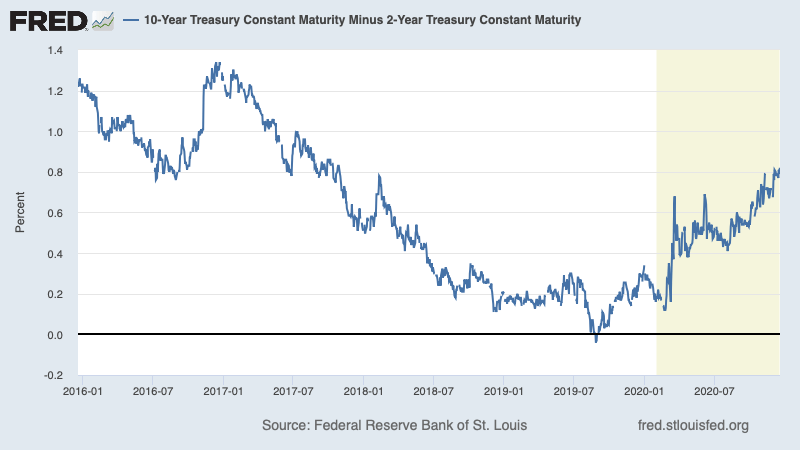

- Data Points: Charts showing the widening spread between short-term and long-term JGB yields, inflation data, and changes in government debt levels would illustrate these factors effectively.

Challenges Posed by the Steep Yield Curve

The steepening of Japan's government bond yield curve presents significant challenges across various sectors:

Japanese Banks

The steep yield curve compresses Japanese banks' net interest margins, impacting their profitability and potentially reducing their lending capacity. The difference between the cost of funding (short-term rates) and the return on lending (long-term rates) shrinks, squeezing profitability.

Pension Funds

Japanese pension funds, heavily invested in JGBs, face lower returns on their investments due to the changes in the yield curve. This necessitates adjustments to their investment strategies and may threaten their long-term solvency.

Government Finances

The steep curve increases the cost of borrowing for the Japanese government, making it more challenging to manage its already substantial debt. Higher interest payments could strain government finances and potentially limit public spending.

Economic Growth

The impact on banks and pension funds can negatively influence economic growth through reduced lending and investment. This slowdown can create a vicious cycle, further pressuring the government’s finances.

- Examples: Specific instances of banks reducing lending due to margin compression and pension funds adjusting their investment strategies would be valuable examples.

Potential Solutions and Future Outlook

The BOJ may consider adjustments to its YCC policy, potentially allowing for greater flexibility in long-term interest rates. This could involve gradually allowing yields to rise, aiming for a more sustainable yield curve. However, this shift carries risks, potentially triggering market volatility.

- Potential Scenarios: Analyzing the likely market reactions to different policy adjustments would provide valuable insight. Including expert opinions and market forecasts can further enhance this section.

Conclusion: Understanding and Managing Japan's Steep Government Bond Yield Curve

The steepening of Japan's government bond yield curve presents a complex set of challenges for the Japanese economy. Understanding the interplay of monetary policy, inflationary pressures, global economic uncertainty, and government borrowing is crucial for navigating this situation. Careful monitoring of the situation and proactive policy adjustments are necessary to mitigate potential negative consequences. Stay informed about developments in Japan's steep government bond yield curve and related economic indicators by consulting reputable financial news sources and economic reports. Understanding these dynamics is key to navigating the future of the Japanese economy.

Featured Posts

-

The Fortnite Music Change A Disaster

May 17, 2025

The Fortnite Music Change A Disaster

May 17, 2025 -

Reddit Service Interruption What We Know So Far

May 17, 2025

Reddit Service Interruption What We Know So Far

May 17, 2025 -

Angelo Stiller 18 Monate Beim Vf B Stuttgart Ein Rueckblick

May 17, 2025

Angelo Stiller 18 Monate Beim Vf B Stuttgart Ein Rueckblick

May 17, 2025 -

Aljzayr Tkrm Almkhrj Allyby Sbry Abwshealt Tkrym Astthnayy Lfnan Mtmyz

May 17, 2025

Aljzayr Tkrm Almkhrj Allyby Sbry Abwshealt Tkrym Astthnayy Lfnan Mtmyz

May 17, 2025 -

Jean Marsh Upstairs Downstairs Star And Co Creator Dies At 90

May 17, 2025

Jean Marsh Upstairs Downstairs Star And Co Creator Dies At 90

May 17, 2025