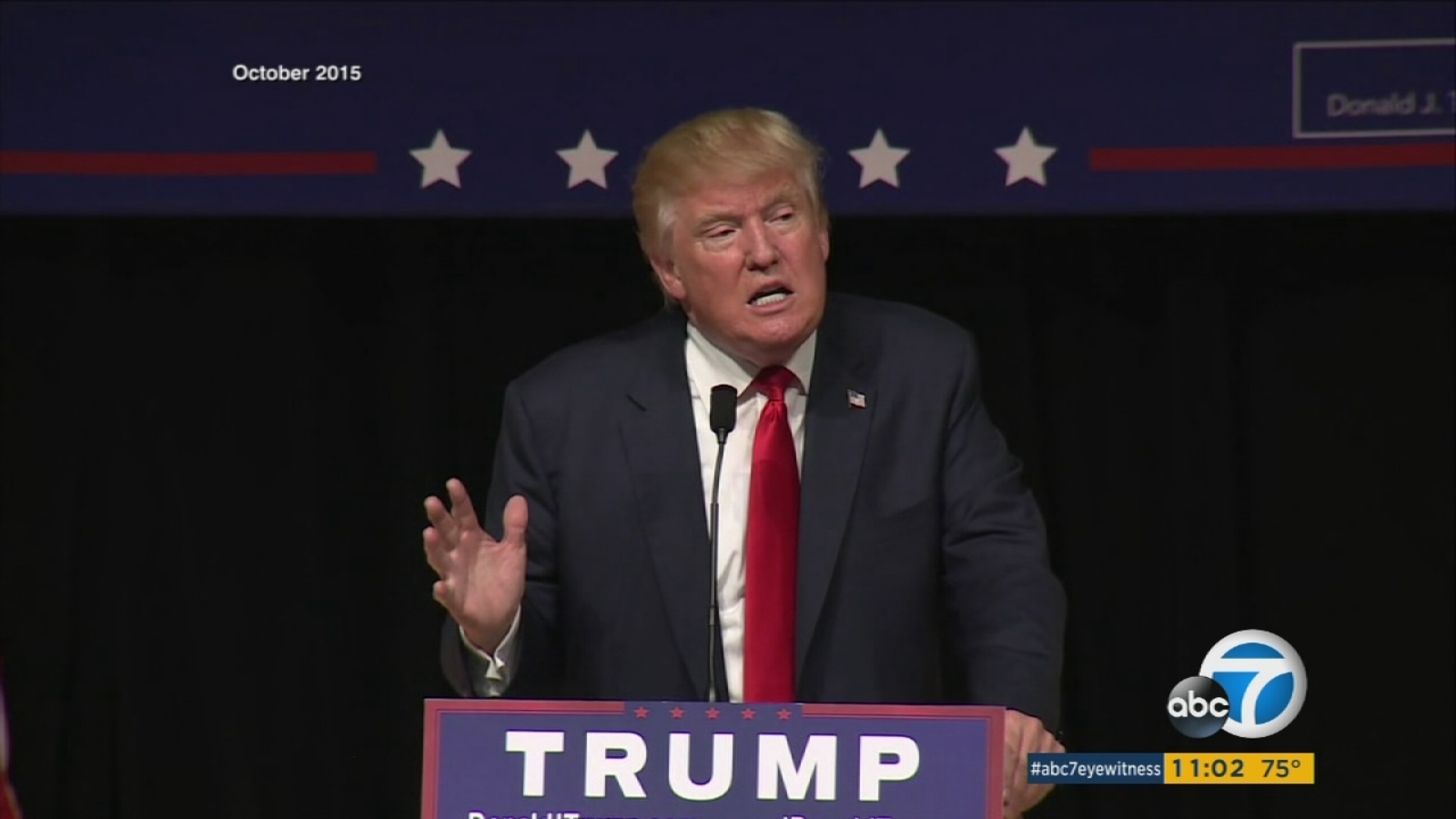

Understanding The House Republicans' Trump Tax Cut Plan

Table of Contents

Core Tenets of the Proposed Trump Tax Cut Plan

The proposed Trump Tax Cut Plan, primarily championed by House Republicans, centers around substantial reductions in both individual and corporate income taxes. While specific proposals have varied slightly over time, several core tenets consistently emerge.

Individual Income Tax Reductions

This plan typically focuses on lower tax rates across the board for individuals. This means a reduction in the percentage of income paid in taxes for most taxpayers.

