Understanding The D-Wave Quantum (QBTS) Stock Fall On Monday

Table of Contents

Analyzing the Market Conditions Preceding the QBTS Stock Drop

The QBTS stock fall didn't occur in a vacuum. Monday's market sentiment was generally negative, impacted by several macroeconomic factors. Understanding the broader market context is crucial to analyzing the D-Wave Quantum stock's specific performance.

- Broader Economic Headwinds: Reports of rising inflation or concerns about interest rate hikes could have created a risk-averse environment, impacting the tech sector, which often sees increased volatility during such periods. Investors may have moved away from riskier assets, like quantum computing stocks, seeking safer havens.

- Tech Sector Weakness: The overall performance of the tech sector on Monday also needs consideration. If other technology stocks, especially those involved in emerging technologies, experienced simultaneous declines, it could indicate a sector-wide correction rather than a problem specific to D-Wave Quantum.

- Quantum Computing Industry Sentiment: Investor confidence in the broader quantum computing industry plays a significant role. Any negative news or concerns regarding the overall viability or near-term prospects of quantum computing could trigger sell-offs across the sector, impacting QBTS stock.

D-Wave Quantum's Recent News and Announcements

Any recent announcements or events related to D-Wave Quantum could have significantly influenced investor decisions. Let's scrutinize the company's recent activities for clues.

- Earnings Reports and Financial Performance: Did D-Wave Quantum release any recent earnings reports or financial updates that fell short of investor expectations? Disappointing revenue figures or widening losses could trigger a sell-off.

- Contract Wins and Losses: Securing major contracts is crucial for companies in the quantum computing space. The loss of a significant contract, or failure to announce new ones, could negatively impact investor confidence.

- Product Launches and Technological Advancements: While positive announcements about new product launches or technological breakthroughs usually boost stock prices, delays or setbacks could have the opposite effect. Any perceived lack of progress compared to competitors could also contribute to a decline.

Speculation and Sentiment Affecting QBTS Stock Price

Market sentiment, often driven by speculation and rumors, can significantly impact stock prices. Social media chatter and analyst opinions played a role in the QBTS stock fall.

- Social Media Sentiment: Negative sentiment on social media platforms, especially from influential accounts or within specific investment communities, can trigger a wave of selling. Any perceived negative news spreading rapidly through social media could exacerbate the stock's decline.

- Analyst Ratings and Price Target Changes: Changes in analyst ratings or price targets from prominent financial institutions can influence investor behavior. A downgrade in rating or a reduction in price target would likely lead to selling pressure.

- Short Selling Activity: An increase in short-selling activity, where investors bet against a stock's price, could also contribute to a downward trend. Short-selling can create a self-fulfilling prophecy, as increased selling pressure further drives the price down.

Technical Analysis of the QBTS Stock Chart

A look at the QBTS stock chart on Monday provides further insight. While a detailed technical analysis requires expertise, certain key observations can be made.

- Support and Resistance Levels: The chart would reveal whether the price broke through any significant support levels, triggering stop-loss orders and further downward pressure. Conversely, any resistance levels encountered could limit the extent of the decline.

- Trading Volume: High trading volume during the price drop suggests strong selling pressure and increased investor participation in the decline. Low volume could indicate less significant selling pressure.

- Technical Indicators: Simple indicators like moving averages or the Relative Strength Index (RSI) could provide additional context. A bearish crossover in moving averages or an RSI indicating oversold conditions could offer clues about the potential for further price movements. (Note: this section should avoid overly technical jargon and keep the explanations simple for a broad audience.)

Conclusion: Understanding the QBTS Stock Fluctuations

The D-Wave Quantum (QBTS) stock fall on Monday was a multifaceted event, resulting from a confluence of market conditions, company-specific news, and speculative factors. The broader market's negative sentiment, potential concerns about D-Wave Quantum's performance, and the influence of social media and analyst opinions all played a role. While a complete understanding requires more detailed analysis, the information presented sheds light on the possible reasons behind this significant decline. To effectively navigate the volatile nature of the quantum computing market and monitor QBTS stock fluctuations, stay updated on D-Wave Quantum's announcements and follow relevant financial news sources. Understand the factors impacting QBTS, and remain informed about developments in the quantum computing industry. Stay updated on D-Wave Quantum (QBTS) stock to make well-informed investment decisions.

