Understanding The GOP's Proposed Student Loan Reforms: Impact On Pell Grants And Repayment

Table of Contents

Proposed Changes to Pell Grants under GOP Student Loan Reforms

The potential changes to Pell Grants under GOP student loan reform proposals are a significant area of concern for many. These changes could dramatically affect access to higher education for low-income students.

Potential Funding Cuts

The GOP has historically advocated for reducing federal spending, raising concerns about potential cuts to Pell Grant funding. This could manifest in several ways:

- Reduced maximum Pell Grant award amounts: Lower award amounts would mean students receive less financial aid, potentially forcing them to take out more loans or abandon their educational pursuits.

- Increased eligibility requirements: Making it harder to qualify for Pell Grants would exclude more students, particularly those from low-income families. This could involve stricter income thresholds or GPA requirements.

- Shifting more responsibility for funding to states or private institutions: This could lead to inconsistent funding levels across states and create disparities in access to higher education.

- Impact on low-income students and access to higher education: Ultimately, funding cuts would disproportionately affect low-income students, making college less accessible and potentially exacerbating existing inequalities.

Increased Emphasis on Merit-Based Aid

Some GOP proposals suggest shifting from need-based aid (like Pell Grants) towards merit-based scholarships. While merit-based aid can incentivize academic achievement, it could also have unintended consequences:

- Potential for less financial aid for students from disadvantaged backgrounds: Students from low-income families often lack access to the resources and support systems that enable high academic performance. A shift towards merit-based aid could disadvantage them.

- Increased competition for limited merit-based scholarships: A more competitive landscape for scholarships could leave many deserving students without the necessary financial support.

- Potential for widening the existing achievement gap: By prioritizing merit, these reforms could inadvertently widen the achievement gap between students from privileged and disadvantaged backgrounds.

- Impact on diversity in higher education: A shift away from need-based aid could negatively impact diversity in colleges and universities, potentially leading to less representative student bodies.

Proposed GOP Reforms to Student Loan Repayment

The Republican Party’s proposed reforms to student loan repayment could significantly impact borrowers' ability to manage their debt.

Income-Driven Repayment (IDR) Plans

The GOP may propose alterations or limitations to existing Income-Driven Repayment (IDR) plans, making repayment more challenging for many borrowers:

- Higher minimum monthly payments: Increased minimum payments could make it harder for borrowers with lower incomes to afford their monthly repayments.

- Shorter repayment periods: Shorter repayment periods would lead to higher monthly payments, increasing the financial burden on borrowers.

- Elimination or reduction of forgiveness programs after a certain number of years: The elimination of loan forgiveness programs would leave borrowers with substantial debt even after years of repayment.

- Increased burden on borrowers and potential increase in loan defaults: More stringent repayment terms could increase the likelihood of loan defaults, leading to negative credit consequences for borrowers.

Changes to Loan Forgiveness Programs

The GOP has expressed skepticism toward broad-based student loan forgiveness initiatives, potentially impacting borrowers who rely on these programs:

- Potential elimination of existing forgiveness programs: This would leave many borrowers with significant debt burdens they may struggle to repay.

- Increased scrutiny of eligibility for existing programs: Stricter eligibility criteria could exclude many borrowers who currently qualify for forgiveness.

- Impact on borrowers who rely on loan forgiveness to manage their debt: The elimination or modification of these programs could have severe financial consequences for many individuals.

- Political debate surrounding the fairness and economic impact of loan forgiveness: The debate surrounding loan forgiveness programs is complex, with strong arguments on both sides.

Alternative Approaches to Reducing Student Loan Debt (GOP Perspectives)

While the GOP's direct approaches to student loan reform are a subject of debate, they also propose alternative strategies to address the issue.

Focus on Tuition Control

The GOP may promote market-based solutions to reduce tuition costs, such as increased competition among colleges and universities:

- Promoting transparency in college pricing: Greater transparency in college pricing could empower students to make more informed decisions.

- Encouraging alternative educational pathways (trade schools, apprenticeships): Promoting vocational training could provide students with valuable skills and reduce reliance on four-year college degrees.

- Supporting measures to increase college affordability without increased federal spending: This approach emphasizes market solutions and individual responsibility.

Emphasis on Personal Responsibility

GOP proposals might highlight individual responsibility in managing student loan debt:

- Encouraging careful borrowing decisions before enrolling in higher education: Educating students about the financial implications of borrowing is crucial.

- Promoting financial literacy programs for students: Improved financial literacy can help students make informed decisions about their education and debt.

- Focus on the role of students and parents in managing college costs: This emphasizes proactive planning and responsible borrowing behavior.

Conclusion

The GOP's proposed student loan reforms represent a significant shift in the approach to federal student aid. Understanding the potential consequences of these reforms – particularly regarding Pell Grants and repayment options – is crucial for students, parents, and policymakers. The potential impact on access to higher education, debt burden, and the overall fairness of the system are all important considerations. It's vital to remain informed about the ongoing developments and potential implications of GOP student loan reforms, engaging in thoughtful discussion to ensure a fair and accessible higher education system for all. Continue researching and staying updated on the latest developments in GOP student loan reforms to make informed decisions about your educational future.