- Proposed Rate Changes: While precise numbers fluctuate depending on the specific iteration of the plan, proposals generally involve lowering the highest individual income tax bracket. For example, past proposals have suggested reducing the top rate from 37% to a significantly lower percentage, although the exact figure has varied. Lower brackets would also see corresponding reductions, though perhaps not as dramatic.

- Changes to Standard Deductions and Tax Brackets: The proposed plans often include adjustments to the standard deduction, potentially increasing it to benefit lower and middle-income taxpayers. The number of tax brackets might also be altered, simplifying the tax code in some versions.

- Impact on Various Income Levels: The impact varies significantly by income level. Higher-income individuals would generally see larger absolute tax cuts, while lower-income individuals would benefit from lower rates and potentially increased standard deductions. However, the overall effect on income inequality remains a subject of ongoing debate.

- Elimination or Modification of Existing Tax Deductions or Credits: A crucial aspect of many proposed Trump Tax Cut Plans involves the elimination or modification of existing tax deductions and credits. This includes potential changes to the state and local tax (SALT) deduction, a significant point of contention in previous iterations.

Corporate Tax Rate Cuts

A central component of the proposed plans is a reduction in the corporate tax rate. This aims to incentivize business investment and job creation.

- Proposed Corporate Tax Rate Reductions: The proposed plans typically call for reducing the corporate tax rate from its current level (21%, enacted under the Tax Cuts and Jobs Act of 2017). Proposals have ranged from minor tweaks to significantly lower rates, impacting corporate profitability and shareholder returns.

- Effects on Business Investment and Job Creation: Proponents argue that lower corporate tax rates will lead to increased business investment and subsequent job creation. This "supply-side" economics theory suggests that businesses will use the extra capital to expand operations and hire more workers.

- Impact on Corporate Profitability and Shareholder Returns: Lower taxes directly increase corporate profitability, potentially leading to higher shareholder returns through dividends or stock buybacks.

- Potential Loopholes and Unintended Consequences: Critics point to the potential for loopholes and unintended consequences. Lower taxes could disproportionately benefit larger corporations, while smaller businesses may not see the same level of benefit.

Estate Tax Changes

The proposed Trump Tax Cut Plans often include changes to the estate tax, sometimes involving repeal or significant increases in the exemption.

- Proposed Changes to the Estate Tax: Proposals have ranged from completely eliminating the estate tax to significantly raising the exemption threshold, meaning larger estates would avoid taxation.

- Impact on Wealthy Families and Estate Planning: These changes dramatically affect wealthy families and the complexities of estate planning. Higher exemptions reduce the number of estates subject to tax.

- Economic and Social Implications: The economic and social implications of estate tax changes are hotly debated. Eliminating or substantially reducing the estate tax could significantly increase income inequality, as wealth is passed down to future generations largely untaxed.

Economic Implications of the Trump Tax Cut Plan

The economic effects of the proposed Trump Tax Cut Plan are complex and subject to varying interpretations.

Potential Economic Growth

Proponents argue that the tax cuts will stimulate economic growth through supply-side economics.

- Supply-Side Argument: Lower taxes, they claim, incentivize businesses to invest more, hire more workers, and increase production, leading to overall economic expansion.

- Potential Job Creation and Increased Investment: This increased investment and production could theoretically lead to job creation and a higher standard of living.

- Potential Inflationary Pressures: However, critics caution that significant tax cuts could also lead to inflationary pressures if demand outpaces supply.

National Debt Concerns

A major concern surrounding the proposed plans is their impact on the national debt.

- Impact on the National Debt: The substantial tax cuts would likely increase the federal budget deficit and add to the national debt over time, unless offset by spending cuts.

- Budget Deficits and Long-Term Fiscal Sustainability: These larger deficits raise concerns about long-term fiscal sustainability and the ability of the government to meet its financial obligations.

- Alternative Approaches to Fiscal Policy: Critics suggest that alternative approaches to fiscal policy, such as targeted investments in infrastructure or education, could be more effective in stimulating long-term economic growth without exacerbating the national debt.

Income Inequality

The distributional effects of the tax cuts are a key area of debate.

- Distributional Effects: Critics argue that the tax cuts would disproportionately benefit high-income earners, exacerbating income inequality. This is particularly true if significant tax deductions are eliminated.

- Impact on Income Inequality: Lowering taxes across the board, without targeted assistance for lower-income individuals, could increase the gap between the wealthy and the less affluent.

- Progressive Versus Regressive Tax Policies: The debate centers around the tension between progressive tax policies (taxing higher earners at higher rates) and regressive tax policies (which disproportionately affect lower-income earners).

