Understanding The Factors Behind D-Wave Quantum Inc.'s (QBTS) 2025 Stock Drop

Table of Contents

Increased Competition in the Quantum Computing Sector

The quantum computing sector is rapidly evolving, becoming increasingly competitive. D-Wave’s market share faced pressure from the emergence of powerful competitors employing different technological approaches. The rise of gate-based quantum computing, with its potential to surpass D-Wave's annealing approach in certain applications, significantly impacted the company's position.

-

Rise of Gate-Based Quantum Computing Technologies: Companies like IBM, Google, and Rigetti are making significant strides in gate-based quantum computing, attracting substantial investment and achieving higher qubit counts and improved coherence times. This poses a challenge to D-Wave's adiabatic quantum computation model. Keywords: quantum computing competitors, market share analysis, gate-based quantum computing, annealing quantum computing.

-

Increased Investment in Competing Companies: Massive investments poured into gate-based quantum computing research and development, accelerating progress and potentially eclipsing D-Wave's advancements. This disparity in funding contributed to D-Wave's perceived lag in the market.

-

Market Share Analysis: As a result of the increased competition, D-Wave's market share likely experienced a decline in 2025. Analyzing market share data from that period is crucial to understanding the extent of this impact and its contribution to the QBTS stock drop.

Technological Hurdles and Development Challenges

D-Wave's technology, based on adiabatic quantum computation, faces inherent limitations. Scaling the number of qubits while maintaining coherence—a crucial factor for stable quantum computations—proved challenging. This technological bottleneck, along with other hurdles, contributed to the QBTS stock decline.

-

Difficulties in Increasing Qubit Count While Maintaining Coherence: Increasing qubit numbers is paramount for solving complex problems. However, maintaining qubit coherence at higher qubit counts remains a significant technological hurdle for D-Wave and other quantum computing companies. Keywords: qubit coherence, error correction quantum computing, adiabatic quantum computation, scalability.

-

Challenges in Error Correction and Fault Tolerance: Quantum computers are extremely sensitive to noise and errors. Developing robust error correction and fault-tolerance mechanisms is critical for achieving reliable computation. D-Wave's progress in this area might have fallen short of investor expectations, impacting the stock price.

-

Slow Progress in Developing Practical Applications: The lack of widespread, commercially viable applications for D-Wave's technology also played a significant role. While showcasing some successes, the company may have struggled to demonstrate the broad applicability of its approach compared to competitors.

