Understanding The Investment Case For Uber Technologies

Table of Contents

Uber's Market Position and Dominance

Ride-Sharing Market Leadership

Uber's market share in the ride-sharing industry is substantial, solidifying its position as a market leader. While precise figures fluctuate, Uber consistently holds a significant portion of the global market, especially in key regions like North America and Europe. This dominance translates to considerable brand recognition, network effects (more drivers attract more riders, and vice-versa), and a strong competitive advantage.

- Market Capitalization: Uber boasts a significant market capitalization, reflecting investor confidence (though this can fluctuate).

- Number of Users: Millions of users rely on the Uber app globally, demonstrating substantial market penetration and user loyalty.

- Geographical Reach: Uber operates in numerous countries and cities worldwide, providing a diverse revenue stream and mitigating risks associated with reliance on a single market.

- Expansion into New Markets: Uber continues to strategically expand into new and emerging markets, further solidifying its global reach and growth potential. This expansion includes both ride-sharing and other services.

Diversification Beyond Ridesharing

Uber's success extends beyond its core ride-sharing business. Uber Eats, its food delivery service, has become a major revenue contributor, competing effectively with other food delivery giants. Uber Freight, focusing on logistics and transportation for businesses, presents another significant growth avenue. This diversification mitigates risk associated with over-reliance on a single service.

- Revenue Breakdown by Service: While ride-sharing remains a significant portion, Uber Eats and Uber Freight are increasingly contributing to overall revenue. Examining the revenue breakdown offers insights into the company's evolving revenue streams.

- Growth Rates of Each Segment: The growth trajectories of each segment are crucial in evaluating the overall investment potential. Consistent, strong growth across multiple sectors strengthens the Uber investment case.

- Potential for Synergies: Uber leverages its existing network and technology to create synergies between its various services. For example, drivers might utilize downtime between ride-sharing trips to fulfill Uber Eats deliveries.

Financial Performance and Growth Prospects

Revenue Growth and Profitability

Analyzing Uber's financial statements is crucial in assessing its investment viability. Investors should examine year-over-year revenue growth, paying close attention to trends and any significant changes. Profitability, or the lack thereof, is another key factor to consider. Key performance indicators (KPIs) such as customer acquisition cost, driver retention rates, and average revenue per user (ARPU) can paint a clearer picture.

- Year-over-Year Revenue Growth: Consistent and substantial year-over-year revenue growth indicates strong market demand and effective business strategies.

- Net Income (or Loss) Trends: While Uber may experience periods of net loss, the trend towards profitability is a crucial indicator of long-term sustainability.

- Key Performance Indicators (KPIs): A detailed analysis of KPIs provides a comprehensive understanding of Uber's operational efficiency and financial health.

Future Growth Drivers

Several factors point towards potential future growth for Uber Technologies. Technological advancements, especially in autonomous vehicle technology, could significantly reduce operational costs and improve efficiency. Continued expansion into new markets and strategic partnerships are other drivers.

- Autonomous Vehicles: The successful implementation of autonomous vehicle technology could revolutionize the ride-sharing industry and drastically improve Uber's profit margins.

- Expansion into Emerging Markets: Untapped markets present substantial opportunities for growth.

- Strategic Acquisitions: Strategic acquisitions of complementary businesses can accelerate growth and expand Uber's service offerings.

- New Service Offerings: Innovation in new service areas can further diversify revenue streams and create new growth opportunities.

Risks and Challenges Facing Uber

Regulatory Hurdles and Legal Challenges

The ride-sharing industry faces significant regulatory hurdles and legal challenges. Labor disputes concerning driver classification, licensing issues, and safety regulations pose ongoing risks. Government-backed initiatives or increased regulation could negatively impact Uber's operations and profitability.

- Labor Disputes: The classification of drivers as independent contractors versus employees is a significant legal and regulatory battleground.

- Licensing Issues: Navigating diverse licensing requirements across different jurisdictions can be complex and costly.

- Safety Regulations: Increased scrutiny of safety standards may lead to higher operational costs and potential legal liabilities.

- Competition from Government-Backed Initiatives: Government-supported ride-sharing or public transportation alternatives can pose significant competitive pressure.

Competition and Market Saturation

Competition in the ride-sharing industry is intense. Lyft is a major competitor, and other ride-sharing apps, along with established public transportation systems, further pressure Uber's market share. Market saturation in established areas also presents a significant challenge.

- Competitive Pressures from Lyft: Lyft's continued presence and competitive pricing strategies pose an ongoing challenge to Uber's market share.

- Other Ride-Sharing Apps: The emergence of new entrants in the market introduces further competition.

- Public Transportation: Efficient and affordable public transportation systems can reduce the demand for ride-sharing services.

Conclusion: Making Informed Decisions about Your Uber Investment

Investing in Uber Technologies presents both significant opportunities and substantial risks. While Uber's market dominance, diversification efforts, and future growth prospects are compelling, regulatory hurdles, intense competition, and potential market saturation pose significant challenges. A thorough analysis of its financial performance, competitive landscape, and future outlook is crucial before making any investment decisions. Remember to conduct thorough due diligence, considering both the potential rewards and risks associated with Uber stock. For more in-depth analysis, consult financial news sources and professional investment advisors. By carefully evaluating the Uber investment case, considering its strengths and weaknesses, you can make a well-informed decision that aligns with your investment goals.