Comparison with Previous Tax Legislation

Understanding the House Republicans’ proposed Trump Tax Cut Plan requires comparing it with previous tax legislation, particularly the Tax Cuts and Jobs Act (TCJA) of 2017.

- Overview of Previous Tax Reform Efforts: The TCJA of 2017 already significantly reduced corporate and individual income tax rates. The proposed plans often build upon these changes, sometimes aiming for even more substantial reductions.

- Similarities and Differences: While sharing a common goal of lower taxes, specific proposals differ in magnitude and targeted beneficiaries.

- Long-Term Effects of Previous Tax Cuts: Analyzing the long-term effects of the TCJA provides valuable context for assessing the likely impact of the current proposals. Did the 2017 cuts lead to the promised economic growth? What were the unintended consequences? Answering these questions is critical.

Conclusion

This article has explored the key components of the House Republicans’ proposed Trump tax cut plan, analyzing its potential economic impacts and societal implications. The plan involves significant changes to individual and corporate tax rates, potentially impacting the national debt and income inequality. The plan’s core tenets, including individual income tax reductions, corporate tax rate cuts, and estate tax changes, have far-reaching effects on various income brackets and the overall economy.

Understanding the complexities of the Trump Tax Cut Plan is vital for informed civic participation. Stay informed about the ongoing debates surrounding tax policy and continue learning about the intricacies of the House Republicans' proposed Trump tax cut plan to make your voice heard effectively. Further research and engagement are crucial for a clear understanding of its long-term effects.