Financial Performance and Investor Sentiment

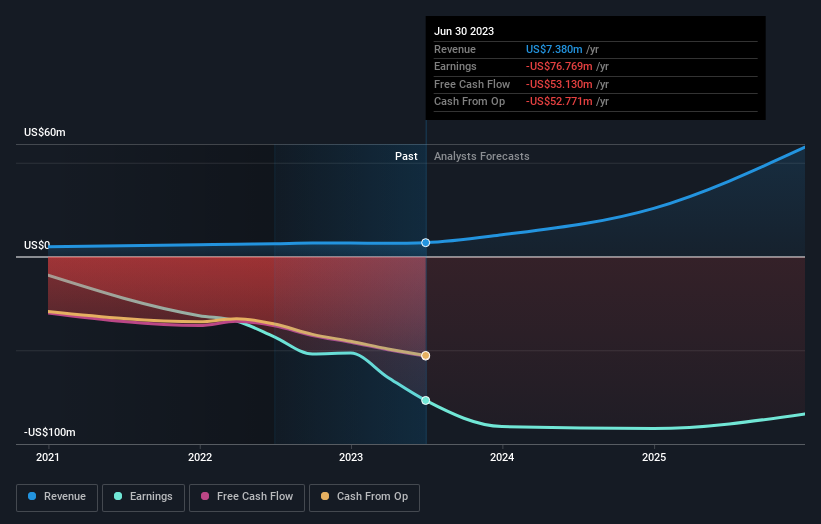

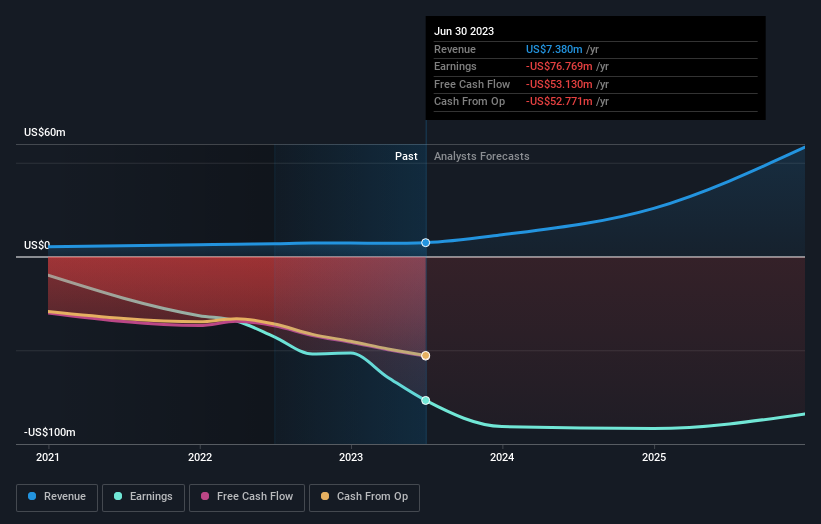

D-Wave's financial performance in the years leading up to 2025 significantly impacted investor sentiment and contributed to the stock drop. Persistent losses, revenue shortfalls, and the need for continuous funding impacted investor confidence.

-

Detailed Analysis of Financial Reports: A thorough examination of D-Wave's financial reports from 2024 and prior years reveals a picture of financial struggles that likely contributed to investor concern. Keywords: QBTS financial reports, investor sentiment, stock valuation, revenue shortfalls.

-

Impact of Negative News and Press Coverage: Negative news reports, highlighting technological challenges or financial difficulties, negatively affected investor confidence and fueled sell-offs.

-

Investor Reaction and Sell-Offs: Negative news and financial performance led to a wave of investor sell-offs, directly contributing to the QBTS stock drop in 2025.

Macroeconomic Factors and Market Volatility

The broader macroeconomic environment in 2025 also influenced QBTS's stock performance. General market volatility and a shift in investor risk aversion towards technology stocks likely contributed to the decline.

-

Overall Market Conditions in 2025: A potential recession or high inflation in 2025 could have negatively impacted investor confidence in the technology sector as a whole, resulting in a sell-off of technology stocks, including QBTS. Keywords: macroeconomic factors, market volatility, investor risk aversion, technology stock market.

-

Impact of General Investor Risk Aversion on Technology Stocks: A general trend toward risk aversion among investors could have caused a disproportionate impact on high-growth, high-risk technology stocks like QBTS.

-

Correlation Between QBTS Stock Performance and Broader Market Trends: Analyzing the correlation between QBTS stock performance and broader market indices during 2025 provides valuable insights into the extent of macroeconomic influence.

Conclusion: Understanding the QBTS Stock Drop and Investing in Quantum Computing

The 2025 QBTS stock drop resulted from a confluence of factors: intensified competition from gate-based quantum computing technologies, inherent technological challenges facing D-Wave's annealing approach, suboptimal financial performance, and macroeconomic headwinds. While the quantum computing sector holds immense potential, investing in this area requires careful consideration of these challenges and opportunities. Thorough research and a robust risk assessment are vital before making any investment decisions related to QBTS or other quantum computing companies. Conduct further research into QBTS and the broader quantum computing market before making any investment decisions. Keywords: QBTS investment, quantum computing investment, risk assessment, market analysis, D-Wave future.