Featured Posts

-

Singapore Airlines Announces Generous Seven Month Bonus For Employees

May 17, 2025

Singapore Airlines Announces Generous Seven Month Bonus For Employees

May 17, 2025 -

Mensik Otkriva Dokovicev Uticaj Na Njegov Uspeh U Novaci

May 17, 2025

Mensik Otkriva Dokovicev Uticaj Na Njegov Uspeh U Novaci

May 17, 2025 -

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025 -

Exclusive Rfk Jr S Hhs Poised To Reassess Covid Vaccine Guidance For Vulnerable Groups

May 17, 2025

Exclusive Rfk Jr S Hhs Poised To Reassess Covid Vaccine Guidance For Vulnerable Groups

May 17, 2025 -

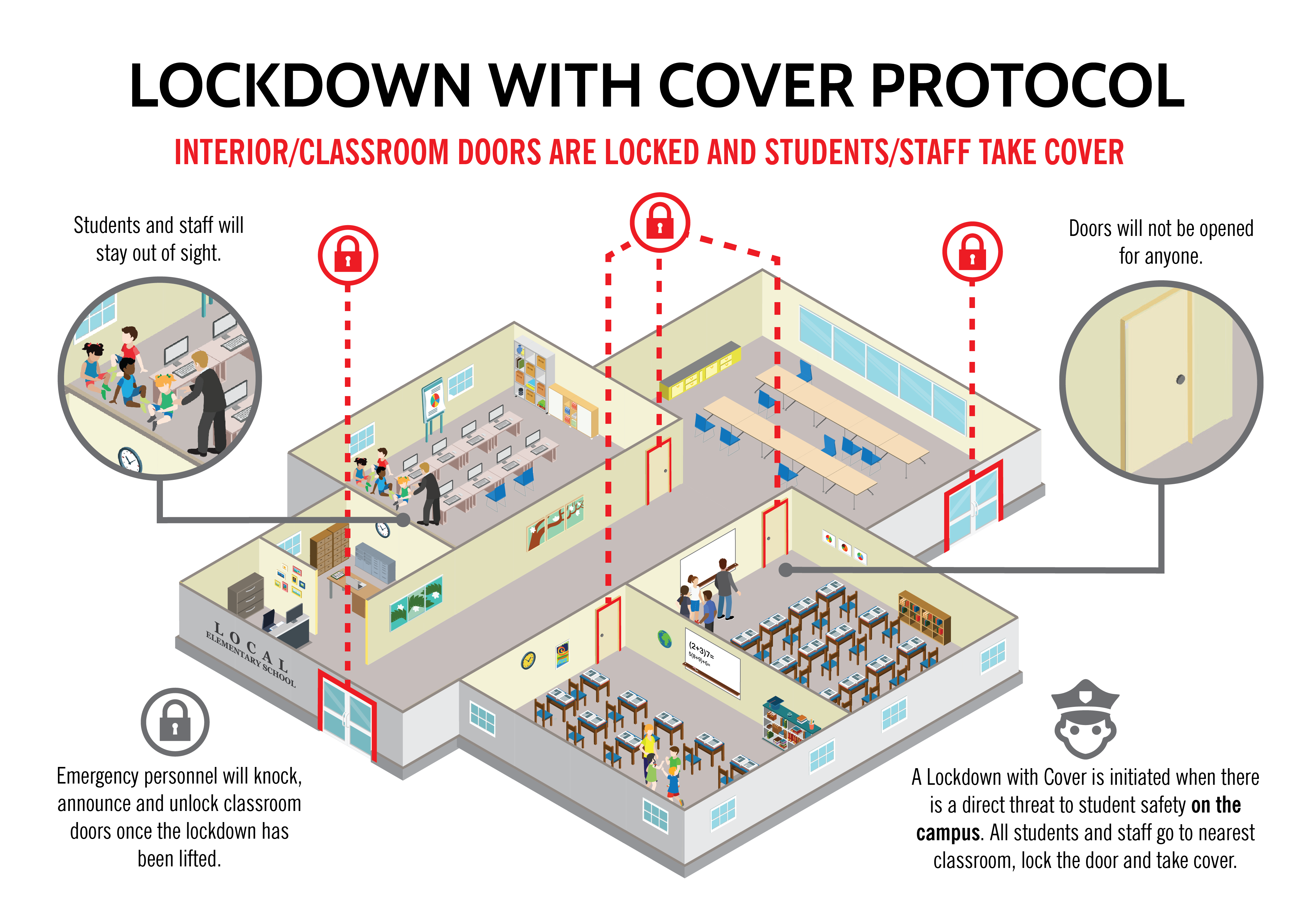

Understanding Florida School Shooter Lockdown Procedures A Generations Perspective

May 17, 2025

Understanding Florida School Shooter Lockdown Procedures A Generations Perspective

May 17, 2025