Featured Posts

-

Brexits Impact Spanish Border Towns Struggle Economically

May 13, 2025

Brexits Impact Spanish Border Towns Struggle Economically

May 13, 2025 -

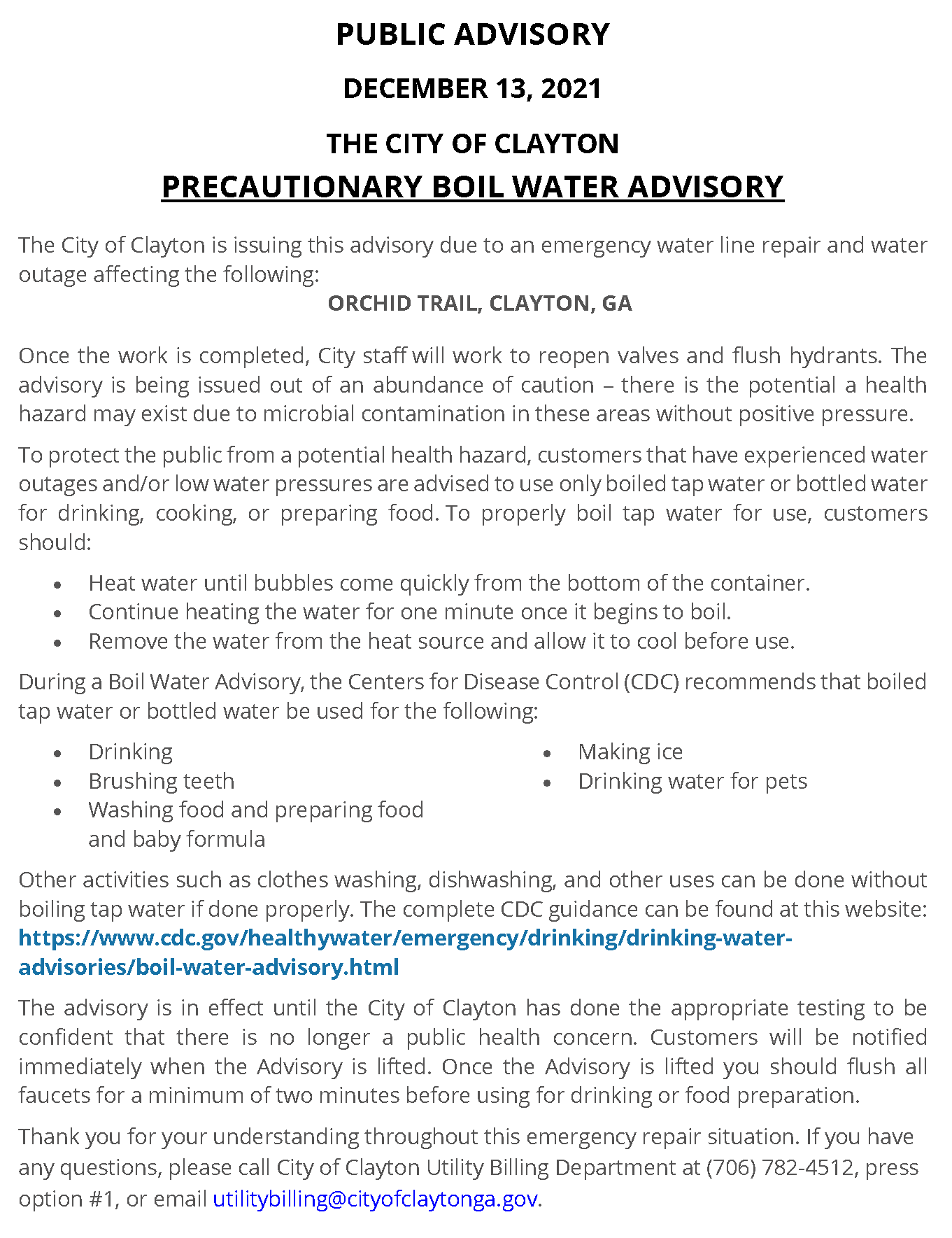

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025 -

Prozhivannya Romiv V Ukrayini Statistichni Dani Ta Sotsialni Aspekti

May 13, 2025

Prozhivannya Romiv V Ukrayini Statistichni Dani Ta Sotsialni Aspekti

May 13, 2025 -

S02 E14 Elsbeths Family Business Predicament A Sneak Peek

May 13, 2025

S02 E14 Elsbeths Family Business Predicament A Sneak Peek

May 13, 2025 -

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025

Latest Posts

-

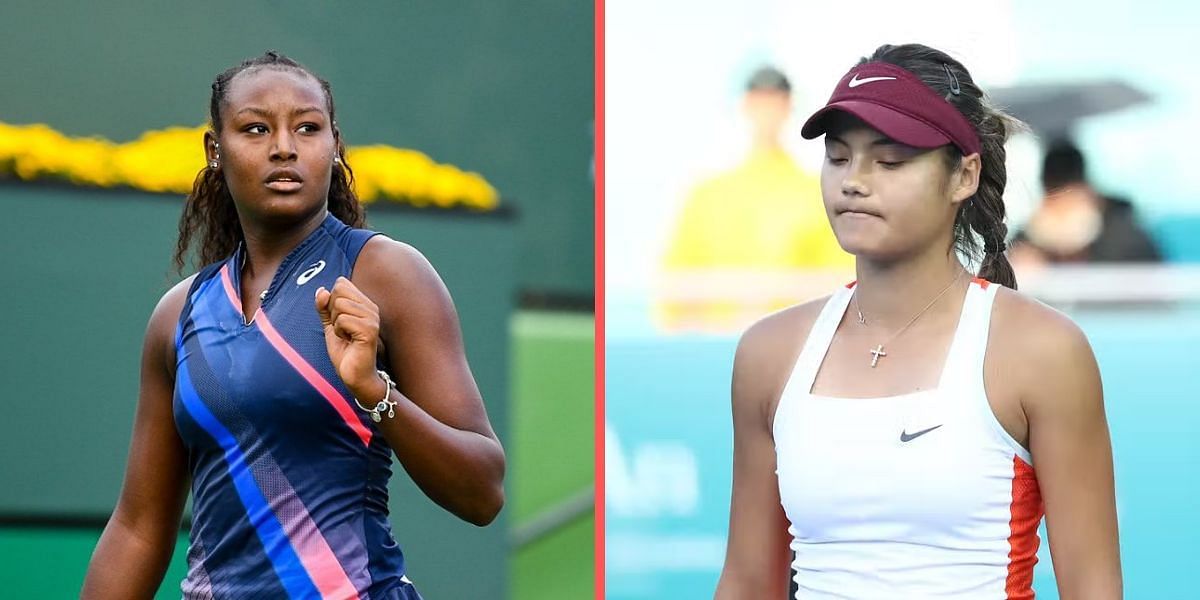

Wta News Stearns Early Departure In Austin

May 14, 2025

Wta News Stearns Early Departure In Austin

May 14, 2025 -

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025

Two Weeks And Out Raducanus Coaching Search Continues

May 14, 2025 -

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025

Raducanus Dubai Defeat Muchova Triumphs

May 14, 2025 -

Danielle Collins Upsets Swiatek Causing World Ranking Shift

May 14, 2025

Danielle Collins Upsets Swiatek Causing World Ranking Shift

May 14, 2025 -

Emma Raducanus Coaching Change A Two Week Trial Ends

May 14, 2025

Emma Raducanus Coaching Change A Two Week Trial Ends

May 14, 2025