Featured Posts

-

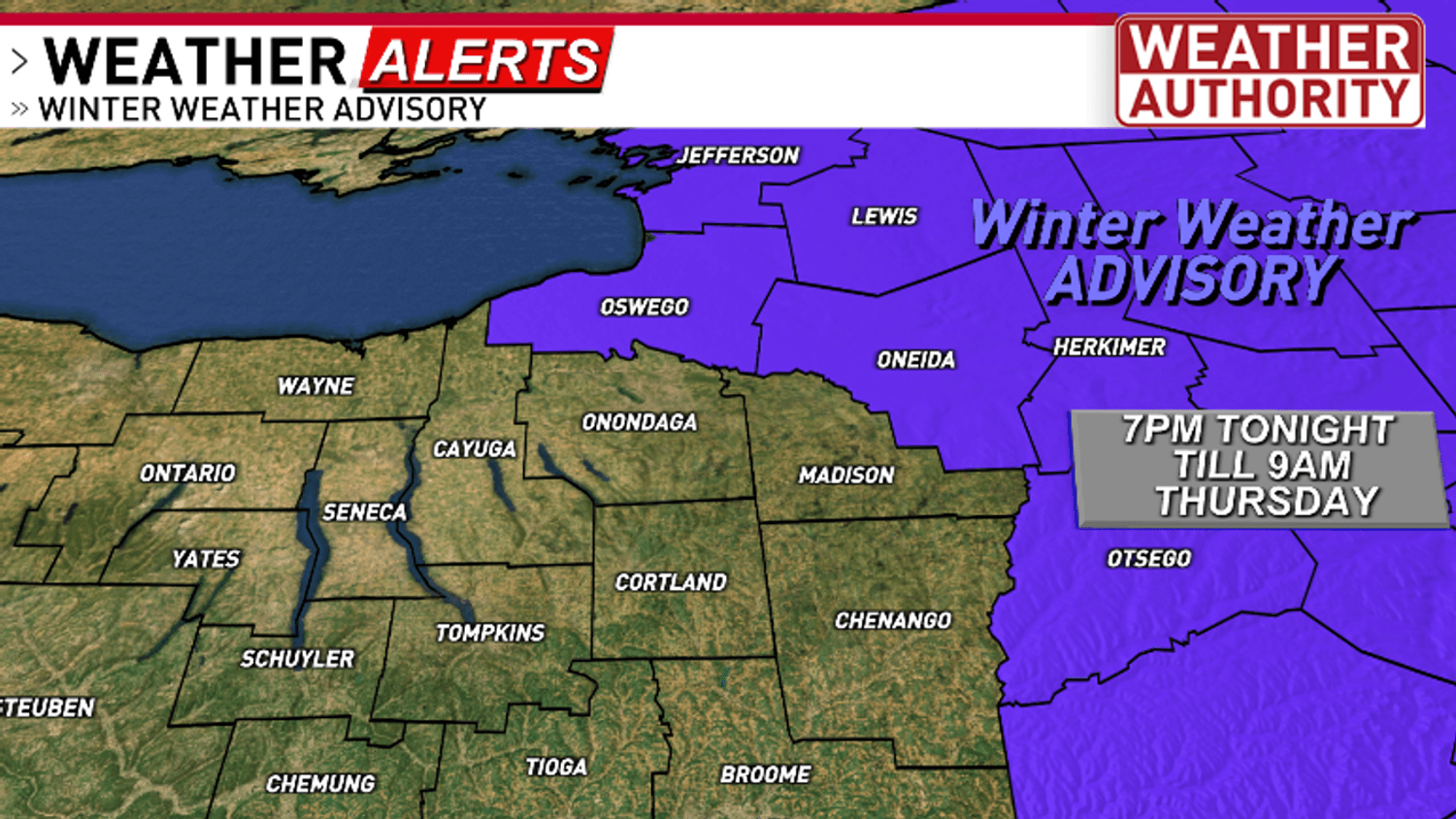

Staying Informed Winter Weather Advisories And School Delays

May 21, 2025

Staying Informed Winter Weather Advisories And School Delays

May 21, 2025 -

Dexter Resurrection Brings Back Beloved Villains

May 21, 2025

Dexter Resurrection Brings Back Beloved Villains

May 21, 2025 -

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025 -

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025 -

Javier Baez Recuperacion Productividad Y Futuro En El Beisbol

May 21, 2025

Javier Baez Recuperacion Productividad Y Futuro En El Beisbol

May 21, 2025

Latest Posts

-

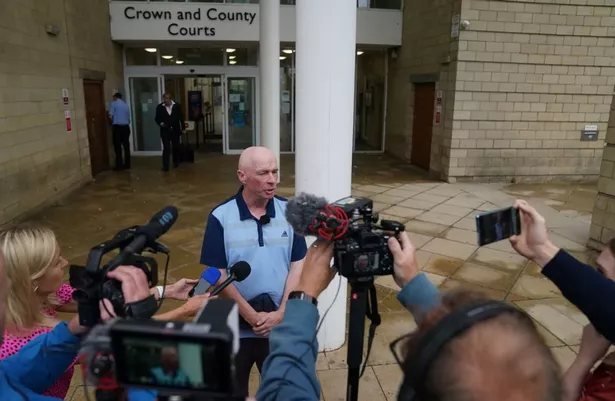

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025 -

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025 -

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025 -

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025