Understanding The Fluctuations In Riot Platforms (RIOT) Stock Price

Table of Contents

The Influence of Bitcoin (BTC) Price on RIOT Stock

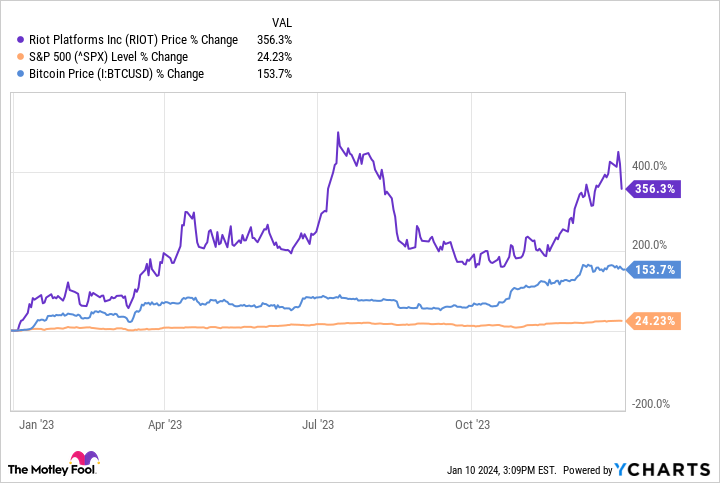

Riot Platforms' core business is Bitcoin mining. Therefore, the price of Bitcoin (BTC) has a direct and undeniable impact on RIOT's profitability and, consequently, its stock price. A simple truth underpins this relationship: higher Bitcoin prices translate to higher revenue for RIOT. Each Bitcoin mined represents profit, and the value of that profit increases directly with the BTC price. This direct correlation is easily illustrated by examining historical price charts of both RIOT and BTC; they tend to move in tandem.

- Increased BTC price = Increased RIOT revenue and stock price. As the value of Bitcoin rises, Riot's revenue increases proportionally, leading to improved financial reports and increased investor confidence, boosting the RIOT stock price.

- Decreased BTC price = Decreased RIOT revenue and stock price. Conversely, a decline in Bitcoin's price directly impacts RIOT's profitability, resulting in lower revenue and potentially impacting the company's bottom line, leading to decreased investor enthusiasm and lower RIOT stock prices.

- BTC price volatility translates to RIOT stock price volatility. The inherent volatility of the cryptocurrency market means that sharp price swings in Bitcoin directly translate to significant fluctuations in RIOT's stock price. This makes RIOT a high-risk, high-reward investment.

Impact of Bitcoin Mining Difficulty and Hash Rate on RIOT

Bitcoin mining difficulty and hash rate are two crucial factors affecting RIOT's operational efficiency and profitability. Mining difficulty refers to the computational power required to mine a Bitcoin block, while hash rate represents the total computational power of the entire Bitcoin network.

- Increased mining difficulty = Reduced profitability for RIOT. A higher mining difficulty means RIOT needs more energy and computational power to mine a Bitcoin, reducing its profitability per unit mined.

- Increased hash rate = Increased competition, potentially impacting RIOT's market share. A higher hash rate signifies increased competition among Bitcoin miners. This competition can potentially reduce RIOT's share of newly mined Bitcoins, impacting its revenue.

- Changes in these metrics often precede price movements in RIOT stock. Investors closely monitor changes in mining difficulty and hash rate as leading indicators of potential future performance for RIOT. Anticipating these changes can be crucial for navigating RIOT stock price fluctuations.

Macroeconomic Factors and Regulatory Landscape

Broader economic conditions and the regulatory environment surrounding cryptocurrencies also significantly influence the Riot Platforms (RIOT) stock price. Investor sentiment is highly sensitive to macroeconomic factors.

- Negative economic news can lead to risk-aversion and lower RIOT stock prices. During times of economic uncertainty (e.g., inflation, recessionary fears, rising interest rates), investors tend to shift towards less risky assets, causing a sell-off in higher-risk investments like RIOT stock.

- Favorable regulatory changes can boost investor confidence. Clearer and more favorable regulations surrounding cryptocurrency mining can attract more institutional investors, leading to increased demand and higher RIOT stock prices.

- Uncertainty in the regulatory environment creates volatility. Regulatory uncertainty – such as potential changes in tax laws or mining regulations – can create significant volatility in RIOT's stock price as investors react to the potential impact on the company's operations.

Company-Specific News and Financial Performance

RIOT's financial reports and company-specific news significantly influence its stock price. Positive announcements tend to boost investor confidence, while negative news can lead to significant price drops.

- Strong financial results typically lead to higher stock prices. Consistently strong earnings reports, showing revenue growth and improving profitability, generally lead to increased investor confidence and higher RIOT stock prices.

- Negative news or missed earnings expectations can cause significant price drops. Conversely, disappointing financial results, negative press coverage, or missed earnings expectations can trigger sell-offs and lead to substantial decreases in the RIOT stock price.

- Positive company developments often result in increased investor interest. Announcements about new partnerships, technological advancements (like improvements in mining efficiency), significant expansions, or strategic acquisitions can create positive investor sentiment and drive up the RIOT stock price.

Conclusion: Navigating the Future of Riot Platforms (RIOT) Stock Price

The Riot Platforms (RIOT) stock price is influenced by a complex interplay of factors: the Bitcoin price, mining difficulty and hash rate, macroeconomic conditions, and company-specific news. Understanding these interrelationships is essential for making informed investment decisions. While RIOT offers exposure to the growth potential of the Bitcoin mining industry, it’s crucial to recognize the inherent volatility of the cryptocurrency market and the risks associated with investing in RIOT stock. Before investing in Riot Platforms (RIOT) stock, conduct thorough research, consider your risk tolerance, and diversify your portfolio accordingly. Further research into Bitcoin mining, cryptocurrency market trends, and appropriate investment strategies for volatile assets will help you navigate the complexities of the Riot Platforms (RIOT) stock price.

Featured Posts

-

Challenges For Reform Uk A Former Deputys Threat Of A New Party

May 03, 2025

Challenges For Reform Uk A Former Deputys Threat Of A New Party

May 03, 2025 -

Fortnite Maintenance Game Down For Update 34 40 Expected Return Time

May 03, 2025

Fortnite Maintenance Game Down For Update 34 40 Expected Return Time

May 03, 2025 -

2008 Disney Game Ps Plus Premium Leak Explained

May 03, 2025

2008 Disney Game Ps Plus Premium Leak Explained

May 03, 2025 -

Public Trust In South Carolina Elections A 93 Approval Rating

May 03, 2025

Public Trust In South Carolina Elections A 93 Approval Rating

May 03, 2025 -

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025

Latest Posts

-

Ufc 314 Everything You Need To Know About Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Everything You Need To Know About Volkanovski Vs Lopes

May 04, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 04, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 04, 2025 -

Early Ufc 314 Odds Key Fights And Value Bets

May 04, 2025

Early Ufc 314 Odds Key Fights And Value Bets

May 04, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Predictions

May 04, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Predictions

May 04, 2025 -

Ufc 314 Betting Odds A Comprehensive Guide To The Fight Card

May 04, 2025

Ufc 314 Betting Odds A Comprehensive Guide To The Fight Card

May 04, 2025