Featured Posts

-

Activite Des Cordistes A Nantes Impact De La Construction Des Grandes Tours

May 21, 2025

Activite Des Cordistes A Nantes Impact De La Construction Des Grandes Tours

May 21, 2025 -

The Goldbergs Impact On Television Comedy

May 21, 2025

The Goldbergs Impact On Television Comedy

May 21, 2025 -

Innovatief Digitaal Platform Transferz Ontvangt Financiering Van Abn Amro

May 21, 2025

Innovatief Digitaal Platform Transferz Ontvangt Financiering Van Abn Amro

May 21, 2025 -

Klopp Un Geri Doenuesue Bir Futbol Devriminin Baslangici Mi

May 21, 2025

Klopp Un Geri Doenuesue Bir Futbol Devriminin Baslangici Mi

May 21, 2025 -

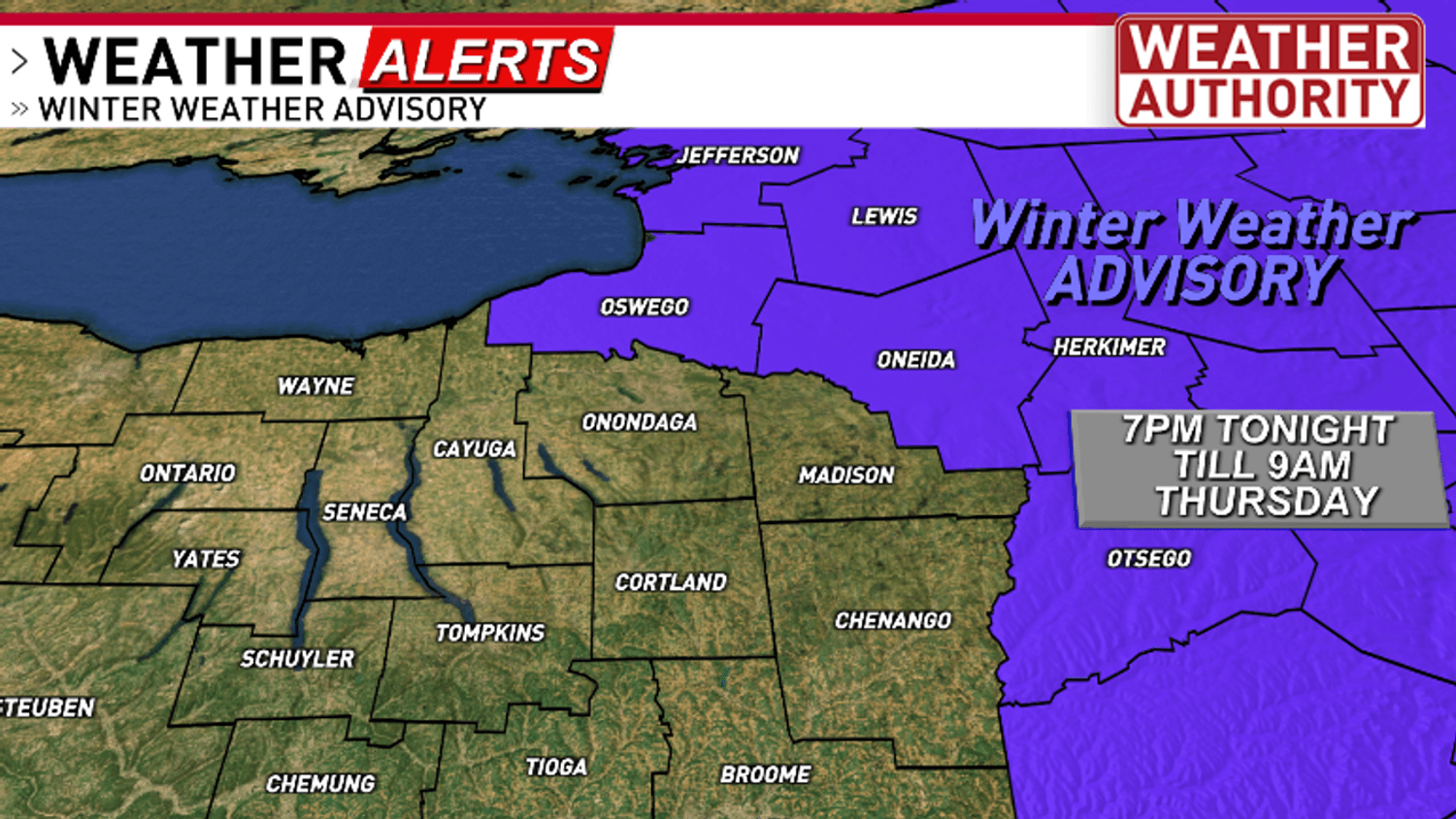

Staying Informed Winter Weather Advisories And School Delays

May 21, 2025

Staying Informed Winter Weather Advisories And School Delays

May 21, 2025

Latest Posts

-

Find Sandylands U On Tv Your Guide To Airtimes

May 21, 2025

Find Sandylands U On Tv Your Guide To Airtimes

May 21, 2025 -

Sandylands U Tv Listings And Showtimes

May 21, 2025

Sandylands U Tv Listings And Showtimes

May 21, 2025 -

Sandylands U Your Complete Tv Guide

May 21, 2025

Sandylands U Your Complete Tv Guide

May 21, 2025 -

Gangsta Granny Character Analysis And Story Breakdown

May 21, 2025

Gangsta Granny Character Analysis And Story Breakdown

May 21, 2025 -

Gangsta Granny Activities And Crafts Inspired By The Book

May 21, 2025

Gangsta Granny Activities And Crafts Inspired By The Book

May 21, 2025