Featured Posts

-

Evrobasket 2024 Srbija Odradila Generalnu Probu U Bajernovoj Dvorani

May 18, 2025

Evrobasket 2024 Srbija Odradila Generalnu Probu U Bajernovoj Dvorani

May 18, 2025 -

Celebrity Only Fans Accounts Amanda Bynes Entry And Its Implications

May 18, 2025

Celebrity Only Fans Accounts Amanda Bynes Entry And Its Implications

May 18, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge

May 18, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Surge

May 18, 2025 -

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Wereldwijde Spanningen

May 18, 2025

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Wereldwijde Spanningen

May 18, 2025 -

Looking For Stake Alternatives Top Crypto Casino Replacements For 2025

May 18, 2025

Looking For Stake Alternatives Top Crypto Casino Replacements For 2025

May 18, 2025

Latest Posts

-

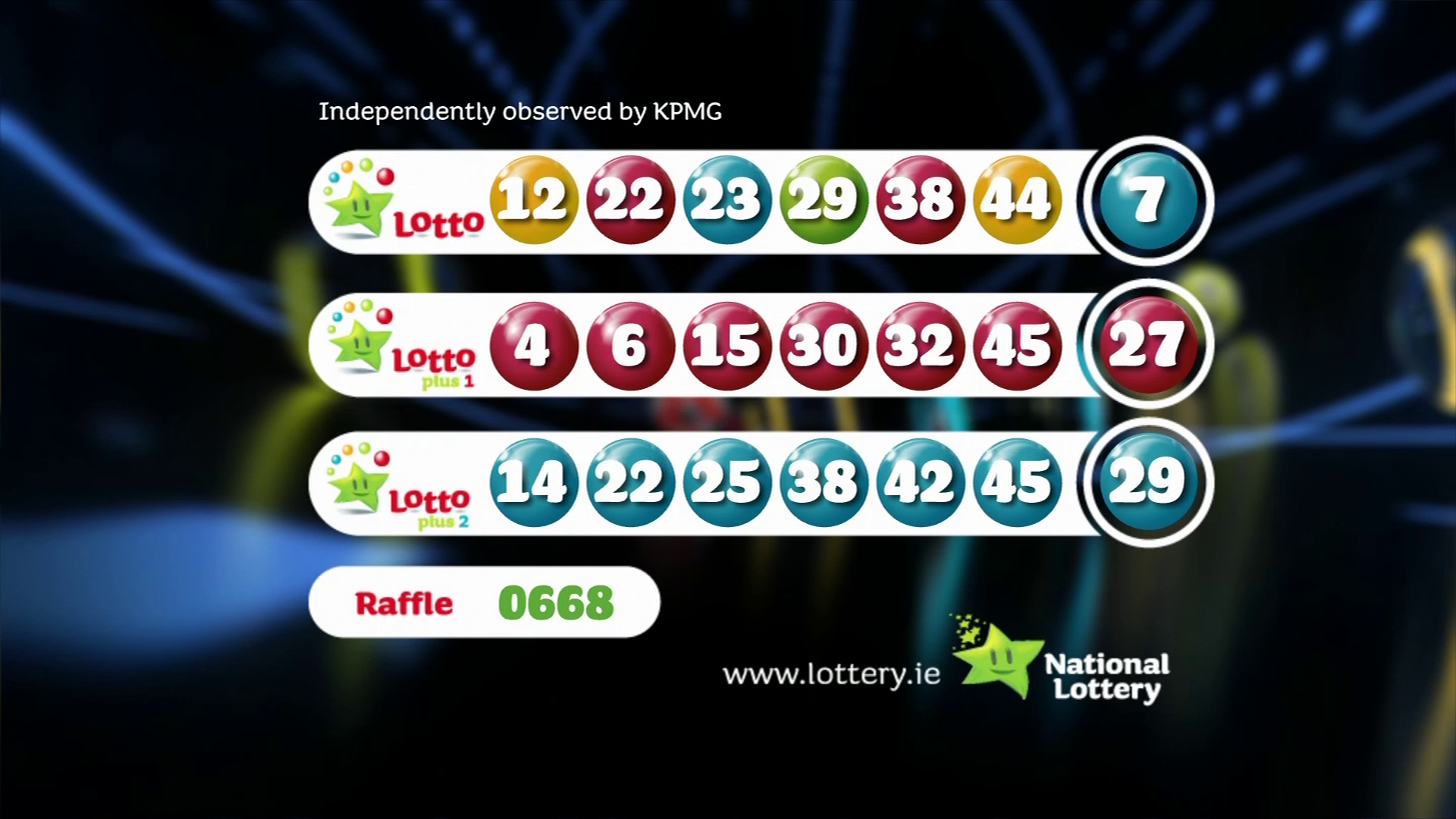

Check The April 12th 2025 Lotto And Lotto Plus Results Here

May 18, 2025

Check The April 12th 2025 Lotto And Lotto Plus Results Here

May 18, 2025 -

17th April 2025 Daily Lotto Results Announced

May 18, 2025

17th April 2025 Daily Lotto Results Announced

May 18, 2025 -

Winning Numbers Lotto And Lotto Plus Results April 12 2025

May 18, 2025

Winning Numbers Lotto And Lotto Plus Results April 12 2025

May 18, 2025 -

Daily Lotto Results Tuesday 22nd April 2025

May 18, 2025

Daily Lotto Results Tuesday 22nd April 2025

May 18, 2025 -

Saturday Lotto Results April 12 2025 Lotto Plus Numbers

May 18, 2025

Saturday Lotto Results April 12 2025 Lotto Plus Numbers

May 18, 2025